Answered step by step

Verified Expert Solution

Question

1 Approved Answer

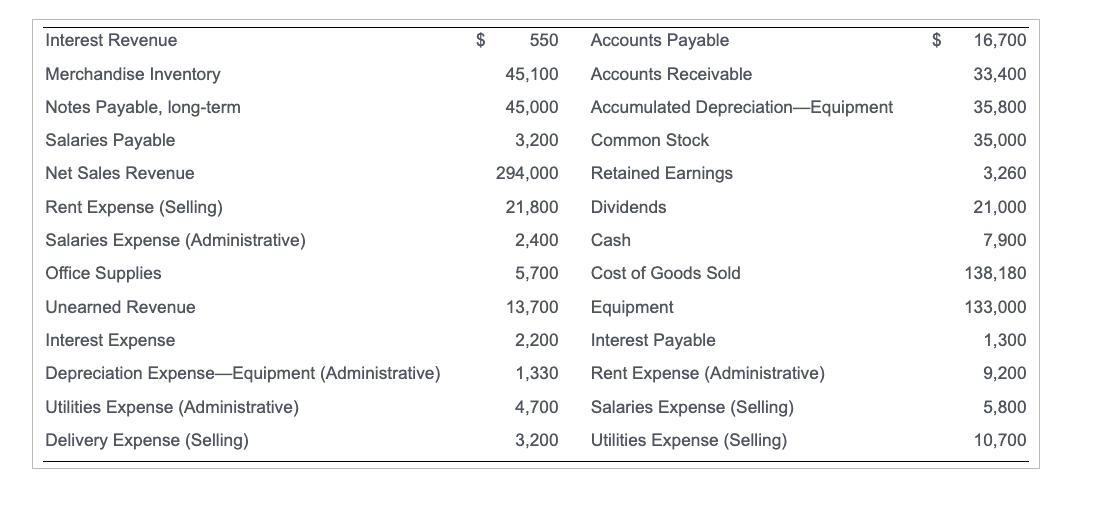

Quality Cut Steak Company uses a perpetual inventory system. The records of Quality Cut Steak Company list the following selected accounts for the quarter

