Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quantitative Option Prepare Pro Forma 1996 and 1997 Financial Statements and conduct breakeven analysis to assess (1) breakeven $ sales, (2) whether CL could breakeven

Quantitative Option

Prepare Pro Forma 1996 and 1997 Financial Statements and conduct breakeven analysis to assess (1) breakeven $ sales, (2) whether CL could breakeven in 1996 or 1997.

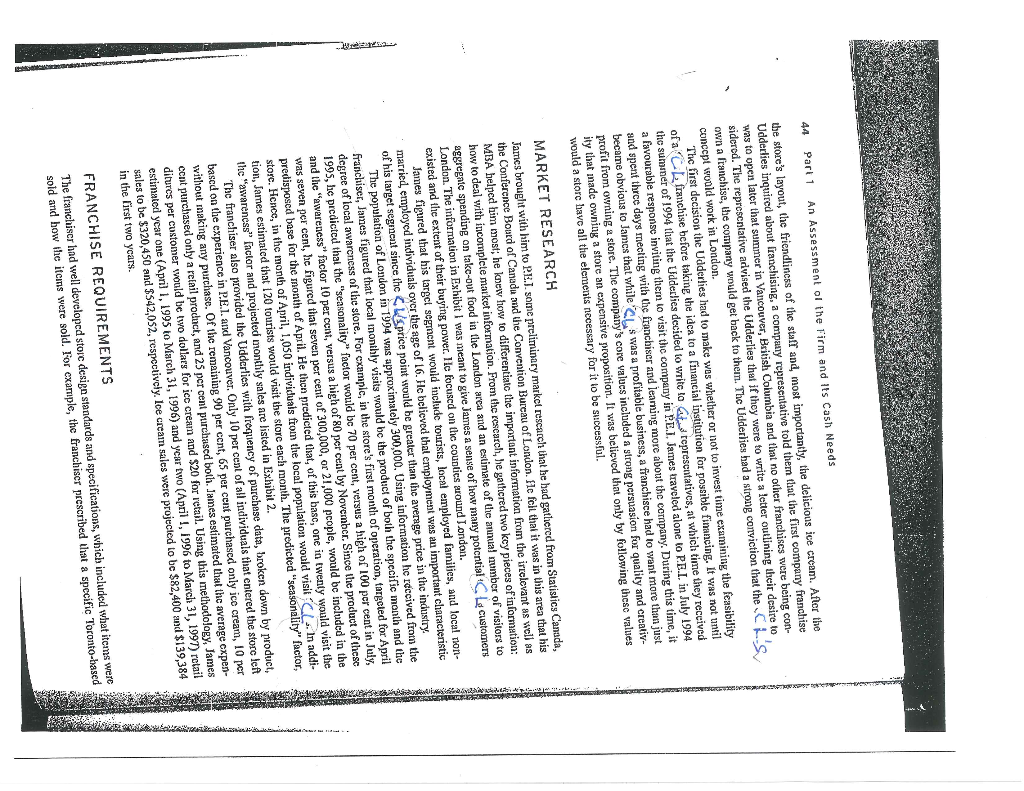

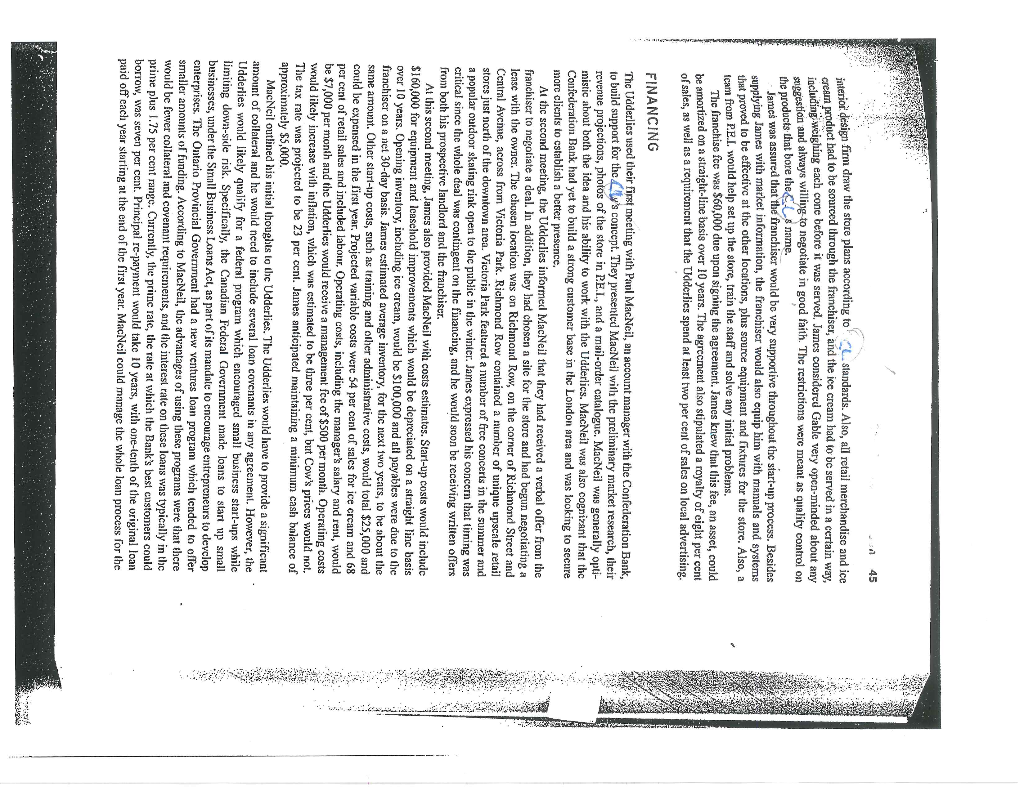

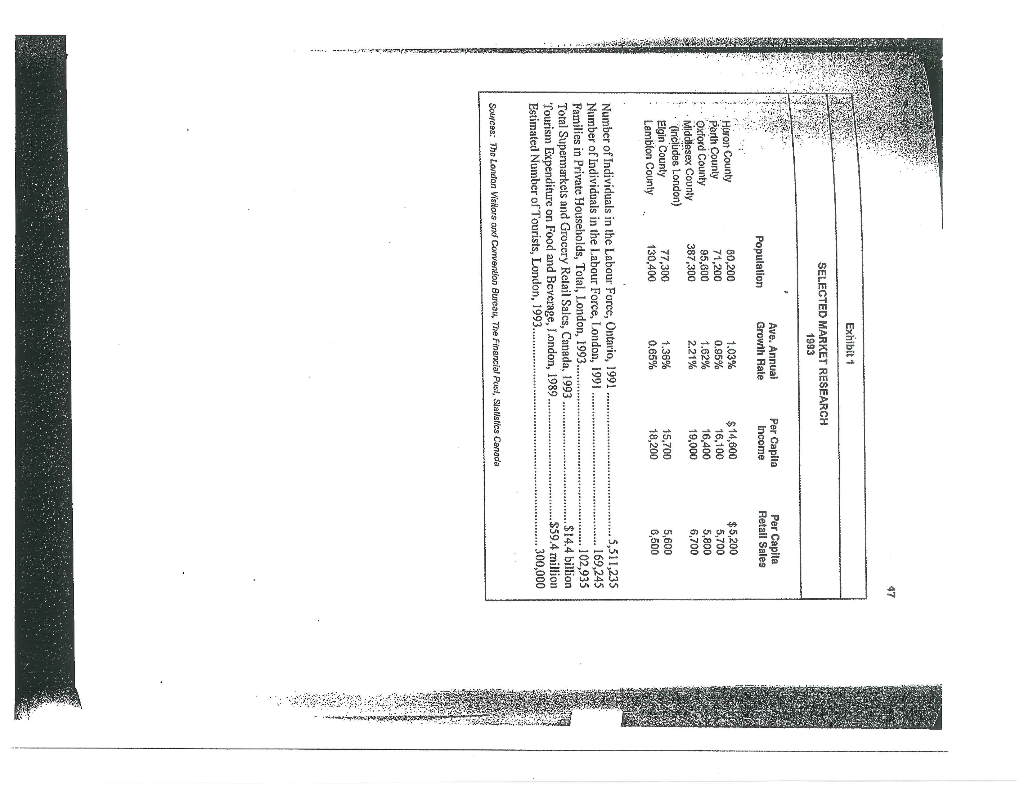

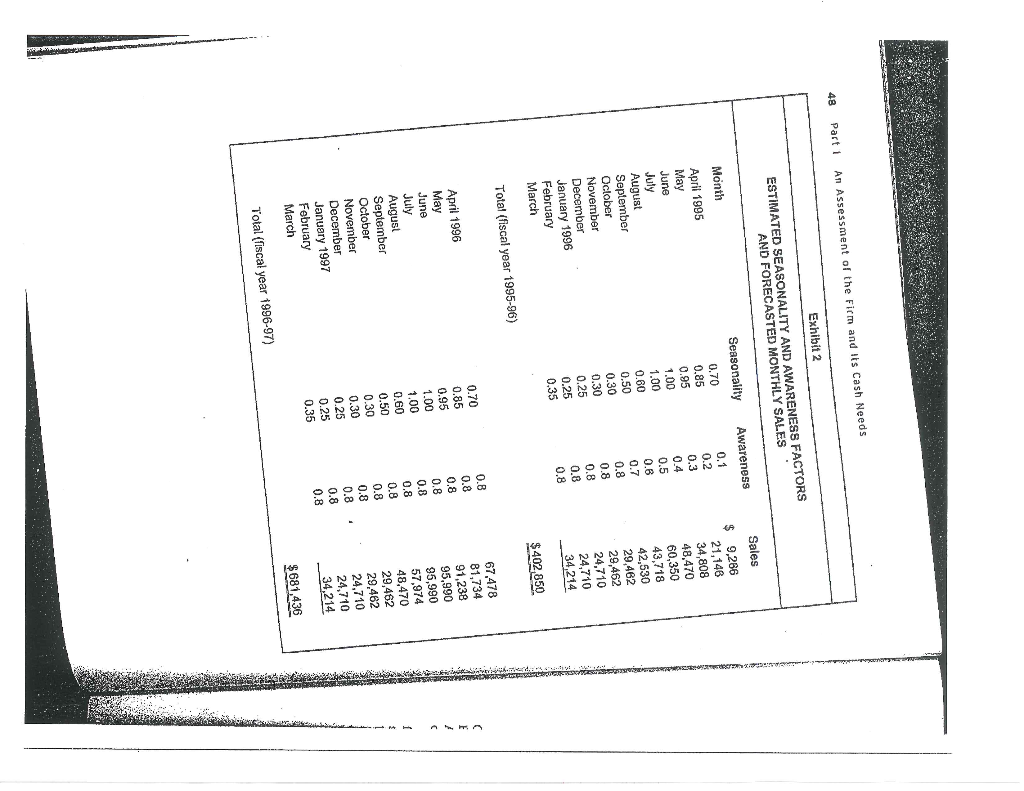

Case CL Ltd 1 In September 1994, Janies and Serena Udderlic were preparing a loan application to a London, Ontario branch of the Confederation Bank of Canada. The Udderlies were requesting a $160,000 term loan, in addition to an operating loan, for the potential opening of a CL ice cream and clothing franchise in London. The Udderlics had a considerable amount of marketing research and cost estimates, and in order to complete the application, they riceded to develop proforma income statements and balance sheels for the store's first two years of operation. They also planned to review carefully the qualitative characteris- tics of their idea in order to assess the chances of success of a franchise in London. The Udderlics also wondered what collateral, if any, they would be able to provide the bank to secure against a loan, and what other terms the bank might deem necessary. els HISTORY OF CL (began in 1983 on Prince Edward Island (PEL), Canada, as a single outlet producing and selling ice cream made from a time-honoured family recipe. I lowever, the clothing with whimsical imagery that the staff wore as uniforms began attracting attention and the company soon exparued to include a retail line, which was 75 to 80 items deep by 1995. The retail line, which included such items as t-shirts, sweatshirts, pins and mooing cookie jars, was subsequently offered by mail order in 1991.C2 began flectie orie of an illestrate either effectives and ---- wider the supervision of Professor Steve Foerster solely to press 43 frikinchising with the opening of a store in Vancouver, British Columbia in 1993, and later opened stores in Park City, Utah and Whistler, British Columbia. Le sold only premium ice cream, with ingredients that included dairy fresh cream, sugar, ftcsh eggs and pure vanilta. Also, the ice cream included very little of the air found in most commercial ice creams to increase volume. All icc cream was served in a fresh waffle cone made at the ice cream counter in full vicw of the customers. When customers ordered their cone, they often sclected from colourful names such as Customers were treated to a complete experience at CL. The staff were very friendly and were will- ing to give customers a sample before they decided on an ice crcam flavour. All stores were innovatively dec- orated to include clocks displaying both the local and P.E.1. time, as well as an ice cream menu shaped as a cow with a swinging tongue. But most important to the experience were the clothing items with witly satir- ical designs and captions Lg founder, Cobie Gable, still managed the company in July 1994. The company's creative director, Marc Gallant, a well-known P.E.I. artist, had recently passed away. While Gable was responsible for most of the business decisions that had brought CL518 success, Gallant was the creative person behind the art work on the whimsical clothing. Gallant's