Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QP ASR 001 | Rev 001 Eff Date: 09-08-2023 Question One [25 marks] The Managing Director of Selepe plc has asked you to prepare

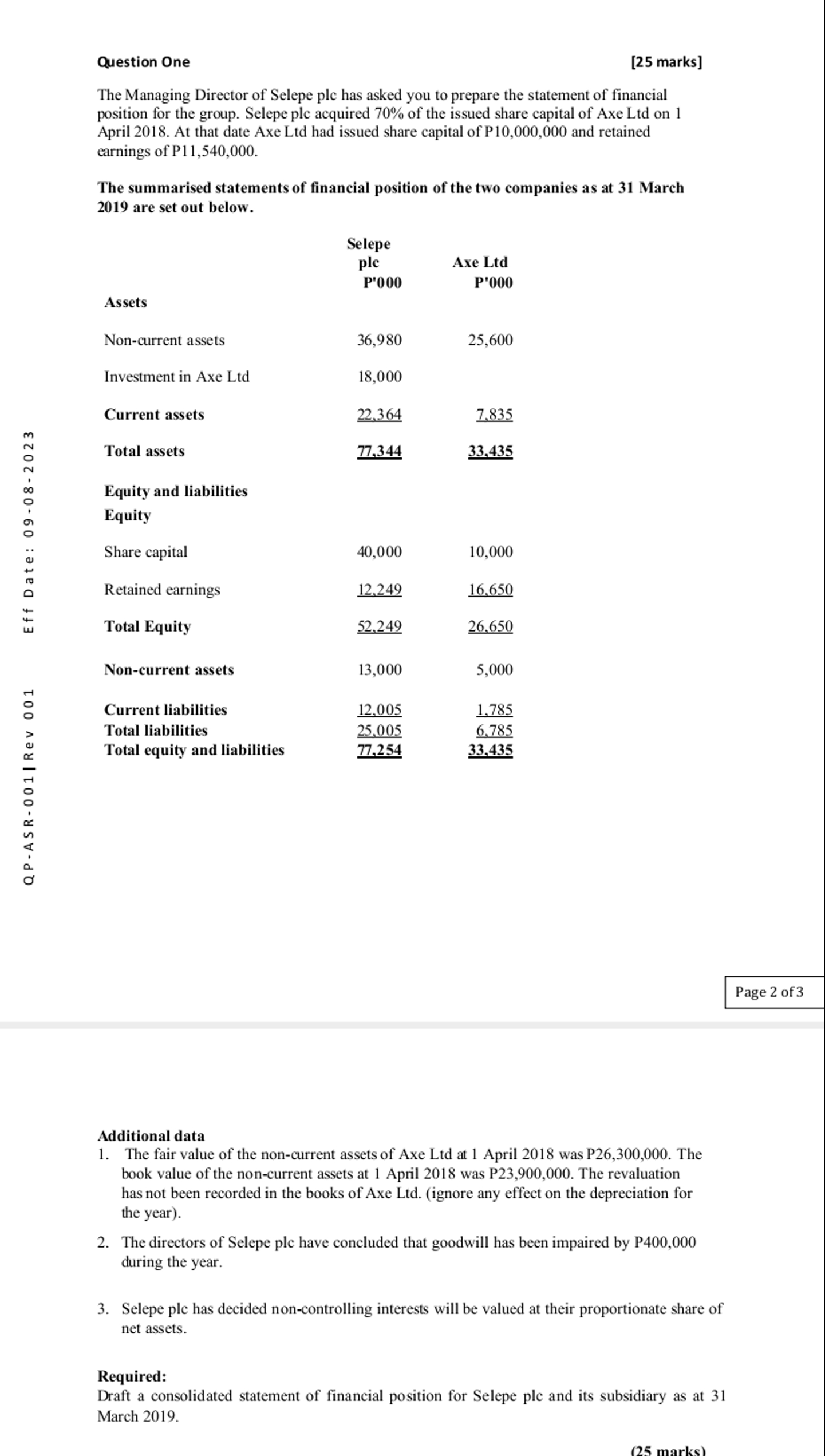

QP ASR 001 | Rev 001 Eff Date: 09-08-2023 Question One [25 marks] The Managing Director of Selepe plc has asked you to prepare the statement of financial position for the group. Selepe plc acquired 70% of the issued share capital of Axe Ltd on 1 April 2018. At that date Axe Ltd had issued share capital of P10,000,000 and retained earnings of P11,540,000. The summarised statements of financial position of the two companies as at 31 March 2019 are set out below. Selepe ple Axe Ltd P'000 P'000 Assets Non-current assets 36,980 25,600 Investment in Axe Ltd 18,000 Current assets 22,364 7,835 Total assets 77,344 33,435 Equity and liabilities Equity Share capital 40,000 10,000 Retained earnings 12,249 16,650 Total Equity 52,249 26.650 Non-current assets 13,000 5,000 Current liabilities 12,005 1,785 Total liabilities 25.005 6.785 Total equity and liabilities 77,254 33.435 Additional data 1. The fair value of the non-current assets of Axe Ltd at 1 April 2018 was P26,300,000. The book value of the non-current assets at 1 April 2018 was P23,900,000. The revaluation has not been recorded in the books of Axe Ltd. (ignore any effect on the depreciation for the year). 2. The directors of Selepe ple have concluded that goodwill has been impaired by P400,000 during the year. 3. Selepe plc has decided non-controlling interests will be valued at their proportionate share of net assets. Required: Draft a consolidated statement of financial position for Selepe plc and its subsidiary as at 31 March 2019. (25 marks). Page 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started