Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q6. The company has traditionally used convenience stores as their preferred distribution channel to cater to their customers (80% of their customer are millennials).

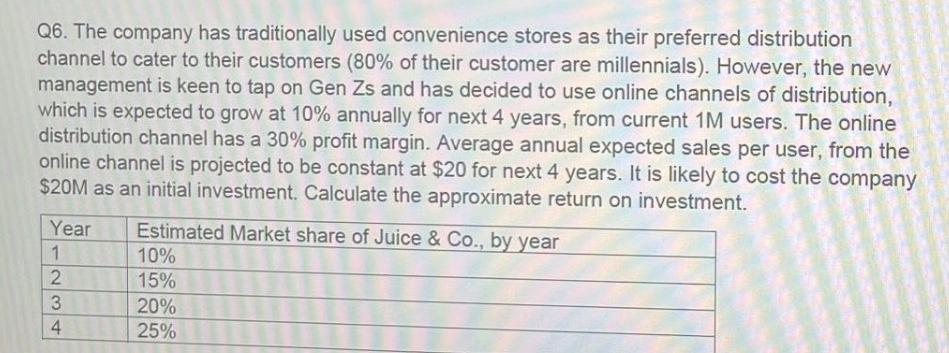

Q6. The company has traditionally used convenience stores as their preferred distribution channel to cater to their customers (80% of their customer are millennials). However, the new management is keen to tap on Gen Zs and has decided to use online channels of distribution, which is expected to grow at 10% annually for next 4 years, from current 1M users. The online distribution channel has a 30% profit margin. Average annual expected sales per user, from the online channel is projected to be constant at $20 for next 4 years. It is likely to cost the company $20M as an initial investment. Calculate the approximate return on investment. Year 1 2 3 4 Estimated Market share of Juice & Co., by year 10% 15% 20% 25%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the approximate return on investment ROI for the companys decision to invest 20 million ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started