Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quality Brick Company produces bricks in two processing departments-Molding and Firing. Information relating to the company's operations in March follows: a. Raw materials used

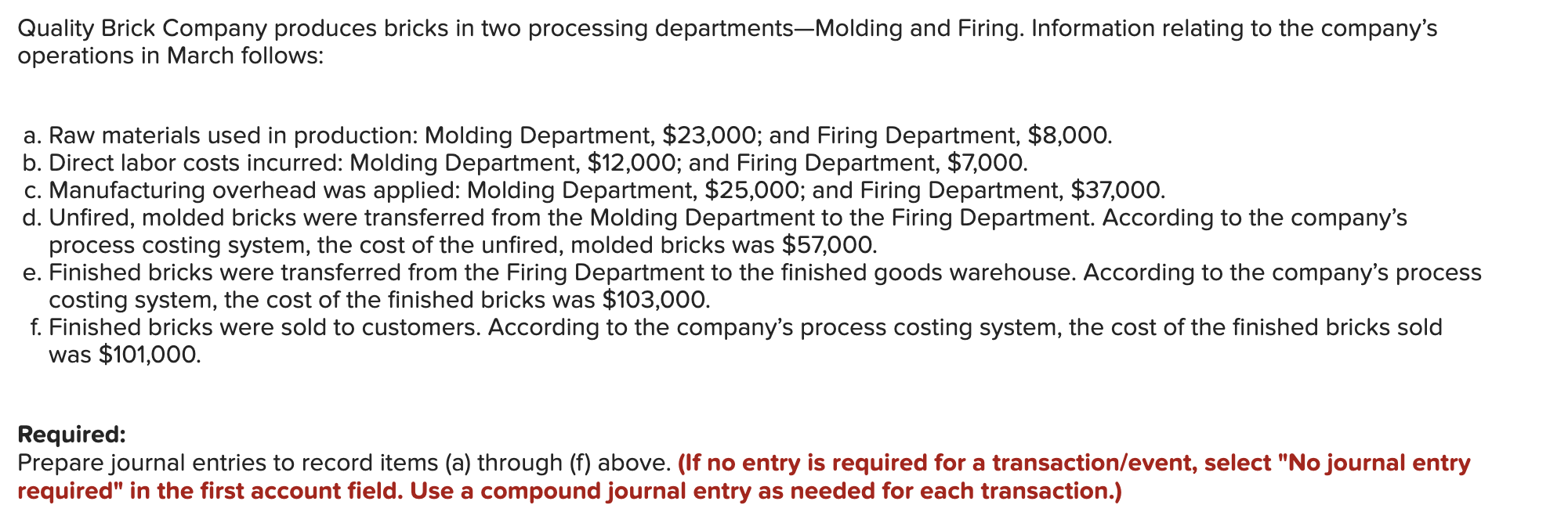

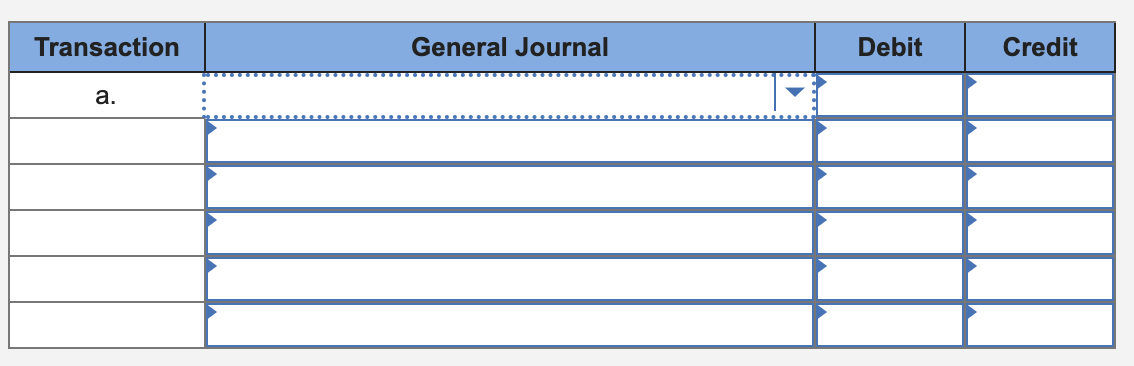

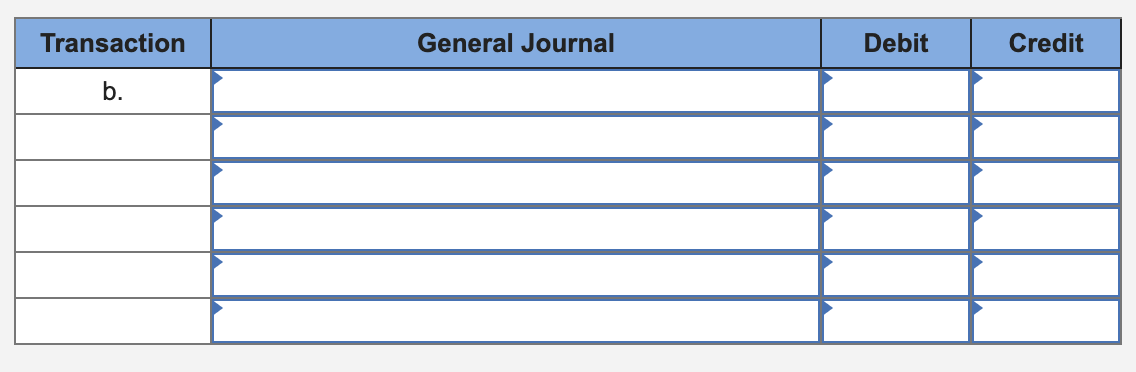

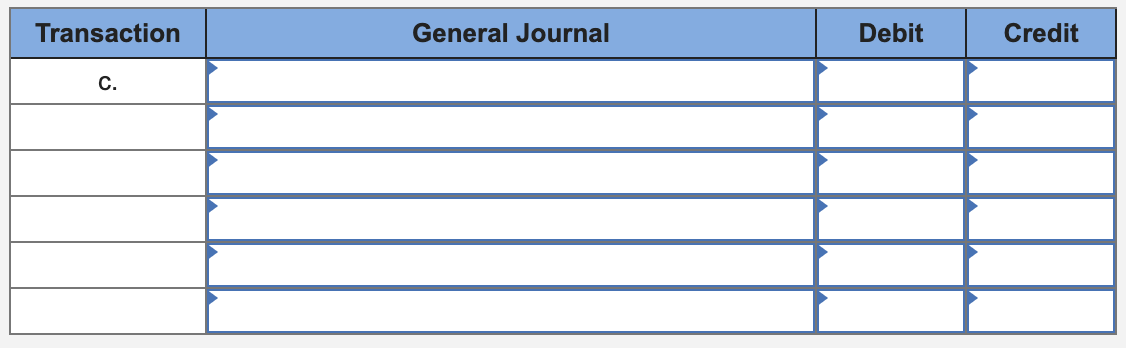

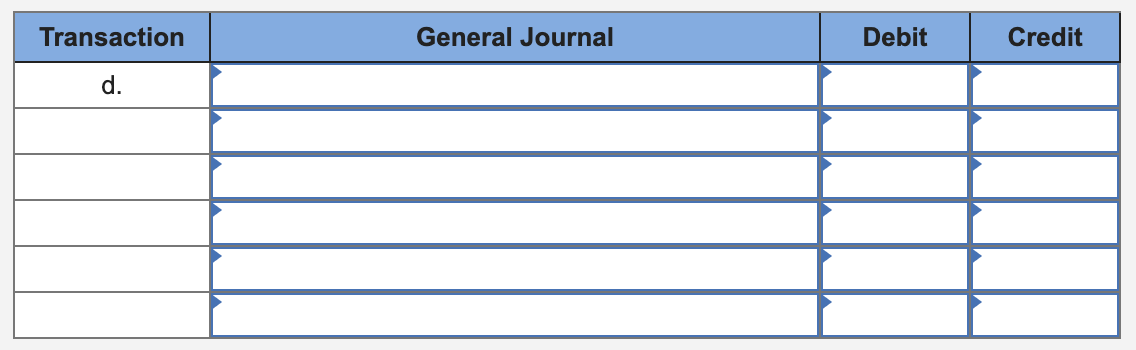

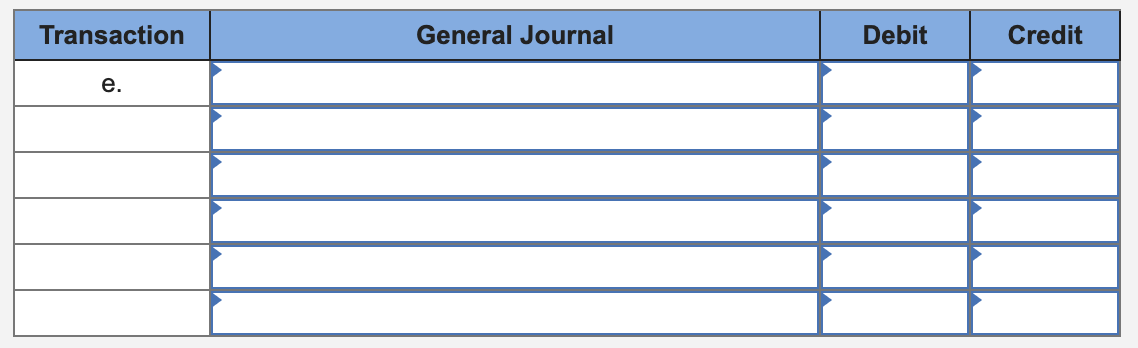

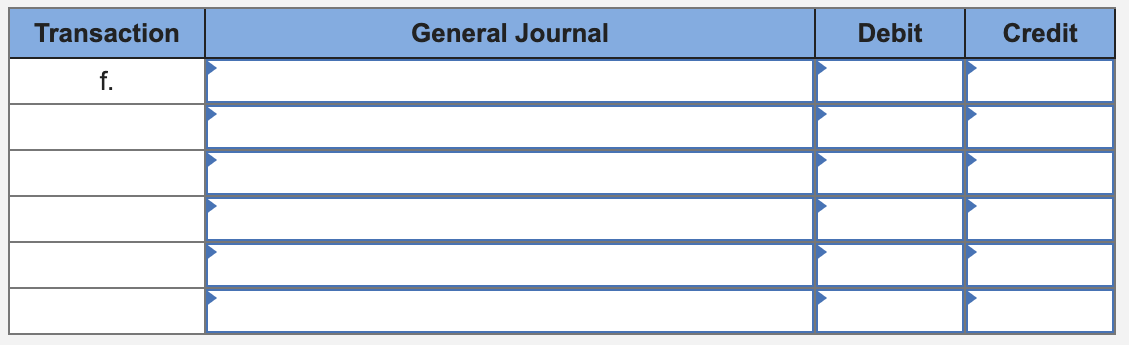

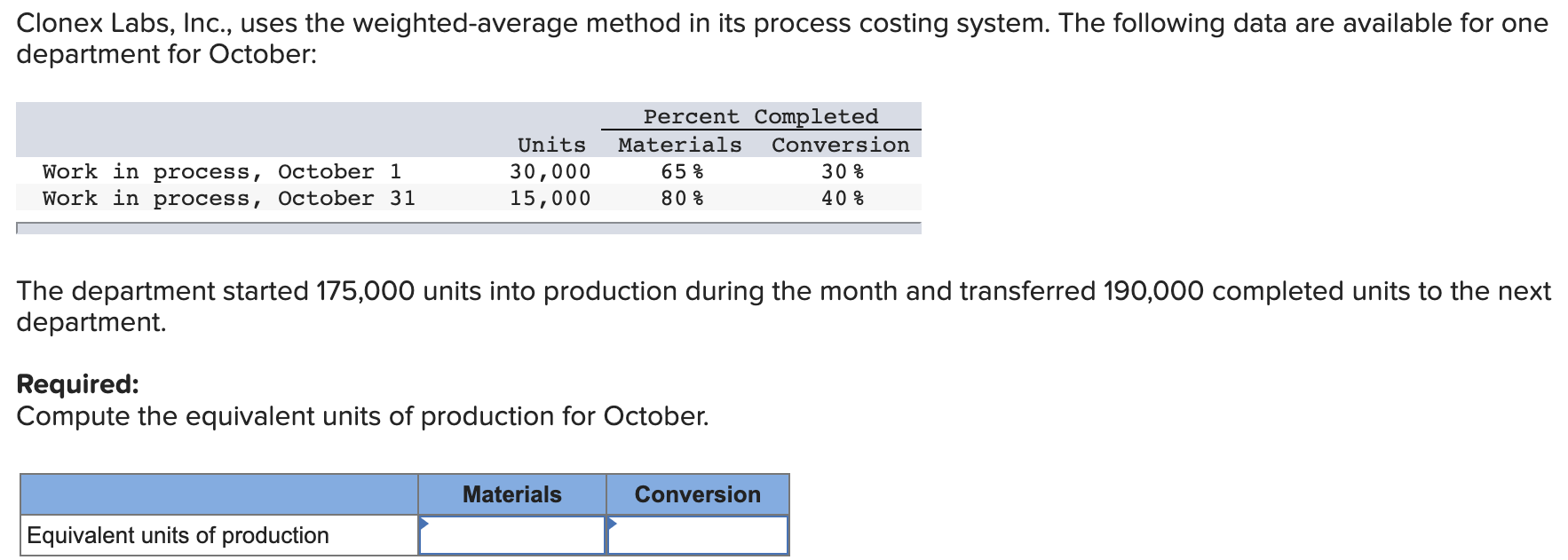

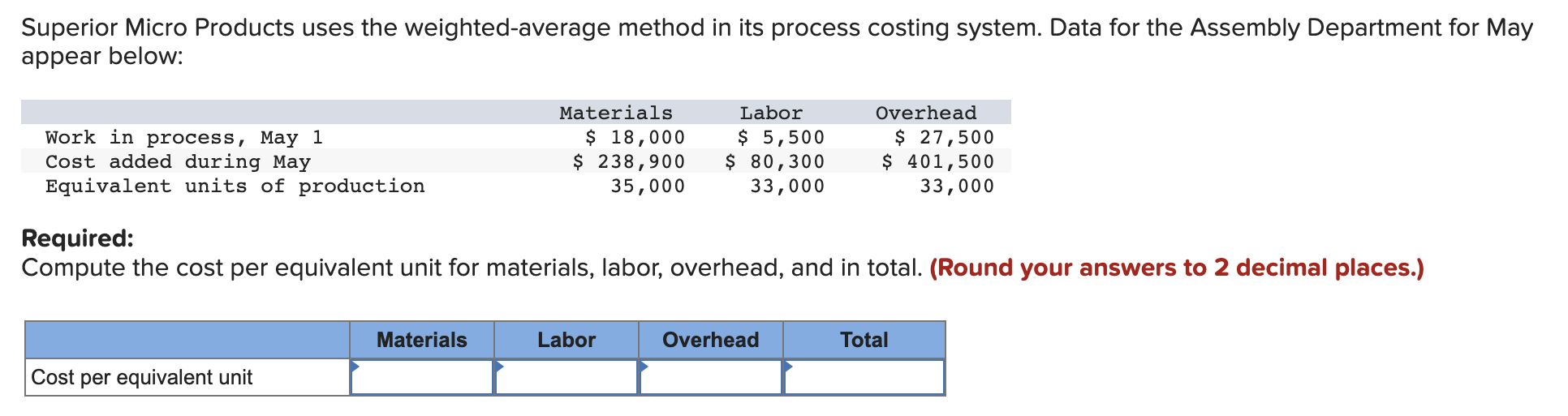

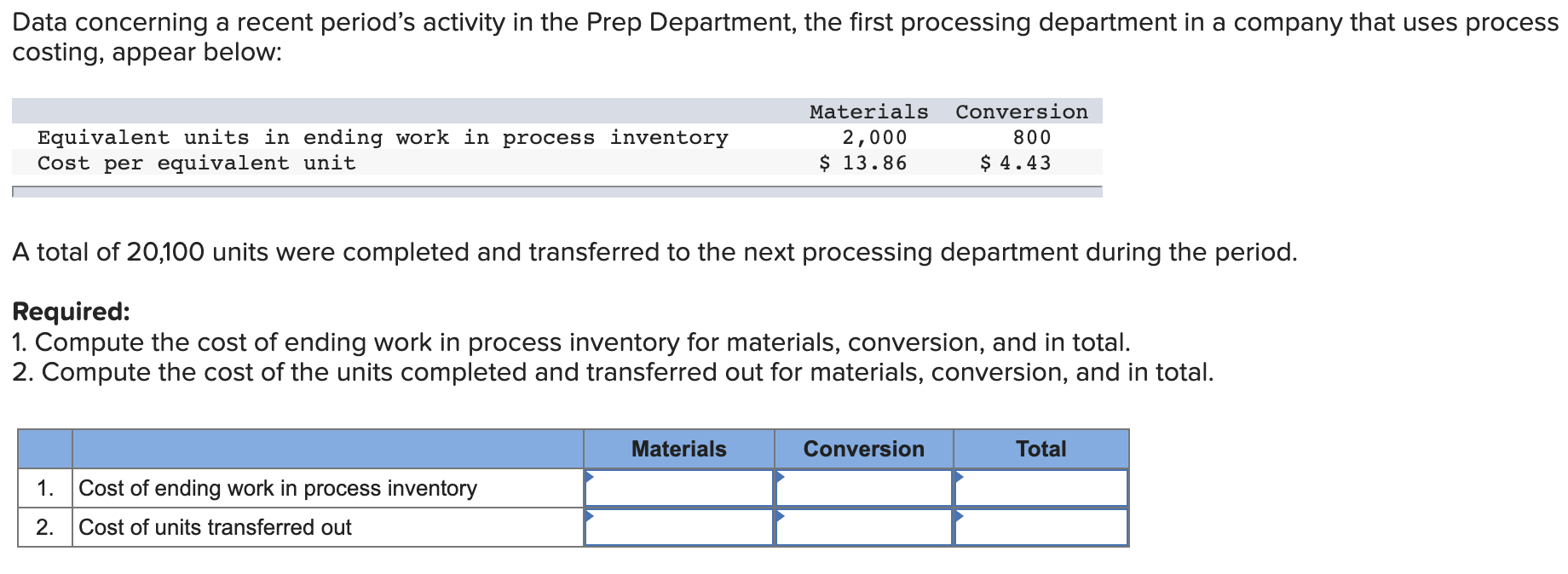

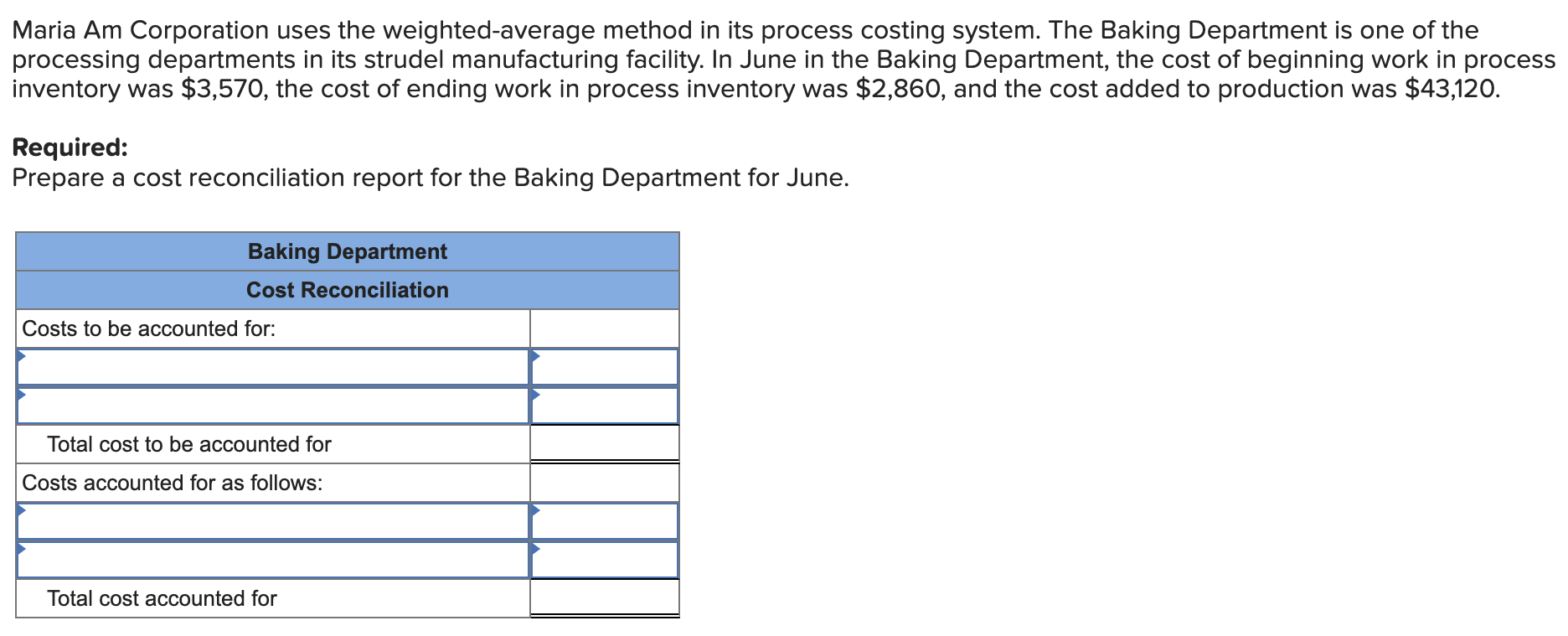

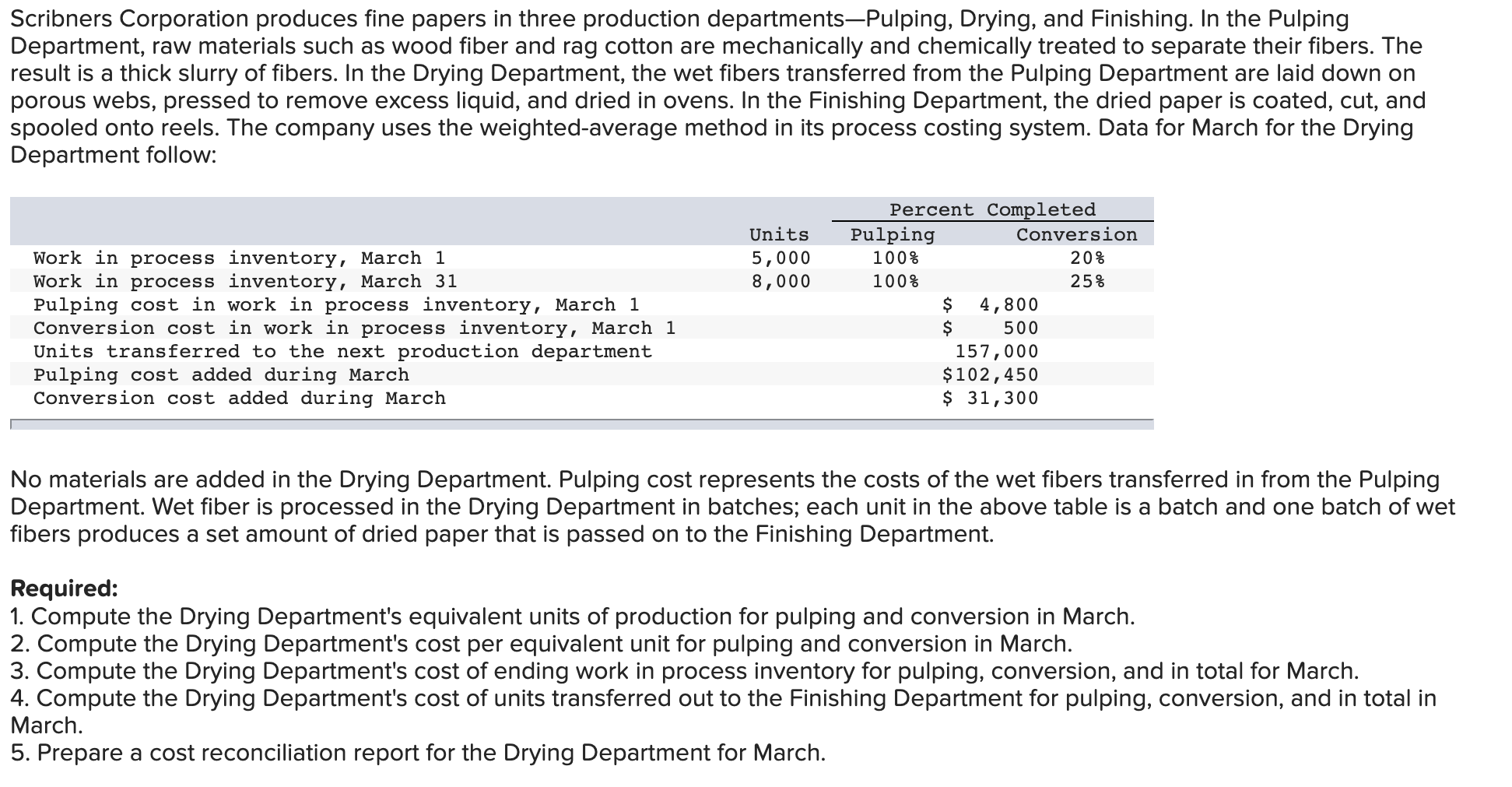

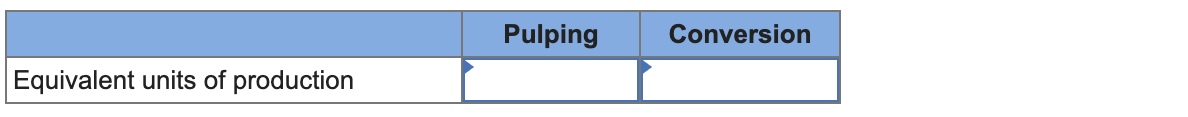

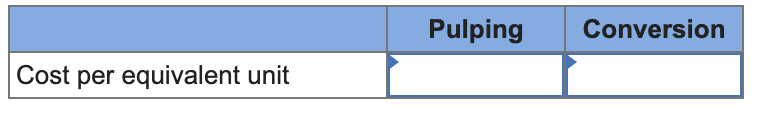

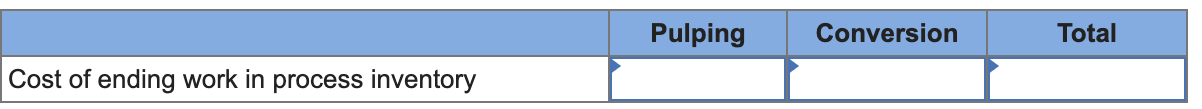

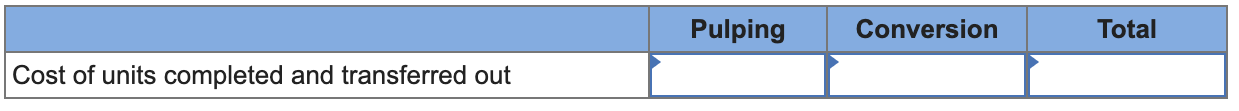

