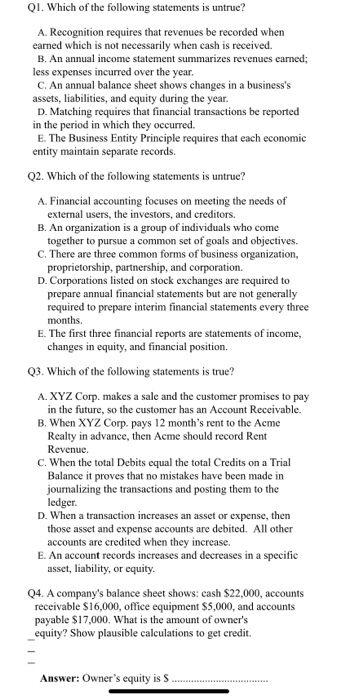

QI. Which of the following statements is untrue? A. Recognition requires that revenues be recorded when earned which is not necessarily when cash is received. B. An annual income statement summarizes revenues earned; less expenses incurred over the year. C. An annual balance sheet shows changes in a business's assets, liabilities, and equity during the year. D. Matching requires that financial transactions be reported in the period in which they occurred. E. The Business Entity Principle requires that each economic entity maintain separate records. Q2. Which of the following statements is untrue? A. Financial accounting focuses on meeting the needs of external users, the investors, and creditors. B. An organization is a group of individuals who come together to pursue a common set of goals and objectives. C. There are three common forms of business organization, proprietorship, partnership, and corporation. D. Corporations listed on stock exchanges are required to prepare annual financial statements but are not generally required to prepare interim financial statements every three months. E. The first three financial reports are statements of income, changes in equity, and financial position. Q3. Which of the following statements is true? A XYZ Corp. makes a sale and the customer promises to pay in the future, so the customer has an Account Receivable. B. When XYZ Corp. pays 12 month's rent to the Acme Realty in advance, then Acme should record Rent Revenue. C. When the total Debits equal the total Credits on a Trial Balance it proves that no mistakes have been made in journalizing the transactions and posting them to the ledger. D. When a transaction increases an asset or expense, then those asset and expense accounts are debited. All other accounts are credited when they increase. E. An account records increases and decreases in a specific asset, liability, or equity. Q4. A company's balance sheet shows: cash $22,000, accounts receivable $16,000, office equipment $5,000, and accounts payable $17,000. What is the amount of owner's equity? Show plausible calculations to get credit Answer: Owner's equity is $