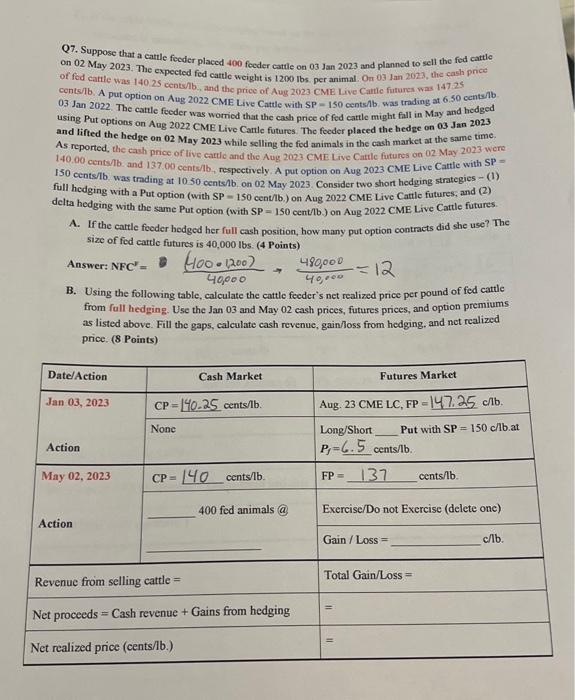

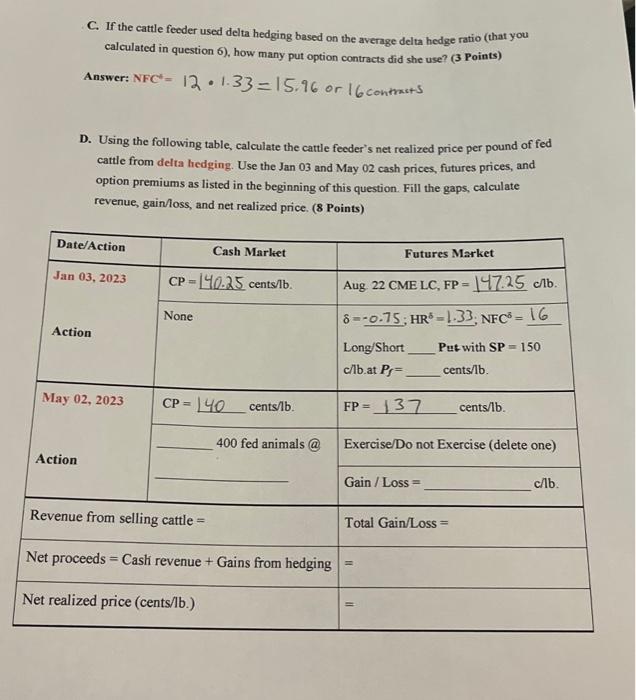

Q7. Suppose that a cattle feeder placed 400 feeder cattle on 03 Jan 2023 and planned to sell the fed cattle on 02 May 2023. The expected fed cattle weight is 1200lbs per animal. On 03 Jan 2023 , the cash price of fod cattle was 140.25 cents/b, and the price of Aug 2023 CME Live Camte futures was 14725 cents/b. A put option on Aug 2022 CME Live Cattle with SP - 150 cents/b, was trading at 6.50 cents /b 03 Jan 2022. The cattle feeder was worried that the cach price of fed cattle might fall in May and hedged using Put options on Aug 2022 CME Live Cartle futures. The foeder placed the hedge on 03 Jan 2023 and lifted the hedge on 02May2023 while selling the fod animals in the cash market at the same time. As reported, the cash price of live cartle and the Aug 2023 CME Live Cattle futures on 02 May 2023 were 140.00 cents/lb and 137.00 cents/1b, respectively. A put option on Aug 2023 CME Live Cartle with SP = 150 cents/1b was trading at 1050 cents 1b, on 02May2023. Consider two short hedging strategies - (1) full hedging with a Put option (with SP = 150 cent/lb) on Aug 2022 CME Live Cattle futures, and (2) delta hedging with the same Put option (with SP = 150 cent/1b) on Aug 2022 CME Live Cartle futures. A. If the cartle feeder hedged her full cash position, how many put option contracts did she use? The size of fed cartle futures is 40,000 lbs. (4 Points) Answer:NFC=240,000(1001200)40,000480,000=12 B. Using the following table, calculate the cattlo feeder's net realized price per pound of fed cattle from full hedging. Use the Jan 03 and May 02 cash prices, futures prices, and option premiums as listed above. Fill the gaps, calculate cash revenue, gain/loss from hedging, and net realized price. ( 8 Points) C. If the cattle feeder used delta hedging based on the average delta hedge ratio (that you calculated in question 6), how many put option contracts did she use? (3 Points) Answer: NFC5=121.33=15.96 or 16 contracts D. Using the following table, calculate the cattle feeder's net realized price per pound of fed cattle from delta hedging. Use the Jan 03 and May 02 cash prices, futures prices, and option premiums as listed in the beginning of this question. Fill the gaps, calculate revenue, gain/loss, and net realized price. ( 8 Points)