Answered step by step

Verified Expert Solution

Question

1 Approved Answer

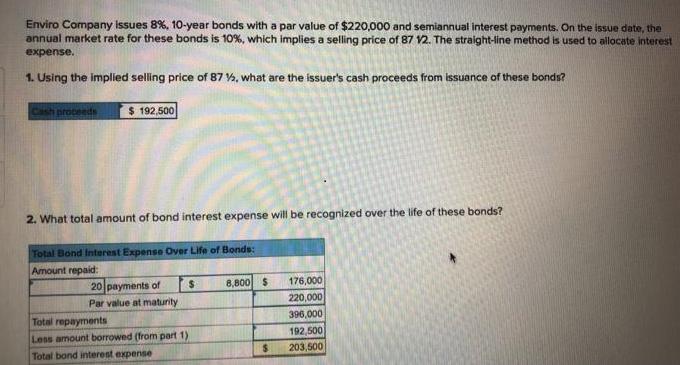

Enviro Company Issues 8%, 10-year bonds with a par value of $220,000 and semiannual interest payments. On the issue date, the annual market rate

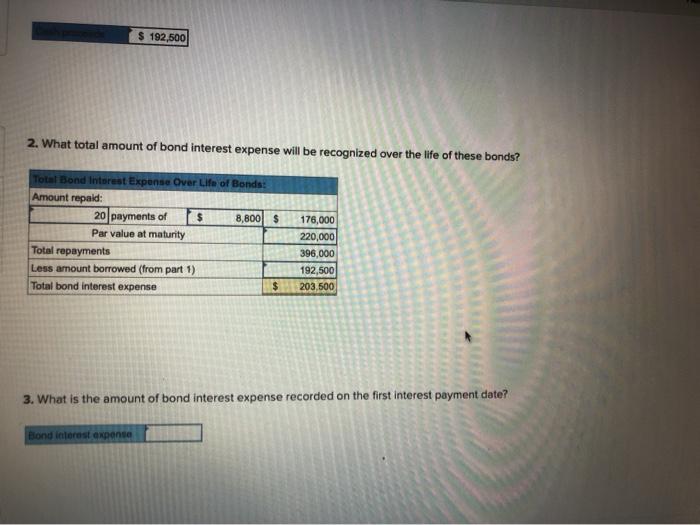

Enviro Company Issues 8%, 10-year bonds with a par value of $220,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%, which implies a selling price of 87 V2. The straight-line method is used to allocate interest expense. 1. Using the implied selling price of 87 %, what are the issuer's cash proceeds from issuance of these bonds? Cash proceeds $ 192,500 2. What total amount of bond interest expense will be recognized over the life of these bonds? Total Bond Interest Expense Over Life of Bonds: Amount repaid: %24 8,800 $ 176,000 20 payments of 220,000 Par value at maturity 396,000 Total repayments Less amount borrowed (from part 1) Total bond interest expense 192,500 203,500 %24 $ 192,500 2. What total amount of bond interest expense will be recognized over the life of these bonds? Total Bond Interest Expense Over Life of Bonds: Amount repaid: 20 payments of 8,800 $ 176,000 Par value at maturity 220,000 Total repayments 396,000 Less amount borrowed (from part 1) 192,500 203,500 Total bond interest expense %24 3. What is the amount of bond interest expense recorded on the first interest payment date? Bond interest expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started