creativity, inspired by his fascination with cows, was preserved by sav. ing many of his preliminary designs intrunner that could easily be manipulated by his creative team to develop new designs JAMES AND SERENA UDDERLIE James Udderlic was the Director of Market Development in the Employee Benefits Division of the Provincial Life Insurance Company. He completed his MBA from the Western Business School in 1983 and joined Provincial in the same year. Although successful and happy in his current position, as James noted, "being an entrepreneur is in the back of the mind of most business school graduates." Serena Udderlic was a spe- cial education teacher who was currently volunteering one day a week while managing their three children full-time, inclding the youngest child who had not yet cntered public school. Serena planned on returning to work -time once their youngest child was in school. She received a Bachelor of Arts, Bachelor of Education and a Master of Education from the University of Western Ontario, and was the gold medalist while carning the Master's clcgrce. Serena, like ler husband, was excited to open up a family business. The Uddcrlies required that any business they started would ncither affect James' commitment 10 Provincial Life nor their commitment to their family. White Jaincs and Serena accepted that changes would be necessary to the family routine, they did not want their children to suffer because of the business and discussed it with them before making a final decision. The Udderlies were under no illusions about the conuitment they would have to make to the venture, but they anticipated that if they were to hire a full-time person to manage their investment," then the time requirement could be kept to a manageable level. They felt that their requirements could be met in London since the three locations, the tentative location of the store, Provincial Life and home, would only be a short distance from each other. James and Serena planned to incorporate, with cach owning 50 per cent of the business. Janics would be responsible for strategic planning, finance and general management. Scrcna would take care of hiring the staff and marketing. They would both take furns meeting with their manager on a weekly basis to keep tabs on their investment," by reviewing results, setting store policy and planning promotions. THE IDEA The idea for the Cis franchise came about when the Udderlie family was camping on P.E.J. in the summer of 1992. At that time, James saw a magazine advertisement for CL s ice cream that caught his attention. What struck James was the "wholesomeness" of the layout that depicted a young boy wcaring clothing with the distinctive motif and having fun cating ice cream. Later, their neighbours at the campsite said they enjoyed the 3 store they visited, and after the Udderlics visited the store themselves, they were greatly impressed with their Cow's experience. In particular, they noticed the interesting clothing and its displays, 44 An Assessment or the firm and its Cash Needs Part 1 the store's layout, the friendliness of the staff and, most importantly, the delicious ice cream. After the Udderlies inquired about franchising, a company representative told them that the first company franchise was to open later that summer in Vancouver, British Columbia and that no other franchises were being con- sidered. The representative advised the Udderlies that if they were to write a letter outlining