Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q8.1 For the year ended 30 June 2021, prepare the BCVR entries Q8.2 For the year ended 30 June 2021, prepare the pre-acquisition elimination entries

Q8.1 For the year ended 30 June 2021, prepare the BCVR entries

Q8.2 For the year ended 30 June 2021, prepare the pre-acquisition elimination entries

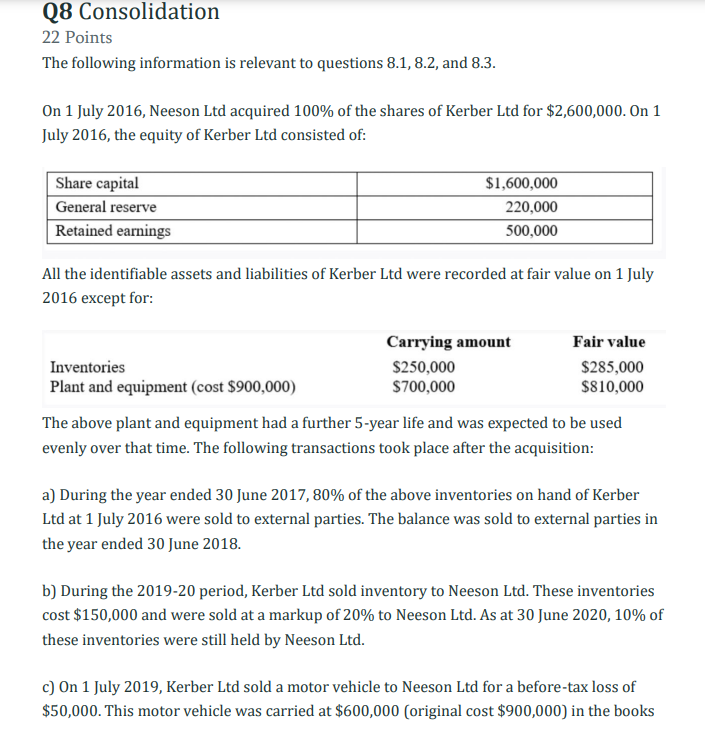

Q8 Consolidation 22 Points The following information is relevant to questions 8.1, 8.2, and 8.3. On 1 July 2016, Neeson Ltd acquired 100% of the shares of Kerber Ltd for $2,600,000. On 1 July 2016, the equity of Kerber Ltd consisted of: Share capital $1,600,000 General reserve 220,000 Retained earnings 500,000 All the identifiable assets and liabilities of Kerber Ltd were recorded at fair value on 1 July 2016 except for: Fair value Inventories Carrying amount $250,000 $700,000 $285,000 $810,000 Plant and equipment (cost $900,000) The above plant and equipment had a further 5-year life and was expected to be used evenly over that time. The following transactions took place after the acquisition: a) During the year ended 30 June 2017, 80% of the above inventories on hand of Kerber Ltd at 1 July 2016 were sold to external parties. The balance was sold to external parties in the year ended 30 June 2018. b) During the 2019-20 period, Kerber Ltd sold inventory to Neeson Ltd. These inventories cost $150,000 and were sold at a markup of 20% to Neeson Ltd. As at 30 June 2020, 10% of these inventories were still held by Neeson Ltd. c) On 1 July 2019, Kerber Ltd sold a motor vehicle to Neeson Ltd for a before-tax loss of $50,000. This motor vehicle was carried at $600,000 (original cost $900,000) in the books of Kerber Ltd at the time of sale. Depreciation on this type of motor vehicle is calculated using a 25% p.a. straight-line method. d) During the 2016-17 period, there was a transfer to general reserve of $140,000 by Kerber Ltd. The transfer to general reserve was from pre-acquisition profits. e) Kerber Ltd paid dividends of $150,000 for the period ended 30 June 2021. Corporate tax rate of 30% applies, where applicable. Q8 Consolidation 22 Points The following information is relevant to questions 8.1, 8.2, and 8.3. On 1 July 2016, Neeson Ltd acquired 100% of the shares of Kerber Ltd for $2,600,000. On 1 July 2016, the equity of Kerber Ltd consisted of: Share capital $1,600,000 General reserve 220,000 Retained earnings 500,000 All the identifiable assets and liabilities of Kerber Ltd were recorded at fair value on 1 July 2016 except for: Fair value Inventories Carrying amount $250,000 $700,000 $285,000 $810,000 Plant and equipment (cost $900,000) The above plant and equipment had a further 5-year life and was expected to be used evenly over that time. The following transactions took place after the acquisition: a) During the year ended 30 June 2017, 80% of the above inventories on hand of Kerber Ltd at 1 July 2016 were sold to external parties. The balance was sold to external parties in the year ended 30 June 2018. b) During the 2019-20 period, Kerber Ltd sold inventory to Neeson Ltd. These inventories cost $150,000 and were sold at a markup of 20% to Neeson Ltd. As at 30 June 2020, 10% of these inventories were still held by Neeson Ltd. c) On 1 July 2019, Kerber Ltd sold a motor vehicle to Neeson Ltd for a before-tax loss of $50,000. This motor vehicle was carried at $600,000 (original cost $900,000) in the books of Kerber Ltd at the time of sale. Depreciation on this type of motor vehicle is calculated using a 25% p.a. straight-line method. d) During the 2016-17 period, there was a transfer to general reserve of $140,000 by Kerber Ltd. The transfer to general reserve was from pre-acquisition profits. e) Kerber Ltd paid dividends of $150,000 for the period ended 30 June 2021. Corporate tax rate of 30% applies, where applicableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started