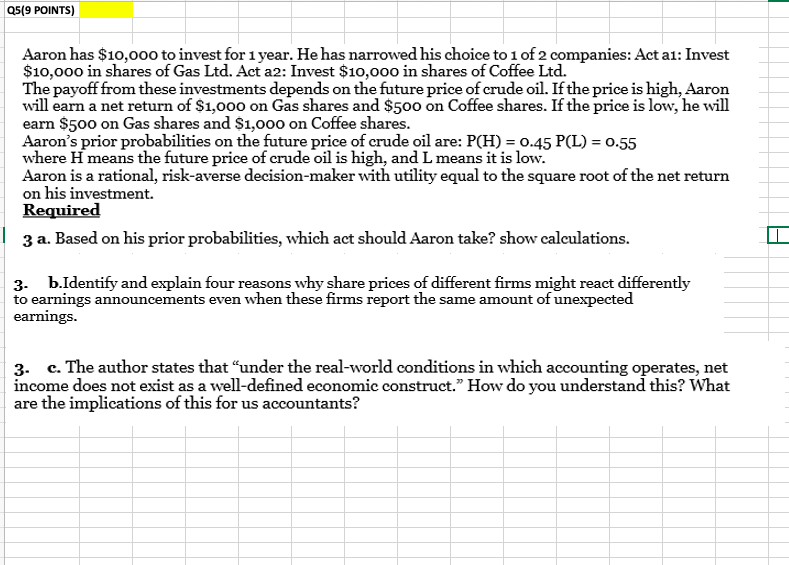

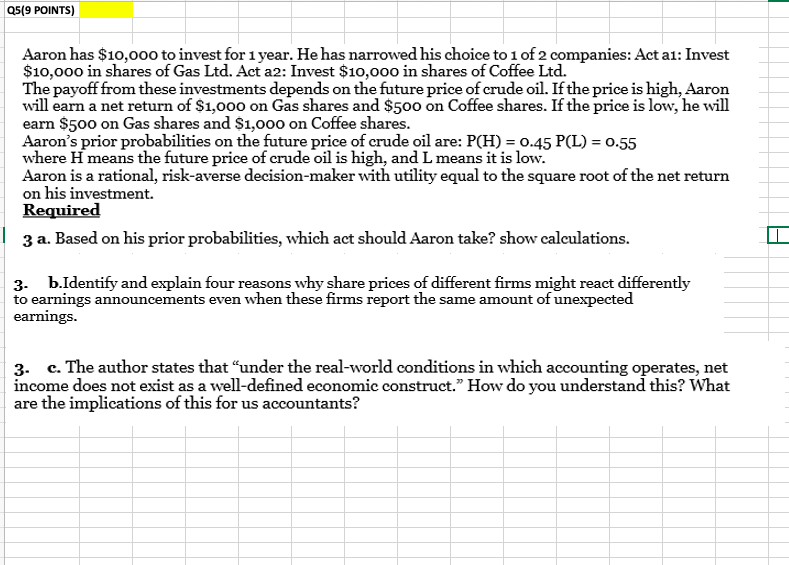

Q5(9 POINTS) Aaron has $10,000 to invest for 1 year. He has narrowed his choice to 1 of 2 companies: Act ai: Invest $10,000 in shares of Gas Ltd. Act a2: Invest $10,000 in shares of Coffee Ltd. The payoff from these investments depends on the future price of crude oil. If the price is high, Aaron will earn a net return of $1,000 on Gas shares and $500 on Coffee shares. If the price is low, he will earn $500 on Gas shares and $1,000 on Coffee shares. Aaron's prior probabilities on the future price of crude oil are: P(H) = 0.45 P(L) = 0.55 where H means the future price of crude oil is high, and L means it is low. Aaron is a rational, risk-averse decision-maker with utility equal to the square root of the net return on his investment. Required 3 a. Based on his prior probabilities, which act should Aaron take? show calculations. 3. b.Identify and explain four reasons why share prices of different firms might react differently to earnings announcements even when these firms report the same amount of unexpected earnings. 3. c. The author states that under the real-world conditions in which accounting operates, net income does not exist as a well-defined economic construct. How do you understand this? What are the implications of this for us accountants? Q5(9 POINTS) Aaron has $10,000 to invest for 1 year. He has narrowed his choice to 1 of 2 companies: Act ai: Invest $10,000 in shares of Gas Ltd. Act a2: Invest $10,000 in shares of Coffee Ltd. The payoff from these investments depends on the future price of crude oil. If the price is high, Aaron will earn a net return of $1,000 on Gas shares and $500 on Coffee shares. If the price is low, he will earn $500 on Gas shares and $1,000 on Coffee shares. Aaron's prior probabilities on the future price of crude oil are: P(H) = 0.45 P(L) = 0.55 where H means the future price of crude oil is high, and L means it is low. Aaron is a rational, risk-averse decision-maker with utility equal to the square root of the net return on his investment. Required 3 a. Based on his prior probabilities, which act should Aaron take? show calculations. 3. b.Identify and explain four reasons why share prices of different firms might react differently to earnings announcements even when these firms report the same amount of unexpected earnings. 3. c. The author states that under the real-world conditions in which accounting operates, net income does not exist as a well-defined economic construct. How do you understand this? What are the implications of this for us accountants