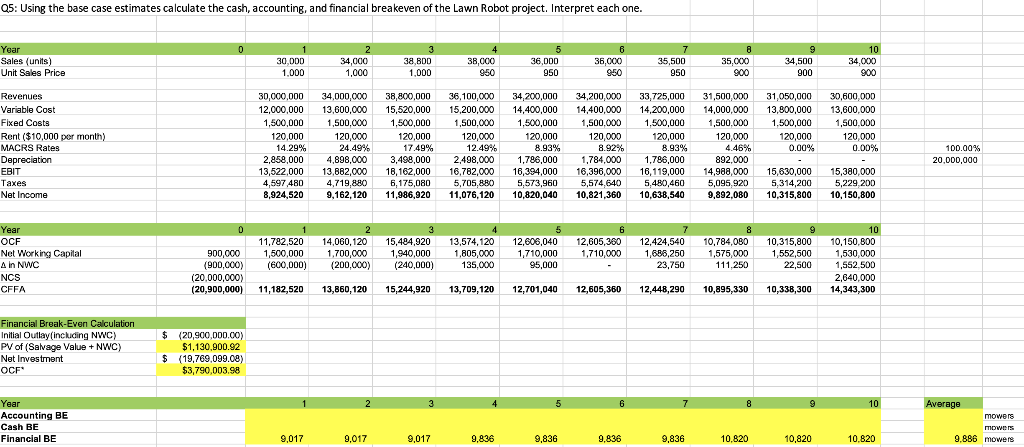

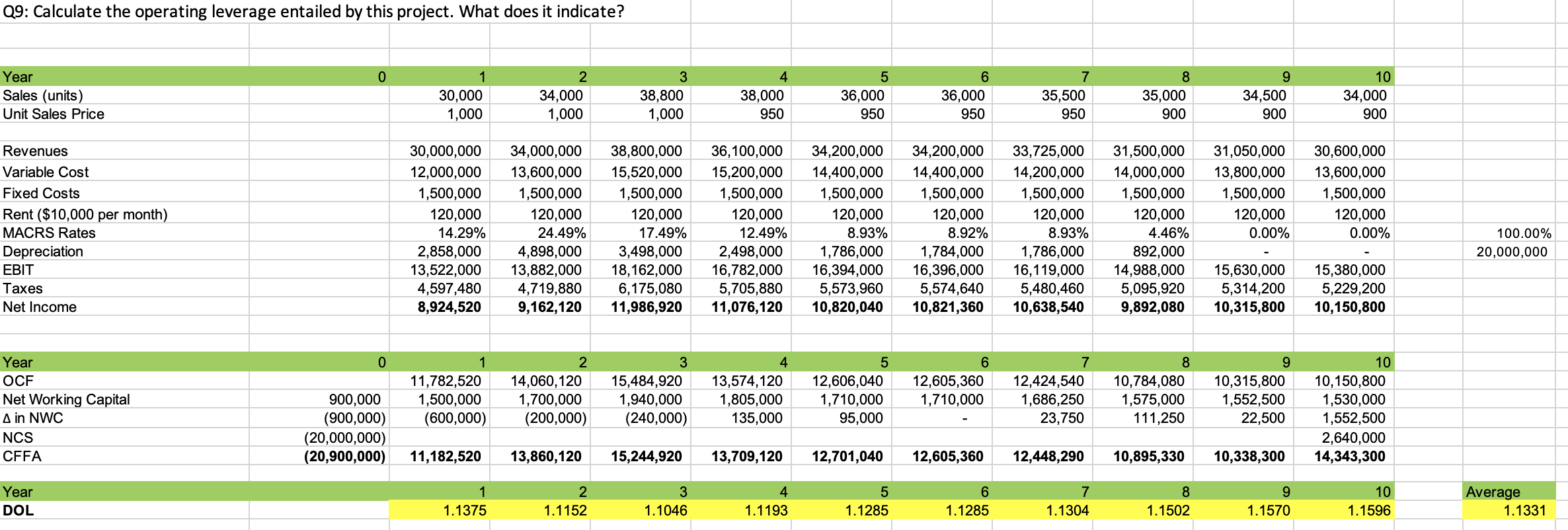

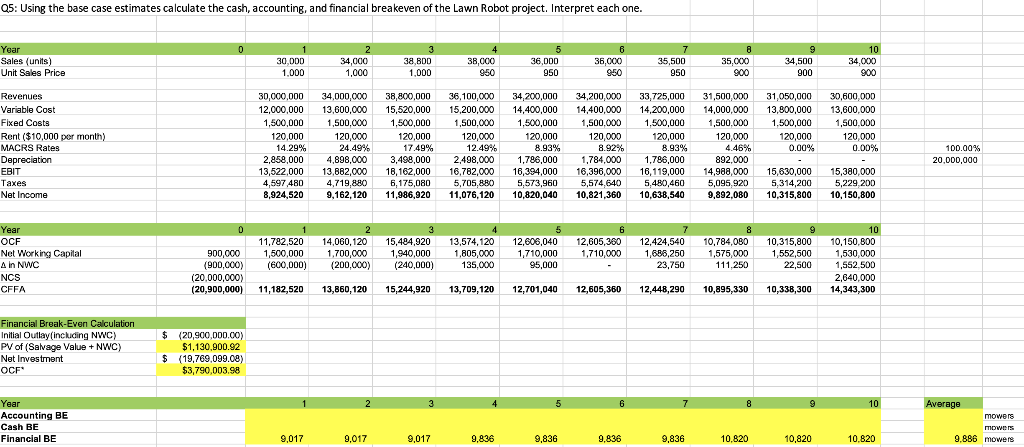

Q5: Using the base case estimates calculate the cash, accounting, and financial breakeven of the Lawn Robot project. Interpret each one.