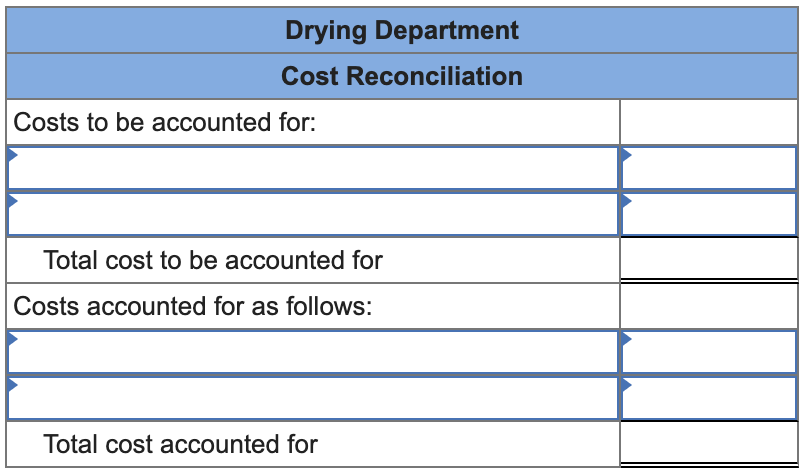

Quality Brick Company produces bricks in two processing departments-Molding and Firing. Information relating to the company's operations in March follows: a. Raw materials used in production: Molding Department, $23,000; and Firing Department, $8,000. b. Direct labor costs incurred: Molding Department, $12,000; and Firing Department, $7,000. c. Manufacturing overhead was applied: Molding Department, $25,000; and Firing Department, $37,000. d. Unfired, molded bricks were transferred from the Molding Department to the Firing Department. According to the company's process costing system, the cost of the unfired, molded bricks was $57,000. e. Finished bricks were transferred from the Firing Department to the finished goods warehouse. According to the company's process costing system, the cost of the finished bricks was $103,000. f. Finished