Question: Quantitative Analysis Estimate each propertys current value by calculating the present discounted value of expected future cash flows. The forward-looking cash flows have been provided

Quantitative Analysis

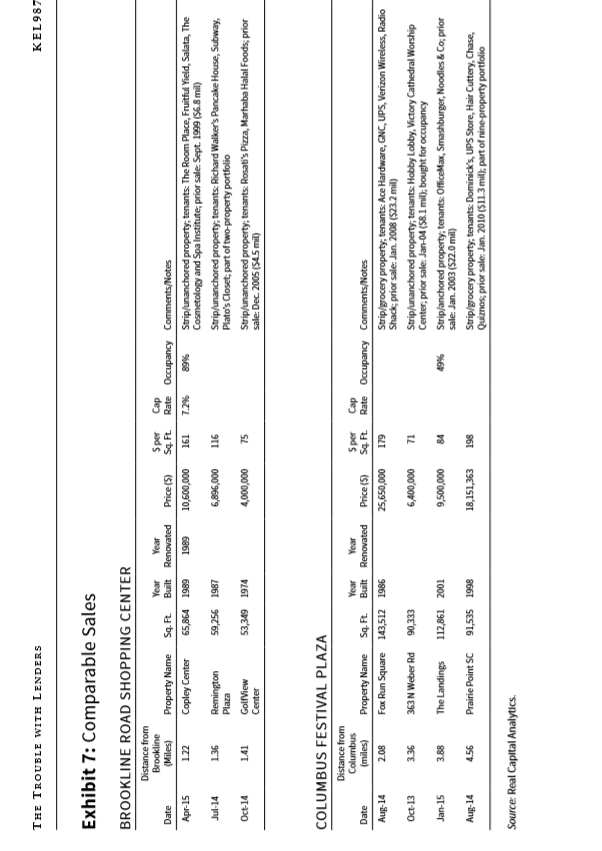

- Estimate each propertys current value by calculating the present discounted value of expected future cash flows. The forward-looking cash flows have been provided for you in the spreadsheet template that accompanies this case. The assumptions underlying those projections are as follows:

- For Brookline:

- Cirano will hold the property another five years.

- Operating expenses beginning in 2016 will grow at a 2.24% annual rate, independent of occupancy.

- The property will require 17% of NOI to be spend on capital expenditures, in addition to any amounts spent on TIs and broker commissions.

- FedEx Ship Center will renew its lease with 75% probability. The lease will run 10 years, require TIs of $12/ft2, have a first year rent of $26.95, and contain a 2.24% annual escalation. Should FedEx not renew, the space will remain vacant for one year before being filled by a tenant who will also lease for 10 years, have a first-year rent of $27.49, and have a 2.24% escalation. The new tenant would require TIs of $35/ft2. Cirano will have to pay a leasing broker $38,000 upon the signing of a new tenant to a 10-year lease. (If FedEx renews its lease, he will not need a broker.) Regardless of tenant, TIs are paid in 2020.

- Tenants under leases will not default during the term of the lease.

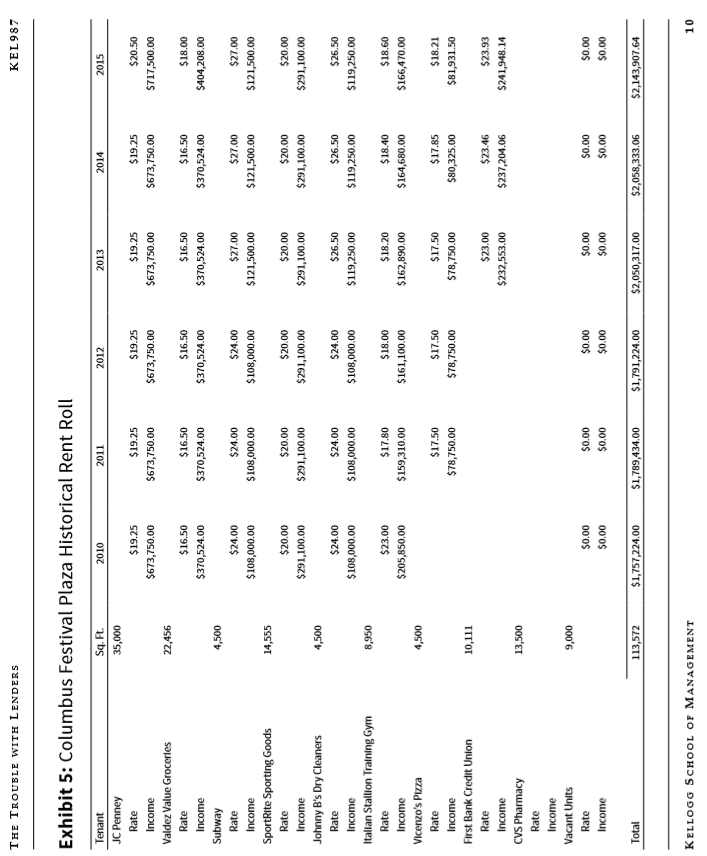

- For Columbus Festival:

- Cirano will hold the property another three years.

- Operating expenses beginning in 2016 will increase by 11% due to the addition of a CVS Pharmacy, but will subsequently grow at a 2.24% annual rate, independent of occupancy.

- The property will require 23% of NOI to be spent on capital expenditures, in addition to any amounts spent on TIs and broker commissions.

- Johnny Bs Dry Cleaners will vacate the property at the end of 2016. That space will remain vacant in 2017, but a new tenant will lease that space for 10 years at $24.50/ft2, with a 1.12% annual escalation. The new tenant will require TIs of $30/ft2. Cirano will have to pay a leasing broker $26,000 upon the signing of this new tenant. TIs and commissions are paid in 2017, but rent collected under the new lease begins in 2018.

- Cirano and the market believes that JC Penney will renew with 90% probability. If it does renew, it will sign another long-term lease beginning at $21.00/ft2, with $0.50 increments every five years. If JC Penney does not renew, Cirano thinks the best option would be to lease the space out to a series of seasonal tenants, which would bring in approximately $350,000/year in rental income. The seasonal tenants would reduce the operating expenses of the property by 4% relative to where they would be with JC Penney. Cirano would incur no TI expense with seasonal tenants, but would have to pay a leasing broker $15,000/year to help in acquiring such tenants. He would be unable to find another true anchor for the space during the next several years.

- Currently vacant space will remain vacant.

- Tenants under leases will not default during the term of the lease.

- For Brookline:

-

- To complete your valuation, you will need to make an exit cap and discount rate assumption. For Columbus Festival, assume that the exit cap rate on the property if JC Penney does not renew would be 0.50% higher than if JC Penney does renew. Do not make any other assumptions.

- Calculate the maximum amount Cirano can currently borrow for each debt option, making sure to satisfy the LTV and DSCR constraints. For the Brookline property, all lenders agree on the cash flow forecasts. For the Columbus Festival property, Oakwood values the property assuming that JC Penney will renew. Northwood values the property based on expected cash flow.

- Assuming that Cirano will always borrow the maximum amount, calculate the expected IRR and expected equity multiple to Cirano and to his limited partners under each refinancing offer. How would these metrics change if Cirano sold the properties immediately? Be sure to include all prepayment, yield maintenance, defeasance, and any other fees in your calculations. For your defeasance calculations, assume that the yield curve is flat at 1.5% up to three years maturity. You should calculate these metrics both from inception and from the time of the case.

