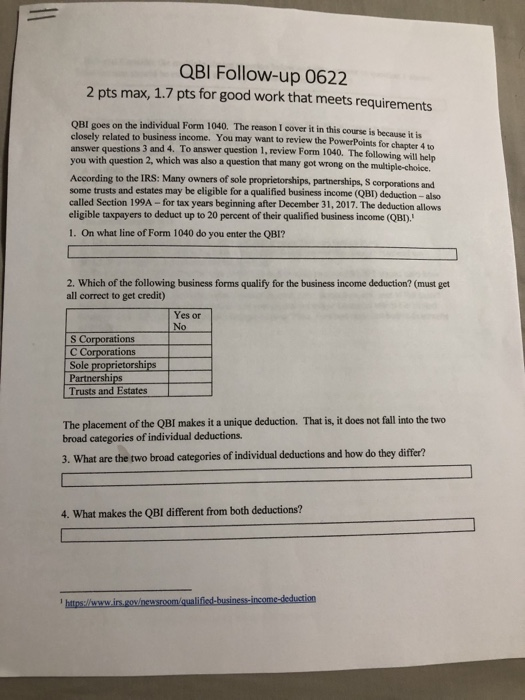

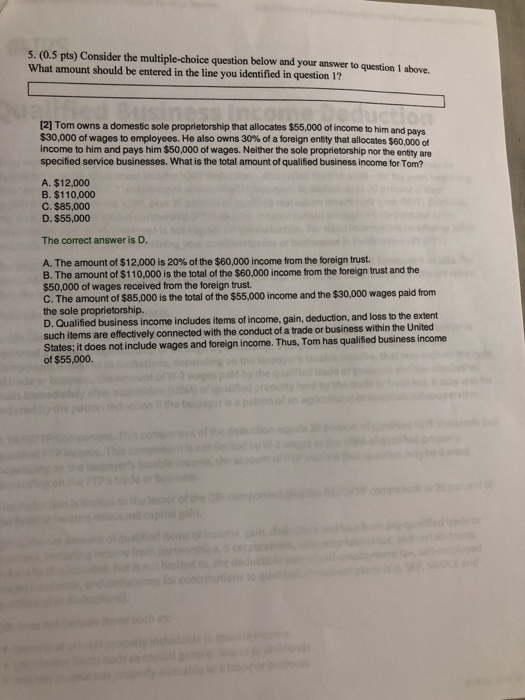

QBI Follow-up 0622 2 pts max, 1.7 pts for good work that meets requirements QBI goes on the individual Form 1040. The reason I cover it in this course is because it is closely related to business income. You may want to review the Power Points for chapter 4 to answer questions 3 and 4. To answer question 1, review Form 1040. The following will help you with question 2, which was also a question that many got wrong on the multiple-choice. According to the IRS: Many owners of sole proprietorships, partnerships, Scorporations and some trusts and estates may be eligible for a qualified business income (QBT) deduction - also called Section 199A-for tax years beginning after December 31, 2017. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income (QBI).' 1. On what line of Form 1040 do you enter the QBI? 2. Which of the following business forms qualify for the business income deduction? (must get all correct to get credit) Yes or No S Corporations C Corporations Sole proprietorships Partnerships Trusts and Estates The placement of the QBI makes it a unique deduction. That is, it does not fall into the two broad categories of individual deductions 3. What are the two broad categories of individual deductions and how do they differ? 4. What makes the QBI different from both deductions? https://www.irs.govewsroom/qualified-business-income-deduction 5. (0.5 pts) Consider the multiple-choice question below and your answer to question 1 above. What amount should be entered in the line you identified in question 1? [2] Tom owns a domestic sole proprietorship that allocates $55,000 of income to him and pays $30,000 of wages to employees. He also owns 30% of a foreign entity that allocates $60,000 of income to him and pays him $50,000 of wages. Neither the sole proprietorship nor the entity are specified service businesses. What is the total amount of qualified business income for Tom? A. $12,000 B. $110,000 C. $85,000 D. $55,000 The correct answer is D. A. The amount of $12,000 is 20% of the $60,000 income from the foreign trust. B. The amount of $110,000 is the total of the $60,000 income from the foreign trust and the $50,000 of wages received from the foreign trust. C. The amount of $85,000 is the total of the $55,000 income and the $30,000 wages paid from the sole proprietorship. D. Qualified business income includes items of income, gain, deduction, and loss to the extent such items are effectively connected with the conduct of a trade or business within the United States; it does not include wages and foreign income. Thus, Tom has qualified business income of $55,000. QBI Follow-up 0622 2 pts max, 1.7 pts for good work that meets requirements QBI goes on the individual Form 1040. The reason I cover it in this course is because it is closely related to business income. You may want to review the Power Points for chapter 4 to answer questions 3 and 4. To answer question 1, review Form 1040. The following will help you with question 2, which was also a question that many got wrong on the multiple-choice. According to the IRS: Many owners of sole proprietorships, partnerships, Scorporations and some trusts and estates may be eligible for a qualified business income (QBT) deduction - also called Section 199A-for tax years beginning after December 31, 2017. The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income (QBI).' 1. On what line of Form 1040 do you enter the QBI? 2. Which of the following business forms qualify for the business income deduction? (must get all correct to get credit) Yes or No S Corporations C Corporations Sole proprietorships Partnerships Trusts and Estates The placement of the QBI makes it a unique deduction. That is, it does not fall into the two broad categories of individual deductions 3. What are the two broad categories of individual deductions and how do they differ? 4. What makes the QBI different from both deductions? https://www.irs.govewsroom/qualified-business-income-deduction 5. (0.5 pts) Consider the multiple-choice question below and your answer to question 1 above. What amount should be entered in the line you identified in question 1? [2] Tom owns a domestic sole proprietorship that allocates $55,000 of income to him and pays $30,000 of wages to employees. He also owns 30% of a foreign entity that allocates $60,000 of income to him and pays him $50,000 of wages. Neither the sole proprietorship nor the entity are specified service businesses. What is the total amount of qualified business income for Tom? A. $12,000 B. $110,000 C. $85,000 D. $55,000 The correct answer is D. A. The amount of $12,000 is 20% of the $60,000 income from the foreign trust. B. The amount of $110,000 is the total of the $60,000 income from the foreign trust and the $50,000 of wages received from the foreign trust. C. The amount of $85,000 is the total of the $55,000 income and the $30,000 wages paid from the sole proprietorship. D. Qualified business income includes items of income, gain, deduction, and loss to the extent such items are effectively connected with the conduct of a trade or business within the United States; it does not include wages and foreign income. Thus, Tom has qualified business income of $55,000