their desire to own a franchise, the company would get back to them. The Udderlies had a strong conviction that the CI'S concept wuald work in London. The first decision the Udderlies had to make wes whether or not to invest time examining the feasibility of a CL franchise before taking the idea to a financial institution for possible financing. It was not until the summer of 1994 that the Udderlies decided to write to a representatives, which time they received a favourable response inviting them to visit the company in P.E.I. James traveled alone to P.E.I. in July 1994 and spent three days mecting with the franchiser and learning more about the company. During this time, it became obvious to James that while SL s was a profitable business, a franchisce had to want more than just profit from owning a store. The company's core values included a strong persuasion for quality and creativ- ity that made owning a store an expensive proposition. It was believed that only by following these values would a store have all the elements necessary for it to be successful. MARKET RESEARCH James brought with him to PE.. some preliminary market research that he had gathered from Statistics Canada, the Conference Bourd of Canada and the Convention Burcau of London. flc fell that it was in this area that his MBA helped him most; he knew how to differentiatc the important information from the irrelevant as well as how to deal with incomplete market information. From the research, he gathered two kcy pieces of information: aggregate spending on take-out food in the London area and estimate of the annual member of visitors to London. The information in Exhibit I was meant to give James a sense of how many potential. La customers existed and the extent of their buying power. He focused on the counties around London, James figured that his target segment would include tourists, local employed families, and local non- married, ernployed individuals over the age of 16. He believed that employment was an important characteristic of his target segment since the Cusprice point would be greater than the average price in the industry The population of London in 1994 was approximately 300,000. Using information he received from the franchiser, James figured that local monthly visits would be the product of both the specific month and the degree of local awareness of the store. For example, in the store's first month of operation, fargcted for April 1995, fic predicted that the seasonality" factor would be 70 per cent, versus a high of 100 per cent in July, and the awareness" factor 10 percent, versus a high of 80 per cent by November. Since the product of these was seven per cent, he figured that seven per cent of 300,000, or 21,000 people would be included in the predisposed base for the month of April. He then predicted that, of this basc, one in twenty would visit the store. Hence, in the month of April, 1,050 individuals from the local population would visit CL. In addi- tion, James estimated that 120 tourists would visit the store each month. The predicted "Seasonality" factor, the awareness" Inclor and projected monthly sales are listed in Exhibit 2. The franchiser also provided the Udderlies with frequency of purchase data, broken down by product, based on the experience in P.E.1 and Vancouver, Only 10 per cent of all individuals that entered the store left without making any purchase. Of the remaining 90 per cent, 65 per cent purchased only ice