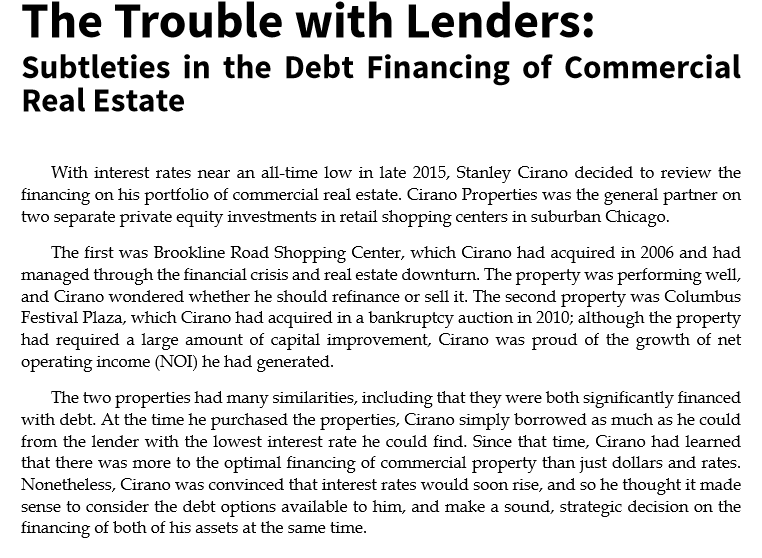

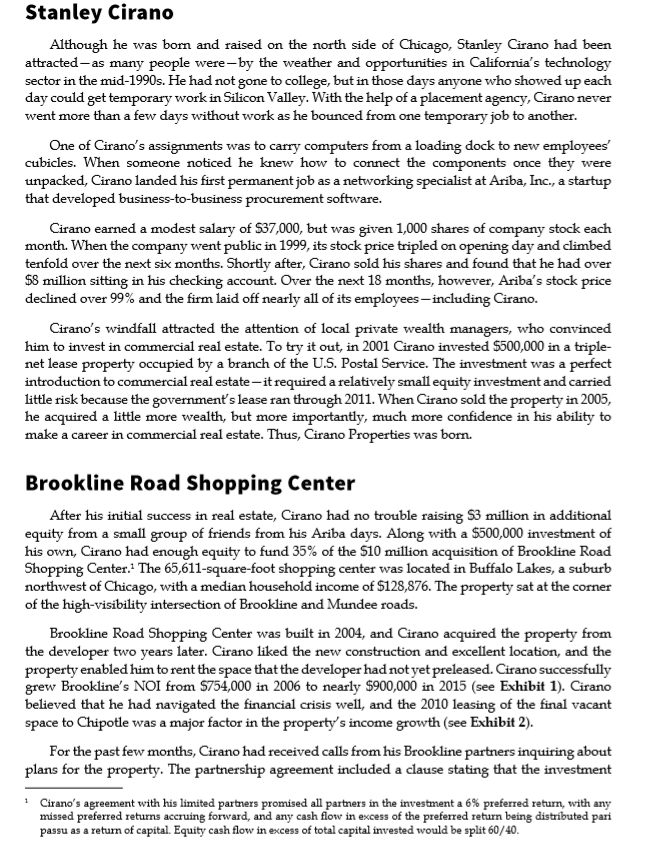

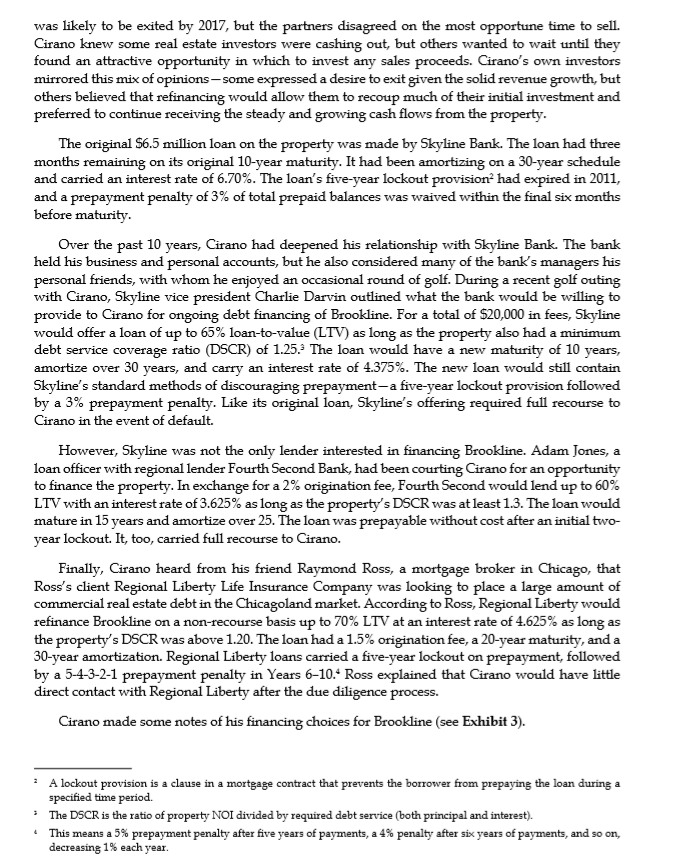

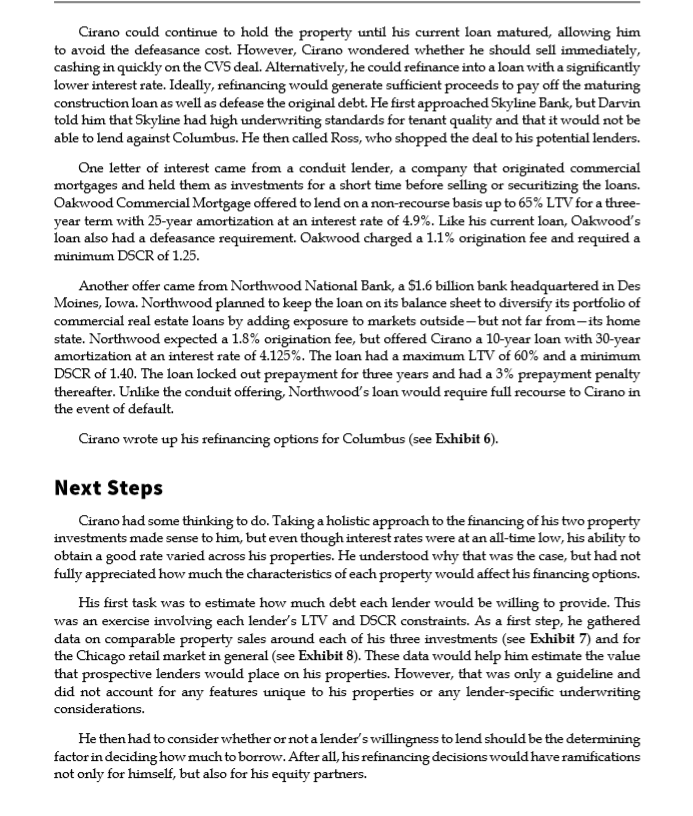

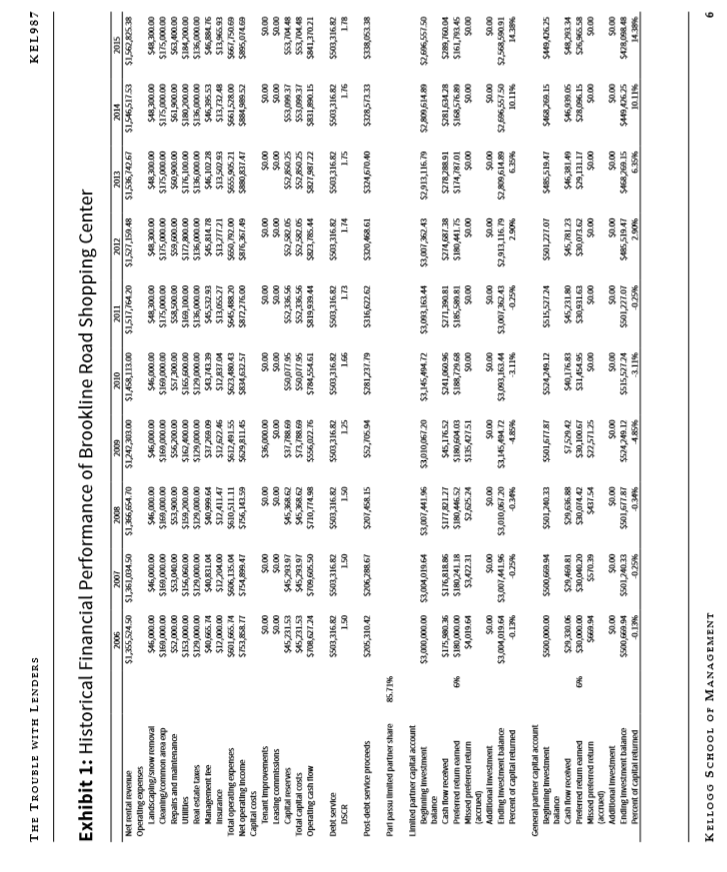

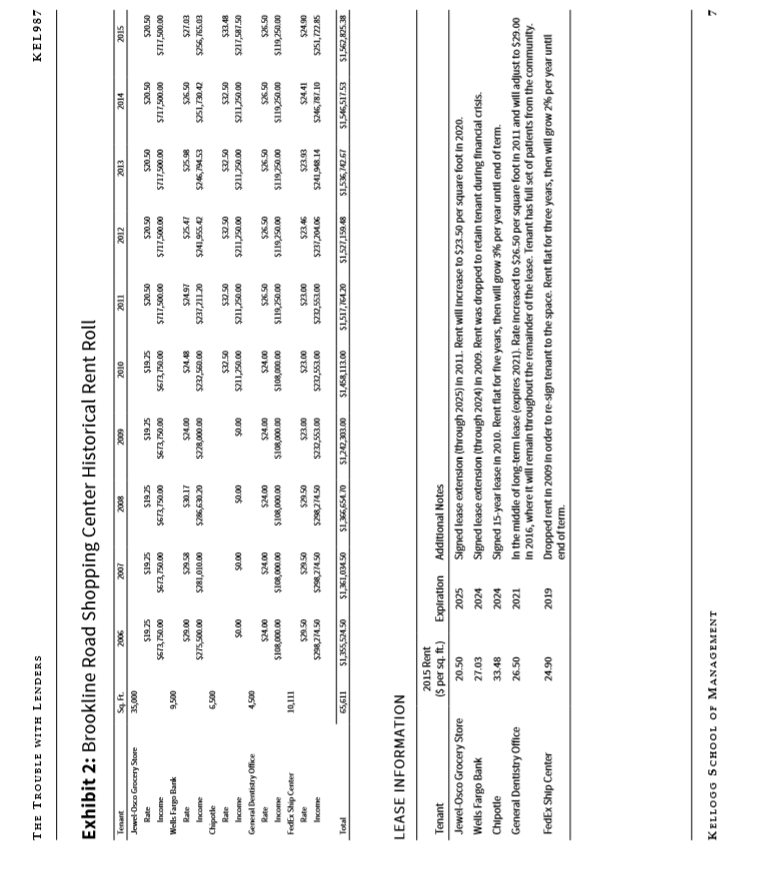

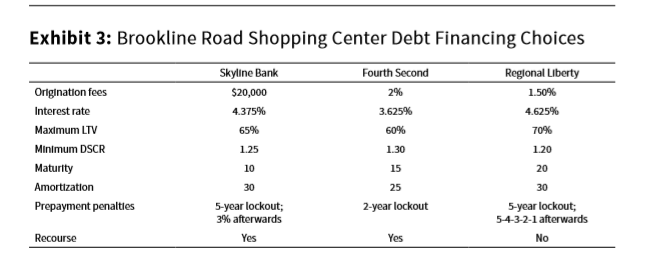

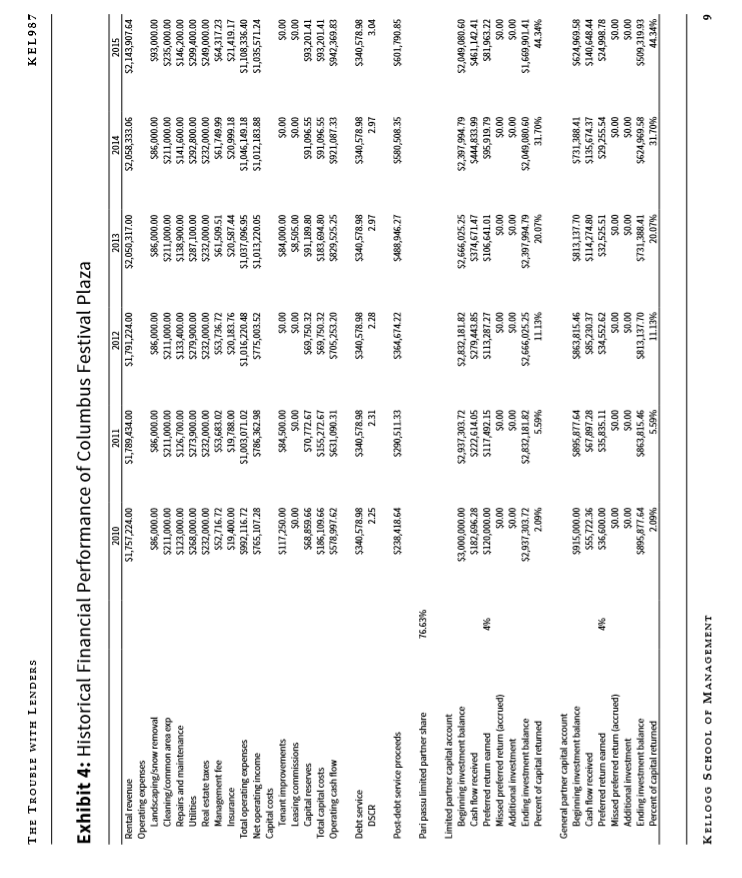

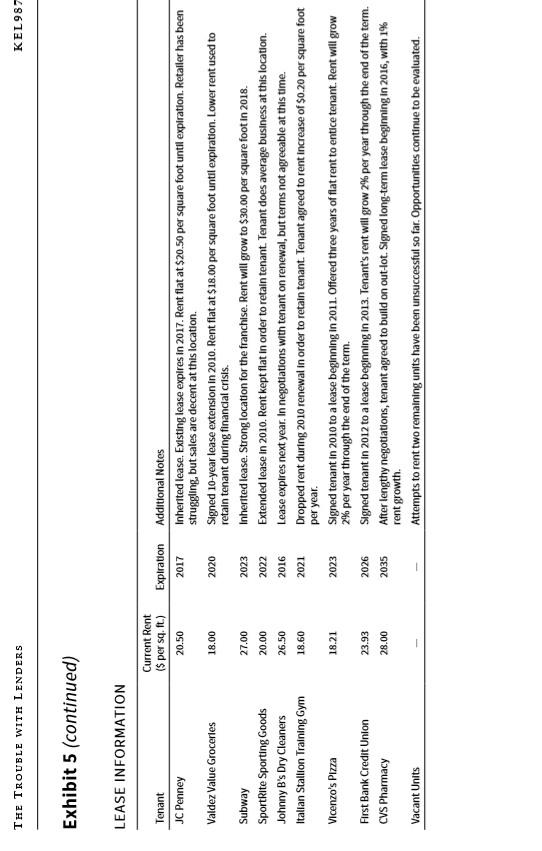

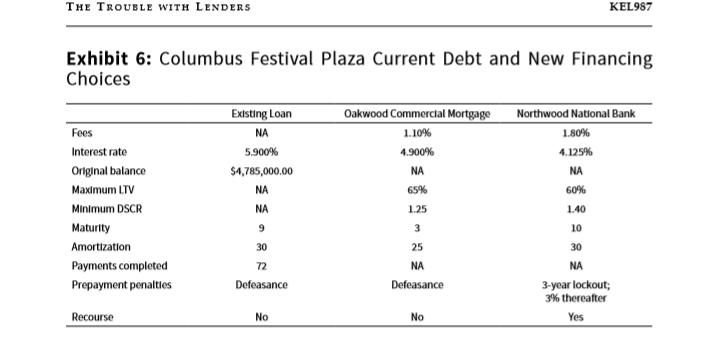

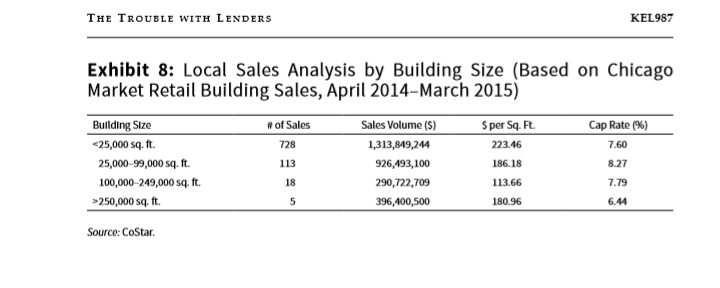

The Trouble with Lenders: Subtleties in the Debt Financing of Commercial Real Estate With interest rates near an all-time low in late 2015, Stanley Cirano decided to review the financing on his portfolio of commercial real estate. Cirano Properties was the general partner on two separate private equity investments in retail shopping centers in suburban Chicago. The first was Brookline Road Shopping Center, which Cirano had acquired in 2006 and had managed through the financial crisis and real estate downturn. The property was performing well, and Cirano wondered whether he should refinance or sell it. The second property was Columbus Festival Plaza, which Cirano had acquired in a bankruptcy auction in 2010; although the property had required a large amount of capital improvement, Cirano was proud of the growth of net operating income (NOI) he had generated. The two properties had many similarities, including that they were both significantly financed with debt. At the time he purchased the properties, Cirano simply borrowed as much as he could from the lender with the lowest interest rate he could find. Since that time, Cirano had learned that there was more to the optimal financing of commercial property than just dollars and rates. Nonetheless, Cirano was convinced that interest rates would soon rise, and so he thought it made sense to consider the debt options available to him, and make a sound, strategic decision on the financing of both of his assets at the same time. Stanley Cirano Although he was born and raised on the north side of Chicago, Stanley Cirano had been attracted -as many people were- by the weather and opportunities in California's technology sector in the mid-1990s. He had not gone to college, but in those days anyone who showed up each day could get temporary work in Silicon Valley. With the help of a placement agency, Cirano never went more than a few days without work as he bounced from one temporary job to another. One of Cirano's assignments was to carry computers from a loading dock to new employees' cubicles. When someone noticed he knew how to connect the components once they were unpacked, Cirano landed his first permanent job as a networking specialist at Ariba, Inc., a startup that developed business-to-business procurement software. Cirano earned a modest salary of $37,000, but was given 1,000 shares of company stock each month. When the company went public in 1999, its stock price tripled on opening day and climbed tenfold over the next six months. Shortly after, Cirano sold his shares and found that he had over $8 million sitting in his checking account. Over the next 18 months, however, Ariba's stock price declined over 99% and the firm laid off nearly all of its employees, including Cirano. Cirano's windfall attracted the attention of local private wealth managers, who convinced him to invest in commercial real estate. To try it out, in 2001 Cirano invested $500,000 in a triple- net lease property occupied by a branch of the U.S. Postal Service. The investment was a perfect introduction to commercial real estate-it required a relatively small equity investment and carried little risk because the government's lease ran through 2011. When Cirano sold the property in 2005, he acquired a little more wealth, but more importantly, much more confidence in his ability to make a career in commercial real estate. Thus, Cirano Properties was born. Brookline Road Shopping Center After his initial success in real estate, Cirano had no trouble raising S3 million in additional equity from a small group of friends from his Ariba days. Along with a $500,000 investment of his own, Cirano had enough equity to fund 35% of the $10 million acquisition of Brookline Road Shopping Center. The 65,611-square-foot shopping center was located in Buffalo Lakes, a suburb northwest of Chicago, with a median household income of $128,876. The property sat at the corner of the high-visibility intersection of Brookline and Mundee roads. Brookline Road Shopping Center was built in 2004, and Cirano acquired the property from the developer two years later. Cirano liked the new construction and excellent location, and the property enabled him to rent the space that the developer had not yet preleased. Cirano successfully grew Brookline's NOI from $754,000 in 2006 to nearly $900,000 in 2015 (see Exhibit 1). Cirano believed that he had navigated the financial crisis well, and the 2010 leasing of the final vacant space to Chipotle was a major factor in the property's income growth (see Exhibit 2). For the past few months, Cirano had received calls from his Brookline partners inquiring about plans for the property. The partnership agreement included a clause stating that the investment Cirano's agreement with his limited partners promised all partners in the investment a 6% preferred return, with any missed preferred returns accruing forward, and any cash flow in excess of the preferred return being distributed pari passu as a return of capital. Equity cash flow in excess of total capital invested would be split 60/40 was likely to be exited by 2017, but the partners disagreed on the most opportune time to sell. Cirano knew some real estate investors were cashing out, but others wanted to wait until they found an attractive opportunity in which to invest any sales proceeds. Cirano's own investors mirrored this mix of opinions-some expressed a desire to exit given the solid revenue growth, but others believed that refinancing would allow them to recoup much of their initial investment and preferred to continue receiving the steady and growing cash flows from the property. The original 56.5 million loan on the property was made by Skyline Bank. The loan had three months remaining on its original 10-year maturity. It had been amortizing on a 30-year schedule and carried an interest rate of 6.70%. The loan's five-year lockout provision had expired in 2011, and a prepayment penalty of 3% of total prepaid balances was waived within the final six months before maturity. Over the past 10 years, Cirano had deepened his relationship with Skyline Bank. The bank held his business and personal accounts, but he also considered many of the bank's managers his personal friends, with whom he enjoyed an occasional round of golf. During a recent golf outing with Cirano, Skyline vice president Charlie Darvin outlined what the bank would be willing to provide to Cirano for ongoing debt financing of Brookline. For a total of $20,000 in fees, Skyline would offer a loan of up to 65% loan-to-value (LTV) as long as the property also had a minimum debt service coverage ratio (DSCR) of 1.25. The loan would have a new maturity of 10 years, amortize over 30 years, and carry an interest rate of 4.375%. The new loan would still contain Skyline's standard methods of discouraging prepayment-a five-year lockout provision followed by a 3% prepayment penalty. Like its original loan, Skyline's offering required full recourse to Cirano in the event of default. However, Skyline was not the only lender interested in financing Brookline. Adam Jones, a loan officer with regional lender Fourth Second Bank, had been courting Cirano for an opportunity to finance the property. In exchange for a 2% origination fee, Fourth Second would lend up to 60% LTV with an interest rate of 3.625% as long as the property's DSCR was at least 1.3. The loan would mature in 15 years and amortize over 25. The loan was prepayable without cost after an initial two- year lockout. It too, carried full recourse to Cirano. Finally, Cirano heard from his friend Raymond Ross, a mortgage broker in Chicago, that Ross's client Regional Liberty Life Insurance Company was looking to place a large amount of commercial real estate debt in the Chicagoland market. According to Ross, Regional Liberty would refinance Brookline on a non-recourse basis up to 70% LTV at an interest rate of 4.625% as long as the property's DSCR was above 1.20. The loan had a 1.5% origination fee, a 20-year maturity, and a 30-year amortization. Regional Liberty loans carried a five-year lockout on prepayment, followed by a 5-4-3-2-1 prepayment penalty in Years 6-10. Ross explained that Cirano would have little direct contact with Regional Liberty after the due diligence process. Cirano made some notes of his financing choices for Brookline (see Exhibit 3). 