Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Qatar Global Sukuk Case Study Spring 2020- FINA404 Hamad Medical Corporation Hamad HEALTH EDUCATION RESEARCH Please read carefully the following Qatar Global Sukuk's Summary

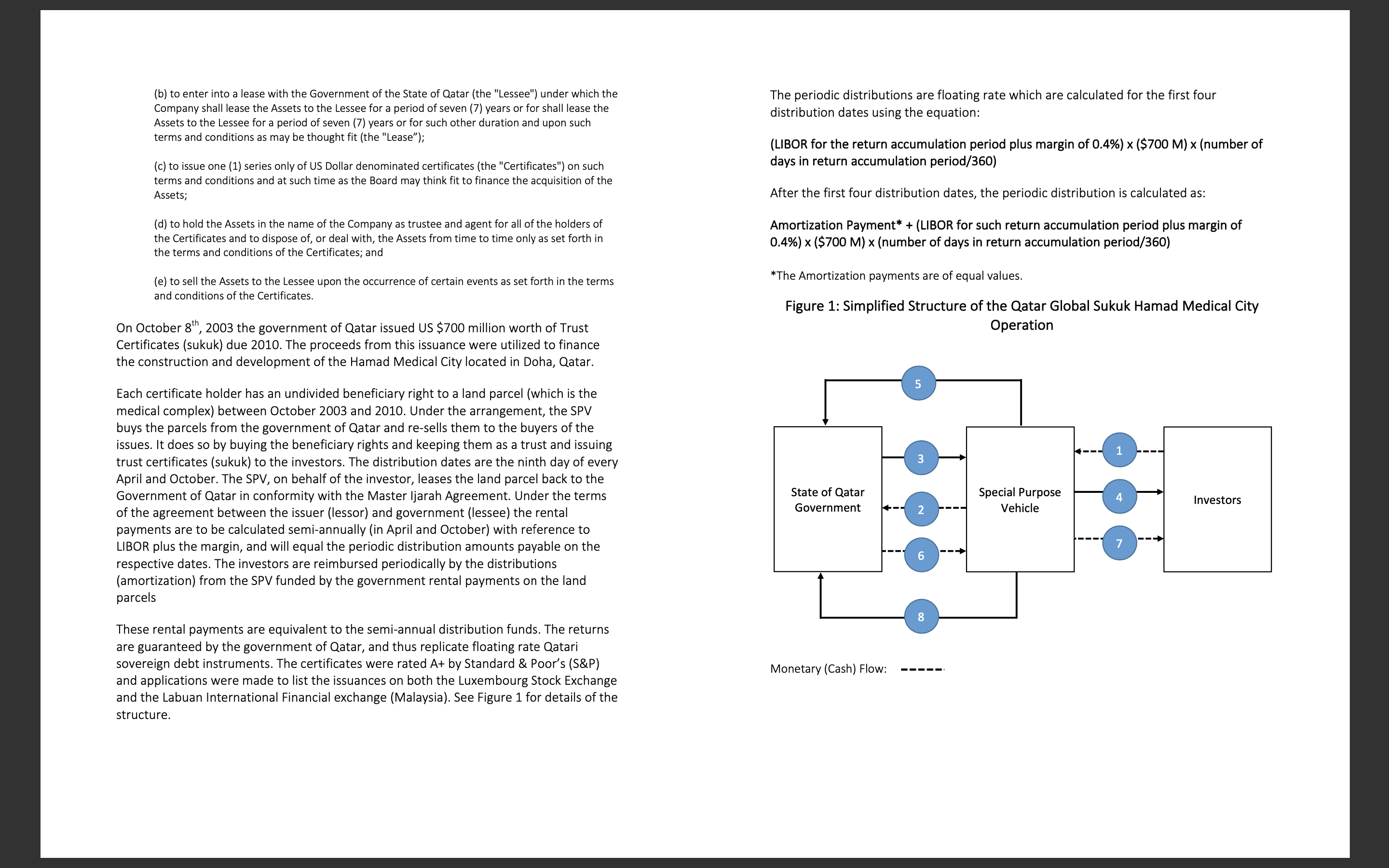

Qatar Global Sukuk Case Study Spring 2020- FINA404 Hamad Medical Corporation Hamad HEALTH EDUCATION RESEARCH Please read carefully the following Qatar Global Sukuk's Summary and answer the questions bellow. Qatar Global Sukuk QSC was incorporated as a joint stock company in Doha during October 2003 and established as a joint-venture special purpose vehicle (SPV) by the government of Qatar, Qatar International Islamic Bank (QIIB) and HSBC. Among the articles governing the creation of Qatar Global Sukuk QSC, the following articles: Article (6) The authorized share capital of the Company is Thirty Qatari Riyals (Qr30) consisting of two (2) shares with a nominal value of Ten Qatari Riyals (Qr10) each and one Golden Share with a nominal value of Ten Qatari Riyals (Qr10). All such shares, when issued, shall be fully paid and non- assessable. Article (7) The Government has agreed to subscribe for Two (2) shares and HSBC Bank Middle East Limited has agreed to subscribe for the Golden Share representing in the aggregate one hundred percent (100%) of the share capital upon the establishment of the Company. Article (3) The objects of the Company are: 3.1 (a) to acquire certain identified immovable properties (the "Assets") from the Government of the State of Qatar and/or such other instrumentality of the State of Qatar on such terms and conditions as may be thought fit; (b) to enter into a lease with the Government of the State of Qatar (the "Lessee") under which the Company shall lease the Assets to the Lessee for a period of seven (7) years or for shall lease the Assets to the Lessee for a period of seven (7) years or for such other duration and upon such terms and conditions as may be thought fit (the "Lease"); (c) to issue one (1) series only of US Dollar denominated certificates (the "Certificates") on such terms and conditions and at such time as the Board may think fit to finance the acquisition of the Assets; (d) to hold the Assets in the name of the Company as trustee and agent for all of the holders of the Certificates and to dispose of, or deal with, the Assets from time to time only as set forth in the terms and conditions of the Certificates; and (e) to sell the Assets to the Lessee upon the occurrence of certain events as set forth in the