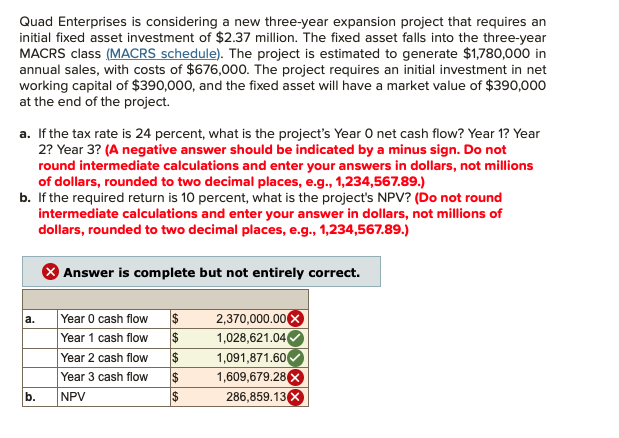

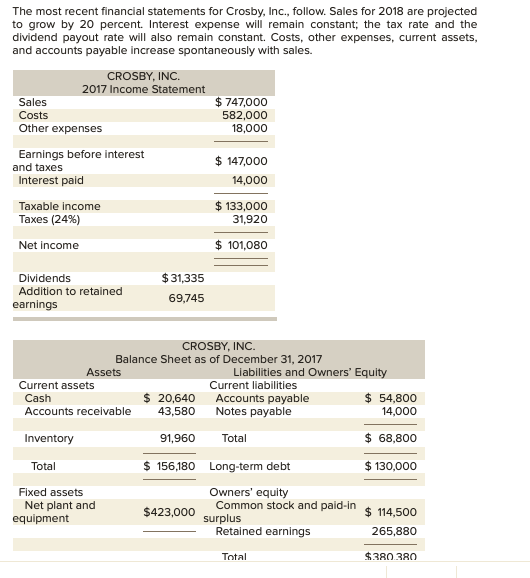

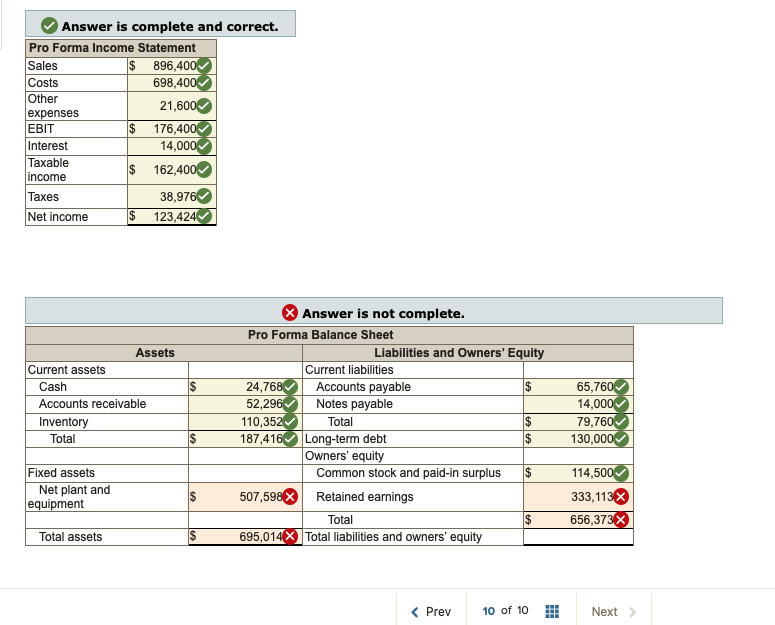

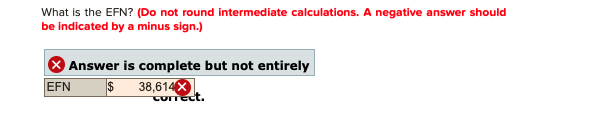

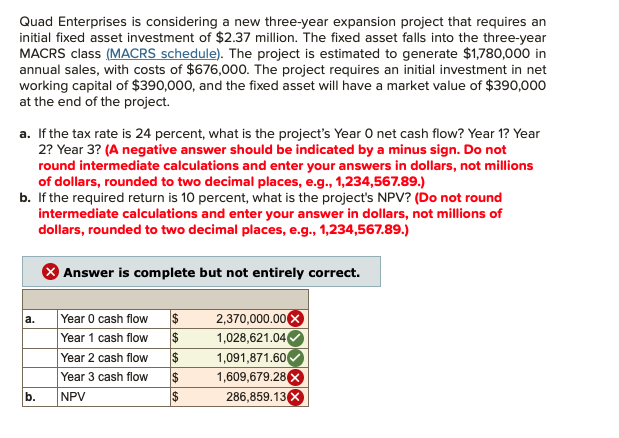

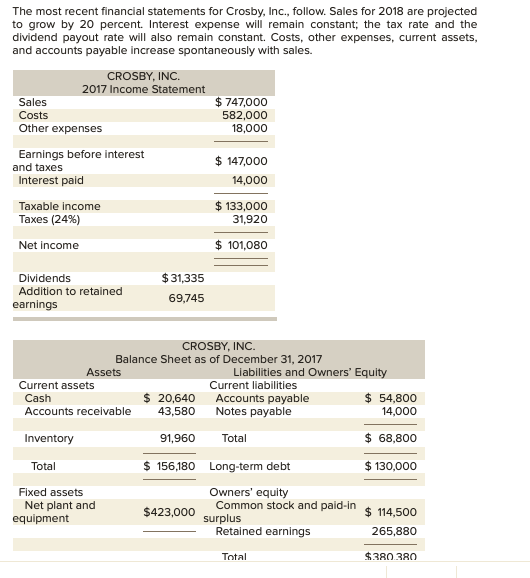

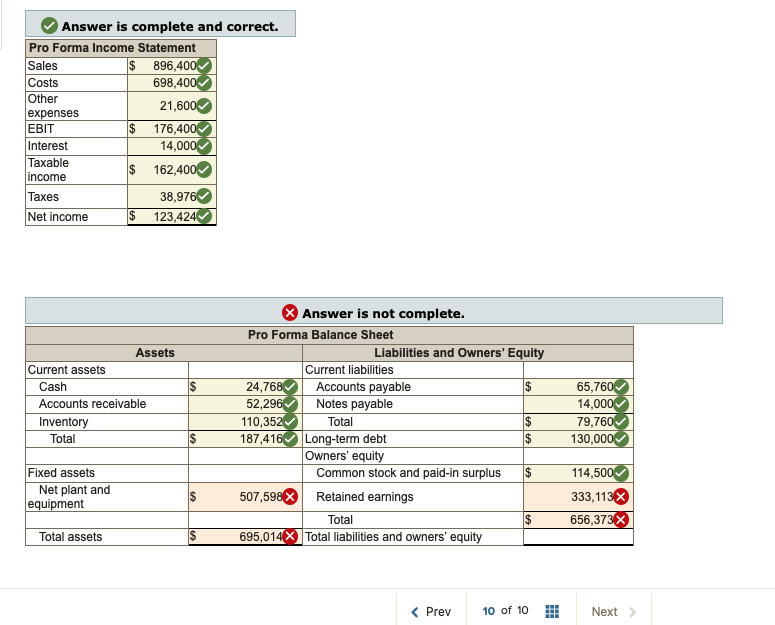

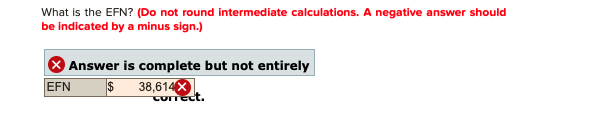

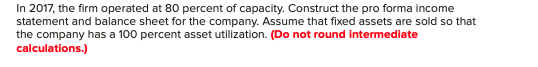

Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.37 million. The fixed asset falls into the three-year MACRS class (MACRS schedule). The project is estimated to generate $1,780,000 in annual sales, with costs of $676,000. The project requires an initial investment in net working capital of $390,000, and the fixed asset will have a market value of $390,000 at the end of the project. a. If the tax rate is 24 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) b. If the required return is 10 percent, what is the project's NPV? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to two decimal places, e.g., 1,234,567.89.) Answer is complete but not entirely correct. a. $ $ Year 0 cash flow Year 1 cash flow Year 2 cash flow Year 3 cash flow NPV $ 2,370,000.00 1,028,621.04 1,091,871.60 1,609,679.28 286,859.13 X $ b. $ The most recent financial statements for Crosby, Inc., follow. Sales for 2018 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable increase spontaneously