Answered step by step

Verified Expert Solution

Question

1 Approved Answer

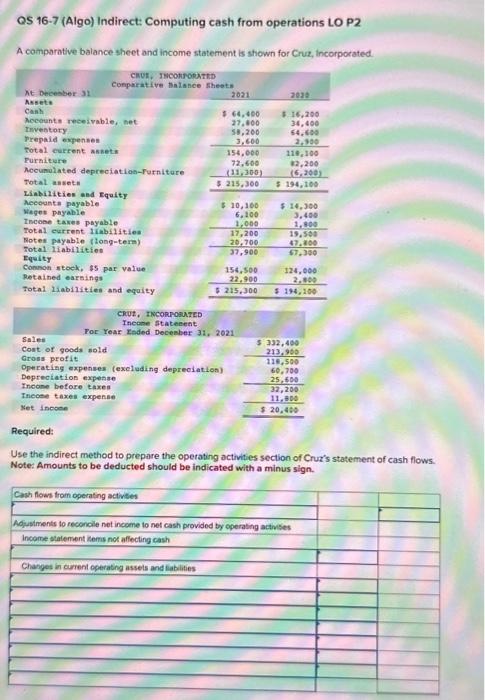

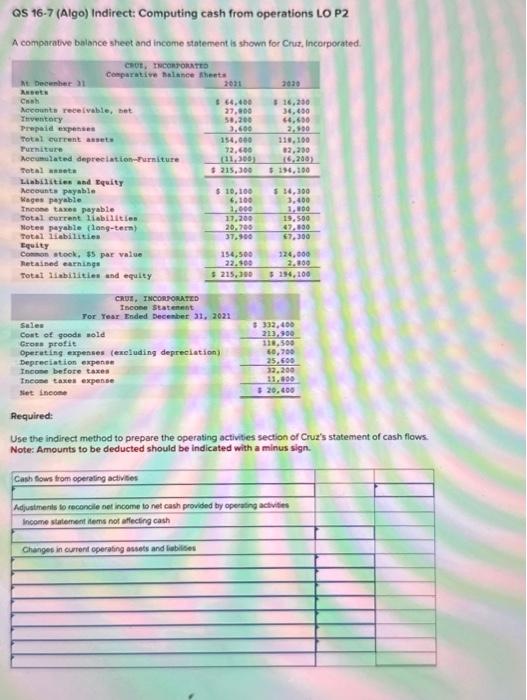

QS 16-7 (Algo) Indirect: Computing cash from operations LO P2 A comparative balance sheet and income statement is shown for Cruz, Incorporated. At December 31

QS 16-7 (Algo) Indirect: Computing cash from operations LO P2 A comparative balance sheet and income statement is shown for Cruz, Incorporated. At December 31 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets CRUZ, INCORPORATED Comparative Balance Sheets Furniture Accumulated depreciation-Furniture Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long-term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity Sales Cost of goods sold Gross profit 2021 $ 64,400 27,800 58,200 3,600 Cash flows from operating activities 154,000 72,600 (11,300) $ 215,300 $ 10,100 6,100 1,000 CRUZ, INCORPORATED Income Statement For Year Ended December 31, 2021 Operating expenses (excluding depreciation) Depreciation expense Income before taxes Income taxes expense Net income Changes in current operating assets and liabilities 17,200 20,700 37,900 154,500 22,900 $ 215,300 2020 $ 16,200 34,400 64,600 2,900 118,100 82,200 (6,200) $ 194,100 $ 14,300 3,400 1,800 19,500 47,800 67,300 124,000 2,800 $ 194,100 $ 332,400 213,900 Required: Use the indirect method to prepare the operating activities section of Cruz's statement of cash flows. Note: Amounts to be deducted should be indicated with a minus sign. 118,500 60,700 25,600 32,200 11,800 $ 20,400 Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started