cream, 10 per cent purchased only a relail product, and 25 per cent purchased both. James estimated that the average cxpen- ditures per customer would be two dollars for ice cream and $20 for retail. Using this methodology, James estimated year one (April 1, 1995 to March 31, 1996) and year two (April 1, 1996 to March 31, 1997) retail sales to be $320,450 and $S42,052, respectively. Ice cream sales were projected to be $82,400 and $139,384 in the first two years. FRANCHISE REQUIREMENTS The franchiser had well developed storc design standards and specifications, which included what items were sold and how the itcns were sold. For example, the franchiser prescribed that a specific Toronto-based Part 1 A6 An Assessment of the Firm and its Cash Needs Udderlies, including any tern facility secured from the two levels of government, and any operating line of credit received from the Confederation Bank. The Udderlies felt that, given their life-cycle stage, they could invest all of their liquid assets, about $150,000, but had to limit the collateral. Given the various start-up costs and initial inventory requirements, the Udderlies estimated the need for $160,000 in term loan financing, as well as an operating loan to meet seasonal and other short-term needs. It was anticipated that peak seasonal financing needs would occur between January and March ECONOMIC OUTLOOK The province of Quebec was scheduled to have a general election in the fall of 1994. The Parti Qubcois, a political party whosc platform centered on Quebec's secession from Canada, was ahead in the popularity polls. This, along with the fact that Canada had the highest per capita debt levels among the major industri- alized countries, tad made foreigners leery of investing in Canada. The result was a Canadian dollar that was experiencing increased volatility relative to other currencies and that required intervention by the Bank of Canada lo protect its value by increasing, short-term interest rates. The effect on the bond market was a noticeable widening of the Canada-U.S. interest rates spread to about 1.50 per cent from 1.15 per cent in April 1994, Canadian economic indicators were showing increasing strength on the domestic front as retail sales were up 1.3 per cent in both Februnty and March of 1994 over the previous month. These results were partly off- set by a weaker trade performance. Nevertheless, real gross domestic product (GDP) increased by 0.5 per cent in March and by three per ccot in the first quarter of 1994 over the same period a year previously. The inflation environnent remained very good with the annual consumer price index (CPI) increasing only by 0.2 per cent and wage settlements averaging up 0.5 per cent during the first three months of the year over the same period a year earlier DECISION The Udderlics were passionate about the franchising idea. They both loved ice cream and foundLs to be unique and exciting. They considered the consequence if Le turned out to be simply a fad. The costs that the Udderlies woald incur to start up the store were significant, and the store would need to generate income over a number of years to guarantee that the loans were covered. They were confident that his was not simply a fad since the ice cream was of very good quslity and the retail line was a social satire and was there- fore, perpetually renewable. The Udderties knew that the ice creana might be moderately cyclical and was certainly seasonal, despite the franchiser's active development of products aimed at smoothing revenue flow, and wondered how that would affect their ability to repay any loans, In order to prepare for his next mecting with MacNeil, James beeded to calculate their cash needs and sat down to develop proforma financial statements. 