Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A conflict of interest between the stockholders and management of a firm is called: A. Stockholders' liability B. Corporate breakdown C. The agency problem

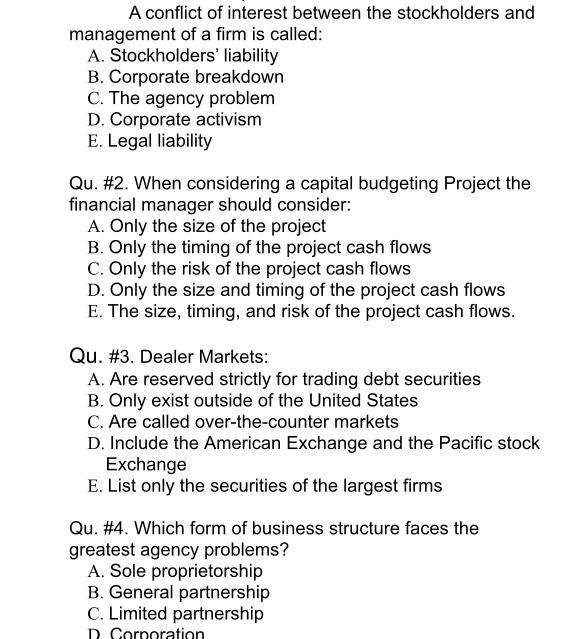

A conflict of interest between the stockholders and management of a firm is called: A. Stockholders' liability B. Corporate breakdown C. The agency problem D. Corporate activism E. Legal liability Qu. #2. When considering a capital budgeting Project the financial manager should consider: A. Only the size of the project B. Only the timing of the project cash flows C. Only the risk of the project cash flows D. Only the size and timing of the project cash flows E. The size, timing, and risk of the project cash flows. Qu. # 3. Dealer Markets: A. Are reserved strictly for trading debt securities B. Only exist outside of the United States C. Are called over-the-counter markets D. Include the American Exchange and the Pacific stock Exchange E. List only the securities of the largest firms Qu. #4. Which form of business structure faces the greatest agency problems? A. Sole proprietorship B. General partnership C. Limited partnership D. Corporation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Qu 1 Answer C Explanation A conflict of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started