Question

Q5. A buyer of a futures contract on Gold bullion with an underlying value of 100,000 on 10 November is required to deliver an initial

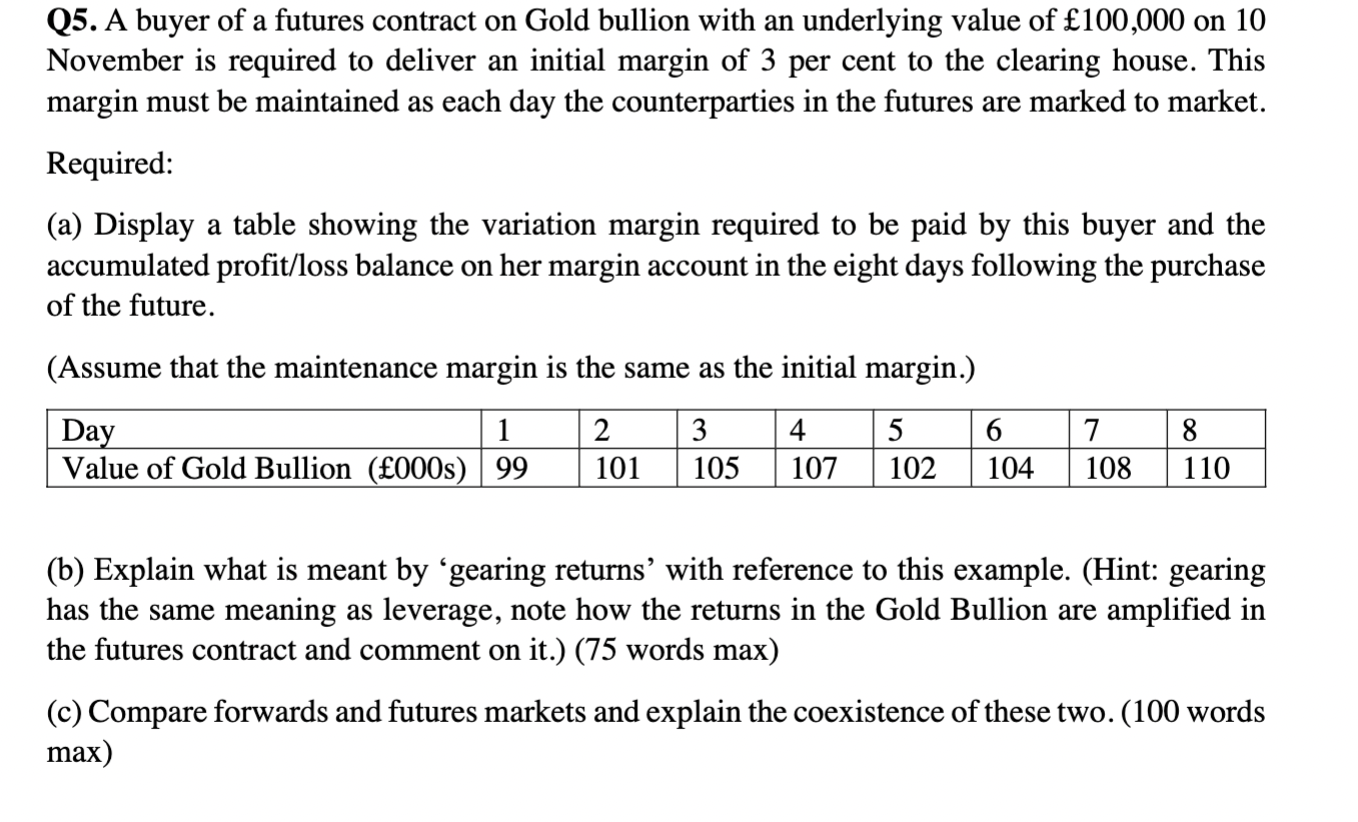

Q5. A buyer of a futures contract on Gold bullion with an underlying value of 100,000 on 10 November is required to deliver an initial margin of 3 per cent to the clearing house. This margin must be maintained as each day the counterparties in the futures are marked to market. Required: (a) Display a table showing the variation margin required to be paid by this buyer and the accumulated profit/loss balance on her margin account in the eight days following the purchase of the future. (Assume that the maintenance margin is the same as the initial margin.)

Q5. A buyer of a futures contract on Gold bullion with an underlying value of 100,000 on 10 November is required to deliver an initial margin of 3 per cent to the clearing house. This margin must be maintained as each day the counterparties in the futures are marked to market. Required: (a) Display a table showing the variation margin required to be paid by this buyer and the accumulated profit/loss balance on her margin account in the eight days following the purchase of the future. (Assume that the maintenance margin is the same as the initial margin.)

| Day | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Value of Gold Bullion (000s) | 99 | 101 | 105 | 107 | 102 | 104 | 108 | 110 |

(b) Explain what is meant by gearing returns with reference to this example. (Hint: gearing has the same meaning as leverage, note how the returns in the Gold Bullion are amplified in the futures contract and comment on it.) (75 words max) (c) Compare forwards and futures markets and explain the coexistence of these two. (100 words max)

Q5. A buyer of a futures contract on Gold bullion with an underlying value of 100,000 on 10 November is required to deliver an initial margin of 3 per cent to the clearing house. This margin must be maintained as each day the counterparties in the futures are marked to market. Required: (a) Display a table showing the variation margin required to be paid by this buyer and the accumulated profit/loss balance on her margin account in the eight days following the purchase of the future. (Assume that the maintenance margin is the same as the initial margin.) 4 Day 1 Value of Gold Bullion (000s) 99 2 101 3 105 5 102 6 104 7 108 8 110 107 (b) Explain what is meant by gearing returns' with reference to this example. (Hint: gearing has the same meaning as leverage, note how the returns in the Gold Bullion are amplified in the futures contract and comment on it.) (75 words max) (c) Compare forwards and futures markets and explain the coexistence of these two. (100 words max)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started