Answered step by step

Verified Expert Solution

Question

1 Approved Answer

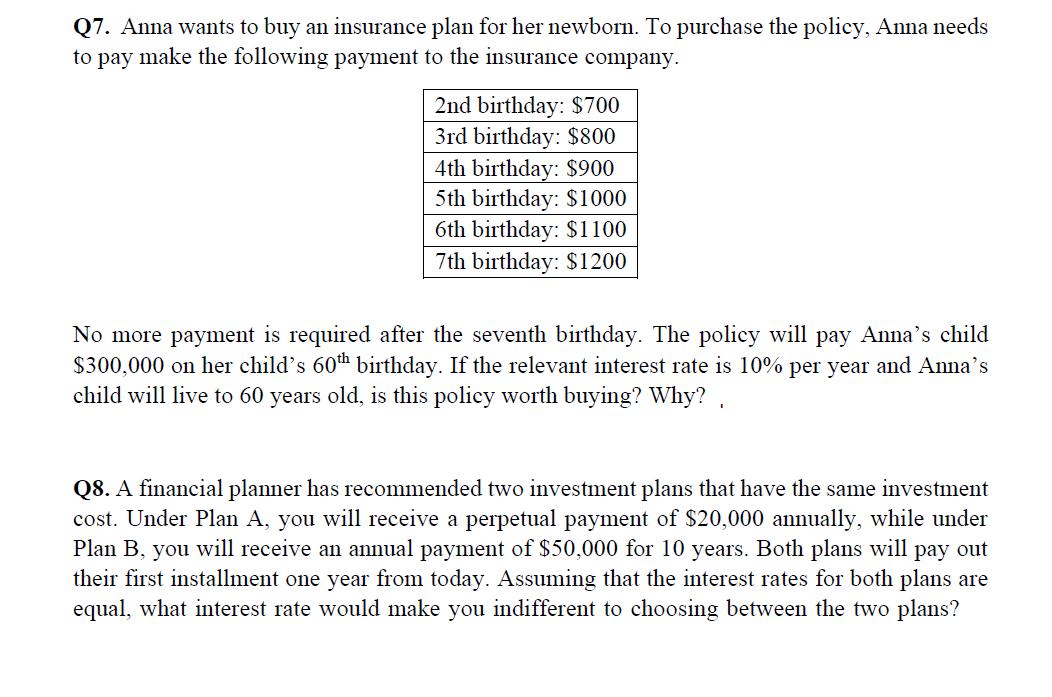

Q7. Anna wants to buy an insurance plan for her newborn. To purchase the policy, Anna needs to pay make the following payment to

Q7. Anna wants to buy an insurance plan for her newborn. To purchase the policy, Anna needs to pay make the following payment to the insurance company. 2nd birthday: $700 3rd birthday: $800 4th birthday: $900 5th birthday: $1000 6th birthday: $1100 7th birthday: $1200 No more payment is required after the seventh birthday. The policy will pay Anna's child $300,000 on her child's 60th birthday. If the relevant interest rate is 10% per year and Anna's child will live to 60 years old, is this policy worth buying? Why? Q8. A financial planner has recommended two investment plans that have the same investment cost. Under Plan A, you will receive a perpetual payment of $20,000 annually, while under Plan B, you will receive an annual payment of $50,000 for 10 years. Both plans will pay out their first installment one year from today. Assuming that the interest rates for both plans are equal, what interest rate would make you indifferent to choosing between the two plans?

Step by Step Solution

★★★★★

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started