Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q7 The LJ Company currently sells short leather jackets for $349 each. The firm is considering selling long coats also. The coats would sell for

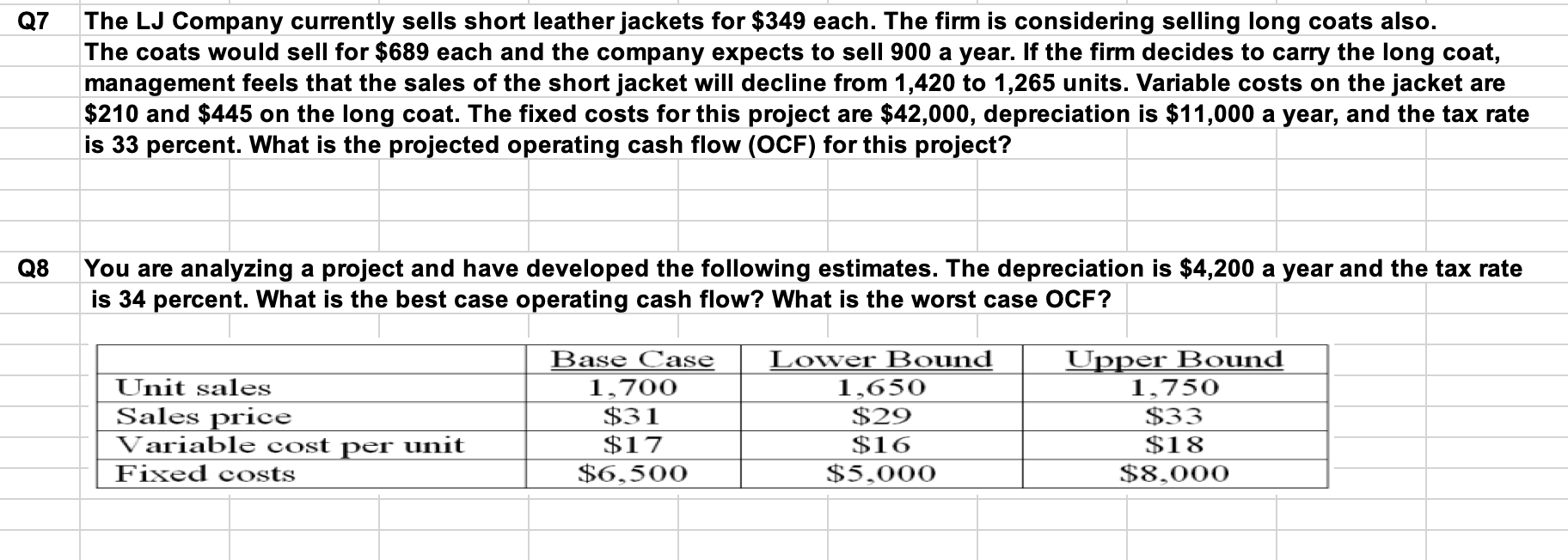

Q7 The LJ Company currently sells short leather jackets for $349 each. The firm is considering selling long coats also. The coats would sell for $689 each and the company expects to sell 900 a year. If the firm decides to carry the long coat, management feels that the sales of the short jacket will decline from 1,420 to 1,265 units. Variable costs on the jacket are $210 and $445 on the long coat. The fixed costs for this project are $42,000, depreciation is $11,000 a year, and the tax rate is 33 percent. What is the projected operating cash flow (OCF) for this project? Q8 You are analyzing a project and have developed the following estimates. The depreciation is $4,200 a year and the tax rate is 34 percent. What is the best case operating cash flow? What is the worst case OCF

Q7 The LJ Company currently sells short leather jackets for $349 each. The firm is considering selling long coats also. The coats would sell for $689 each and the company expects to sell 900 a year. If the firm decides to carry the long coat, management feels that the sales of the short jacket will decline from 1,420 to 1,265 units. Variable costs on the jacket are $210 and $445 on the long coat. The fixed costs for this project are $42,000, depreciation is $11,000 a year, and the tax rate is 33 percent. What is the projected operating cash flow (OCF) for this project? Q8 You are analyzing a project and have developed the following estimates. The depreciation is $4,200 a year and the tax rate is 34 percent. What is the best case operating cash flow? What is the worst case OCF Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started