Answered step by step

Verified Expert Solution

Question

1 Approved Answer

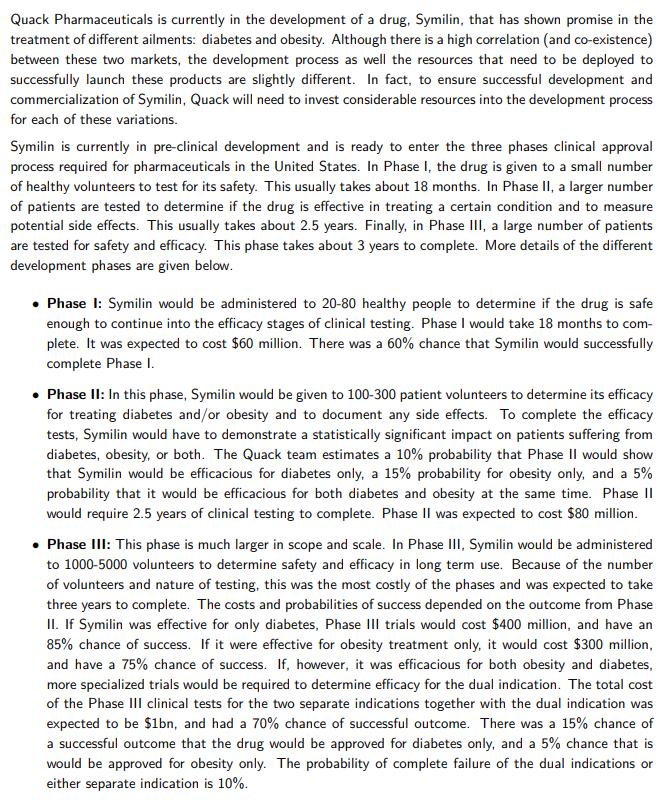

Quack Pharmaceuticals is currently in the development of a drug, Symilin, that has shown promise in the treatment of different ailments: diabetes and obesity.

Quack Pharmaceuticals is currently in the development of a drug, Symilin, that has shown promise in the treatment of different ailments: diabetes and obesity. Although there is a high correlation (and co-existence) between these two markets, the development process as well the resources that need to be deployed to successfully launch these products are slightly different. In fact, to ensure successful development and commercialization of Symilin, Quack will need to invest considerable resources into the development process for each of these variations. Symilin is currently in pre-clinical development and is ready to enter the three phases clinical approval process required for pharmaceuticals in the United States. In Phase I, the drug is given to a small number of healthy volunteers to test for its safety. This usually takes about 18 months. In Phase II, a larger number of patients are tested to determine if the drug is effective in treating a certain condition and to measure potential side effects. This usually takes about 2.5 years. Finally, in Phase III, a large number of patients are tested for safety and efficacy. This phase takes about 3 years to complete. More details of the different development phases are given below. Phase 1: Symilin would be administered to 20-80 healthy people to determine if the drug is safe enough to continue into the efficacy stages of clinical testing. Phase I would take 18 months to com- plete. It was expected to cost $60 million. There was a 60% chance that Symilin would successfully complete Phase I. Phase II: In this phase, Symilin would be given to 100-300 patient volunteers to determine its efficacy for treating diabetes and/or obesity and to document any side effects. To complete the efficacy tests, Symilin would have to demonstrate a statistically significant impact on patients suffering from diabetes, obesity, or both. The Quack team estimates a 10% probability that Phase II would show that Symilin would be efficacious for diabetes only, a 15% probability for obesity only, and a 5% probability that it would be efficacious for both diabetes and obesity at the same time. Phase II would require 2.5 years of clinical testing to complete. Phase II was expected to cost $80 million. Phase III: This phase is much larger in scope and scale. In Phase III, Symilin would be administered to 1000-5000 volunteers to determine safety and efficacy in long term use. Because of the number of volunteers and nature of testing, this was the most costly of the phases and was expected to take three years to complete. The costs and probabilities of success depended on the outcome from Phase II. If Symilin was effective for only diabetes, Phase III trials would cost $400 million, and have an 85% chance of success. If it were effective for obesity treatment only, it would cost $300 million, and have a 75% chance of success. If, however, it was efficacious for both obesity and diabetes, more specialized trials would be required to determine efficacy for the dual indication. The total cost of the Phase III clinical tests for the two separate indications together with the dual indication was expected to be $1bn, and had a 70% chance of successful outcome. There was a 15% chance of a successful outcome that the drug would be approved for diabetes only, and a 5% chance that is would be approved for obesity only. The probability of complete failure of the dual indications or either separate indication is 10%. Symilin would be able to generate substantial potential profits, especially if it was effective both as a treatment for diabetes and weight loss. If the drug were approved only for the treatment of diabetes, it would cost $500 million to launch, and had a commercialization present value of $2.5 billion. If it were only approved for obesity treatment, it would cost $200 million to launch, and would have a PV of $700 million. However, if Quack could launch the product with claims for both indications, it would cost $750 million to launch and have a PV of $5 billion. Answer the following questions based on the description above. All cash flows are expressed as after-tax present values discounted to time zero, including capital expenditures. 1. Using the data from the case, build a decision tree that shows the cash flows and probabilities at the different stages of the FDA approval process. Subsequently, use the tree to determine Quack's optimal decisions at each phase and calculate the value that they can generate by going through the development process? 15 points 2. How would your analysis change if the costs of launching (in the commercialization phase) Symilin for obesity were $400 million instead of $200 million as given in the case? 10 points 3. The Quack R&D team believes that it is equally likely that the launch costs of Symilin for obesity could be 400mn or 200mn (probability of each of these cases is 50%). Now suppose Quack could conduct a separate analysis to accurately estimate the launch costs of Symilin for obesity before the beginning of Phase 1. What is the maximum cost that Quack should incur to conduct such an analysis? 15 points 4. Suppose the analysis can be delayed until the start of Phase 3 (i.e. after the end of Phase 2 but before the beginning of Phase 3). What is the maximum cost that Quack is willing to incur under this scenario? 10 points 5. Compare the amounts they were willing to spend for the analysis in Part 3 and Part 4 above. Are they same or different? Why? 10 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Prob Cost Prob Cost Prob Cost Stage Launch Total Cost Revenue Profit Final Probability Expected Values Total Expected Diabetes Only 10 80 85 400 DO1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started