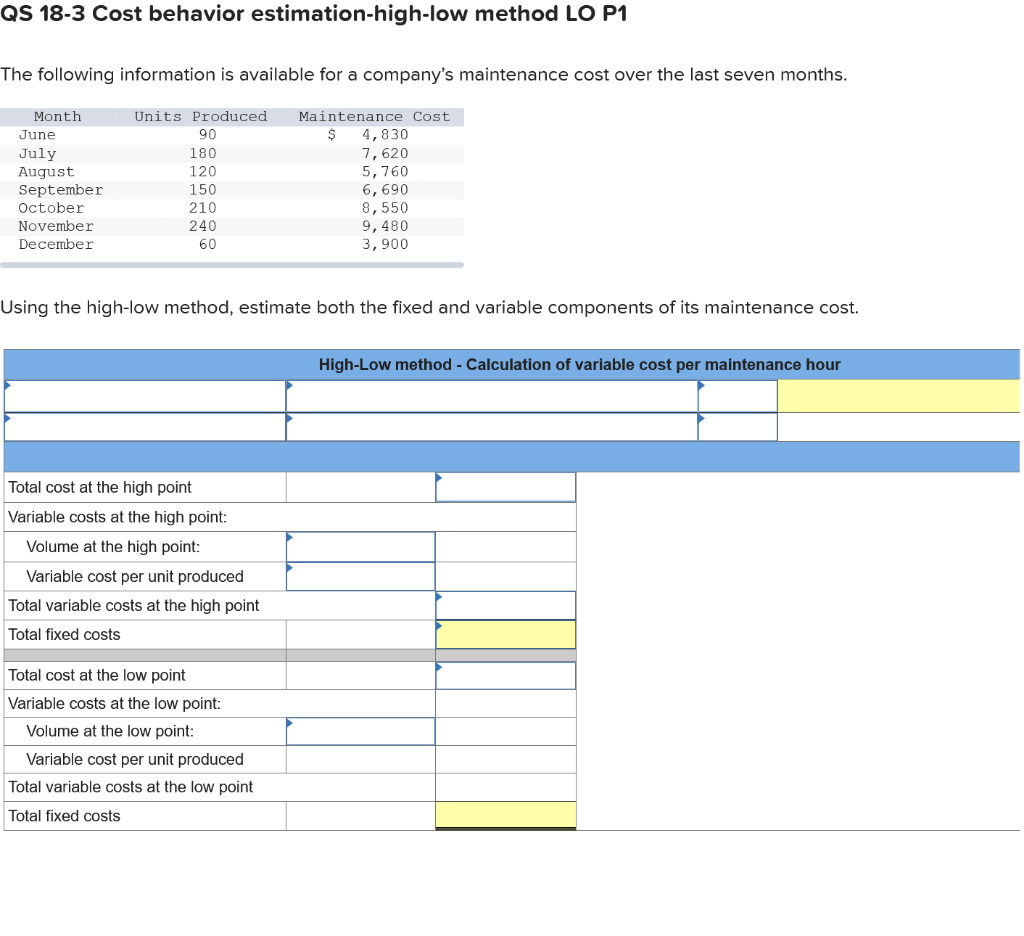

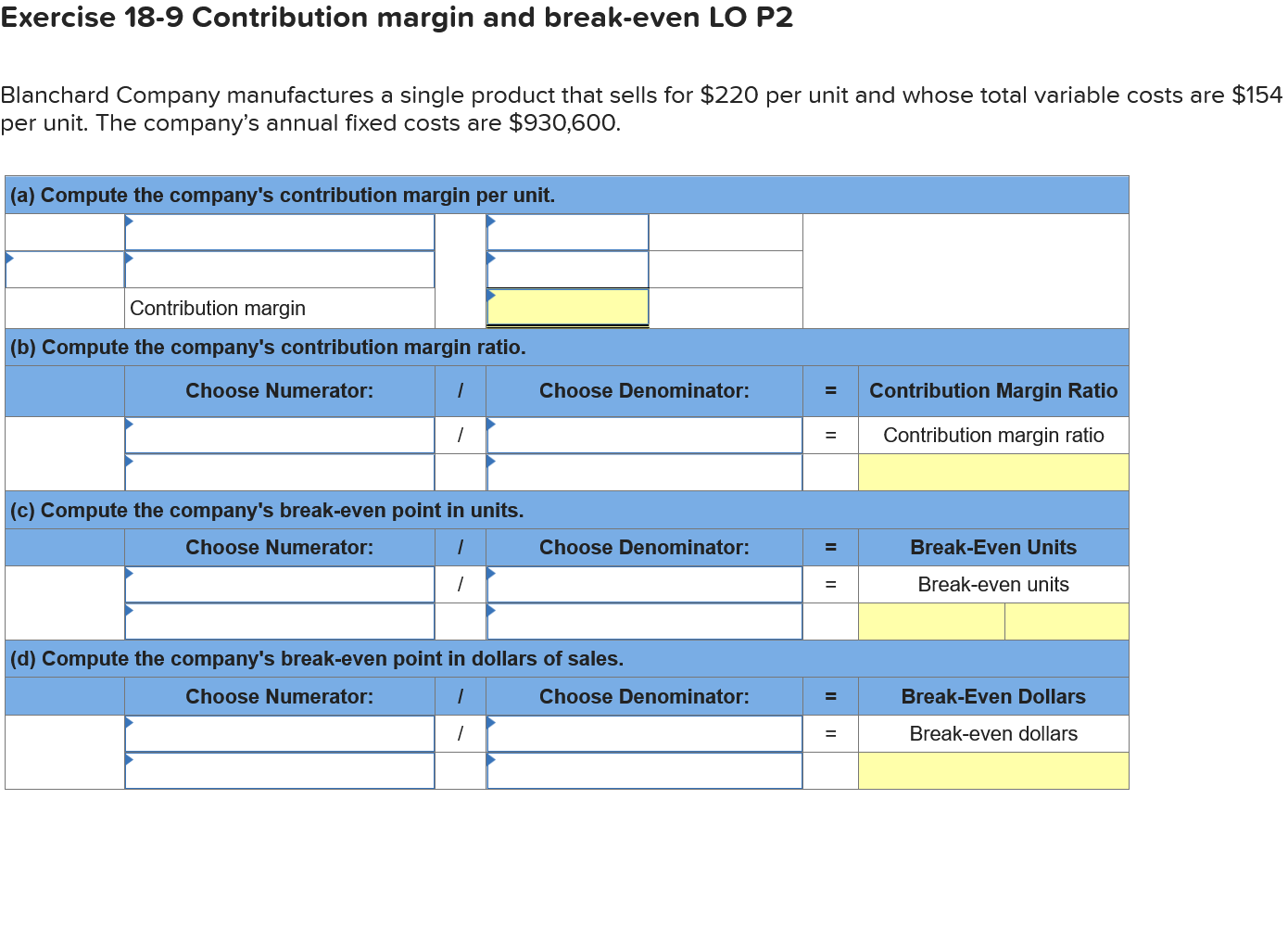

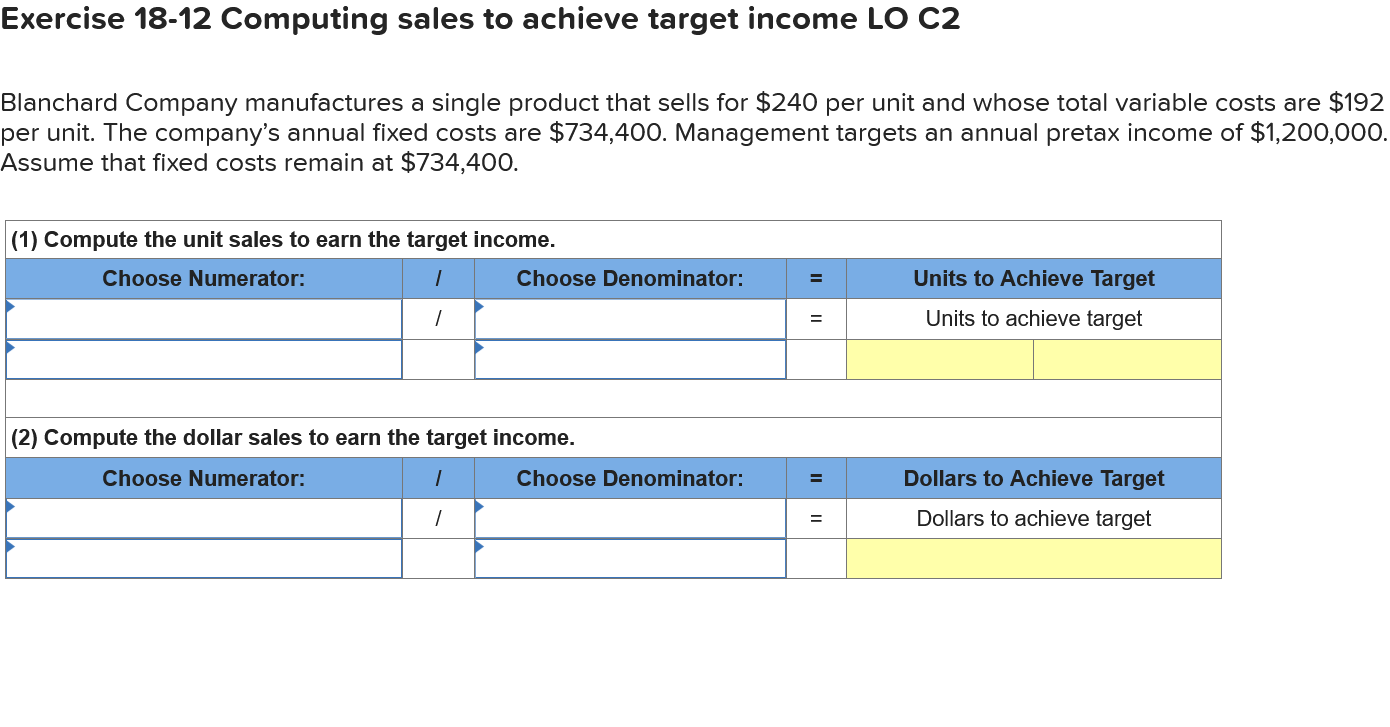

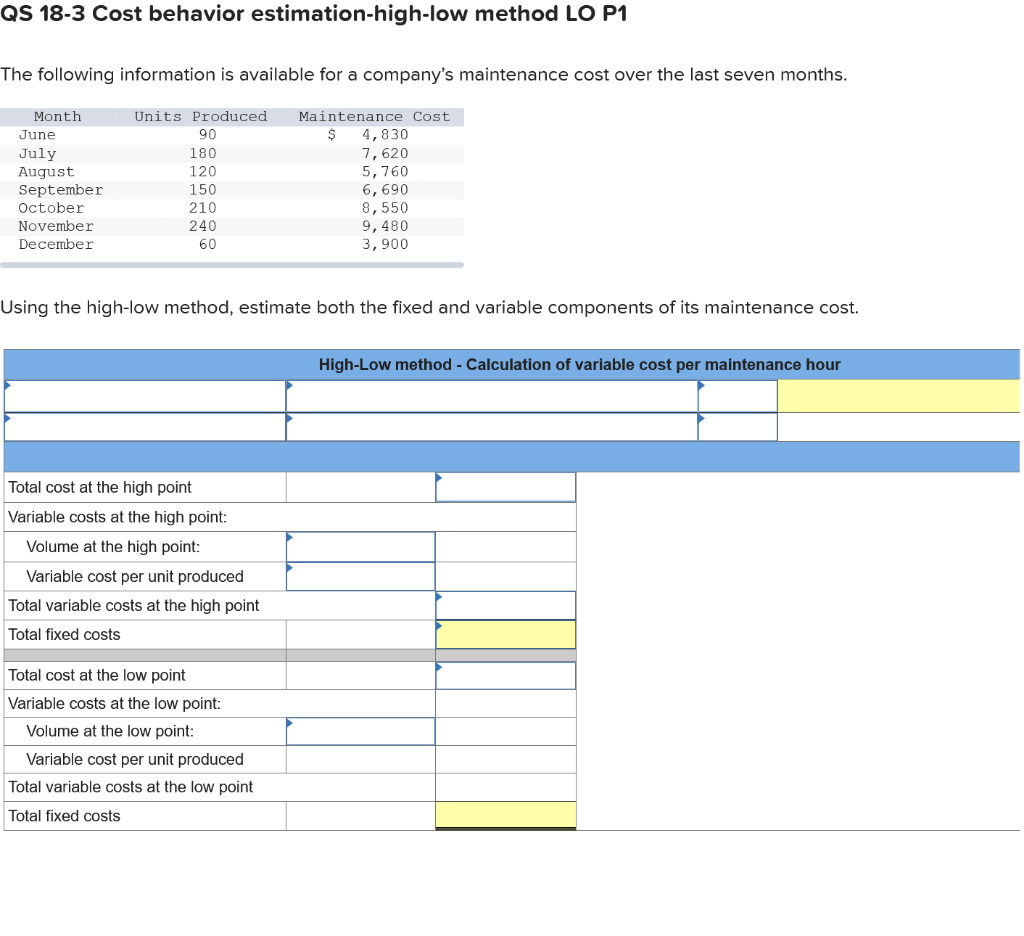

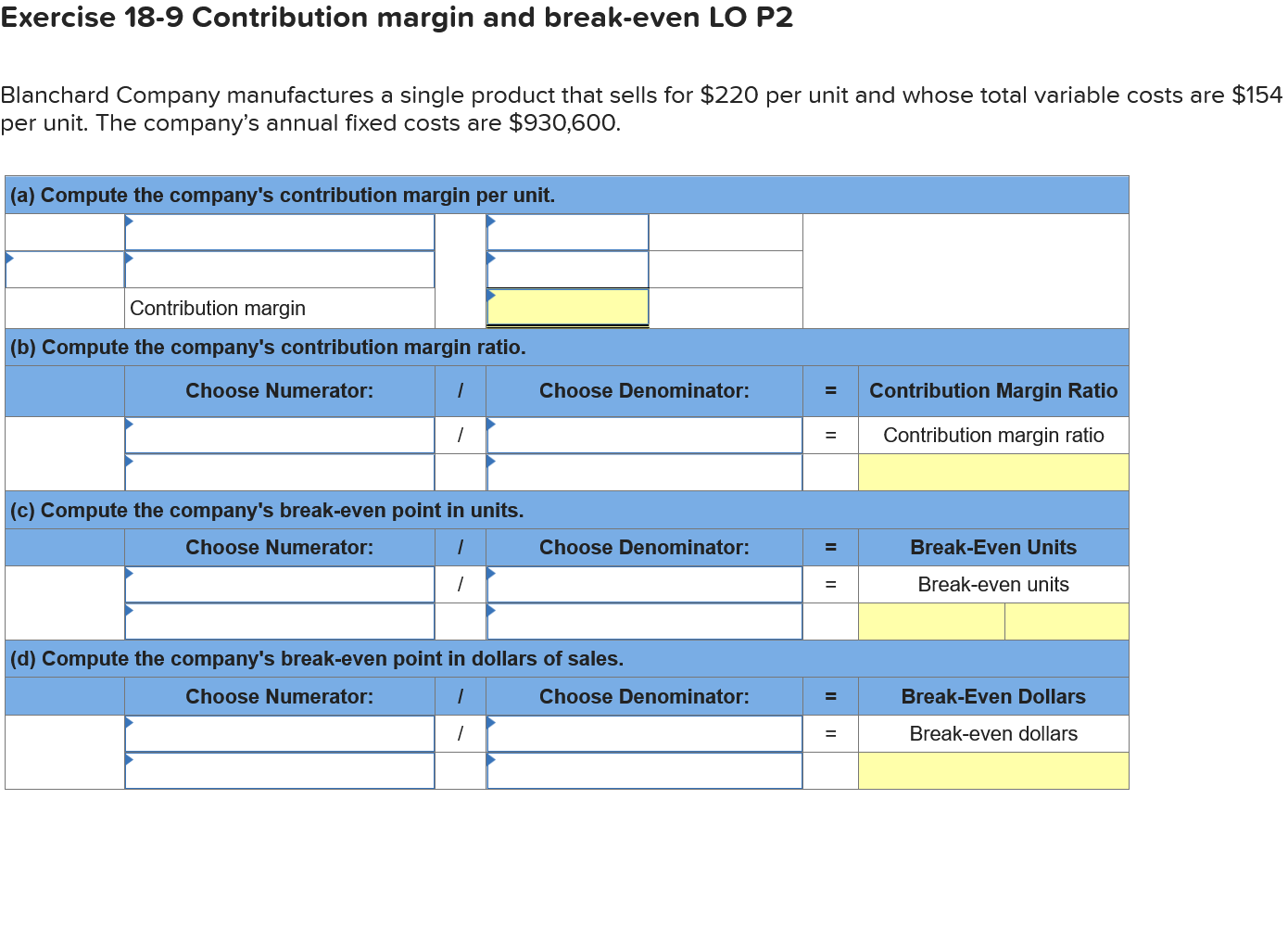

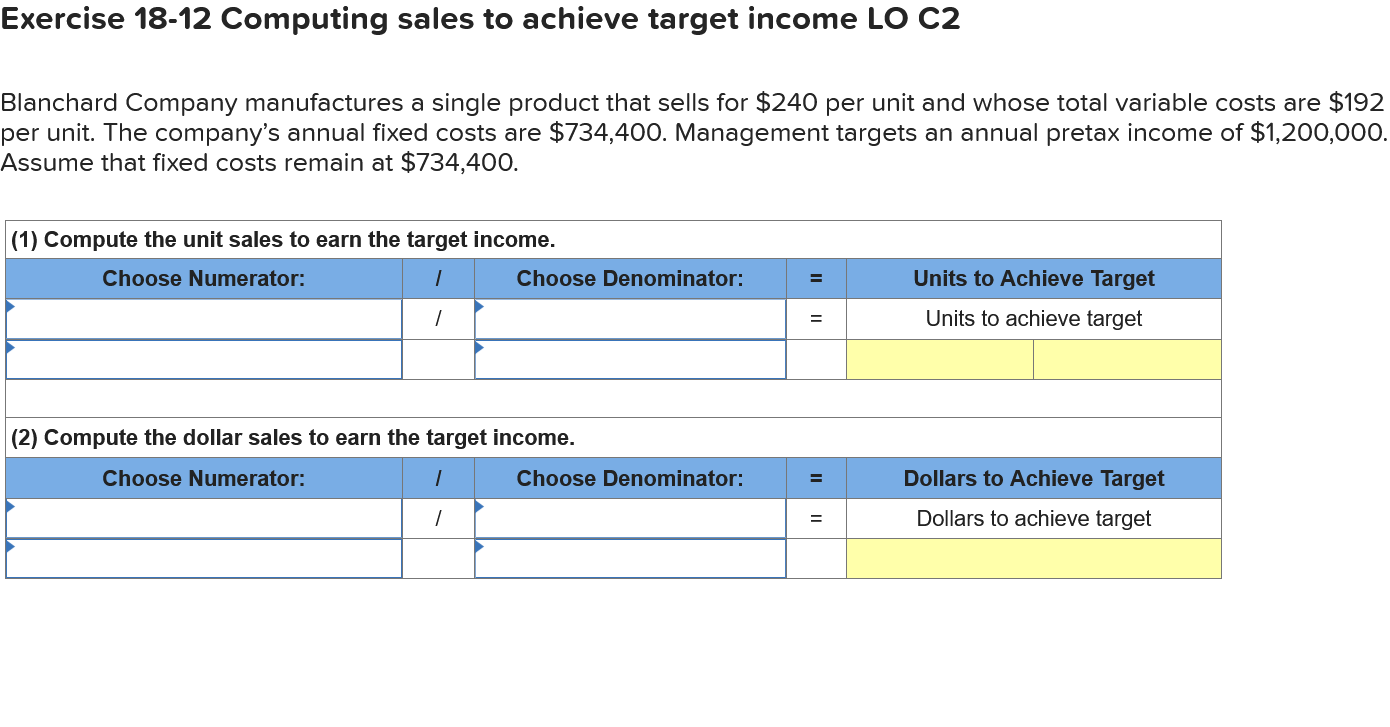

QS 18-3 Cost behavior estimation-high-low method LO P1 The following information is available for a company's maintenance cost over the last seven months. Month June July August September October November December Units Produced 90 180 