Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QAB plc is a UK-based multinational manufacturer of high-tech parts in medical diagnostic instruments. The company is well established, with steady growth in turnover

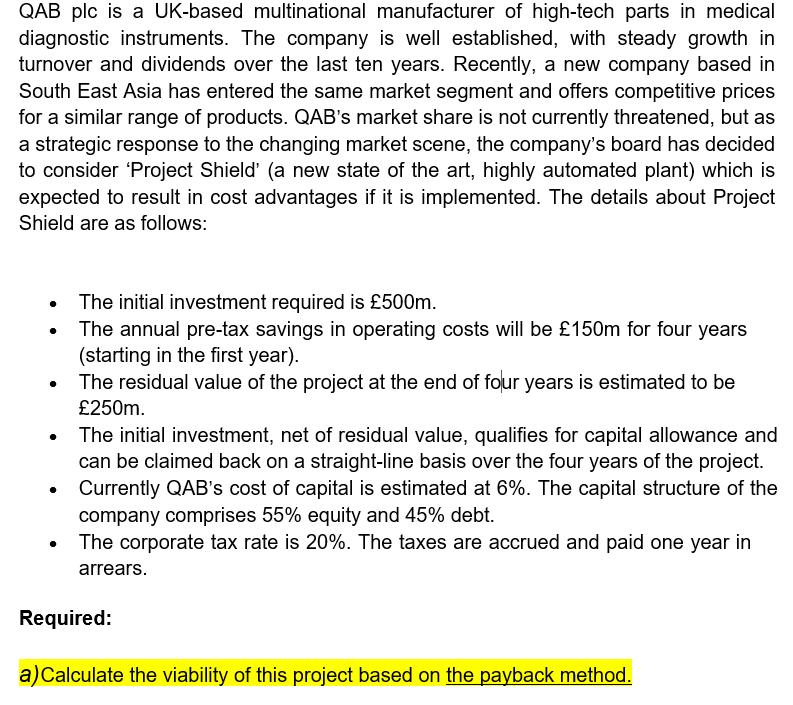

QAB plc is a UK-based multinational manufacturer of high-tech parts in medical diagnostic instruments. The company is well established, with steady growth in turnover and dividends over the last ten years. Recently, a new company based in South East Asia has entered the same market segment and offers competitive prices for a similar range of products. QAB's market share is not currently threatened, but as a strategic response to the changing market scene, the company's board has decided to consider 'Project Shield' (a new state of the art, highly automated plant) which is expected to result in cost advantages if it is implemented. The details about Project Shield are as follows: The initial investment required is 500m. The annual pre-tax savings in operating costs will be 150m for four years (starting in the first year). The residual value of the project at the end of four years is estimated to be 250m. The initial investment, net of residual value, qualifies for capital allowance and can be claimed back on a straight-line basis over the four years of the project. Currently QAB's cost of capital is estimated at 6%. The capital structure of the company comprises 55% equity and 45% debt. The corporate tax rate is 20%. The taxes are accrued and paid one year in arrears. Required: a) Calculate the viability of this project based on the payback method.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the viability of the project based on the payback method we need to determine the numbe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started