Answered step by step

Verified Expert Solution

Question

1 Approved Answer

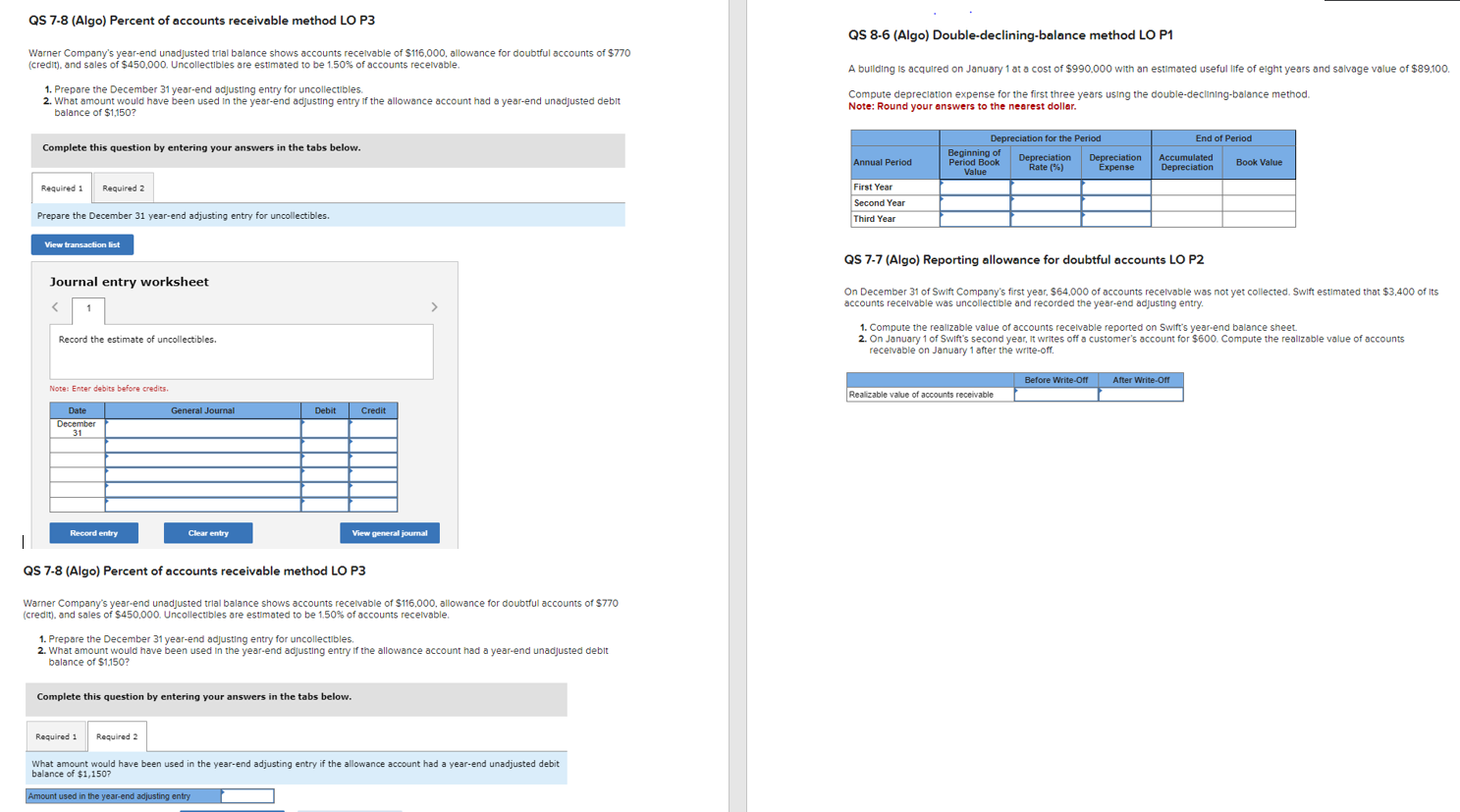

QS 7 . 8 ( Algo ) Percent of accounts receivable method LO P 3 Warner Company's year - end unadjusted trial balance shows accounts

QS Algo Percent of accounts receivable method LO P

Warner Company's yearend unadjusted trial balance shows accounts recelvable of $ allowance for doubtful accounts of $

credit and sales of $ Uncollectibles are estimated to be of accounts recelvable.

Prepare the December yearend adjusting entry for uncollectlbles.

What amount would have been used in the yearend adjusting entry if the allowance account had a yearend unadjusted debit

balance of $

Complete this question by entering your answers in the tabs below.

Required

Prepare the December yearend adjusting entry for uncollectibles.

Journal entry worksheet

Record the estimate of uncollectibles.

Note: Enter debits before credits.

QS Algo Percent of accounts receivable method LO P

Warner Company's yearend unadjusted trial balance shows accounts recelvable of $ allowance for doubtful accounts of $

credit and sales of $ Uncollectibles are estimated to be of accounts recelvable.

Prepare the December yearend adjusting entry for uncollectibles.

What amount would have been used in the yearend adjusting entry if the allowance account had a yearend unadjusted debit

balance of $

Complete this question by entering your answers in the tabs below.

Required

What amount would have been used in the yearend adjusting entry if the allowance account had a yearend unadjusted debit

balance of $

Amount used in the yearend adjusting entry

QS Algo Doubledecliningbalance method LO P

A bullding is acquired on January at a cost of $ with an estimated useful life of eight years and salvage value of $

Compute depreciation expense for the first three years using the doubledecliningbalance method.

Note: Round your answers to the nearest dollar.

QS Algo Reporting allowance for doubtful accounts LO P

On December of Swift Company's first year, $ of accounts recelvable was not yet collected. Swift estimated that $ of Its

accounts recelvable was uncollectible and recorded the yearend adjusting entry.

Compute the realizable value of accounts recelvable reported on Swift's yearend balance sheet.

On January of Swift's second year, It writes off a customer's account for $ Compute the realizable value of accounts,

recervable on January after the writeoff.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started