120 150 210 240 60 Maintenance Cost $ 4,830 7,620 5, 760 6,690 8,550 9, 480 3,900 Using the high-low method, estimate both the fixed and variable components of its maintenance cost. High-Low method - Calculation of variable cost per maintenance hour Total cost at the high point Variable costs at the high point: Volume at the high point: Variable cost per unit produced Total variable costs at the high point Total fixed costs Total cost at the low point Variable costs at the low point: Volume at the low point: Variable cost per unit produced Total variable costs at the low point Total fixed costs Exercise 18-9 Contribution margin and break-even LO P2 Blanchard Company manufactures a single product that sells for $220 per unit and whose total variable costs are $154 per unit. The company's annual fixed costs are $930,600. (a) Compute the company's contribution margin per unit. Contribution margin (b) Compute the company's contribution margin ratio. Choose Numerator: 1 Choose Denominator: = Contribution Margin Ratio Contribution margin ratio (c) Compute the company's break-even point in units. Choose Numerator: 1 Choose Denominator: Break-Even Units / Break-even units (d) Compute the company's break-even point in dollars of sales. Choose Numerator: / Choose Denominator: Break-Even Dollars / Break-even dollars Exercise 18-12 Computing sales to achieve target income LO C2 Blanchard Company manufactures a single product that sells for $240 per unit and whose total variable costs are $192 per unit. The company's annual fixed costs are $734,400. Management targets an annual pretax income of $1,200,000. Assume that fixed costs remain at $734,400. (1) Compute the unit sales to earn the target income. Choose Numerator: 1 Choose Denominator: Units to Achieve Target 1 Units to achieve target (2) Compute the dollar sales to earn the target income. Choose Numerator: / Choose Denominator: Dollars to Achieve Target Dollars to achieve target 1