terms and conditions of the Certificates. On October 8th, 2003 the government of Qatar issued US $700 million worth of Trust Certificates (sukuk) due 2010. The proceeds from this issuance were utilized to finance the construction and development of the Hamad Medical City located in Doha, Qatar. Each certificate holder has an undivided beneficiary right to a land parcel (which is the medical complex) between October 2003 and 2010. Under the arrangement, the SPV buys the parcels from the government of Qatar and re-sells them to the buyers of the issues. It does so by buying the beneficiary rights and keeping them as a trust and issuing trust certificates (sukuk) to the investors. The distribution dates are the ninth day of every April and October. The SPV, on behalf of the investor, leases the land parcel back to the Government of Qatar in conformity with the Master Ijarah Agreement. Under the terms of the agreement between the issuer (lessor) and government (lessee) the rental payments are to be calculated semi-annually (in April and October) with reference to LIBOR plus the margin, and will equal the periodic distribution amounts payable on the respective dates. The investors are reimbursed periodically by the distributions (amortization) from the SPV funded by the government rental payments on the land parcels These rental payments are equivalent to the semi-annual distribution funds. The returns are guaranteed by the government of Qatar, and thus replicate floating rate Qatari sovereign debt instruments. The certificates were rated A+ by Standard & Poor's (S&P) and applications were made to list the issuances on both the Luxembourg Stock Exchange and the Labuan International Financial exchange (Malaysia). See Figure 1 for details of the structure. The periodic distributions are floating rate which are calculated for the first four distribution dates using the equation: (LIBOR for the return accumulation period plus margin of 0.4%) x ($700 M) x (number of days in return accumulation period/360) After the first four distribution dates, the periodic distribution is calculated as: Amortization Payment* + (LIBOR for such return accumulation period plus margin of 0.4%) x ($700 M) x (number of days in return accumulation period/360) *The Amortization payments are of equal values. Figure 1: Simplified Structure of the Qatar Global Sukuk Hamad Medical City Operation State of Qatar Government |-- Monetary (Cash) Flow: 5 3 6 8 Special Purpose Vehicle Investors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started