Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q9 Which of the following actions are most likely to directly increase cash as shown on a firm's balance sheet? Select the appropriate assumptions that

q9

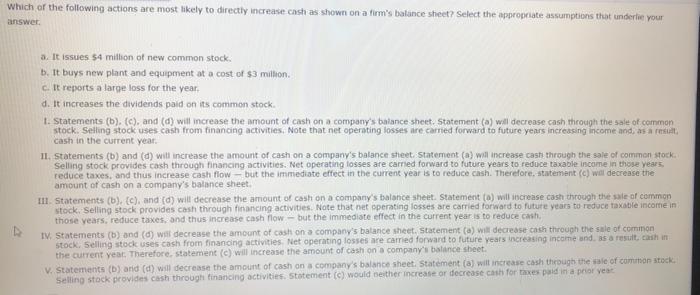

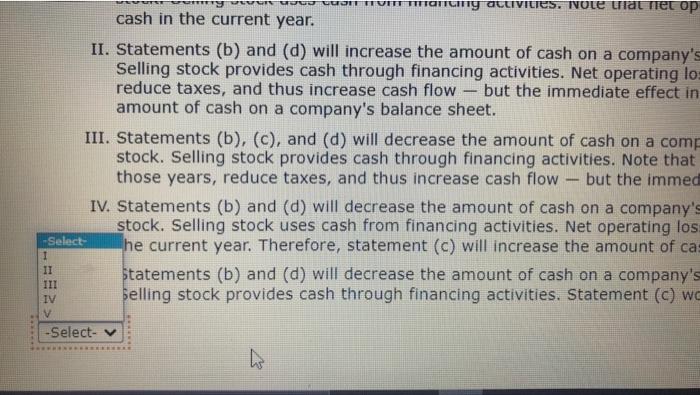

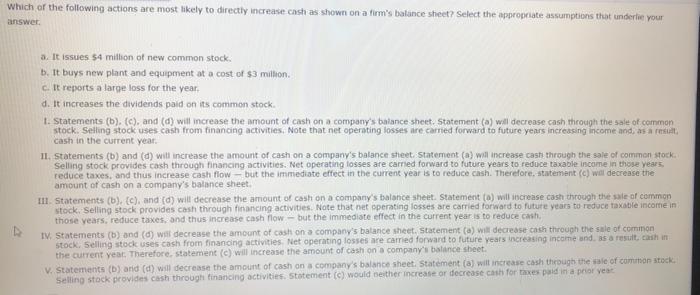

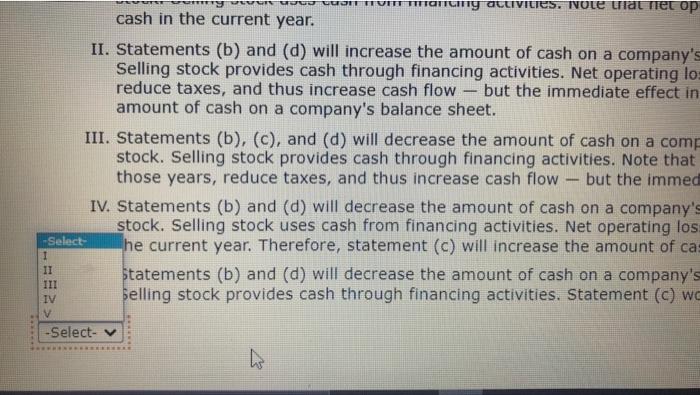

Which of the following actions are most likely to directly increase cash as shown on a firm's balance sheet? Select the appropriate assumptions that underlie your answer. a. It issues $4 million of new common stock, b. It buys new plant and equipment at a cost of $3 million. c. It reports a large loss for the year. d. It increases the dividends paid on its common stock. 1. Statements (b), (c), and (d) will increase the amount of cash on a company's balance sheet. Statement (a) will decrease cash through the sale of common stock. Selling stock uses cash from financing activities. Note that net operating losses are carried forward to future years increasing income and, as a result, cash in the current year. II, Statements (b) and (d) will increase the amount of cash on a company's balance sheet. Statement (a) will increase cash through the sale of common stock. Selling stock provides cash through financing activities. Net operating losses are carried forward to future years to reduce taxable income in those years, reduce taxes, and thus increase cash flow- but the immediate effect in the current year is to reduce cash. Therefore, statement (c) will decrease the amount of cash on a company's balance sheet. III. Statements (b), (c), and (d) will decrease the amount of cash on a company's balance sheet. Statement (a) will increase cash through the sale of common stock. Selling stock provides cash through financing activities. Note that net operating losses are carried forward to future years to reduce taxable income in those years, reduce taxes, and thus increase cash flow - but the immediate effect in the current year is to reduce cash. IV. Statements (b) and (d) will decrease the amount of cash on a company's balance sheet. Statement (a) will decrease cash through the sale of common stock. Selling stock uses cash from financing activities. Net operating losses are carried forward to future years increasing income and, as a result, cash in the current year. Therefore, statement (c) will increase the amount of cash on a company's balance sheet. V. Statements (b) and (d) will decrease the amount of cash on a company's balance sheet. Statement (a) will increase cash through the sale of common stock. Selling stock provides cash through financing activities. Statement (c) would neither increase or decrease cash for taxes paid in a prior year -Select- I II III IV V do con TOME TRANcing activities. Note that het op cash in the current year. II. Statements (b) and (d) will increase the amount of cash on a company's Selling stock provides cash through financing activities. Net operating los reduce taxes, and thus increase cash flow - but the immediate effect in amount of cash on a company's balance sheet. III. Statements (b), (c), and (d) will decrease the amount of cash on a comp stock. Selling stock provides cash through financing activities. Note that those years, reduce taxes, and thus increase cash flow - but the immed IV. Statements (b) and (d) will decrease the amount of cash on a company's stock. Selling stock uses cash from financing activities. Net operating los: he current year. Therefore, statement (c) will increase the amount of cas Statements (b) and (d) will decrease the amount of cash on a company's Selling stock provides cash through financing activities. Statement (c) wo -Select- v

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started