3 A lockout provision is a clause in a mortgage contract that prevents the borrower from prepaying the loan during a specified time period. The DSCR is the ratio of property NOI divided by required debt service (both principal and interest). This means a 5% prepayment penalty after five years of payments, a 4% penalty after six years of payments, and so on, decreasing 1% each year. Cirano could continue to hold the property until his current loan matured, allowing him to avoid the defeasance cost. However, Cirano wondered whether he should sell immediately, cashing in quickly on the CVS deal. Alternatively, he could refinance into a loan with a significantly lower interest rate. Ideally, refinancing would generate sufficient proceeds to pay off the maturing construction loan as well as defease the original debt. He first approached Skyline Bank, but Darvin told him that Skyline had high underwriting standards for tenant quality and that it would not be able to lend against Columbus. He then called Ross, who shopped the deal to his potential lenders. One letter of interest came from a conduit lender, a company that originated commercial mortgages and held them as investments for a short time before selling or securitizing the loans. Oakwood Commercial Mortgage offered to lend on a non-recourse basis up to 65% LTV for a three- year term with 25-year amortization at an interest rate of 4.9%. Like his current loan, Oakwood's loan also had a defeasance requirement. Oakwood charged a 1.1% origination fee and required a minimum DSCR of 1.25. Another offer came from Northwood National Bank, a $1.6 billion bank headquartered in Des Moines, Iowa. Northwood planned to keep the loan on its balance sheet to diversify its portfolio of commercial real estate loans by adding exposure to markets outside - but not far from-its home state. Northwood expected a 1.8% origination fee, but offered Cirano a 10-year loan with 30-year amortization at an interest rate of 4.125%. The loan had a maximum LTV of 60% and a minimum DSCR of 1.40. The loan locked out prepayment for three years and had a 3% prepayment penalty thereafter. Unlike the conduit offering, Northwood's loan would require full recourse to Cirano in the event of default Cirano wrote up his refinancing options for Columbus (see Exhibit 6). Next Steps Cirano had some thinking to do. Taking a holistic approach to the financing of his two property investments made sense to him, but even though interest rates were at an all-time low, his ability to obtain a good rate varied across his properties. He understood why that was the case, but had not fully appreciated how much the characteristics of each property would affect his financing options. His first task was to estimate how much debt each lender would be willing to provide. This was an exercise involving each lender's LTV and DSCR constraints. As a first step, he gathered data on comparable property sales around each of his three investments (see Exhibit 7) and for the Chicago retail market in general (see Exhibit 8). These data would help him estimate the value that prospective lenders would place on his properties. However, that was only a guideline and did not account for any features unique to his properties or any lender-specific underwriting considerations. He then had to consider whether or not a lender's willingness to lend should be the determining factor in deciding how much to borrow. After all, his refinancing decisions would have ramifications not only for himself, but also for his equity partners. THE TROUBLE WITH LENDERS KEL987 Exhibit 1: Historical Financial Performance of Brookline Road Shopping Center 2005 2001 $1,355,524.50 $1,361,034.50 2008 $1,366,654.70 2009 $1,242,303.00 2010 $1,458,113.00 2011 $1,517,764.20 2012 $1,527,158.48 2013 $1,536,74267 2014 $1,546,51753 2015 $1,562,825.38 Net rental revenue Operating expenses Landscaping/snow removal Cleaning common area exp Repairs and maintenance Utilities Real estate taxes Management tee Insurance Total operating expenses Net operating Income Capital costs Tenant Improvements Leasing commissions Capital reserves Total capital costs Operating cash flow $46,000.00 $169,000.00 $52,000.00 $153,000.00 $129,000.00 $40,665.74 $12,000.00 $501,666.74 $753,858.77 $46,000.00 $169,000.00 $52,040.00 $156,060.00 $129,000.00 $40,83104 $12,204.00 $606,135.04 $754,899.47 $46,000.00 $169,000.00 $53,900.00 $159,200.00 $129,000.00 $40,999.64 $12,411.47 $610,511.11 $756,142.59 $46,000.00 $169,000.00 $56,200.00 $162.400.00 $129,000.00 $37,269.09 $12,922.46 $612.491.55 $429,811.45 546,000.00 $169,000.00 $57,200.00 $165,500.00 $129,000.00 543,743.39 $12.837.04 $623.480.43 $834,622.57 $48,300.00 $175,000.00 $58,500.00 SIG,100.00 $135,000.00 $65,532.93 $13,065.27 5645,488.20 $872,276.00 $48,300.00 $175,000.00 $59,600.00 $172800.00 $135,000.00 $45,814.78 $13,277.21 $650,792.00 $876,357.49 $48,300.00 $175,000.00 $60,900.00 $176,100.00 $135,000.00 $46,102.28 $13,502.93 $655,905.21 $880,831 A1 $48,300.00 $175,000.00 $61,900.00 $180,200.00 $135,000.00 $46,39553 $13,732.48 $661,528.00 $881,98952 548,300.00 $175,000.00 $63,400,00 $184,200.00 $136,000.00 $46,884.76 $13.96593 $667,750.69 $895,074.69 $0.00 $0.00 $45,231.53 $45.231.53 $708.01.24 $503,316.2 1.50 $205,310.42 $0.00 $0.00 $45,293.97 $45,293.97 $709,605.50 $0.00 $0.00 $45,368.62 $15,358.62 $710,774.98 $36,000.00 $0.00 $37,78869 $73,788.69 $556,022.76 $0.00 $0.00 $50,07795 $50,077.95 $784,554.61 $0.00 $0.00 $52,336,56 $52,336,56 $819,939.44 $503,316.82 $0.00 $0.00 $52,582.05 $52,582.05 $223,785.44 $0.00 $0.00 $52850.25 $52.850.25 $827,987.22 $503,316.82 175 $0.00 $0.00 $53,099.37 $53,099.37 $631,890.15 $0.00 $0.00 $53,704.48 $53,70148 $841,370.21 Debit service DSCR $503,316.82 1.50 $503,316.82 1.50 $503,316,82 125 $503,316,82 1.66 $503,316.82 1.74 $503,31682 1.75 $503,316,82 178 ELT $206.288.67 $201.58.15 $52,705.91 $281.237.19 $316,672,62 $120,468.61 $324670.40 $328,573.33 $338,053.38 $2,313,116.79 Post debt service proceeds Pati passu limited partner share Limited partner capital account Beginning investment balance Cash flow received Preferred retum eamed Missed preferred return (accrued) Additional Investment Ending Investment balance Percent of capital returned $3,000,000,00 $3,004,019.64 $3,007 M1.56 $3,010,067.20 $3,145,494.12 $3,003,163.44 $3,007,3243 $175,980.36 $176,818.86 $177,221.27 $45,176.52 $241,060.96 $271,290.81 $274,687 38 $180,000.00 $180,241.18 $180,446.52 $180,504.03 $188,729.58 $185,589.81 $180 M1.75 51,019.64 $3,422.31 $2,925.24 $135,42751 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $3,004,019.64 $3,001.11.96 $3,010,067.20 $3,145,491.22 $3,093,163.4 $3,001,392.43 $2,913,116.19 -0.13% -0.25% $278,288,91 $174,787.01 $0.00 $2,300,614.89 $2,696,557.50 $281,634.28 $289,760.04 $168,576.89 $161.793.45 $0.00 $0.00 $0.00 $2.809,614.89 $0.00 $2,696,55750 10.11% $0.00 $2,568,590.91 General partner capital account Beginning investment balance Cash flow received Preferred return earned