Need answers for all questions below. For Q5 please show formulas too not just the numerical answers, also please interpret each one.

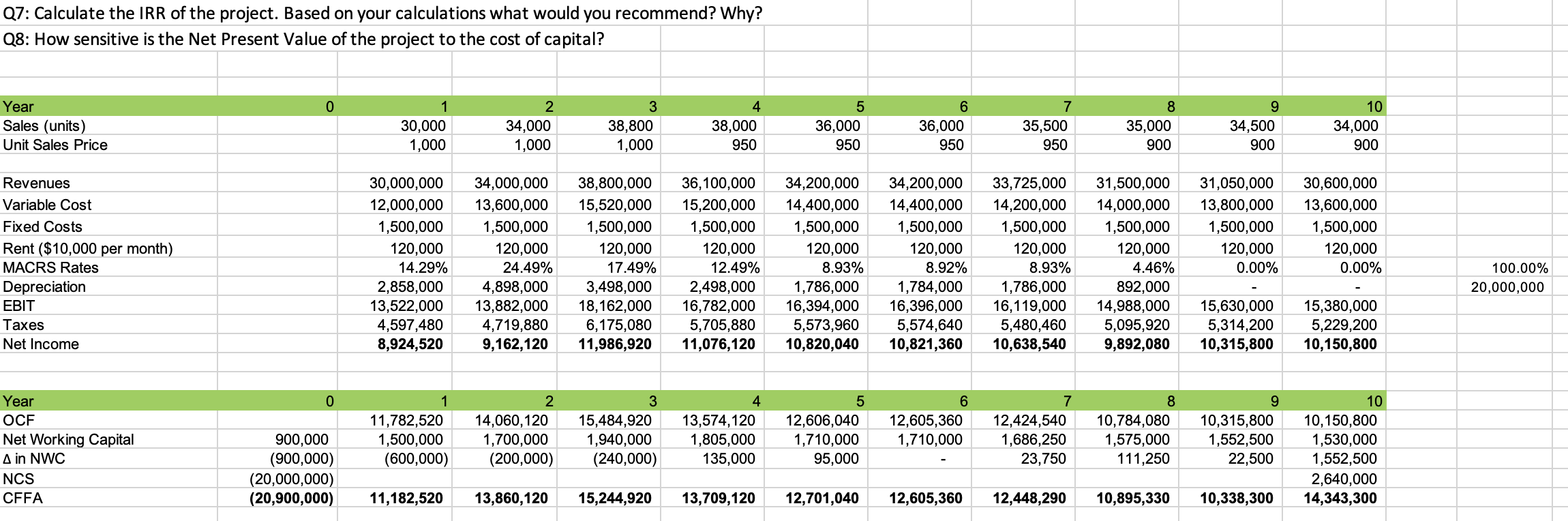

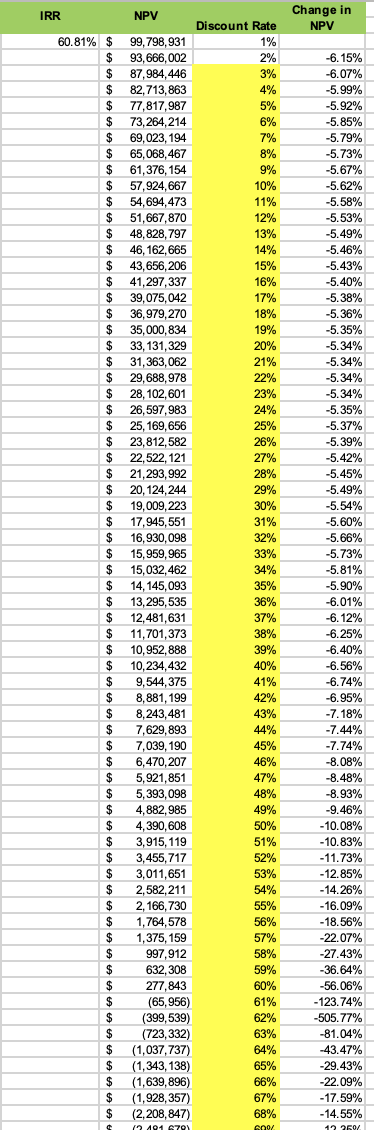

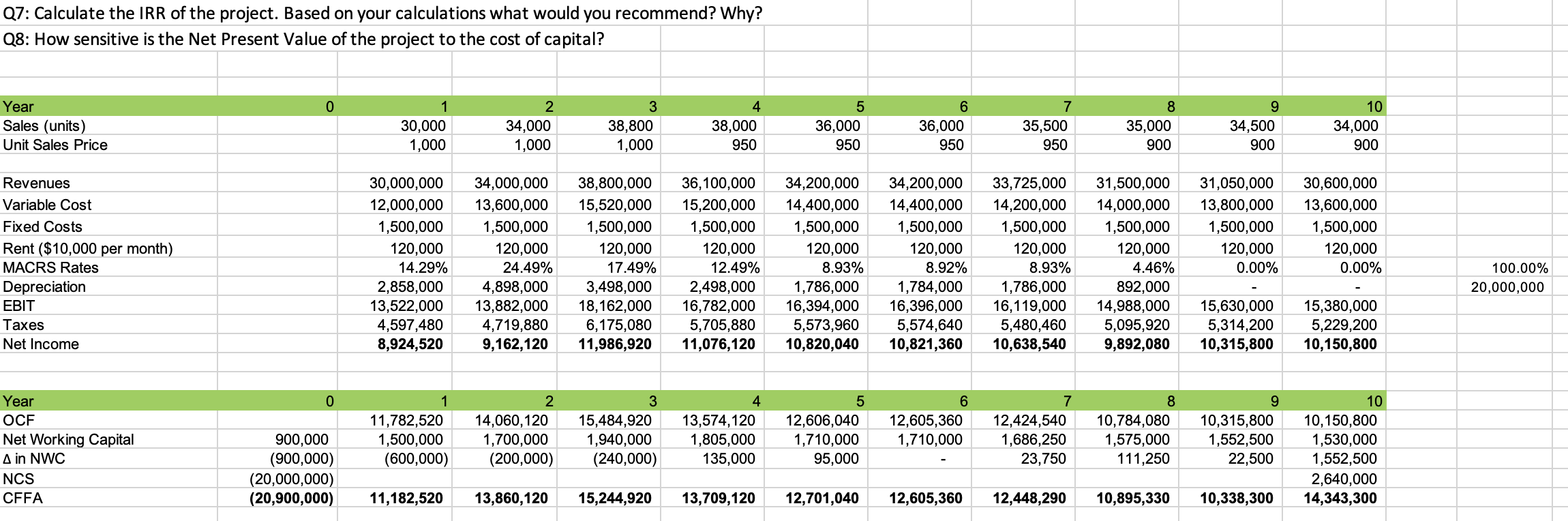

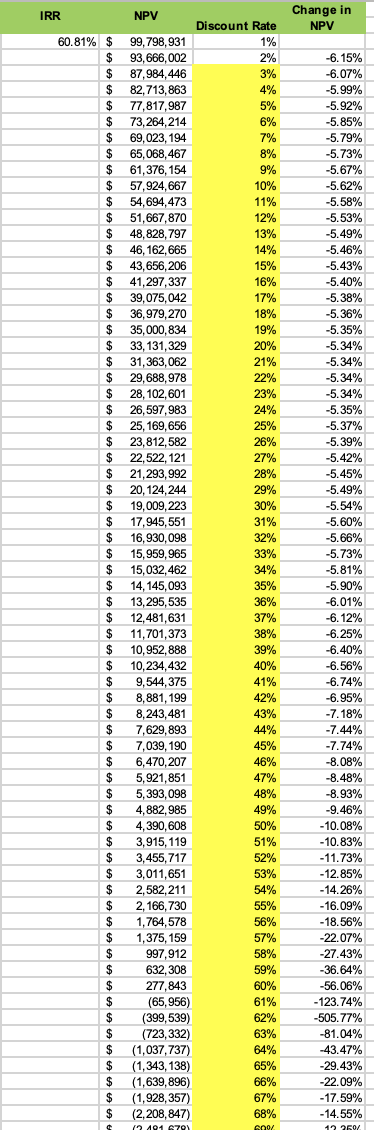

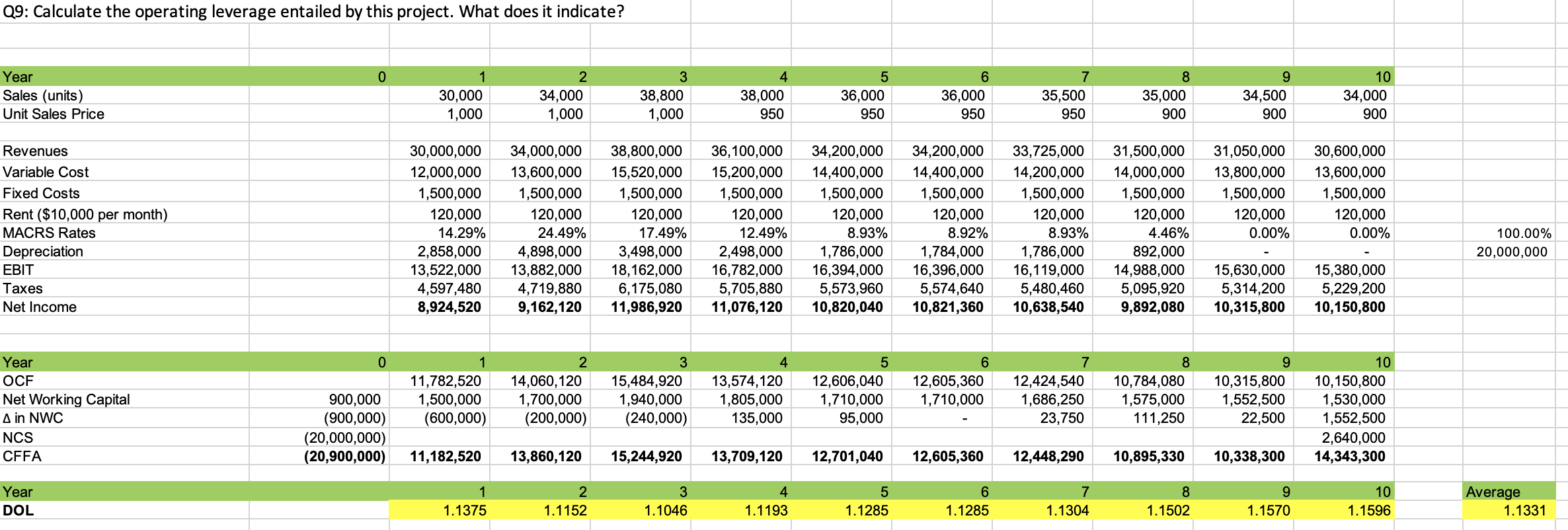

05: Using the base case estimates calculate the cash, accounting, and financial breakeven of the Lawn Robot project. Interpret each one. 0 Year Sales (units) Unit Sales Price 30,00D 1.000 2 34,000 1,000 3 38,800 1,000 4 38,000 950 5 36,000 950 6 36,000 950 7 35,500 950 8 35,000 900 9 34,500 900 10 34,000 900 36,100,000 15,200,000 1,500,000 Revenues Variable Cost Fixed Costs Rent ($10,000 per month) MACRS Rates Depreciation EBIT Taxes Net Income 30,000,000 12,000,000 1,500,000 120,000 14.29% 2,858,000 13,522,000 4,597,480 8,924,520 120,000 34,000,000 13,600,000 1,500,000 120,000 24.49% 4,898,000 13,862,000 4,719,880 9,162,120 38,800,000 15,520,000 1,500,000 120,000 17.49% % 3,498,000 18,162,000 6,175,080 11.986.920 34,200,000 14,400,000 1,500,000 120,000 8.93% 1,786,000 16,394,000 5,573,960 10,820,040 34,200,000 14,400,000 1,500,000 120,000 8.92% 1,784,000 16,396,000 5,574,640 10,821,360 33,725,000 14,200,000 1.500,000 120,000 8.93% 1,786,000 16,119,000 5,480,460 10,638,540 31,050,000 13,800,000 1.500,000 120,000 0.00% 12.49% 2,498,000 16,782.000 5,705,880 11,076,120 31,500,000 14,000,000 1,500,000 120.000 4.46% 892.000 14,980,000 5,095,920 9,892,080 30,600,000 13,600,000 1,500,000 120,000 0.00% 100.00% 20,000,000 15,630,000 5,314,200 10,315,800 15,380,000 5,229,200 10,150.800 D Year OCF Net Working Capital A In NWC NCS CFFA 11,782,520 1,500,000 (600,000) 2 14,060, 120 1,700,000 (200,000) 3 15,484,920 1,940,000 (240,000) 13,574,120 1,805,000 135,000 6 12,605,360 1,710.000 12,606,040 1,710,000 95,000 8 10,784,080 1,575,000 12,424,540 1,685,250 23,750 900,000 (900,000) (20,000,000) (20,900,000) 9 10,315,800 1,552,500 22,500 111.250 10 10,150,000 1,530,000 1,552.500 2,640,000 14,343,300 11, 182,520 13,860,120 15,244,920 13,709,120 12,701,040 12,605,360 12,448,290 10,895,330 10,338,300 Financial Break-Even Calculation Initial Outlay(including NWC) PV of (Salvage Value + NWC) Net Investment OCF $ (20,900,000.00) $1,130,900.92 $ (19.769,099.08) $3,790,003.98 2 3 5 6 7 8 10 Year Accounting BE Cash BE Financial BE Average mowers mowers 9.886 mowers 