47 Exhibit 1 SELECTED MARKET RESEARCH 1993 Ave. Annual Growth Rale Per Capila Income Per Capita Retail Sales Population 30,200 71,200 95,000 387,300 Huron County Perth Counly Oxford County Middlesex County Includes London) Elgin County Lambton County 1.03% 0.95% 1.62% 2.21% $5,200 5,700 5,800 6,700 $ 14,600 16.100 16,400 19,000 77,300 130,400 1.36% 0.65% 15,700 18,200 5,600 8,500 Number of Individuals in the Labour Force, Ontario, 1991 Number of Individuals in the Labour Force, London, 1991 Families in Private Households, Total, London, 1993. Total Supermarkets and Grocery Retail Salcs, Canada, 1993 Tourism Expenditure on Food and Beverage, London, 1989 Estimated Number of Tourists, London, 1993... 5,511,235 169,245 ........ 102,935 $14.4 billion $59.4 million .300,000 Sources: The London Vis Hors and Convention Bureat, The Financial Post, Statistics Canada 48 Part 1 An Assessment of the Firm and its Cash Needs Exhibit 2 ESTIMATED SEASONALITY AND AWARENESS FACTORS AND FORECASTED MONTHLY SALES Awareness Seasonality 0.70 0.85 0.95 0.1 0.2 Month April 1995 May June July August September October November December January 1996 February March 1.00 0.60 0.50 0.30 0.30 0.25 0.25 0.35 04 0.5 0.6 0.7 0.8 08 0.8 0.8 0.8 Sales $ 9,286 21,146 34,808 48,470 60,350 43,718 42,630 29,462 29,462 24,710 24,710 34,214 $402 850 Total (fiscal year 1995-96) April 1996 May June 67.478 81,734 91,238 95.990 95,990 57,974 48,470 29,462 29,462 0.B 0.8 0.8 0.8 0.8 0.8 08 0.8 0.8 0.70 0.85 0.95 1.00 1.00 0.60 0.50 0.30 0.30 0.25 0.25 0.35 July August September 24.710 October November December January 1997 February 0.8 0.8 24,710 34,214 March $681,436 Total (fiscal year 1996-97) Case CL Ltd 1 In September 1994, Janies and Serena Udderlic were preparing a loan application to a London, Ontario branch of the Confederation Bank of Canada. The Udderlies were requesting a $160,000 term loan, in addition to an operating loan, for the potential opening of a CL ice cream and clothing franchise in London. The Udderlics had a considerable amount of marketing research and cost estimates, and in order to complete the application, they riceded to develop proforma income statements and balance sheels for the store's first two years of operation. They also planned to review carefully the qualitative characteris- tics of their idea in order to assess the chances of success of a franchise in London. The Udderlics also wondered what collateral, if any, they would be able to provide the bank to secure against a loan, and what other terms the bank might deem necessary. els HISTORY OF CL (began in 1983 on Prince Edward Island (PEL), Canada, as a single outlet producing and selling ice cream made from a time-honoured family recipe. I lowever, the clothing with whimsical imagery that the staff wore as uniforms began attracting attention and the company soon exparued to include a retail line, which was 75 to 80 items deep by 1995. The retail line, which included such items as t-shirts, sweatshirts, pins and mooing cookie jars, was subsequently offered by mail order in 1991.C2 began flectie orie of an illestrate either effectives and ---- wider the supervision of Professor Steve Foerster