Answered step by step

Verified Expert Solution

Question

1 Approved Answer

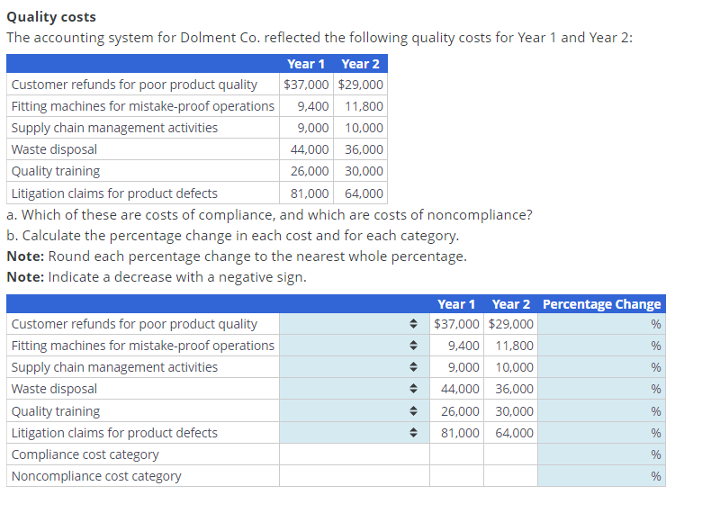

Quality costs The accounting system for Dolment Co . reflected the following quality costs for Year 1 and Year 2 : a . Which of

Quality costs

The accounting system for Dolment Co reflected the following quality costs for Year and Year :

a Which of these are costs of compliance, and which are costs of noncompliance?

b Calculate the percentage change in each cost and for each category.

Note: Round each percentage change to the nearest whole percentage.

Note: Indicate a decrease with a negative sign.Quality costs

The accounting system for Dolment Co reflected the following quality costs for Year and Year :

Year Year

Customer refunds for poor product quality $ $

Fitting machines for mistakeproof operations

Supply chain management activities

Waste disposal

Quality training

Litigation claims for product defects

a Which of these are costs of compliance, and which are costs of noncompliance?

b Calculate the percentage change in each cost and for each category.

Note: Round each percentage change to the nearest whole percentage.

Note: Indicate a decrease with a negative sign.

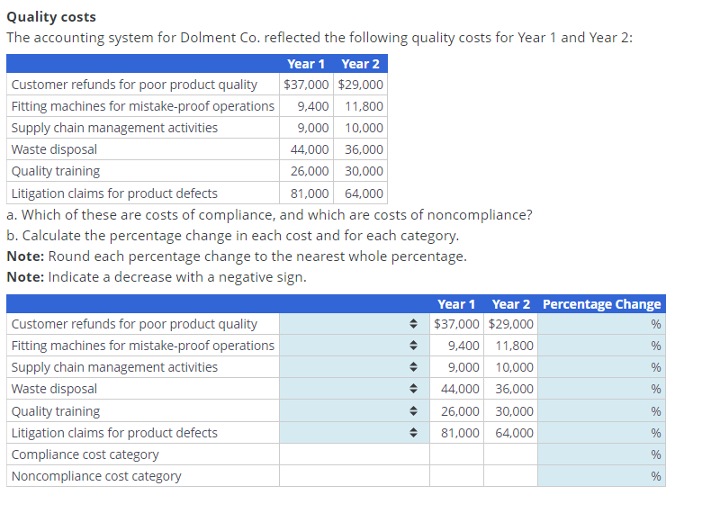

Year Year Percentage Change

Customer refunds for poor product quality Answer

$ $ Answer

Fitting machines for mistakeproof operations Answer

Answer

Supply chain management activities Answer

Answer

Waste disposal Answer

Answer

Quality training Answer

Answer

Litigation claims for product defects Answer

Answer

Compliance cost category Answer

Noncompliance cost category Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started