Missed preferred return (accrue) Additional Investment Ending Investment balance Percent of capital returned $500,000.00 $29,330,06 $30,000.00 S669.94 $500,662.90 $29,461.81 $30,000.20 $570.39 $501,240.23 $29,636.88 $30,074.2 $137.54 $501,677.87 $7,529.42 $30,100.67 $22.57125 $0.00 $524,249.12 $520209.12 $40,176.83 $31,454.95 $0.00 $515,521.24 $45.23.80 $30,931.03 $0.00 $901.227.01 S45,781.33 $20,013.02 $0.00 S485,519.41 $46,38149 $29,131.17 $0.00 $168.26.15 $46,339.05 $28,096.15 $0.00 $149,426.25 SAR,283.34 $26,96558 $0.00 $0.00 $500,66.94 0.1.3 $0.00 $501,240.33 0.256 $0.00 $501,677.87 $0.00 $S15,527.24 3.11% 50.00 $501,227.07 $0.00 SA85,519.47 2.50% 50.00 $168.76.15 $0.00 $149,426.25 10.11% $0.00 S428,098.48 KELLOOO SCHOOL OF MANAGEMENT THE TROUBLE WITH LENDERS KEL987 Exhibit 2: Brookline Road Shopping Center Historical Rent Roll 2006 2007 2008 2010 2011 2012 2013 2014 2015 Sq. Ft. 35,000 $19.25 $672,750.00 $19.25 $673,750,00 $19.25 $673,750.00 $19.25 5673,750.00 $19.75 $673,750.00 $20.50 $717,500.00 $20.50 $717,500.00 $20.50 $717,500.00 $20.50 $717,500.00 $20.50 $717,500.00 Tenant Jewel-Osco Grocery Store Rate income Wells Fargo Bank Rate Income Chipotle Rate $29.00 $275,500.00 $29.58 $281.010.00 $30.17 $286,63020 $24.00 $278,000.00 $24.48 $230,560.00 $24.97 $237,211.20 $25.98 $24,194.33 $241,955.42 $27.03 $256,765.03 $251,720.42 50.00 $0.00 $0.00 $0.00 $22.50 $211,250.00 $32.50 $211,250.00 $32.50 $211,250.00 $32.50 $211,250.00 $33.48 $217,587.50 $211,250.00 $24.00 $108,000.00 $24.00 $100,000.00 $24.00 $100,000.00 $24.00 $108,000.00 $24.00 $10,000.00 $26.50 $119,250.00 $26.50 $119,250.00 $26.50 $119.250.00 $26.50 $119,250.00 General Dentistry Office Rate Income FedEx Ship Center Rate Income $119,250,00 10,111 $29.50 $23.00 $236.27.50 $298.21.50 $298.276.50 $23.00 $200,553.00 $220,552.00 $23.00 $209,553.00 $23.46 $231,204.06 $1,521,159.68 $23.93 $241.96.14 $24.90 $251. m2.85 $24.41 $246,787.10 Total GS 611 $1,355,524.50 $1,361,034.50 $1,366,654.70 $1,20,300.00 $1,458,113.00 $1,517,76420 $1,536,702.61 $1,546,517.53 $1,562,825.38 2024 LEASE INFORMATION 2015 Rent Tenant (s per sq. ft.) Explration Additional Notes Jewel-Osco Grocery Store 20.50 2025 Signed lease extension (through 2025) In 2011. Rent will increase to $23.50 per square foot in 2020. Wells Fargo Bank 27.03 Signed lease extension (through 2024) In 2009. Rent was dropped to retain tenant during financial crisis. Chipotle 33.48 2024 Signed 15-year lease in 2010. Rent flat for five years, then will grow 3% per year until end of term. General Dentistry Office 26.50 2021 In the middle of long-term lease (expires 2021). Rate Increased to $26.50 per square foot in 2011 and will adjust to $29.00 In 2016, where it will remain throughout the remainder of the lease. Tenant has full set of patients from the community. FedEx Ship Center 2019 Dropped rent in 2009 in order to re-sign tenant to the space. Rent flat for three years, then will grow 2% per year until end of term. 24.90 KELLOGG SCHOOL OF MANAGEMENT 65% Exhibit 3: Brookline Road Shopping Center Debt Financing Choices Skyline Bank Fourth Second Regional Liberty Origination fees $20,000 2% 1.50% Interest rate 4.375% 3.625% 4.625% Maximum LTV 60% 70% Minimum DSCR 1.30 Maturity 10 15 20 Amortization 30 Prepayment penalties 5-year lockout; 2-year lockout 5-year lockout 3% afterwards 5-4-3-2-1 afterwards Recourse Yes No 1.25 1.20 30 25 Yes THE TROUBLE WITH LENDERS KEL 987 Exhibit 4: Historical Financial Performance of Columbus Festival Plaza 2010 $1,757,224.00 2011 2012 $1,791,224.00 $1,789,434.00 2013 $2,050,317.00 2014 $2,058,333.06 2015 $2,143,907.64 Rental revenue Operating expenses Landscaping/snow removal Cleaning/common area exp Repairs and maintenance Utilities Real estate taxes Management fee Insurance Total operating expenses Net operating income Capital costs Tenant improvements Leasing commissions Capital reserves Total capital costs Operating cash flow $86,000.00 $211,000.00 $133,400.00 $279,900.00 $232,000.00 $53,736.72 $20,183.76 $1,016,220.48 $775,003.52 $86,000.00 $211,000.00 $141,600.00 $292,800.00 $232,000.00 $61,749.99 $20,999.18 $1,046,149.18 $1,012,183.88 $86,000.00 $211,000.00 $123,000.00 $268,000.00 $232,000.00 $52,716.72 $19,400.00 $992, 116.72 $765,107.28 $117,250.00 $0.00 $68,859.66 $186,109.66 $578,997.62 $340,578.98 2.25 $238,418.64 $86,000.00 $211,000.00 $138,900.00 $287,100.00 $232,000.00 $61,509.51 $20,587.44 $1,037,096.95 $1,013,220.05 $84,000.00 $8,505.00 $91,189.80 $183,694.80 $829,525.25 $340,578,98 2.97 $93,000.00 $235,000.00 $146,200.00 $299,400.00 $249,000.00 $64,317.23 $21,419.17 $1,108,336.40 $1,035,571.24 $86,000.00 $211,000.00 $126,700.00 $273,900.00 $232,000.00 $53,683.02 $19,788.00 $1,003,071.02 $786,362.98 $84,500.00 $0.00 $70,772.67 $155,272.67 $631,090.31 $340,578.98 2.31 $290,511.33 $0.00 $0.00 $69,750.32 $69,750.32 $705,253.20 $340,578,98 2.28 $0.00 $0.00 $91,096.55 $91,096.55 $921,087.33 $340,578.98 2.97 $0.00 $0.00 593,201.41 $93,20141 $942,369.83 $340,578.98 3.04 Debt service DSCR $364,674.22 5488,946.27 $580,508.35 $601,790.85 76.63% 4% Post debt service proceeds Pari passu limited partner share Limited partner capital account Beginning investment balance Cash flow received Preferred return earned Missed preferred return (accrued) Additional investment Ending investment balance Percent of capital returned General partner capital account Beginning investment balance Cash flow received Preferred return earned Missed preferred return (accrued) Additional investment Ending investment balance Percent of capital returned $3,000,000.00 $182,696.28 $120,000.00 $0.00 $0.00 $2,937,303.72 2.09% $2,937,303.72 $222,614.05 $117,492.15 $0.00 $0.00 $2,832,181.82 5.59% $2,832,181.82 $279,443.85 $113,287.27 $0.00 $0.00 $2,666,025.25 11.13% $2,666,025.25 $374,671.47 $106,641.01 50.00 $0.00 $2,397,994.79 20.07% $2,397,994.79 $444,833.99 $95,919.79 $0.00 $0.00 $2,049,080.60 31.70% $2,049,080.60 $461,142.41 $81,963.22 $0.00 $0.00 $1,669,90141 44.34% 4% $915,000.00 $55,722.36 $36,600.00 $0.00 $0.00 $895,877.64 2.09% $895,877.64 $67,897.28 $35,835.11 $0.00 $0.00 $863,815.46 5.59% $863,815.46 $85,230.37 $34,552.62 $0.00 $0.00 $813,137.70 11.13% $813,137.70 $114,274.80 $32,525.51 $0.00 $0.00 $731,388.41 20.07% $731,388,41 $135,674.37 $29,255.54 $0.00 $0.00 $624,969.58 31.70% $624,969.58 $140,648.44 $24,998.78 $0.00 $0.00 $509,319.93 44.34% KELLOOO SCHOOL OF MANAGEMENT 9 THE TROUBLE WITH LENDERS KEL987 Exhibit 5: Columbus Festival Plaza Historical Rent Roll 2010 2011 2012 2013 2014 Sq. Ft. 35,000 2015 $19.25 $673,750.00 $19.25 $673,750.00 $19.25 $673,750.00 $19.25 $673,750.00 $19.25 $673,750.00 $20.50 $717,500.00 22,456 $16.50 $370,524.00 $16.50 $370,524.00 $16.50 $370,524.00 $16.50 $370,524.00 $16.50 $370,524.00 $18.00 $404,208.00 4,500 $24.00 $108,000.00 $24.00 $108,000.00 $24.00 $108,000.00 $27.00 $121,500.00 $27.00 $121,500.00 $27.00 $121,500.00 14,555 $20.00 $291,100.00 $20.00 $291,100.00 $20.00 $291,100.00 $20.00 $291,100.00 $20.00 $291,100.00 $20.00 $291,100.00 Tenant JC Penney Rate Income Valdez Value Groceries Rate Income Subway Rate Income SportRite Sporting Goods Rate Income Johnny B's Dry Cleaners Rate Income Italian Stallion Training Gym Rate Income Vicenzo's Pizza Rate Income First Bank Credit Union Rate Income CVS Pharmacy 4,500 $24.00 $108,000.00 $24.00 $108,000.00 $24.00 $108,000.00 $26.50 $119,250.00 $26.50 $119,250.00 $26.50 $119,250.00 8,950 $23.00 $205,850.00 $17.80 $159,310.00 $18.00 $161,100.00 $18.20 $18.40 $164,680.00 $162,890.00 $18.60 $166,470.00 4,500 $17.50 $78,750.00 $17.50 $78,750.00 $17.50 $78,750.00 $17.85 $80,325.00 $18.21 $81,931.50 10,111 $23.00 $232,553.00 $23.46 $237,204.06 $23.93 $241,948.14 13,500 Rate Income Vacant Units Rate Income 9,000 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Total 113,572 $1,757,224.00 $1,789,434.00 $1,791,224.00 $2,050,317.00 $2,058,333.06 $2,143,907.64 KELLOGG SCHOOL OF MANAGEMENT 10 THE TROUBLE WITH LENDERS KEL987 Exhibit 5 (continued) LEASE INFORMATION Tenant Current Rent ($ per sq. ft.) 20.50 JC Penney 2017 Valdez Value Groceries 18.00 27.00 2023 Subway SportRite Sporting Goods Johnny B's Dry Cleaners Italian Stallion Training Gym 20.00 26.50 Explration Additional Notes Inherited lease. Existing lease expires in 2017. Rent flat at $20.50 per square foot until expiration. Retailer has been struggling, but sales are decent at this location. 