bricks were sold to customers. According to the company's process costing system, the cost of the finished bricks sold was $101,000. Required: Prepare journal entries to record items (a) through (f) above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Use a compound journal entry as needed for each transaction.) Transaction General Journal Debit Credit a. Transaction General Journal Debit Credit b. Transaction General Journal Debit Credit C. Transaction d. General Journal Debit Credit Transaction General Journal Debit Credit e. Transaction f. General Journal Debit Credit Clonex Labs, Inc., uses the weighted-average method in its process costing system. The following data are available for one department for October: Percent Completed Units Materials Conversion Work in process, October 1 Work in process, October 31 30,000 15,000 65 % 80% 30 % 40 % The department started 175,000 units into production during the month and transferred 190,000 completed units to the next department. Required: Compute the equivalent units of production for October. Equivalent units of production Materials Conversion Superior Micro Products uses the weighted-average method in its process costing system. Data for the Assembly Department for May appear below: Work in process, May 1 Cost added during May Equivalent units of production Required: Materials $ 18,000 $ 238,900 35,000 Labor $ 5,500 $ 80,300 33,000 Overhead $ 27,500 $ 401,500 33,000 Compute the cost per equivalent unit for materials, labor, overhead, and in total. (Round your answers to 2 decimal places.) Cost per equivalent unit Materials Labor Overhead Total Data concerning a recent period's activity in the Prep Department, the first processing department in a company that uses process costing, appear below: Equivalent units in ending work in process inventory Cost per equivalent unit Materials 2,000 Conversion 800 $ 13.86 $ 4.43 A total of 20,100 units were completed and transferred to the next processing department during the period. Required: 1. Compute the cost of ending work in process inventory for materials, conversion, and in total. 2. Compute the cost of the units completed and transferred out for materials, conversion, and in total. 1. Cost of ending work in process inventory 2. Cost of units transferred out Materials Conversion Total Maria Am Corporation uses the weighted-average method in its process costing system. The Baking Department is one of the processing departments in its strudel manufacturing facility. In June in the Baking Department, the cost of beginning work in process inventory was $3,570, the cost of ending work in process inventory was $2,860, and the cost added to production was $43,120. Required: Prepare a cost reconciliation report for the Baking Department for June. Baking Department Cost Reconciliation Costs to be accounted for: Total cost to be accounted for Costs accounted for as follows: Total cost accounted for Scribners Corporation produces fine papers in three production departmentsPulping, Drying, and Finishing. In the Pulping Department, raw materials such as wood fiber and rag cotton are mechanically and chemically treated to separate their fibers. The result is a thick slurry of fibers. In the Drying Department, the wet fibers transferred from the Pulping Department are laid down on porous webs, pressed to remove excess liquid, and dried in ovens. In the Finishing Department, the dried paper is coated, cut, and spooled onto reels. The company uses the weighted-average method in its process costing system. Data for March for