9,017 9,017 9,017 9,836 9,836 9,836 9,836 10.820 10,820 10,820 10.820 Q6: Let's say that the company had spent $500,000 in developing the prototype of the Lawn Robot How should Matt and Chris treat this item in their report? Please explain. Q7: Calculate the IRR of the project. Based on your calculations what would you recommend? Why? Q8: How sensitive is the Net Present Value of the project to the cost of capital? 0 Year Sales (units) Unit Sales Price 1 30,000 1,000 2 34,000 1,000 3 38,800 1,000 4 38,000 950 5 36,000 950 6 36,000 950 7 35,500 950 8 35,000 900 9 34,500 900 10 34,000 900 Revenues Variable Cost Fixed Costs Rent ($10,000 per month) MACRS Rates Depreciation EBIT Taxes Net Income 30,000,000 12,000,000 1,500,000 120,000 14.29% 2,858,000 13,522,000 4,597,480 8,924,520 34,000,000 13,600,000 1,500,000 120,000 24.49% 4,898,000 13,882,000 4,719,880 9,162,120 38,800,000 15,520,000 1,500,000 120,000 17.49% 3,498,000 18,162,000 6,175,080 11,986,920 36,100,000 15,200,000 1,500,000 120,000 12.49% 2,498,000 16,782,000 5,705,880 11,076,120 34,200,000 14,400,000 1,500,000 120,000 8.93% 1,786,000 16,394,000 5,573,960 10,820,040 34,200,000 14,400,000 1,500,000 120,000 8.92% 1,784,000 16,396,000 5,574,640 10,821,360 33,725,000 14,200,000 1,500,000 120,000 8.93% 1,786,000 16,119,000 5,480,460 10,638,540 31,500,000 14,000,000 1,500,000 120,000 4.46% 892,000 14,988,000 5,095,920 9,892,080 31,050,000 13,800,000 1,500,000 120,000 0.00% 30,600,000 13,600,000 1,500,000 120,000 0.00% 100.00% 20,000,000 15,630,000 5,314,200 10,315,800 15,380,000 5,229,200 10,150,800 0 Year OCF Net Working Capital A in NWC NCS CFFA 1 11,782,520 1,500,000 (600,000) 2 14,060,120 1,700,000 (200,000) 3 15,484,920 1,940,000 (240,000) 4 13,574,120 1,805,000 135,000 5 12,606,040 1,710,000 95,000 6 12,605,360 1,710,000 7 12,424,540 1,686,250 23,750 8 10,784,080 1,575,000 111,250 9 10,315,800 1,552,500 22,500 900,000 (900,000) (20,000,000) (20,900,000) 10 10,150,800 1,530,000 1,552,500 2,640,000 14,343,300 11,182,520 13,860,120 15,244,920 13,709,120 12,701,040 12,605,360 12,448,290 10,895,330 10,338,300 IRR Change in NPV -6.15% -6.07% -5.99% 60.81% $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ NPV Discount Rate 99,798,931 1% 93,666,002 2% 87,984,446 20/ 3% 404 82,713,863 4% 77,817,987 5% FO 73,264,214 6% 20 69,023, 194 7% 20/ 65,068,467 8% wie 00 9% 61,376,154 400 57,924,667 10% 24 4401 54,694,473 11% 420/ 