2020 Signed 10-year lease extension in 2010. Rent flat at $18.00 per square foot until expiration. Lower rent used to retain tenant during financial crisis. Inherited lease. Strong location for the franchise. Rent will grow to $30.00 per square foot in 2018. 2022 Extended lease in 2010. Rent kept flat in order to retain tenant. Tenant does average business at this location. 2016 Lease expires next year. In negotiations with tenant on renewal, butterms not agreeable at this time. 2021 Dropped rent during 2010 renewal in order to retain tenant. Tenant agreed to rent increase of $0.20 per square foot per year. 2023 Signed tenant in 2010 to a lease beginning in 2011. Offered three years of flat rent to entice tenant. Rent will grow 2% per year through the end of the term. 2026 Signed tenant in 2012 to a lease beginning in 2013. Tenant's rent will grow 2% per year through the end of the term. After lengthy negotiations, tenant agreed to build on out-lot. Signed long-term lease beginning in 2016, with 1% rent growth Attempts to rent two remaining units have been unsuccessful so far. Opportunities continue to be evaluated. 18.60 Vicenzo's Pizza 18.21 23.93 First Bank Credit Union CVS Pharmacy 28.00 2035 Vacant Units THE TROUBLE WITH LENDERS KEL987 Exhibit 6: Columbus Festival Plaza Current Debt and New Financing Choices Existing Loan NA 5.900% $4,785,000.00 NA Oakwood Commercial Mortgage 1.10% 4.900% NA 65% Northwood National Bank 1.80% 4.125% NA 60% Fees Interest rate Original balance Maximum LTV Minimum DSCR Maturity Amortization Payments completed Prepayment penalties NA 1.25 1.40 9 10 30 3 25 NA Defeasance 72 Defeasance 30 NA 3-year lockout; 3% thereafter Yes Recourse No No THE TROUBLE WITH LENDERS KEL 987 Exhibit 7: Comparable Sales BROOKLINE ROAD SHOPPING CENTER Distance from Brookline Year Year Date (Miles) Property Name Sq. Ft. Built Renovated Apr-15 1.22 Copley Center 65,864 1989 1989 Price (5) 10,600,000 Sper Sq. Ft 161 Jul-14 Cap Rate Occupancy Comments/Notes 7.2% 89% Strip/unanchored property, tenants: The Room Place, Fruitful Yield, Salata, The Cosmetology and Spa Institute, prior sale: Sept. 1999 (56.8 mil) Strip/unanchored property, tenants: Richard Walker's Pancake House, Subway, Plato's Closet, part of two-property portfolio Strip/unanchored property, tenants: Rosati's Pizza, Marhaba Halal Foods, prior sale: Dec. 2005 (54.5 mil 1.36 Remington Plaza 59,256 1987 6,896,000 116 Oct-14 141 Golf View Center 53,349 1974 4,000,000 75 COLUMBUS FESTIVAL PLAZA Distance from Columbus Year Year Date (miles) Property Name Sq.Ft Built Renovated Aug-14 2.08 Fox Run Square 143,512 1986 Sper Cap Sq. Ft. Price (5) 25,650,000 179 Oct-13 3.36 363 N Weber Rd 90,333 6,400,000 71 Rate Occupancy Comments/Notes Strip/grocery property; tenants: Ace Hardware, GNC, UPS, Verizon Wireless, Radio Shack, prior sale: Jan. 2008 (523.2 mil) Strip/unanchored property, tenants: Hobby Lobby, Victory Cathedral Worship Center, prior sale: Jan-04 (58.1 mil); bought for occupancy 49% Striplanchored property, tenants OfficeMax Smashburger, Noodles & Co; prior sale: Jan. 2003 (522.0 mil Strip/grocery property, tenants: Dominick's, UPS Store, Hair Cuttery, Chase, Quiznos, prior sale: Jan. 2010 (511.3 mil); part of nine property portfolio Jan-15 3.88 The Landings 112,861 2001 9,500,000 84 Aug-14 4.56 Prairie Point SC 91,535 1998 18,151,363 198 Source: Real Capital Analytics THE TROUBLE WITH LENDERS KEL987 Exhibit 8: Local Sales Analysis by Building Size (Based on Chicago Market Retail Building Sales, April 2014-March 2015) Building Size #of Sales Sales Volume (5) Sper Sq. Ft. Cap Rate(%) 250,000 sq.ft 396,400,500 113 186.18 8.27 18 113.66 7.79 5 180.96 6.44 Source: CoStar. The Trouble with Lenders: Subtleties in the Debt Financing of Commercial Real Estate With interest rates near an all-time low in late 2015, Stanley Cirano decided to review the financing on his portfolio of commercial real estate. Cirano Properties was the general partner on two separate private equity investments in retail shopping centers in suburban Chicago. The first was Brookline Road Shopping Center, which Cirano had acquired in 2006 and had managed through the financial crisis and real estate downturn. The property was performing well, and Cirano wondered whether he should refinance or sell it. The second property was Columbus Festival Plaza, which Cirano had acquired in a bankruptcy auction in 2010; although the property had required a large amount of capital improvement, Cirano was proud of the growth of net operating income (NOI) he had generated. The two properties had many similarities, including that they were both significantly financed with debt. At the time he purchased the properties, Cirano simply borrowed as much as he could from the lender with the lowest interest rate he could find. Since that time, Cirano had learned that there was more to the optimal financing of commercial property than just dollars and rates. Nonetheless, Cirano was convinced that interest rates would soon rise, and so he thought it made sense to consider the debt options available to him, and make a sound, strategic decision on the financing of both of his assets at the same time. Stanley Cirano Although he was born and raised on the north side of Chicago, Stanley Cirano had been attracted -as many people were- by the weather and opportunities in California's technology sector in the mid-1990s. He had not gone to college, but in those days anyone who showed up each day could get temporary work in Silicon Valley. With the help of a placement agency, Cirano never went more than a few days without work as he bounced from one temporary job to another. One of Cirano's assignments was to carry computers from a loading dock to new employees' cubicles. When someone noticed he knew how to connect the components once they were unpacked, Cirano landed his first permanent job as a networking specialist at Ariba, Inc., a startup that developed business-to-business procurement software. Cirano earned a modest salary of $37,000, but was given 1,000 shares of company stock each month. When the company went public in 1999, its stock price tripled on opening day and climbed tenfold over the next six months. Shortly after, Cirano sold his shares and found that he had over $8 million sitting in his checking account. Over the next 18 months, however, Ariba's stock price declined over 99% and the firm laid off nearly all of its employees, including Cirano. Cirano's windfall attracted the attention of local private wealth managers, who convinced him to invest in commercial real estate. To try it out, in 2001 Cirano invested $500,000 in a triple- net lease property occupied by a branch of the U.S. Postal Service. The investment was a perfect introduction to commercial real estate-it required a relatively small equity investment and carried little risk because the government's lease ran through 2011. When Cirano sold the property in 2005, he acquired a little more wealth, but more importantly, much more confidence in his ability to make a career in commercial real estate. Thus, Cirano Properties was born. Brookline Road Shopping Center After his initial success in real estate, Cirano had no trouble raising S3 million in additional equity from a small group of friends from his Ariba days. Along with a $500,000 investment of his own, Cirano had enough equity to fund 35% of the $10 million acquisition of Brookline Road Shopping