solely to press 43 frikinchising with the opening of a store in Vancouver, British Columbia in 1993, and later opened stores in Park City, Utah and Whistler, British Columbia. Le sold only premium ice cream, with ingredients that included dairy fresh cream, sugar, ftcsh eggs and pure vanilta. Also, the ice cream included very little of the air found in most commercial ice creams to increase volume. All icc cream was served in a fresh waffle cone made at the ice cream counter in full vicw of the customers. When customers ordered their cone, they often sclected from colourful names such as Customers were treated to a complete experience at CL. The staff were very friendly and were will- ing to give customers a sample before they decided on an ice crcam flavour. All stores were innovatively dec- orated to include clocks displaying both the local and P.E.1. time, as well as an ice cream menu shaped as a cow with a swinging tongue. But most important to the experience were the clothing items with witly satir- ical designs and captions Lg founder, Cobie Gable, still managed the company in July 1994. The company's creative director, Marc Gallant, a well-known P.E.I. artist, had recently passed away. While Gable was responsible for most of the business decisions that had brought CL518 success, Gallant was the creative person behind the art work on the whimsical clothing. Gallant's creativity, inspired by his fascination with cows, was preserved by sav. ing many of his preliminary designs intrunner that could easily be manipulated by his creative team to develop new designs JAMES AND SERENA UDDERLIE James Udderlic was the Director of Market Development in the Employee Benefits Division of the Provincial Life Insurance Company. He completed his MBA from the Western Business School in 1983 and joined Provincial in the same year. Although successful and happy in his current position, as James noted, "being an entrepreneur is in the back of the mind of most business school graduates." Serena Udderlic was a spe- cial education teacher who was currently volunteering one day a week while managing their three children full-time, inclding the youngest child who had not yet cntered public school. Serena planned on returning to work -time once their youngest child was in school. She received a Bachelor of Arts, Bachelor of Education and a Master of Education from the University of Western Ontario, and was the gold medalist while carning the Master's clcgrce. Serena, like ler husband, was excited to open up a family business. The Uddcrlies required that any business they started would ncither affect James' commitment 10 Provincial Life nor their commitment to their family. White Jaincs and Serena accepted that changes would be necessary to the family routine, they did not want their children to suffer because of the business and discussed it with them before making a final decision. The Udderlies were under no illusions about the conuitment they would have to make to the venture, but they anticipated that if they were to hire a full-time person to manage their investment," then the time requirement could be kept to a manageable level. They felt that their requirements could be met in London since the three locations, the tentative location of the store, Provincial Life and home, would only be a short distance from each other. James and Serena planned to incorporate, with cach owning 50 per cent of the business. Janics would be responsible for