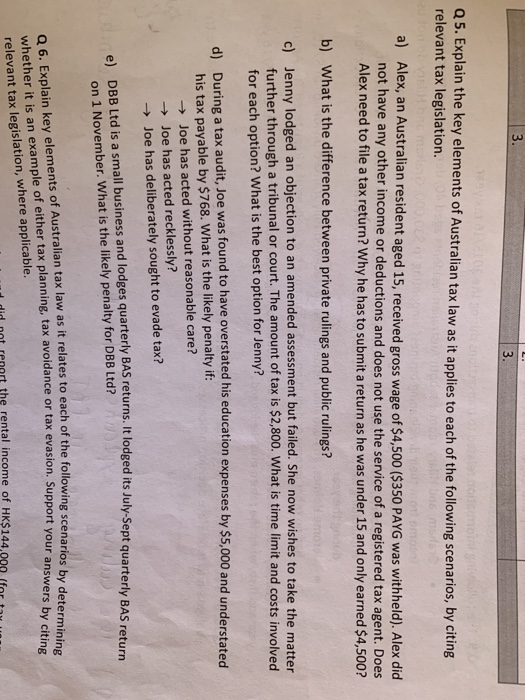

Q5. Explain the key elements of Australian tax law as it applies to each of the following scenarios, by citing relevant tax legislation. a) Alex, an Australian resident aged 15, received gross wage of $4,500 ($350 PAYG was withheld). Alex did not have any other income or deductions and does not use the service of a registered tax agent. Does Alex need to file a tax return? Why he has to submit a return as he was under 15 and only earned $4,500? b) What is the difference between private rulings and public rulings? c) Jenny lodged an objection to an amended assessment but failed. She now wishes to take the matter further through a tribunal or court. The amount of tax is $2,800. What is time limit and costs involved for each option? What is the best option for Jenny? d) During a tax audit, Joe was found to have overstated his education expenses by $5,000 and understated his tax payable by $768. What is the likely penalty if: Joe has acted without reasonable care? Joe has acted recklessly? Joe has deliberately sought to evade tax? arly BAS returns. It lodged its July-Sept quarterly BAS return e) DBB Ltd is a small business and lodges quarterly BAS returns. It lodged its July-Sept au on 1 November. What is the likely penalty for DBB Ltd? of the following scenarios by determining tax evasion. Support your answers by citing Explain key elements of Australian tax law as it relates to each of the following scenari whether it is an example of either tax plan xample of either tax planning, tax avoidance or tax evasion. Support your relevant tax legislation, where applicable. did not renart the rental income of HK$144,000 (for ty Q5. Explain the key elements of Australian tax law as it applies to each of the following scenarios, by citing relevant tax legislation. a) Alex, an Australian resident aged 15, received gross wage of $4,500 ($350 PAYG was withheld). Alex did not have any other income or deductions and does not use the service of a registered tax agent. Does Alex need to file a tax return? Why he has to submit a return as he was under 15 and only earned $4,500? b) What is the difference between private rulings and public rulings? c) Jenny lodged an objection to an amended assessment but failed. She now wishes to take the matter further through a tribunal or court. The amount of tax is $2,800. What is time limit and costs involved for each option? What is the best option for Jenny? d) During a tax audit, Joe was found to have overstated his education expenses by $5,000 and understated his tax payable by $768. What is the likely penalty if: Joe has acted without reasonable care? Joe has acted recklessly? Joe has deliberately sought to evade tax? arly BAS returns. It lodged its July-Sept quarterly BAS return e) DBB Ltd is a small business and lodges quarterly BAS returns. It lodged its July-Sept au on 1 November. What is the likely penalty for DBB Ltd? of the following scenarios by determining tax evasion. Support your answers by citing Explain key elements of Australian tax law as it relates to each of the following scenari whether it is an example of either tax plan xample of either tax planning, tax avoidance or tax evasion. Support your relevant tax legislation, where applicable. did not renart the rental income of HK$144,000 (for ty