Answered step by step

Verified Expert Solution

Question

1 Approved Answer

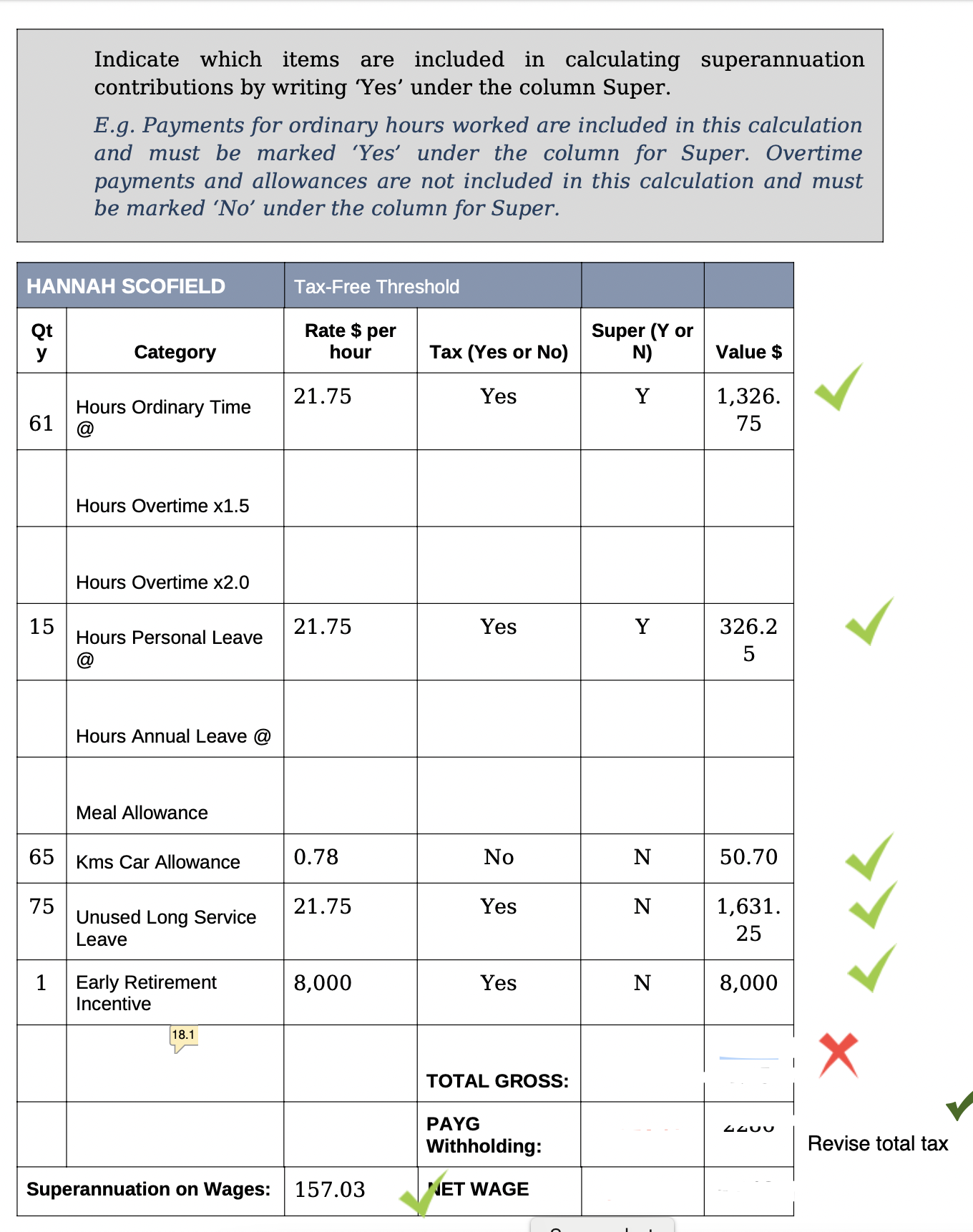

Qt HANNAH SCOFIELD 61 15 Indicate which items are included in calculating superannuation contributions by writing 'Yes' under the column Super. 65 | 75

Qt HANNAH SCOFIELD 61 15 Indicate which items are included in calculating superannuation contributions by writing 'Yes' under the column Super. 65 | 75 E.g. Payments for ordinary hours worked are included in this calculation and must be marked 'Yes' under the column for Super. Overtime payments and allowances are not included in this calculation and must be marked 'No' under the column for Super. Category Hours Ordinary Time Hours Overtime x1.5 Hours Overtime x2.0 Hours Personal Leave Hours Annual Leave Meal Allowance 65 Kms Car Allowance Unused Long Service Leave 1 Early Retirement Incentive 18.1 Tax-Free Threshold Rate $ per hour 21.75 21.75 0.78 21.75 8,000 Superannuation on Wages: 157.03 Tax (Yes or No) Yes Yes No Yes Yes TOTAL GROSS: PAYG Withholding: NET WAGE Super (Y or N) Y Y N N N Value $ 1,326. 75 326.2 5 50.70 1,631. 25 8,000 2400 Revise total tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information heres how to indicate which ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started