Center. The 65,611-square-foot shopping center was located in Buffalo Lakes, a suburb northwest of Chicago, with a median household income of $128,876. The property sat at the corner of the high-visibility intersection of Brookline and Mundee roads. Brookline Road Shopping Center was built in 2004, and Cirano acquired the property from the developer two years later. Cirano liked the new construction and excellent location, and the property enabled him to rent the space that the developer had not yet preleased. Cirano successfully grew Brookline's NOI from $754,000 in 2006 to nearly $900,000 in 2015 (see Exhibit 1). Cirano believed that he had navigated the financial crisis well, and the 2010 leasing of the final vacant space to Chipotle was a major factor in the property's income growth (see Exhibit 2). For the past few months, Cirano had received calls from his Brookline partners inquiring about plans for the property. The partnership agreement included a clause stating that the investment Cirano's agreement with his limited partners promised all partners in the investment a 6% preferred return, with any missed preferred returns accruing forward, and any cash flow in excess of the preferred return being distributed pari passu as a return of capital. Equity cash flow in excess of total capital invested would be split 60/40 was likely to be exited by 2017, but the partners disagreed on the most opportune time to sell. Cirano knew some real estate investors were cashing out, but others wanted to wait until they found an attractive opportunity in which to invest any sales proceeds. Cirano's own investors mirrored this mix of opinions-some expressed a desire to exit given the solid revenue growth, but others believed that refinancing would allow them to recoup much of their initial investment and preferred to continue receiving the steady and growing cash flows from the property. The original 56.5 million loan on the property was made by Skyline Bank. The loan had three months remaining on its original 10-year maturity. It had been amortizing on a 30-year schedule and carried an interest rate of 6.70%. The loan's five-year lockout provision had expired in 2011, and a prepayment penalty of 3% of total prepaid balances was waived within the final six months before maturity. Over the past 10 years, Cirano had deepened his relationship with Skyline Bank. The bank held his business and personal accounts, but he also considered many of the bank's managers his personal friends, with whom he enjoyed an occasional round of golf. During a recent golf outing with Cirano, Skyline vice president Charlie Darvin outlined what the bank would be willing to provide to Cirano for ongoing debt financing of Brookline. For a total of $20,000 in fees, Skyline would offer a loan of up to 65% loan-to-value (LTV) as long as the property also had a minimum debt service coverage ratio (DSCR) of 1.25. The loan would have a new maturity of 10 years, amortize over 30 years, and carry an interest rate of 4.375%. The new loan would still contain Skyline's standard methods of discouraging prepayment-a five-year lockout provision followed by a 3% prepayment penalty. Like its original loan, Skyline's offering required full recourse to Cirano in the event of default. However, Skyline was not the only lender interested in financing Brookline. Adam Jones, a loan officer with regional lender Fourth Second Bank, had been courting Cirano for an opportunity to finance the property. In exchange for a 2% origination fee, Fourth Second would lend up to 60% LTV with an interest rate of 3.625% as long as the property's DSCR was at least 1.3. The loan would mature in 15 years and amortize over 25. The loan was prepayable without cost after an initial two- year lockout. It too, carried full recourse to Cirano. Finally, Cirano heard from his friend Raymond Ross, a mortgage broker in Chicago, that Ross's client Regional Liberty Life Insurance Company was looking to place a large amount of commercial real estate debt in the Chicagoland market. According to Ross, Regional Liberty would refinance Brookline on a non-recourse basis up to 70% LTV at an interest rate of 4.625% as long as the property's DSCR was above 1.20. The loan had a 1.5% origination fee, a 20-year maturity, and a 30-year amortization. Regional Liberty loans carried a five-year lockout on prepayment, followed by a 5-4-3-2-1 prepayment penalty in Years 6-10. Ross explained that Cirano would have little direct contact with Regional Liberty after the due diligence process. Cirano made some notes of his financing choices for Brookline (see Exhibit 3). 3 A lockout provision is a clause in a mortgage contract that prevents the borrower from prepaying the loan during a specified time period. The DSCR is the ratio of property NOI divided by required debt service (both principal and interest). This means a 5% prepayment penalty after five years of payments, a 4% penalty after six years of payments, and so on, decreasing 1% each year. Cirano could continue to hold the property until his current loan matured, allowing him to avoid the defeasance cost. However, Cirano wondered whether he should sell immediately, cashing in quickly on the CVS deal. Alternatively, he could refinance into a loan with a significantly lower interest rate. Ideally, refinancing would generate sufficient proceeds to pay off the maturing construction loan as well as defease the original debt. He first approached Skyline Bank, but Darvin told him that Skyline had high underwriting standards for tenant quality and that it would not be able to lend against Columbus. He then called Ross, who shopped the deal to his potential lenders. One letter of interest came from a conduit lender, a company that originated commercial mortgages and held them as investments for a short time before selling or securitizing the loans. Oakwood Commercial Mortgage offered to lend on a non-recourse basis up to 65% LTV for a three- year term with 25-year amortization at an interest rate of 4.9%. Like his current loan, Oakwood's loan also had a defeasance requirement. Oakwood charged a 1.1% origination fee and required a minimum DSCR of 1.25. Another offer came from Northwood National Bank, a $1.6 billion bank headquartered in Des Moines, Iowa. Northwood planned to keep the loan on its balance sheet to diversify its portfolio of commercial real estate loans by adding exposure to markets outside - but not far from-its home state. Northwood expected a 1.8% origination fee, but offered Cirano a 10-year loan with 30-year amortization at an interest rate of 4.125%. The loan had a maximum LTV of 60% and a minimum DSCR of 1.40. The loan locked out prepayment for three years and had a 3% prepayment penalty thereafter. Unlike the conduit offering, Northwood's loan would require full recourse to Cirano in the event of default Cirano wrote up his refinancing options for Columbus (see Exhibit 6). Next Steps Cirano had some thinking to do. Taking a holistic approach to the financing of his two property investments made sense to him, but even though interest rates were at an all-time low, his ability to obtain a good rate varied across his properties. He understood why that was the case, but had not fully appreciated how much the characteristics of each property would affect his financing options. His first task was to estimate how much debt each lender would be willing to provide. This was an exercise involving each lender's LTV and DSCR constraints. As a first step, he gathered data on comparable property sales around each of his three investments (see Exhibit 7) and for the Chicago retail market in general (see Exhibit 8). These data would help him estimate the value that prospective lenders would place on his properties. However, that was only a guideline and did not account for any features unique to his properties or any lender-specific underwriting