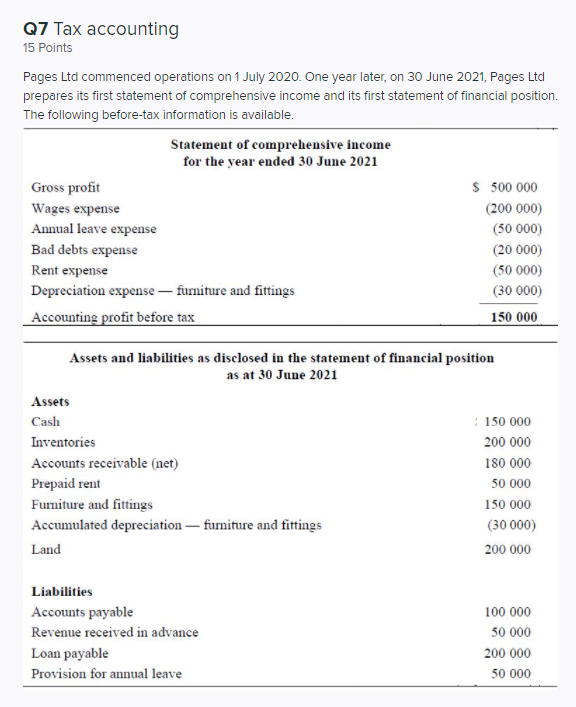

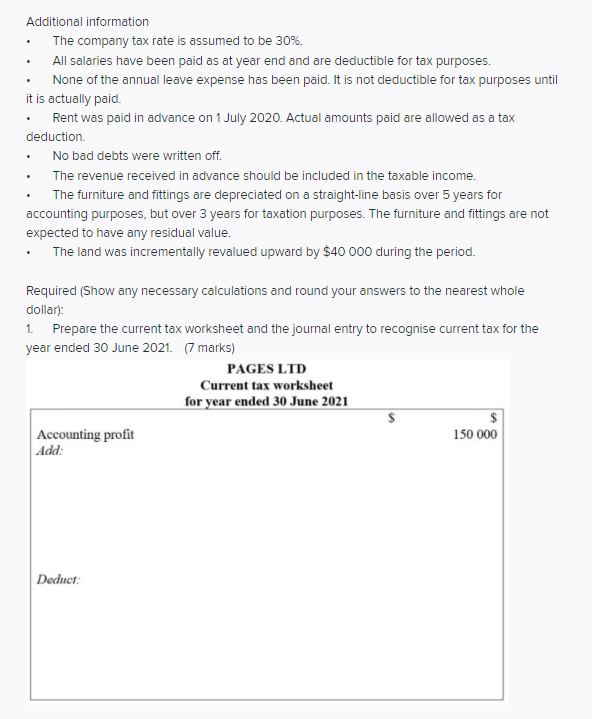

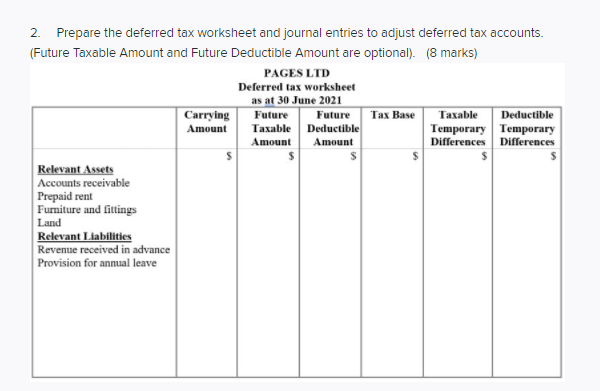

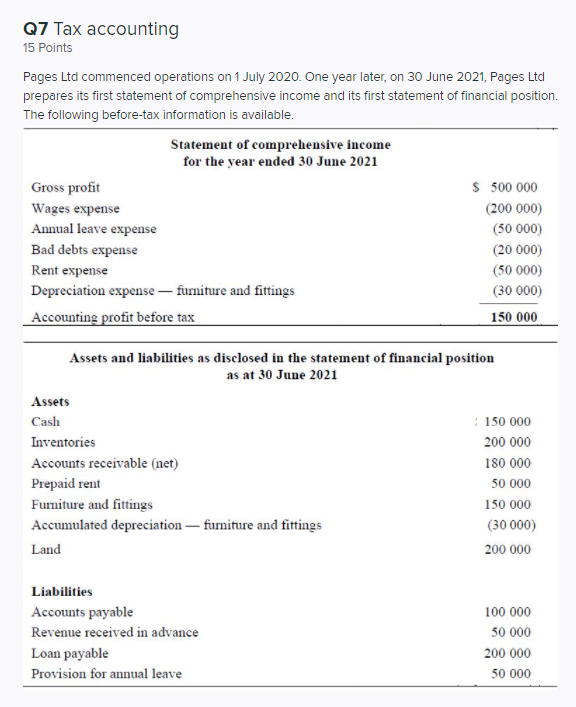

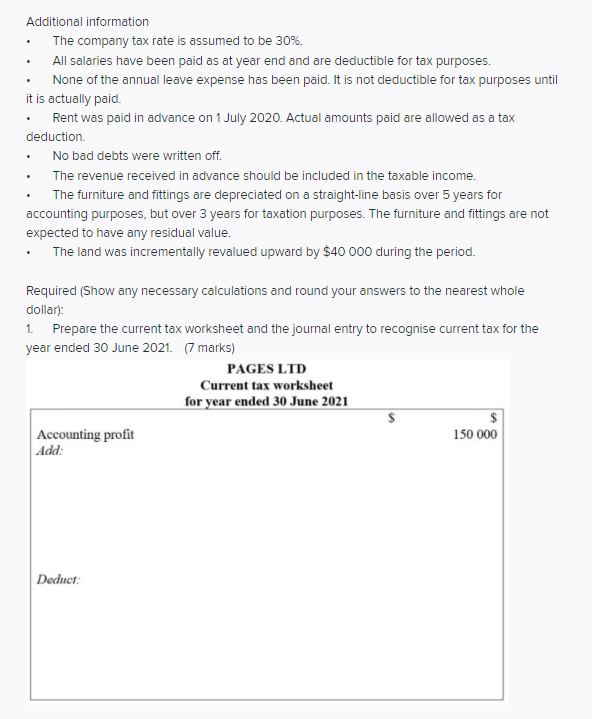

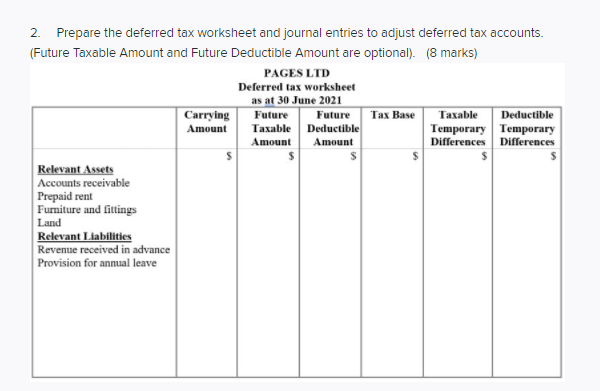

Q7 Tax accounting 15 Points Pages Ltd commenced operations on 1 July 2020. One year later, on 30 June 2021, Pages Ltd prepares its first statement of comprehensive income and its first statement of financial position. The following before-tax information is available. Statement of comprehensive income for the year ended 30 June 2021 Gross profit $ 500 000 Wages expense (200 000) Annual leave expense (50 000) Bad debts expense (20 000) Rent expense (50 000) Depreciation expense - furniture and fittings (30 000) Accounting profit before tax 150 000 Assets and liabilities as disclosed in the statement of financial position as at 30 June 2021 Assets Cash : 150 000 Inventories 200 000 Accounts receivable (net) 180 000 Prepaid rent 50 000 Furniture and fittings 150 000 Accumulated depreciation furniture and fittings (30 000) Land 200 000 Liabilities Accounts payable Revenue received in advance Loan payable Provision for annual leave 100 000 50 000 200 000 50 000 . Additional information The company tax rate is assumed to be 30%. All salaries have been paid as at year end and are deductible for tax purposes. None of the annual leave expense has been paid. It is not deductible for tax purposes until it is actually paid. Rent was paid in advance on 1 July 2020. Actual amounts paid are allowed as a tax deduction. No bad debts were written off. The revenue received in advance should be included in the taxable income. The furniture and fittings are depreciated on a straight-line basis over 5 years for accounting purposes, but over 3 years for taxation purposes. The furniture and fittings are not expected to have any residual value. The land was incrementally revalued upward by $40 000 during the period. Required (Show any necessary calculations and round your answers to the nearest whole dollar): 1. Prepare the current tax worksheet and the journal entry to recognise current tax for the year ended 30 June 2021. (7 marks) PAGES LTD Current tax worksheet for year ended 30 June 2021 Accounting profit Add: 150 000 Deduct: 2. Prepare the deferred tax worksheet and journal entries to adjust deferred tax accounts. (Future Taxable Amount and Future Deductible Amount are optional). (8 marks) PAGES LTD Deferred tax worksheet as at 30 June 2021 Carrying Future Future Tax Base Taxable Deductible Amount Taxable Deductible Temporary Temporary Amount Amount Differences Differences Relevant Assets Accounts receivable Prepaid rent Furniture and fittings Relevant Liabilities Revenue received in advance Provision for annual leave Land