the Drying Department follow: Percent Completed Units Pulping Conversion Work in process inventory, March 1 5,000 100% 20% Work in process inventory, March 31 8,000 100% 25% Pulping cost in work in process inventory, March 1 Conversion cost in work in process inventory, March 1 Units transferred to the next production department Pulping cost added during March $ Conversion cost added during March $ 4,800 500 157,000 $102,450 $ 31,300 No materials are added in the Drying Department. Pulping cost represents the costs of the wet fibers transferred in from the Pulping Department. Wet fiber is processed in the Drying Department in batches; each unit in the above table is a batch and one batch of wet fibers produces a set amount of dried paper that is passed on to the Finishing Department. Required: 1. Compute the Drying Department's equivalent units of production for pulping and conversion in March. 2. Compute the Drying Department's cost per equivalent unit for pulping and conversion in March. 3. Compute the Drying Department's cost of ending work in process inventory for pulping, conversion, and in total for March. 4. Compute the Drying Department's cost of units transferred out to the Finishing Department for pulping, conversion, and in total in March. 5. Prepare a cost reconciliation report for the Drying Department for March. Pulping Conversion Equivalent units of production Pulping Conversion Cost per equivalent unit Pulping Conversion Total Cost of ending work in process inventory Pulping Conversion Total Cost of units completed and transferred out Drying Department Cost Reconciliation Costs to be accounted for: Total cost to be accounted for Costs accounted for as follows: Total cost accounted for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started