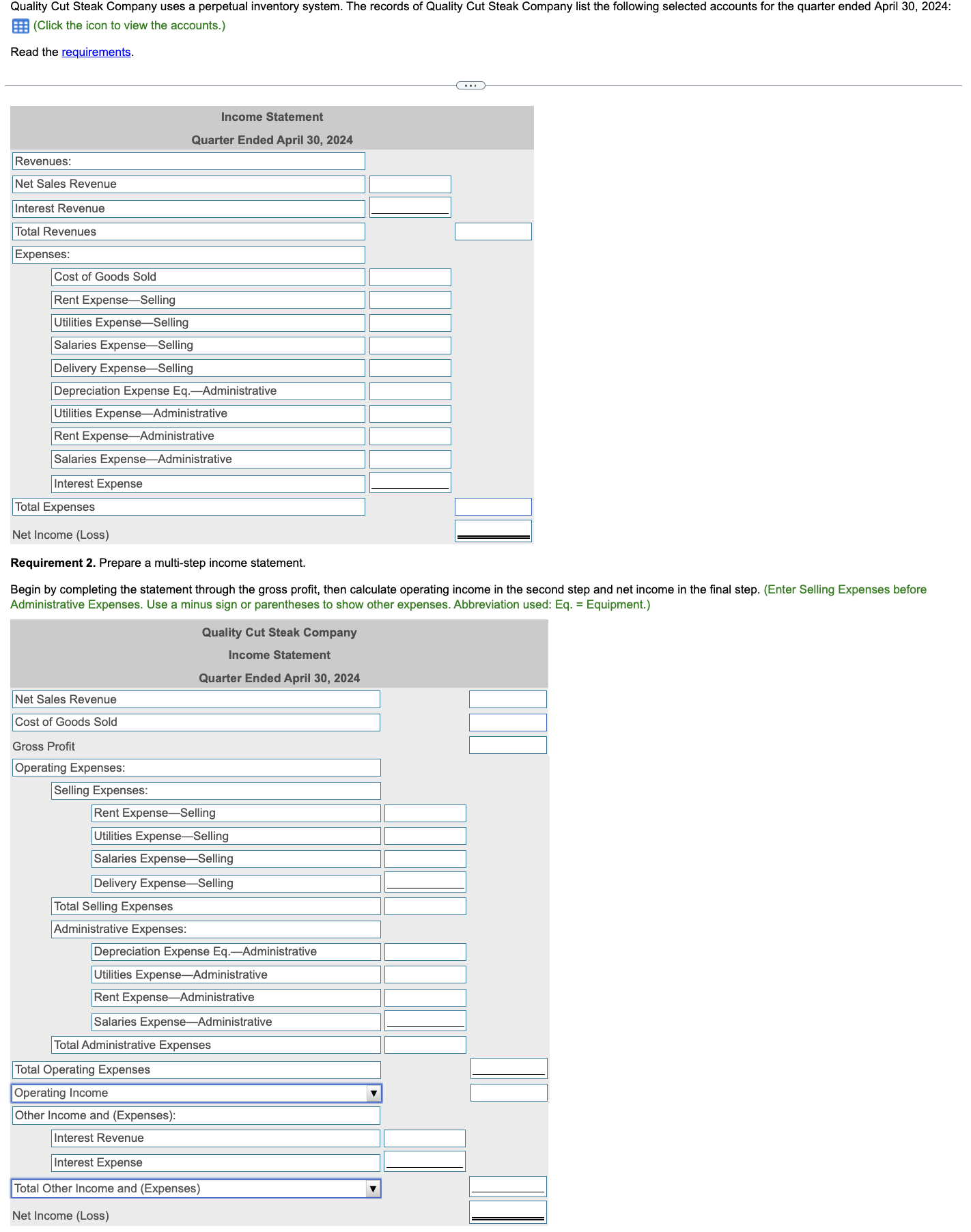

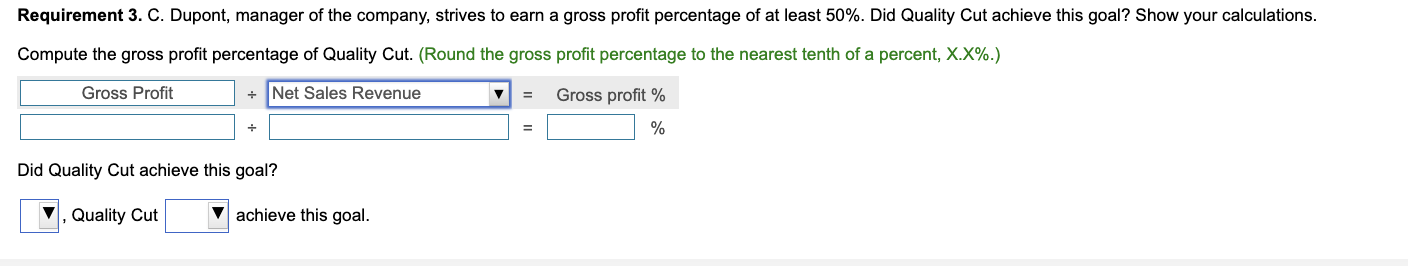

Quality Cut Steak Company uses a perpetual inventory system. The records of Quality Cut Steak Company list the following selected accounts for the quarter ended April 30, 2024: (Click the icon to view the accounts.) Read the requirements. Revenues: Net Sales Revenue Interest Revenue Total Revenues Expenses: Cost of Goods Sold Rent Expense-Selling Utilities Expense-Selling Salaries Expense-Selling Delivery Expense-Selling Depreciation Expense Eq.-Administrative Utilities Expense-Administrative Rent Expense-Administrative Salaries Expense-Administrative Interest Expense Income Statement Quarter Ended April 30, 2024 Total Expenses Net Income (Loss) Requirement 2. Prepare a multi-step income statement. Begin by completing the statement through the gross profit, then calculate operating income in the second step and net income in the final step. (Enter Selling Expenses before Administrative Expenses. Use a minus sign or parentheses to show other expenses. Abbreviation used: Eq. = Equipment.) Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Selling Expenses: Total Selling Expenses Administrative Expenses: Rent Expense-Selling Utilities Expense-Selling Salaries Expense-Selling Delivery Expense-Selling Quality Cut Steak Company Income Statement Quarter Ended April 30, 2024 Depreciation Expense Eq.-Administrative Total Operating Expenses Utilities Expense-Administrative Rent Expense-Administrative Salaries Expense-Administrative Total Administrative Expenses Operating Income Other Income and (Expenses): Interest Revenue Interest Expense Total Other Income and (Expenses) Net Income (Loss) Requirement 3. C. Dupont, manager of the company, strives to earn a gross profit percentage of at least 50%. Did Quality Cut achieve this goal? Show your calculations. Compute the gross profit percentage of Quality Cut. (Round the gross profit percentage to the nearest tenth of a percent, X.X%.) Gross Profit Gross profit % % + Net Sales Revenue Quality Cut + Did Quality Cut achieve this goal? achieve this goal. = Interest Revenue Merchandise Inventory Notes Payable, long-term Salaries Payable Net Sales Revenue Rent Expense (Selling) Salaries Expense (Administrative) Office Supplies Unearned Revenue Interest Expense Depreciation Expense-Equipment (Administrative) Utilities Expense (Administrative) Delivery Expense (Selling) $ 550 45,100 45,000 3,200 294,000 21,800 2,400 5,700 13,700 2,200 1,330 4,700 3,200 Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Common Stock Retained Earnings Dividends Cash Cost of Goods Sold Equipment Interest Payable Rent Expense (Administrative) Salaries Expense (Selling) Utilities Expense (Selling) $ 16,700 33,400 35,800 35,000 3,260 21,000 7,900 138,180 133,000 1,300 9,200 5,800 10,700

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

CALCULATIONS Gross Profit Net Sales RevenueCost of Goods Sold 294000138180 155820 Operating Income G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started