strategic planning, finance and general management. Scrcna would take care of hiring the staff and marketing. They would both take furns meeting with their manager on a weekly basis to keep tabs on their investment," by reviewing results, setting store policy and planning promotions. THE IDEA The idea for the Cis franchise came about when the Udderlie family was camping on P.E.J. in the summer of 1992. At that time, James saw a magazine advertisement for CL s ice cream that caught his attention. What struck James was the "wholesomeness" of the layout that depicted a young boy wcaring clothing with the distinctive motif and having fun cating ice cream. Later, their neighbours at the campsite said they enjoyed the 3 store they visited, and after the Udderlics visited the store themselves, they were greatly impressed with their Cow's experience. In particular, they noticed the interesting clothing and its displays, 44 An Assessment or the firm and its Cash Needs Part 1 the store's layout, the friendliness of the staff and, most importantly, the delicious ice cream. After the Udderlies inquired about franchising, a company representative told them that the first company franchise was to open later that summer in Vancouver, British Columbia and that no other franchises were being con- sidered. The representative advised the Udderlies that if they were to write a letter outlining their desire to own a franchise, the company would get back to them. The Udderlies had a strong conviction that the CI'S concept wuald work in London. The first decision the Udderlies had to make wes whether or not to invest time examining the feasibility of a CL franchise before taking the idea to a financial institution for possible financing. It was not until the summer of 1994 that the Udderlies decided to write to a representatives, which time they received a favourable response inviting them to visit the company in P.E.I. James traveled alone to P.E.I. in July 1994 and spent three days mecting with the franchiser and learning more about the company. During this time, it became obvious to James that while SL s was a profitable business, a franchisce had to want more than just profit from owning a store. The company's core values included a strong persuasion for quality and creativ- ity that made owning a store an expensive proposition. It was believed that only by following these values would a store have all the elements necessary for it to be successful. MARKET RESEARCH James brought with him to PE.. some preliminary market research that he had gathered from Statistics Canada, the Conference Bourd of Canada and the Convention Burcau of London. flc fell that it was in this area that his MBA helped him most; he knew how to differentiatc the important information from the irrelevant as well as how to deal with incomplete market information. From the research, he gathered two kcy pieces of information: aggregate spending on take-out food in the London area and estimate of the annual member of visitors to London. The information in Exhibit I was meant to give James a sense of how many potential. La customers existed and the extent of their buying power. He focused on the counties around London, James figured that his target segment would include tourists, local employed families, and local non- married, ernployed individuals over the age of 16. He believed that employment was an important characteristic of his target segment since the Cusprice point would