51,667,870 12% 40 000 48,828,797 4201 13% de encer 46, 162, 665 14% re BOL 43,656,206 15% COL 41,297,337 16% 470 39,075,042 17% 100/ 36,979,270 18% 200 400/ 35,000,834 19% 2020 2001 33, 131,329 20% ce 2402 31,363,062 21% coco 29,688,978 22% 28, 102, 601 23% 26,597,983 2002 24% 240 cee 2502 25, 169,656 23,812,582 26% 22,522, 121 2702 27% 21,293,992 28% 20, 124,244 29% 19,009,223 30% 17,945,551 31% 16,930,098 32% 15,959,965 33% 15,032,462 34% 14, 145,093 35% 13,295,535 36% 12,481,631 37% 11,701,373 38% 10,952,888 39% o 10,234,432 40% 9,544,375 41% 8,881,199 42% W0100 8,243,481 43% 7,629,893 7,039, 190 45% 6,470,207 46% 5,921,851 47% 5,393,098 48% 4,882,985 4,390,608 3,915, 119 51% 3,455, 717 "! 52% 3,011,651 53% 2,582,211 54% 2, 166,730 5502 55% ze za ECO 1,764,578 56% 1,375, 159 6707 57% FOOL 997,912 58% 632,308 QOL 59% COO 277,843 60% (65,956) 61% 200 (399,539) 62% 1702 2001 6202 (723,332) 63% (1,037,737) 64% (1,343, 138) 6502 65% (1,639,896) 66% (1,928,357) 67% (2, 208,847) 68% 12 491 679 2007 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ . $ . $ $ $ $ $ $ . $ . $ $ . -5.92% 5050 -5.79% ook -5.73% -5.67% -5.62% COM -5.58% COM -5.53% -5.49% 400 -5.46% 1902 -5.43% -5.40% 2001 -5.38% -5.36% COM -5.35% 2408 -5.34% 2408 -5.34% 2408 -5.34% 2408 -5.34% -5.35% -5.37% 2702 -5.39% 2008 5.1997 -5.45% -5.49% -5.54% 9.04 -5.60% Dado -5.66% 0.00% -5.73% -5.81% on -5.90% Die -6.01% -6.12% -6.25% -0.20% -6.40% -6.56% 0.000 -6.74% . -6.95% con -7.18% 10 -7.44% -7.74% -8.08% som -8.48% -8.93% om -9.46% 2.0 - 10.08% 10.000 -10.83% 18:00 -11.73% ho -12.85% -14.26% -16.09% -18.56% 10 ECO 20707 -22.07% ON -27.43% -36.64% FOCO -56.06% -123.74% 199 200 COE270 -505.77% 04 40 -81.04% 12.470 -43.47% -29.43% -22.09% -17.59% -14.55% 17 769/ 44% 49% 50% $ $ $ ) Q9: Calculate the operating leverage entailed by this project. What does it indicate? 0 Year Sales (units) Unit Sales Price 1 30,000 1,000 2 34,000 1,000 3 38,800 1,000 4 38,000 950 5 36,000 950 6 36,000 950 7 35,500 950 8 35,000 900 9 34,500 900 10 34,000 900 Revenues Variable Cost Fixed Costs Rent ($10,000 per month) MACRS Rates Depreciation EBIT Taxes Net Income 30,000,000 12,000,000 1,500,000 120,000 14.29% 2,858,000 13,522,000 4,597,480 8,924,520 34,000,000 13,600,000 1,500,000 120,000 24.49% 4,898,000 13,882,000 4,719,880 9,162,120 38,800,000 15,520,000 1,500,000 120,000 17.49% 3,498,000 18,162,000 6,175,080 11,986,920 36,100,000 15,200,000 