Answered step by step

Verified Expert Solution

Question

1 Approved Answer

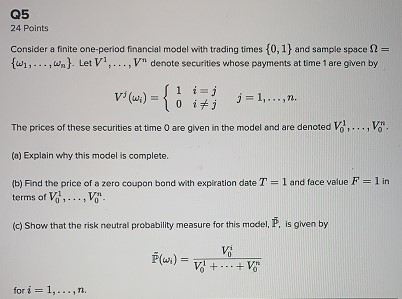

Q5 24 Points Consider a finite one-period financial model with trading times {0, 1} and sample space = {w, w}. Let V1,..., V denote

Q5 24 Points Consider a finite one-period financial model with trading times {0, 1} and sample space = {w, w}. Let V1,..., V" denote securities whose payments at time 1 are given by V (wi)={ 1 i=j 0 ij j=1,...,n. The prices of these securities at time 0 are given in the model and are denoted V,..., V. (a) Explain why this model is complete. (b) Find the price of a zero coupon bond with expiration date T = 1 and face value F = 1 in terms of V,..., V (c) Show that the risk neutral probability measure for this model, P. is given by P(wi)= V = + V for i=1,..., n.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This is a question related to financial mathematics specifically about a finite oneperiod financial ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started