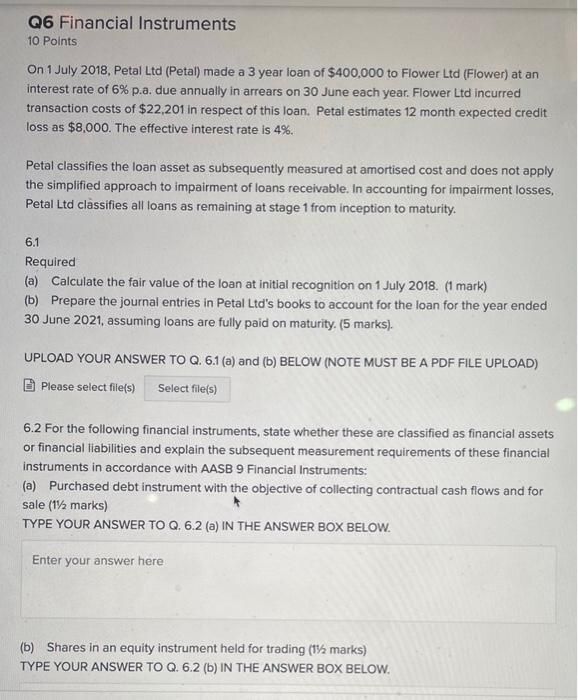

Q6 Financial Instruments 10 Points On 1 July 2018, Petal Ltd (Petal) made a 3 year loan of $400,000 to Flower Ltd (Flower) at an interest rate of 6% p.a. due annually in arrears on 30 June each year. Flower Ltd incurred transaction costs of $22,201 in respect of this loan. Petal estimates 12 month expected credit loss as $8,000. The effective interest rate is 4%. Petal classifies the loan asset as subsequently measured at amortised cost and does not apply the simplified approach to impairment of loans receivable. In accounting for impairment losses, Petal Ltd classifies all loans as remaining at stage 1 from inception to maturity. 6.1 Required (a) Calculate the fair value of the loan at initial recognition on 1 July 2018. (1 mark) (b) Prepare the journal entries in Petal Ltd's books to account for the loan for the year ended 30 June 2021, assuming loans are fully paid on maturity. (5 marks). UPLOAD YOUR ANSWER TO Q. 6.1 (a) and (b) BELOW (NOTE MUST BE A PDF FILE UPLOAD) Please select file(s) Select file(s) 6.2 For the following financial instruments, state whether these are classified as financial assets or financial liabilities and explain the subsequent measurement requirements of these financial instruments in accordance with AASB 9 Financial Instruments: (a) Purchased debt instrument with the objective of collecting contractual cash flows and for sale (122 marks) TYPE YOUR ANSWER TO Q. 6.2 (a) IN THE ANSWER BOX BELOW. Enter your answer here (6) Shares in an equity instrument held for trading (172 marks) TYPE YOUR ANSWER TO Q. 6.2 (b) IN THE ANSWER BOX BELOW. Q6 Financial Instruments 10 Points On 1 July 2018, Petal Ltd (Petal) made a 3 year loan of $400,000 to Flower Ltd (Flower) at an interest rate of 6% p.a. due annually in arrears on 30 June each year. Flower Ltd incurred transaction costs of $22,201 in respect of this loan. Petal estimates 12 month expected credit loss as $8,000. The effective interest rate is 4%. Petal classifies the loan asset as subsequently measured at amortised cost and does not apply the simplified approach to impairment of loans receivable. In accounting for impairment losses, Petal Ltd classifies all loans as remaining at stage 1 from inception to maturity. 6.1 Required (a) Calculate the fair value of the loan at initial recognition on 1 July 2018. (1 mark) (b) Prepare the journal entries in Petal Ltd's books to account for the loan for the year ended 30 June 2021, assuming loans are fully paid on maturity. (5 marks). UPLOAD YOUR ANSWER TO Q. 6.1 (a) and (b) BELOW (NOTE MUST BE A PDF FILE UPLOAD) Please select file(s) Select file(s) 6.2 For the following financial instruments, state whether these are classified as financial assets or financial liabilities and explain the subsequent measurement requirements of these financial instruments in accordance with AASB 9 Financial Instruments: (a) Purchased debt instrument with the objective of collecting contractual cash flows and for sale (122 marks) TYPE YOUR ANSWER TO Q. 6.2 (a) IN THE ANSWER BOX BELOW. Enter your answer here (6) Shares in an equity instrument held for trading (172 marks) TYPE YOUR ANSWER TO Q. 6.2 (b) IN THE ANSWER BOX BELOW