1,500,000 120,000 12.49% 2,498,000 16,782,000 5,705,880 11,076,120 34,200,000 14,400,000 1,500,000 120,000 8.93% 1,786,000 16,394,000 5,573,960 10,820,040 34,200,000 14,400,000 1,500,000 120,000 8.92% 1,784,000 16,396,000 5,574,640 10,821,360 33,725,000 14,200,000 1,500,000 120,000 8.93% 1,786,000 16,119,000 5,480,460 10,638,540 31,500,000 14,000,000 1,500,000 120,000 4.46% 892,000 14,988,000 5,095,920 9,892,080 31,050,000 13,800,000 1,500,000 120,000 0.00% 30,600,000 13,600,000 1,500,000 120,000 0.00% 100.00% 20,000,000 15,630,000 5,314,200 10,315,800 15,380,000 5,229,200 10,150,800 0 Year OCF Net Working Capital A in NWC NCS CFFA 1 11,782,520 1,500,000 (600,000) 2 14,060,120 1,700,000 (200,000) 3 15,484,920 1,940,000 (240,000) 13,574,120 1,805,000 135,000 5 12,606,040 1,710,000 95,000 6 12,605,360 1,710,000 7 12,424,540 1,686,250 23,750 8 10,784,080 1,575,000 111,250 9 10,315,800 1,552,500 22,500 900,000 (900,000) (20,000,000) (20,900,000) 10 10,150,800 1,530,000 1,552,500 2,640,000 14,343,300 11,182,520 13,860,120 15,244,920 13,709,120 12,701,040 12,605,360 12,448,290 10,895,330 10,338,300 Year DOL 1 1.1375 2 1.1152 3 1.1046 4 1.1193 5 1.1285 6 1.1285 7 1.1304 8 1.1502 9 1.1570 10 1.1596 Average 1.1331 Q10: What other types of contingency planning should Chris and Matt include to make the report comprehensive? Please explain the relevance of each suggestion. 05: Using the base case estimates calculate the cash, accounting, and financial breakeven of the Lawn Robot project. Interpret each one. 0 Year Sales (units) Unit Sales Price 30,00D 1.000 2 34,000 1,000 3 38,800 1,000 4 38,000 950 5 36,000 950 6 36,000 950 7 35,500 950 8 35,000 900 9 34,500 900 10 34,000 900 36,100,000 15,200,000 1,500,000 Revenues Variable Cost Fixed Costs Rent ($10,000 per month) MACRS Rates Depreciation EBIT Taxes Net Income 30,000,000 12,000,000 1,500,000 120,000 14.29% 2,858,000 13,522,000 4,597,480 8,924,520 120,000 34,000,000 13,600,000 1,500,000 120,000 24.49% 4,898,000 13,862,000 4,719,880 9,162,120 38,800,000 15,520,000 1,500,000 120,000 17.49% % 3,498,000 18,162,000 6,175,080 11.986.920 34,200,000 14,400,000 1,500,000 120,000 8.93% 1,786,000 16,394,000 5,573,960 10,820,040 34,200,000 14,400,000 1,500,000 120,000 8.92% 1,784,000 16,396,000 5,574,640 10,821,360 33,725,000 14,200,000 1.500,000 120,000 8.93% 1,786,000 16,119,000 5,480,460 10,638,540 31,050,000 13,800,000 1.500,000 120,000 0.00% 