with sales. CROSBY, INC. 2017 Income Statement Sales $ 747,000 Costs 582,000 Other expenses 18,000 Earnings before interest and taxes $ 147,000 Interest paid 14,000 Taxable income $ 133,000 Taxes (24%) 31,920 Net income $ 101,080 Dividends Addition to retained earnings $ 31,335 69,745 CROSBY, INC. Balance Sheet as of December 31, 2017 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 20,640 Accounts payable $ 54,800 Accounts receivable 43,580 Notes payable 14,000 Inventory 91,960 Total $ 68,800 Total $ 130,000 Fixed assets Net plant and equipment $ 156,180 Long-term debt Owners' equity $423,000 Common stock and paid-in surplus Retained earnings $ 114,500 265,880 Total $380.380 Answer is complete and correct. Pro Forma Income Statement Sales $ 896,400 Costs 698,400 Other 21,600 expenses EBIT $ 176,400 Interest 14,000 Taxable $ 162,400 income Taxes 38,976 Net income 123,424 $ Assets Current assets Cash Accounts receivable Inventory Total Answer is not complete. Pro Forma Balance Sheet Liabilities and Owners' Equity Current liabilities 24,768 Accounts payable 52,296 Notes payable 110,352 Total 187,416 Long-term debt $ Owners' equity Common stock and paid-in surplus 507,598 Retained earnings Total 695,014% Total liabilities and owners' equity 65,760 14,000 79,760 130,000 $ Fixed assets Net plant and equipment $ 114,500 333,113 656,373 Total assets