Q.6 A company uses the FIFO (First-In-First-Out) method for inventory valuation. During the month, the following units of a product were purchased and sold:

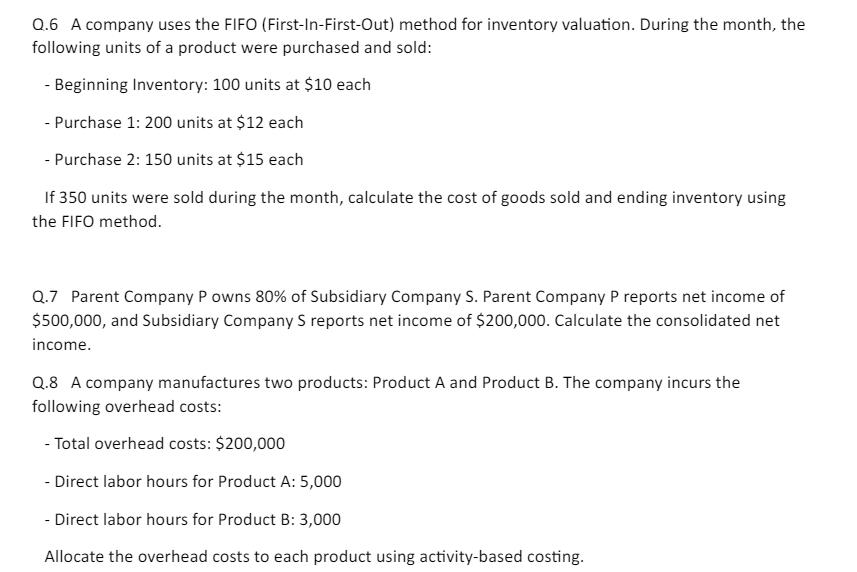

Q.6 A company uses the FIFO (First-In-First-Out) method for inventory valuation. During the month, the following units of a product were purchased and sold: - Beginning Inventory: 100 units at $10 each - Purchase 1: 200 units at $12 each - Purchase 2: 150 units at $15 each If 350 units were sold during the month, calculate the cost of goods sold and ending inventory using the FIFO method. Q.7 Parent Company P owns 80% of Subsidiary Company S. Parent Company P reports net income of $500,000, and Subsidiary Company S reports net income of $200,000. Calculate the consolidated net income. Q.8 A company manufactures two products: Product A and Product B. The company incurs the following overhead costs: - Total overhead costs: $200,000 - Direct labor hours for Product A: 5,000 - Direct labor hours for Product B: 3,000 Allocate the overhead costs to each product using activity-based costing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started