12.49% 2,498,000 16,782.000 5,705,880 11,076,120 31,500,000 14,000,000 1,500,000 120.000 4.46% 892.000 14,980,000 5,095,920 9,892,080 30,600,000 13,600,000 1,500,000 120,000 0.00% 100.00% 20,000,000 15,630,000 5,314,200 10,315,800 15,380,000 5,229,200 10,150.800 D Year OCF Net Working Capital A In NWC NCS CFFA 11,782,520 1,500,000 (600,000) 2 14,060, 120 1,700,000 (200,000) 3 15,484,920 1,940,000 (240,000) 13,574,120 1,805,000 135,000 6 12,605,360 1,710.000 12,606,040 1,710,000 95,000 8 10,784,080 1,575,000 12,424,540 1,685,250 23,750 900,000 (900,000) (20,000,000) (20,900,000) 9 10,315,800 1,552,500 22,500 111.250 10 10,150,000 1,530,000 1,552.500 2,640,000 14,343,300 11, 182,520 13,860,120 15,244,920 13,709,120 12,701,040 12,605,360 12,448,290 10,895,330 10,338,300 Financial Break-Even Calculation Initial Outlay(including NWC) PV of (Salvage Value + NWC) Net Investment OCF $ (20,900,000.00) $1,130,900.92 $ (19.769,099.08) $3,790,003.98 2 3 5 6 7 8 10 Year Accounting BE Cash BE Financial BE Average mowers mowers 9.886 mowers 9,017 9,017 9,017 9,836 9,836 9,836 9,836 10.820 10,820 10,820 10.820 Q6: Let's say that the company had spent $500,000 in developing the prototype of the Lawn Robot How should Matt and Chris treat this item in their report? Please explain. Q7: Calculate the IRR of the project. Based on your calculations what would you recommend? Why? Q8: How sensitive is the Net Present Value of the project to the cost of capital? 0 Year Sales (units) Unit Sales Price 1 30,000 1,000 2 34,000 1,000 3 38,800 1,000 4 38,000 950 5 36,000 950 6 36,000 950 7 35,500 950 8 35,000 900 9 34,500 900 10 34,000 900 Revenues Variable Cost Fixed Costs Rent ($10,000 per month) MACRS Rates Depreciation EBIT Taxes Net Income 30,000,000 12,000,000 1,500,000 120,000 14.29% 2,858,000 13,522,000 4,597,480 8,924,520 34,000,000 13,600,000 1,500,000 120,000 24.49% 4,898,000 13,882,000 4,719,880 9,162,120 38,800,000 15,520,000 1,500,000 120,000 17.49% 3,498,000 18,162,000 6,175,080 11,986,920 36,100,000 15,200,000 1,500,000 120,000 12.49% 2,498,000 16,782,000 5,705,880 11,076,120 34,200,000 14,400,000 1,500,000 120,000 8.93% 1,786,000 16,394,000 5,573,960 10,820,040 34,200,000 14,400,000 1,500,000 120,000 8.92% 1,784,000 16,396,000 5,574,640 10,821,360 33,725,000 14,200,000 1,500,000 120,000 8.93% 1,786,000 16,119,000 5,480,460 10,638,540 31,500,000 14,000,000 1,500,000 120,000 4.46% 892,000 14,988,000 