considerations. He then had to consider whether or not a lender's willingness to lend should be the determining factor in deciding how much to borrow. After all, his refinancing decisions would have ramifications not only for himself, but also for his equity partners. THE TROUBLE WITH LENDERS KEL987 Exhibit 1: Historical Financial Performance of Brookline Road Shopping Center 2005 2001 $1,355,524.50 $1,361,034.50 2008 $1,366,654.70 2009 $1,242,303.00 2010 $1,458,113.00 2011 $1,517,764.20 2012 $1,527,158.48 2013 $1,536,74267 2014 $1,546,51753 2015 $1,562,825.38 Net rental revenue Operating expenses Landscaping/snow removal Cleaning common area exp Repairs and maintenance Utilities Real estate taxes Management tee Insurance Total operating expenses Net operating Income Capital costs Tenant Improvements Leasing commissions Capital reserves Total capital costs Operating cash flow $46,000.00 $169,000.00 $52,000.00 $153,000.00 $129,000.00 $40,665.74 $12,000.00 $501,666.74 $753,858.77 $46,000.00 $169,000.00 $52,040.00 $156,060.00 $129,000.00 $40,83104 $12,204.00 $606,135.04 $754,899.47 $46,000.00 $169,000.00 $53,900.00 $159,200.00 $129,000.00 $40,999.64 $12,411.47 $610,511.11 $756,142.59 $46,000.00 $169,000.00 $56,200.00 $162.400.00 $129,000.00 $37,269.09 $12,922.46 $612.491.55 $429,811.45 546,000.00 $169,000.00 $57,200.00 $165,500.00 $129,000.00 543,743.39 $12.837.04 $623.480.43 $834,622.57 $48,300.00 $175,000.00 $58,500.00 SIG,100.00 $135,000.00 $65,532.93 $13,065.27 5645,488.20 $872,276.00 $48,300.00 $175,000.00 $59,600.00 $172800.00 $135,000.00 $45,814.78 $13,277.21 $650,792.00 $876,357.49 $48,300.00 $175,000.00 $60,900.00 $176,100.00 $135,000.00 $46,102.28 $13,502.93 $655,905.21 $880,831 A1 $48,300.00 $175,000.00 $61,900.00 $180,200.00 $135,000.00 $46,39553 $13,732.48 $661,528.00 $881,98952 548,300.00 $175,000.00 $63,400,00 $184,200.00 $136,000.00 $46,884.76 $13.96593 $667,750.69 $895,074.69 $0.00 $0.00 $45,231.53 $45.231.53 $708.01.24 $503,316.2 1.50 $205,310.42 $0.00 $0.00 $45,293.97 $45,293.97 $709,605.50 $0.00 $0.00 $45,368.62 $15,358.62 $710,774.98 $36,000.00 $0.00 $37,78869 $73,788.69 $556,022.76 $0.00 $0.00 $50,07795 $50,077.95 $784,554.61 $0.00 $0.00 $52,336,56 $52,336,56 $819,939.44 $503,316.82 $0.00 $0.00 $52,582.05 $52,582.05 $223,785.44 $0.00 $0.00 $52850.25 $52.850.25 $827,987.22 $503,316.82 175 $0.00 $0.00 $53,099.37 $53,099.37 $631,890.15 $0.00 $0.00 $53,704.48 $53,70148 $841,370.21 Debit service DSCR $503,316.82 1.50 $503,316.82 1.50 $503,316,82 125 $503,316,82 1.66 $503,316.82 1.74 $503,31682 1.75 $503,316,82 178 ELT $206.288.67 $201.58.15 $52,705.91 $281.237.19 $316,672,62 $120,468.61 $324670.40 $328,573.33 $338,053.38 $2,313,116.79 Post debt service proceeds Pati passu limited partner share Limited partner capital account Beginning investment balance Cash flow received Preferred retum eamed Missed preferred return (accrued) Additional Investment Ending Investment balance Percent of capital returned $3,000,000,00 $3,004,019.64 $3,007 M1.56 $3,010,067.20 $3,145,494.12 $3,003,163.44 $3,007,3243 $175,980.36 $176,818.86 $177,221.27 $45,176.52 $241,060.96 $271,290.81 $274,687 38 $180,000.00 $180,241.18 $180,446.52 $180,504.03 $188,729.58 $185,589.81 $180 M1.75 51,019.64 $3,422.31 $2,925.24 $135,42751 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $3,004,019.64 $3,001.11.96 $3,010,067.20 $3,145,491.22 $3,093,163.4 $3,001,392.43 $2,913,116.19 -0.13% -0.25% $278,288,91 $174,787.01 $0.00 $2,300,614.89 $2,696,557.50 $281,634.28 $289,760.04 $168,576.89 $161.793.45 $0.00 $0.00 $0.00 $2.809,614.89 $0.00 $2,696,55750 10.11% $0.00 $2,568,590.91 General partner capital account Beginning investment balance Cash flow received Preferred return earned Missed preferred return (accrue) Additional Investment Ending Investment balance Percent of capital returned $500,000.00 $29,330,06 $30,000.00 S669.94 $500,662.90 $29,461.81 $30,000.20 $570.39 $501,240.23 $29,636.88 $30,074.2 $137.54 $501,677.87 $7,529.42 $30,100.67 $22.57125 $0.00 $524,249.12 $520209.12 $40,176.83 $31,454.95 $0.00 $515,521.24 $45.23.80 $30,931.03 $0.00 $901.227.01 S45,781.33 $20,013.02 $0.00 S485,519.41 $46,38149 $29,131.17 $0.00 $168.26.15 $46,339.05 $28,096.15 $0.00 $149,426.25 SAR,283.34 $26,96558 $0.00 $0.00 $500,66.94 0.1.3 $0.00 $501,240.33 0.256 $0.00 $501,677.87 $0.00 $S15,527.24 3.11% 50.00 $501,227.07 $0.00 SA85,519.47 2.50% 50.00 $168.76.15 $0.00 $149,426.25 10.11% $0.00 S428,098.48 KELLOOO SCHOOL OF MANAGEMENT THE TROUBLE WITH LENDERS KEL987 Exhibit 2: Brookline Road Shopping Center Historical Rent Roll 2006 2007 2008 2010 2011 2012 2013 2014 2015 Sq. Ft. 35,000 $19.25 $672,750.00 $19.25 $673,750,00 $19.25 $673,750.00 $19.25 5673,750.00 $19.75 $673,750.00 $20.50 $717,500.00 $20.50 $717,500.00 $20.50 $717,500.00 $20.50 $717,500.00 $20.50 $717,500.00 Tenant Jewel-Osco Grocery Store Rate income Wells Fargo Bank Rate Income Chipotle Rate $29.00 $275,500.00 $29.58 $281.010.00 $30.17 $286,63020 $24.00 $278,000.00 $24.48 $230,560.00 $24.97 $237,211.20 $25.98 $24,194.33 $241,955.42 $27.03 $256,765.03 $251,720.42 50.00 $0.00 $0.00 $0.00 $22.50 $211,250.00 $32.50 $211,250.00 $32.50 $211,250.00 $32.50 $211,250.00 $33.48 $217,587.50 $211,250.00 $24.00 $108,000.00 $24.00 $100,000.00 $24.00 $100,000.00 $24.00 $108,000.00 $24.00 $10,000.00 $26.50 $119,250.00 $26.50 $119,250.00 $26.50 $119.250.00 $26.50 $119,250.00 General Dentistry Office Rate Income FedEx Ship Center Rate Income $119,250,00 10,111 $29.50 $23.00 $236.27.50 $298.21.50 $298.276.50 $23.00 $200,553.00 $220,552.00 $23.00 $209,553.00 $23.46 $231,204.06 $1,521,159.68 $23.93 $241.96.14 $24.90 $251. m2.85 $24.41 $246,787.10 Total GS 611 $1,355,524.50 $1,361,034.50 $1,366,654.70 $1,20,300.00 $1,458,113.00 $1,517,76420 $1,536,702.61 $1,546,517.53 $1,562,825.38 2024 LEASE INFORMATION 2015 Rent Tenant (s per sq. ft.) Explration Additional Notes Jewel-Osco Grocery Store 20.50 2025 Signed lease extension (through 2025) In 2011. Rent will increase to $23.50 per square foot in 2020. Wells Fargo Bank 27.03 Signed lease extension (through 2024) In 2009. Rent was dropped to retain tenant during financial crisis. Chipotle 33.48 2024 Signed 15-year lease in 2010. Rent flat for five years, then will grow 3% per year until end of term. General Dentistry Office 26.50 2021 In the middle of long-term lease (expires 2021). Rate Increased to $26.50 per square foot in 2011 and will adjust to $29.00 In 2016, where it will remain throughout the remainder of the lease. Tenant has full set of patients from the community. FedEx Ship Center 2019 Dropped rent in 2009 in order to re-sign tenant to the space. Rent flat for three years, then will grow 2% per year until end of term. 24.90 KELLOGG SCHOOL OF MANAGEMENT 65% Exhibit 3: Brookline Road Shopping Center Debt Financing Choices Skyline Bank Fourth Second Regional Liberty Origination fees $20,000 2% 1.50% Interest rate 4.375% 3.625% 4.625% Maximum LTV 60% 70% Minimum DSCR 1.30 Maturity 10 15 20 Amortization 30 Prepayment penalties 5-year lockout; 2-year lockout 5-year lockout 3% afterwards 5-4-3-2-1 afterwards Recourse Yes No 1.25 1.20 30 25 Yes THE TROUBLE WITH LENDERS KEL 987 Exhibit 4: Historical Financial Performance of Columbus Festival Plaza 2010 $1,757,224.00 2011 2012 $1,791,224.00 $1,789,434.00 2013 $2,050,317.00 2014 $2,058,333.06 2015 $2,143,907.64 Rental revenue Operating expenses Landscaping/snow removal Cleaning/common area exp Repairs and maintenance Utilities Real estate taxes Management fee Insurance Total operating expenses Net operating income Capital costs Tenant improvements Leasing commissions Capital reserves Total capital costs Operating cash flow $86,000.00 $211,000.00 $133,400.00 $279,900.00 $232,000.00 $53,736.72 $20,183.76 $1,016,220.48 $775,003.52 $86,000.00 $211,000.00 $141,600.00 $292,800.00 $232,000.00 $61,749.99 $20,999.18 $1,046,149.18 $1,012,183.88 $86,000.00 $211,000.00 $123,000.00 $268,000.00 $232,000.00 $52,716.72 $19,400.00 $992, 116.72 $765,107.28 $117,250.00 $0.00 $68,859.66 $186,109.66 $578,997.62 $340,578.98 2.25 $238,418.64 $86,000.00 $211,000.00 $138,900.00 $287,100.00 $232,000.00 $61,509.51 $20,587.44 $1,037,096.95 $1,013,220.05 $84,000.00 $8,505.00 $91,189.80 $183,694.80 $829,525.25 $340,578,98 2.97 $93,000.00 $235,000.00 $146,200.00 $299,400.00 $249,000.00 $64,317.23 $21,419.17 $1,108,336.40 $1,035,571.24 $86,000.00 $211,000.00 $126,700.00 $273,900.00 $232,000.00 $53,683.02 $19,788.00 $1,003,071.02 $786,362.98 $84,500.00 $0.00 $70,772.67 $155,272.67 $631,090.31 $340,578.98 2.31 $290,511.33 $0.00 $0.00 $69,750.32 $69,750.32 $705,253.20 $340,578,98 2.28 $0.00 $0.00 $91,096.55 $91,096.55 $921,087.33 $340,578.98 2.97 $0.00 $0.00 593,201.41 $93,20141 $942,369.83 $340,578.98 3.04 Debt service DSCR $364,674.22 5488,946.27 $580,508.35 $601,790.85 76.63% 4% Post debt service proceeds Pari passu limited partner share Limited partner capital account Beginning investment balance Cash flow received Preferred return earned Missed preferred return (accrued) Additional investment Ending investment balance Percent of capital returned General partner capital account Beginning investment balance Cash flow received Preferred return earned Missed preferred return (accrued) Additional investment Ending investment balance Percent of capital returned $3,000,000.00 $182,696.28 $120,000.00 $0.00 $0.00 $2,937,303.72 2.09% $2,937,303.72 $222,614.05 $117,492.15 $0.00 $0.00 $2,832,181.82 5.59% $2,832,181.82 $279,443.85 $113,287.27 $0.00 $0.00 $2,666,025.25 11.13% $2,666,025.25 $374,671.47 $106,641.01 50.00 $0.00 $2,397,994.79 20.07% $2,397,994.79 $444,833.99 $95,919.79 $0.00 $0.00 $2,049,080.60 31.70% $2,049,080.60 $461,142.41 $81,963.22 $0.00 $0.00 $1,669,90141 44.34% 4% $915,000.00 $55,722.36 $36,600.00 $0.00 $0.00 $895,877.64 2.09% $895,877.64 $67,897.28 $35,835.11 $0.00 $0.00 $863,815.46 5.59% $863,815.46 $85,230.37 $34,552.62 $0.00 $0.00 $813,137.70 11.13% $813,137.70 $114,274.80 $32,525.51 $0.00 $0.00 $731,388.41 20.07% $731,388,41 $135,674.37 $29,255.54 $0.00 $0.00 $624,969.58 31.70% $624,969.58 $140,648.44 $24,998.78 $0.00 $0.00 $509,319.93 44.34% KELLOOO SCHOOL OF MANAGEMENT 9 THE TROUBLE WITH LENDERS KEL987 Exhibit 5: Columbus Festival Plaza Historical Rent Roll 2010 2011 2012 2013 2014 Sq. Ft. 35,000 2015 $19.25 $673,750.00 $19.25 $673,750.00 $19.25 $673,750.00 $19.25 $673,750.00 $19.25 $673,750.00 $20.50 $717,500.00 22,456 $16.50 $370,524.00 $16.50 $370,524.00 $16.50 $370,524.00 $16.50 $370,524.00 $16.50 $370,524.00 $18.00 $404,208.00 4,500 $24.00 $108,000.00 $24.00 $108,000.00 $24.00 $108,000.00 $27.00 $121,500.00 $27.00 $121,500.00 $27.00 $121,500.00 14,555 $20.00 $291,100.00 $20.00 $291,100.00 $20.00 $291,100.00 $20.00 $291,100.00 $20.00 $291,100.00 $20.00 $291,100.00 Tenant JC Penney Rate Income Valdez Value Groceries Rate Income Subway Rate Income SportRite Sporting Goods Rate Income Johnny B's Dry Cleaners Rate Income Italian Stallion Training Gym Rate Income Vicenzo's Pizza Rate Income First Bank Credit Union Rate Income CVS Pharmacy 4,500 $24.00 $108,000.00 $24.00 $108,000.00 $24.00 $108,000.00 $26.50 $119,250.00 $26.50 $119,250.00 $26.50 $119,250.00 8,950 $23.00 $205,850.00 $17.80 $159,310.00 $18.00 $161,100.00 $18.20 $18.40 $164,680.00 $162,890.00 $18.60 $166,470.00 4,500 $17.50 $78,750.00 $17.50 $78,750.00 $17.50 $78,750.00 $17.85 $80,325.00 $18.21 $81,931.50 10,111 $23.00 $232,553.00 $23.46 $237,204.06 $23.93 $241,948.14 13,500 Rate Income Vacant Units Rate Income 9,000 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Total 113,572 $1,757,224.00 $1,789,434.00 $1,791,224.00 $2,050,317.00 $2,058,333.06 $2,143,907.64 KELLOGG SCHOOL OF MANAGEMENT 10 THE TROUBLE WITH LENDERS KEL987 Exhibit 5 (continued) LEASE INFORMATION Tenant Current Rent ($ per sq. ft.) 20.50 JC Penney 2017 Valdez Value Groceries 18.00 27.00 2023 Subway SportRite Sporting Goods Johnny B's Dry Cleaners Italian Stallion Training Gym 20.00 26.50 Explration Additional Notes Inherited lease. Existing lease expires in 2017. Rent flat at $20.50 per square foot until expiration. Retailer has been struggling, but sales are decent at this location. 2020 Signed 10-year lease extension in 2010. Rent flat at $18.00 per square foot until expiration. Lower rent used to retain tenant during financial crisis. Inherited lease. Strong location for the franchise. Rent will grow to $30.00 per square foot in 2018. 2022 Extended lease in 2010. Rent kept flat in order to retain tenant. Tenant does average business at this location. 2016 Lease expires next year. In negotiations with tenant on renewal, butterms not agreeable at this time. 2021 Dropped rent during 2010 renewal in order to retain tenant. Tenant agreed to rent increase of $0.20 per square foot per year. 2023 Signed tenant in 2010 to a lease beginning in 2011. Offered three years of flat rent to entice tenant. Rent will grow 2% per year through the end of the term. 2026 Signed tenant in 2012 to a lease beginning in 2013. Tenant's rent will grow 2% per year through the end of the term. After lengthy negotiations, tenant agreed to build on out-lot. Signed long-term lease beginning in 2016, with 1% rent growth Attempts to rent two remaining units have been unsuccessful so far. Opportunities continue to be evaluated. 18.60 Vicenzo's Pizza 18.21 23.93 First Bank Credit Union CVS Pharmacy 28.00 2035 Vacant Units THE TROUBLE WITH LENDERS KEL987 Exhibit 6: Columbus Festival Plaza Current Debt and New Financing Choices Existing Loan NA 5.900% $4,785,000.00 NA Oakwood Commercial Mortgage 1.10% 4.900% NA 65% Northwood National Bank 1.80% 4.125% NA 60% Fees Interest rate Original balance Maximum LTV Minimum DSCR Maturity Amortization Payments completed Prepayment penalties NA 1.25 1.40 9 10 30 3 25 NA Defeasance 72 Defeasance 30 NA 3-year lockout; 3% thereafter Yes Recourse No No THE TROUBLE WITH LENDERS KEL 987 Exhibit 7: Comparable Sales BROOKLINE ROAD SHOPPING CENTER Distance from Brookline Year Year Date (Miles) Property Name Sq. Ft. Built Renovated Apr-15 1.22 Copley Center 65,864 1989 1989 Price (5) 10,600,000 Sper Sq. Ft 161 Jul-14 Cap Rate Occupancy Comments/Notes 7.2% 89% Strip/unanchored property, tenants: The Room Place, Fruitful Yield, Salata, The Cosmetology and Spa Institute, prior sale: Sept. 1999 (56.8 mil) Strip/unanchored property, tenants: Richard Walker's Pancake House, Subway, Plato's Closet, part of two-property portfolio Strip/unanchored property, tenants: Rosati's Pizza, Marhaba Halal Foods, prior sale: Dec. 2005 (54.5 mil 1.36 Remington Plaza 59,256 1987 6,896,000 116 Oct-14 141 Golf View Center 53,349 1974 4,000,000 75 COLUMBUS FESTIVAL PLAZA Distance from Columbus Year Year Date (miles) Property Name Sq.Ft Built Renovated Aug-14 2.08 Fox Run Square 143,512 1986 Sper Cap Sq. Ft. Price (5) 25,650,000 179 Oct-13 3.36 363 N Weber Rd 90,333 6,400,000 71 Rate Occupancy Comments/Notes Strip/grocery property; tenants: Ace Hardware, GNC, UPS, Verizon Wireless, Radio Shack, prior sale: Jan. 2008 (523.2 mil) Strip/unanchored property, tenants: Hobby Lobby, Victory Cathedral Worship Center, prior sale: Jan-04 (58.1 mil); bought for occupancy 49% Striplanchored property, tenants OfficeMax Smashburger, Noodles & Co; prior sale: Jan. 2003 (522.0 mil Strip/grocery property, tenants: Dominick's, UPS Store, Hair Cuttery, Chase, Quiznos, prior sale: Jan. 2010 (511.3 mil); part of nine property portfolio Jan-15 3.88 The Landings 112,861 2001 9,500,000 84 Aug-14 4.56 Prairie Point SC 91,535 1998 18,151,363 198 Source: Real Capital Analytics THE TROUBLE WITH LENDERS KEL987 Exhibit 8: Local Sales Analysis by Building Size (Based on Chicago Market Retail Building Sales, April 2014-March 2015) Building Size #of Sales Sales Volume (5) Sper Sq. Ft. Cap Rate(%) 250,000 sq.ft 396,400,500 113 186.18 8.27 18 113.66 7.79 5 180.96 6.44 Source: CoStar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts