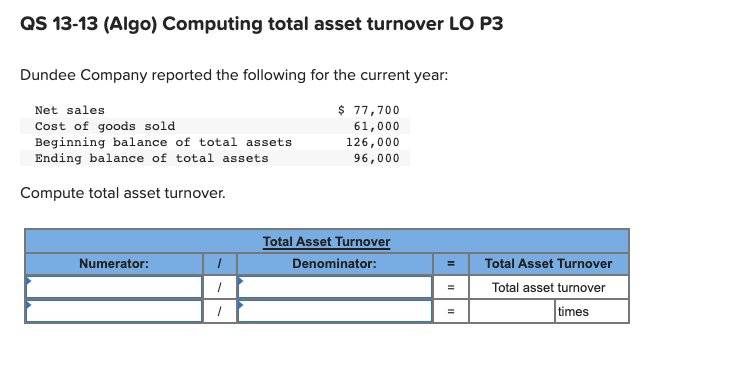

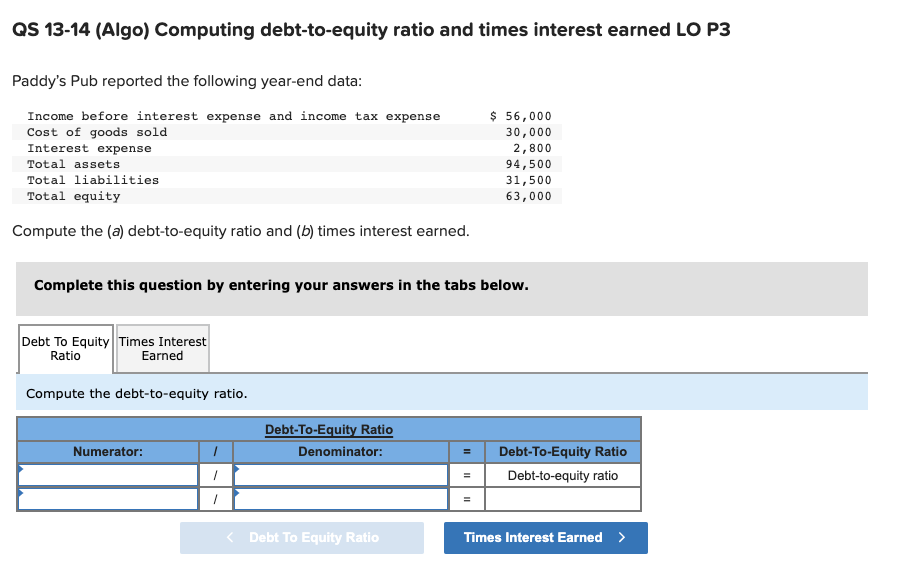

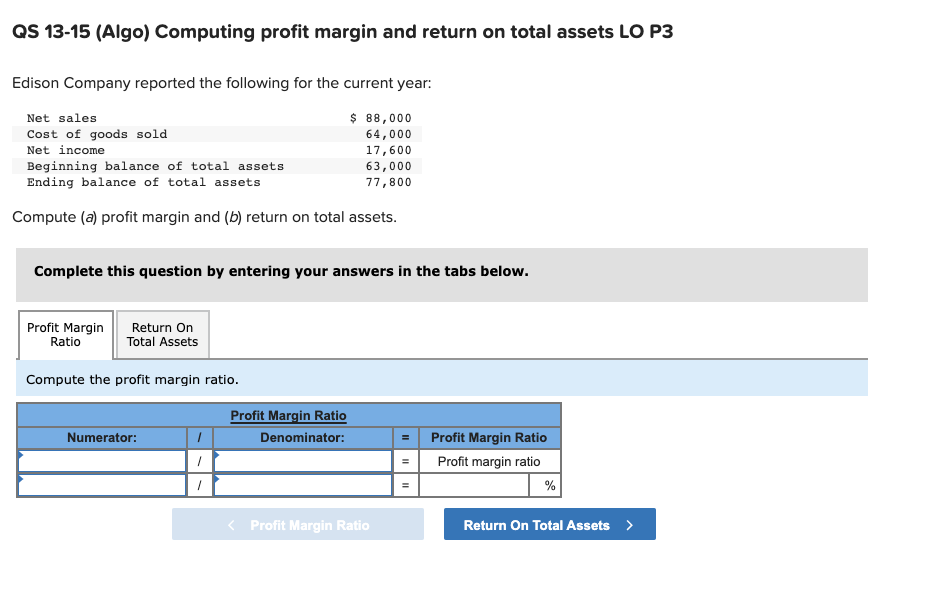

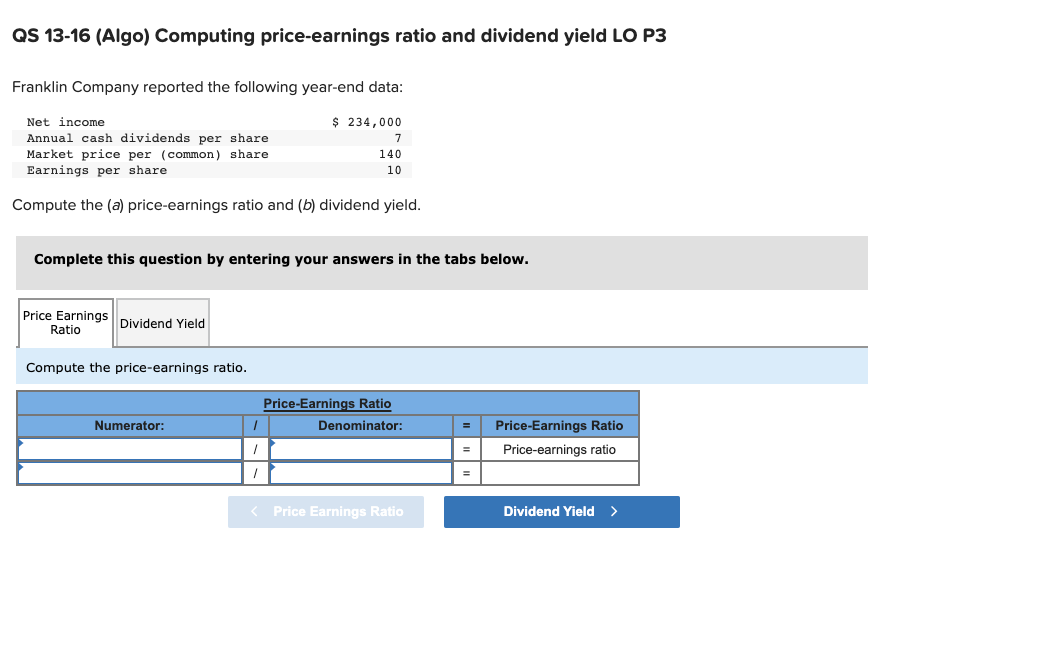

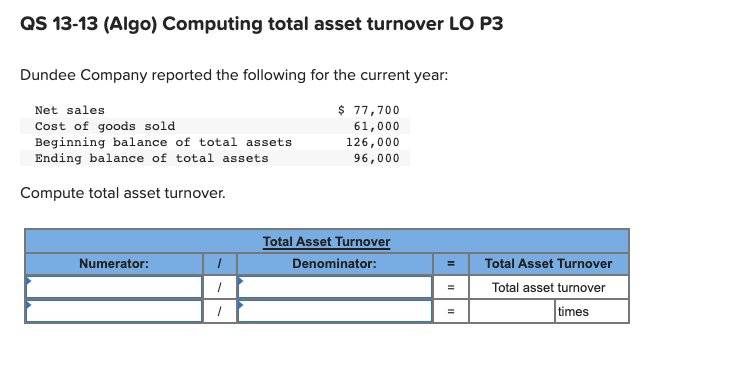

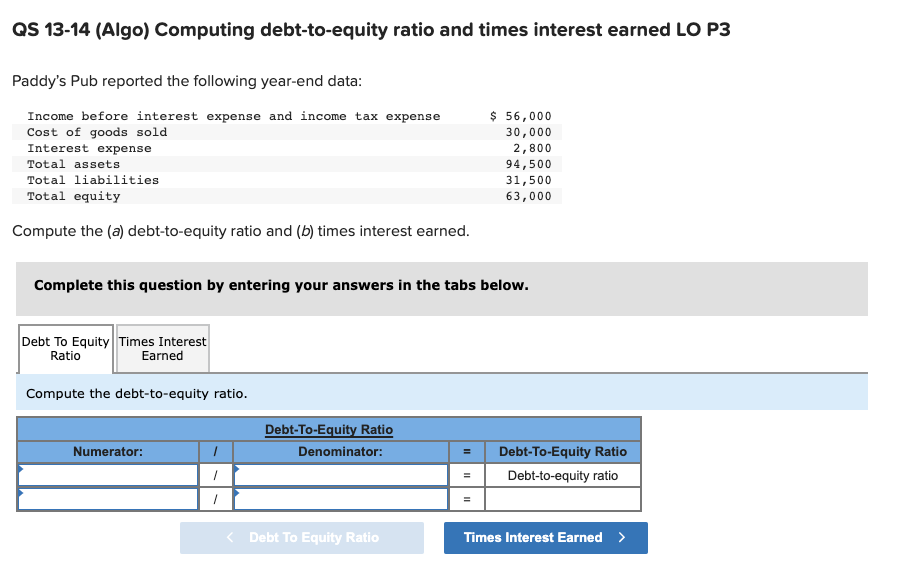

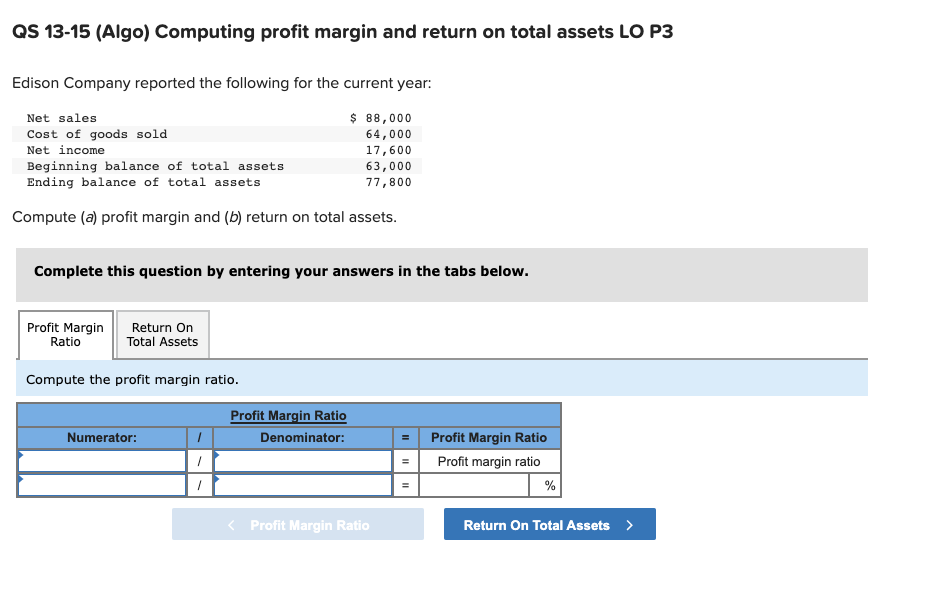

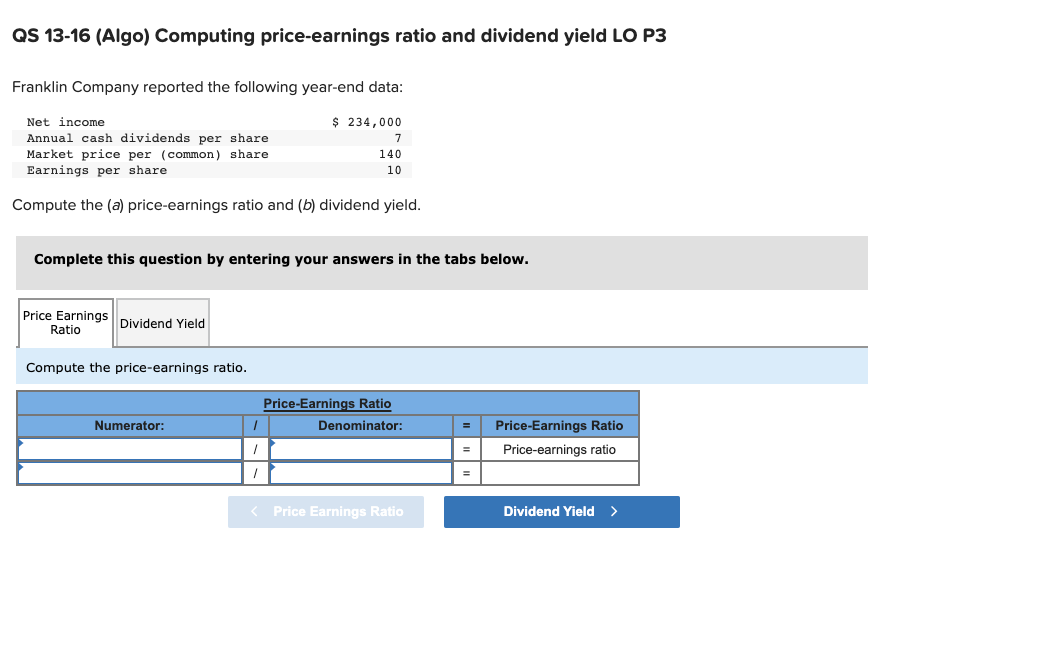

QS 13-13 (Algo) Computing total asset turnover LO P3 Dundee Company reported the following for the current year: Net sales $ 77,700 Cost of goods sold 61,000 Beginning balance of total assets 126,000 Ending balance of total assets 96,000 Compute total asset turnover. Total Asset Turnover Denominator: Numerator: 1 = = 1 1 Total Asset Turnover Total asset turnover times II QS 13-14 (Algo) Computing debt-to-equity ratio and times interest earned LO P3 Paddy's Pub reported the following year-end data: Income before interest expense and income tax expense Cost of goods sold Interest expense Total assets Total liabilities Total equity $ 56,000 30,000 2,800 94,500 31,500 63,000 Compute the (a) debt-to-equity ratio and (b) times interest earned. Complete this question by entering your answers in the tabs below. Debt To Equity Times Interest Ratio Earned Compute the debt-to-equity ratio. Debt-To-Equity Ratio Denominator: Numerator: Debt-To-Equity Ratio Debt-to-equity ratio = II QS 13-15 (Algo) Computing profit margin and return on total assets LO P3 Edison Company reported the following for the current year: Net sales Cost of goods sold Net income Beginning balance of total assets Ending balance of total assets $ 88,000 64,000 17,600 63,000 77,800 Compute (a) profit margin and (b) return on total assets. Complete this question by entering your answers in the tabs below. Profit Margin Ratio Return on Total Assets Compute the profit margin ratio. Profit Margin Ratio Den inator: Numerator: II 1 / / Profit Margin Ratio = Profit margin ratio % QS 13-16 (Algo) Computing price-earnings ratio and dividend yield LO P3 Franklin Company reported the following year-end data: Net income Annual cash dividends per share Market price per (common) share Earnings per share $ 234,000 7 140 10 Compute the (a) price-earnings ratio and (b) dividend yield. Complete this question by entering your answers in the tabs below. Price Earnings Ratio Dividend Yield Compute the price-earnings ratio. Price-Earnings Ratio Denominator: Numerator: 1 = Price-Earnings Ratio Price-earnings ratio = 1 =