Question

Q#6: Calculate the taxable income and net tax payable of Mr. Imran Rana for the tax year 2019. (10) Basic Salary 80000 pm Bonus.

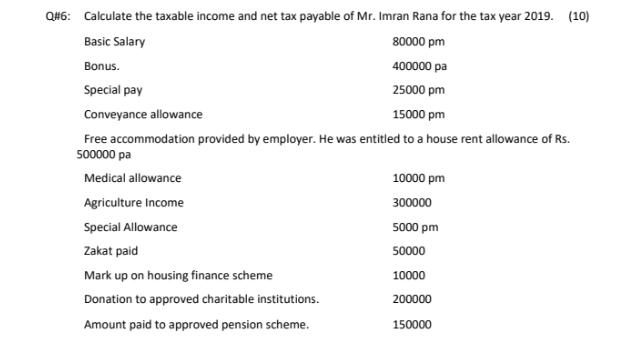

Q#6: Calculate the taxable income and net tax payable of Mr. Imran Rana for the tax year 2019. (10) Basic Salary 80000 pm Bonus. 400000 pa Special pay 25000 pm Conveyance allowance 15000 pm Free accommodation provided by employer. He was entitled to a house rent allowance of Rs. 500000 pa Medical allowance 10000 pm Agriculture Income 300000 Special Allowance 5000 pm Zakat paid 50000 Mark up on housing finance scheme 10000 Donation to approved charitable institutions. 200000 Amount paid to approved pension scheme. 150000

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting What the Numbers Mean

Authors: David H. Marshall, Wayne W. McManus, Daniel F. Viele

10th edition

9780077515904, 007802529X, 77515900, 978-0078025297

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App