5,095,920 9,892,080 31,050,000 13,800,000 1,500,000 120,000 0.00% 30,600,000 13,600,000 1,500,000 120,000 0.00% 100.00% 20,000,000 15,630,000 5,314,200 10,315,800 15,380,000 5,229,200 10,150,800 0 Year OCF Net Working Capital A in NWC NCS CFFA 1 11,782,520 1,500,000 (600,000) 2 14,060,120 1,700,000 (200,000) 3 15,484,920 1,940,000 (240,000) 4 13,574,120 1,805,000 135,000 5 12,606,040 1,710,000 95,000 6 12,605,360 1,710,000 7 12,424,540 1,686,250 23,750 8 10,784,080 1,575,000 111,250 9 10,315,800 1,552,500 22,500 900,000 (900,000) (20,000,000) (20,900,000) 10 10,150,800 1,530,000 1,552,500 2,640,000 14,343,300 11,182,520 13,860,120 15,244,920 13,709,120 12,701,040 12,605,360 12,448,290 10,895,330 10,338,300 IRR Change in NPV -6.15% -6.07% -5.99% 60.81% $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ NPV Discount Rate 99,798,931 1% 93,666,002 2% 87,984,446 20/ 3% 404 82,713,863 4% 77,817,987 5% FO 73,264,214 6% 20 69,023, 194 7% 20/ 65,068,467 8% wie 00 9% 61,376,154 400 57,924,667 10% 24 4401 54,694,473 11% 420/ 51,667,870 12% 40 000 48,828,797 4201 13% de encer 46, 162, 665 14% re BOL 43,656,206 15% COL 41,297,337 16% 470 39,075,042 17% 100/ 36,979,270 18% 200 400/ 35,000,834 19% 2020 2001 33, 131,329 20% ce 2402 31,363,062 21% coco 29,688,978 22% 28, 102, 601 23% 26,597,983 2002 24% 240 cee 2502 25, 169,656 23,812,582 26% 22,522, 121 2702 27% 21,293,992 28% 20, 124,244 29% 19,009,223 30% 17,945,551 31% 16,930,098 32% 15,959,965 33% 15,032,462 34% 14, 145,093 35% 13,295,535 36% 12,481,631 37% 11,701,373 38% 10,952,888 39% o 10,234,432 40% 9,544,375 41% 8,881,199 42% W0100 8,243,481 43% 7,629,893 7,039, 190 45% 6,470,207 46% 5,921,851 47% 5,393,098 48% 4,882,985 4,390,608 3,915, 119 51% 3,455, 717 "! 52% 3,011,651 53% 2,582,211 54% 2, 166,730 5502 55% ze za ECO 1,764,578 56% 1,375, 159 6707 57% FOOL 997,912 58% 632,308 QOL 59% COO 277,843 60% (65,956) 61% 200 (399,539) 62% 1702 2001 6202 (723,332) 63% (1,037,737) 64% (1,343, 138) 6502 65% (1,639,896) 66% (1,928,357) 67% (2, 208,847) 68% 12 491 679 2007 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ . $ . $ $ $ $ $ $ . $ . $ $ . -5.92% 5050 -5.79% ook -5.73% -5.67% -5.62% COM -5.58% COM -5.53% -5.49% 400 -5.46% 1902 -5.43% -5.40% 2001 -5.38% -5.36% COM -5.35% 2408 -5.34% 2408 -5.34% 2408 -5.34% 2408 -5.34% -5.35% -5.37% 2702 -5.39% 2008 5.1997 -5.45% -5.49% -5.54% 9.04 -5.60% Dado -5.66% 0.00% -5.73% -5.81% on -5.90% Die -6.01% -6.12% -6.25% -0.20% -6.40% -6.56% 0.000 -6.74% . -6.95% con -7.18% 10 -7.44% -7.74% -8.08% som -8.48% -8.93% om -9.46% 2.0 - 10.08% 10.000 -10.83% 18:00 -11.73% ho -12.85% -14.26% -16.09% -18.56% 10 ECO 20707 -22.07% ON -27.43% -36.64% FOCO -56.06% -123.74% 199 200 COE270 -505.77% 04 40 -81.04% 12.470 -43.47% -29.43% -22.09% -17.59% -14.55% 17 769/ 44% 49% 50% $ $ $ ) Q9: Calculate the operating leverage entailed by this project. What does it indicate? 0 Year Sales (units) Unit Sales Price 1 30,000 1,000 2 34,000 1,000 3 38,800 1,000 4 38,000 950 5 36,000 950 6 36,000 950 7 35,500 950 8 35,000 900 9 34,500 900 10 34,000 900 Revenues Variable Cost Fixed Costs Rent ($10,000 per month) MACRS Rates Depreciation EBIT Taxes Net Income 30,000,000 12,000,000 1,500,000 120,000 14.29% 2,858,000 13,522,000 4,597,480 8,924,520 34,000,000 13,600,000 1,500,000 120,000 24.49% 4,898,000 13,882,000 4,719,880 9,162,120 38,800,000 15,520,000 1,500,000 120,000 17.49% 3,498,000 18,162,000 6,175,080 11,986,920 36,100,000 15,200,000 1,500,000 120,000 12.49% 2,498,000 16,782,000 5,705,880 11,076,120 34,200,000 14,400,000 1,500,000 120,000 8.93% 1,786,000 16,394,000 5,573,960 10,820,040 34,200,000 14,400,000 1,500,000 120,000 8.92% 1,784,000 16,396,000 5,574,640 10,821,360 33,725,000 14,200,000 1,500,000 120,000 8.93% 1,786,000 16,119,000 5,480,460 10,638,540 31,500,000 14,000,000 1,500,000 120,000 4.46% 892,000 14,988,000 5,095,920 9,892,080 31,050,000 13,800,000 1,500,000 120,000 0.00% 30,600,000 13,600,000 1,500,000 120,000 0.00% 100.00% 20,000,000 15,630,000 5,314,200 10,315,800 15,380,000 5,229,200 10,150,800 0 Year OCF Net Working Capital A in NWC NCS CFFA 1 11,782,520 1,500,000 (600,000) 2 14,060,120 1,700,000 (200,000) 3 15,484,920 1,940,000 (240,000) 13,574,120 1,805,000 135,000 5 12,606,040 1,710,000 95,000 6 12,605,360 1,710,000 7 12,424,540 1,686,250 23,750 8 10,784,080 1,575,000 111,250 9 10,315,800 1,552,500 22,500 900,000 (900,000) (20,000,000) (20,900,000) 10 10,150,800 1,530,000 1,552,500 2,640,000 14,343,300 11,182,520 13,860,120 15,244,920 13,709,120 12,701,040 12,605,360 12,448,290 10,895,330 10,338,300 Year DOL 1 1.1375 2 1.1152 3 1.1046 4 1.1193 5 1.1285 6 1.1285 7 1.1304 8 1.1502 9 1.1570 10 1.1596 Average 1.1331 Q10: What other types of contingency planning should Chris and Matt include to make the report comprehensive? Please explain the relevance of each suggestion