be greater than the average price in the industry The population of London in 1994 was approximately 300,000. Using information he received from the franchiser, James figured that local monthly visits would be the product of both the specific month and the degree of local awareness of the store. For example, in the store's first month of operation, fargcted for April 1995, fic predicted that the seasonality" factor would be 70 per cent, versus a high of 100 per cent in July, and the awareness" factor 10 percent, versus a high of 80 per cent by November. Since the product of these was seven per cent, he figured that seven per cent of 300,000, or 21,000 people would be included in the predisposed base for the month of April. He then predicted that, of this basc, one in twenty would visit the store. Hence, in the month of April, 1,050 individuals from the local population would visit CL. In addi- tion, James estimated that 120 tourists would visit the store each month. The predicted "Seasonality" factor, the awareness" Inclor and projected monthly sales are listed in Exhibit 2. The franchiser also provided the Udderlies with frequency of purchase data, broken down by product, based on the experience in P.E.1 and Vancouver, Only 10 per cent of all individuals that entered the store left without making any purchase. Of the remaining 90 per cent, 65 per cent purchased only ice cream, 10 per cent purchased only a relail product, and 25 per cent purchased both. James estimated that the average cxpen- ditures per customer would be two dollars for ice cream and $20 for retail. Using this methodology, James estimated year one (April 1, 1995 to March 31, 1996) and year two (April 1, 1996 to March 31, 1997) retail sales to be $320,450 and $S42,052, respectively. Ice cream sales were projected to be $82,400 and $139,384 in the first two years. FRANCHISE REQUIREMENTS The franchiser had well developed storc design standards and specifications, which included what items were sold and how the itcns were sold. For example, the franchiser prescribed that a specific Toronto-based Part 1 A6 An Assessment of the Firm and its Cash Needs Udderlies, including any tern facility secured from the two levels of government, and any operating line of credit received from the Confederation Bank. The Udderlies felt that, given their life-cycle stage, they could invest all of their liquid assets, about $150,000, but had to limit the collateral. Given the various start-up costs and initial inventory requirements, the Udderlies estimated the need for $160,000 in term loan financing, as well as an operating loan to meet seasonal and other short-term needs. It was anticipated that peak seasonal financing needs would occur between January and March ECONOMIC OUTLOOK The province of Quebec was scheduled to have a general election in the fall of 1994. The Parti Qubcois, a political party whosc platform centered on Quebec's secession from Canada, was ahead in the popularity polls. This, along with the fact that Canada had the highest per capita debt levels among the major industri- alized countries, tad made foreigners leery of investing in Canada. The result was a Canadian dollar that was experiencing increased volatility relative to other currencies and that required intervention by the Bank of Canada lo protect its value by increasing, short-term interest rates. The effect on the bond market was a noticeable widening of the Canada-U.S. interest rates spread to about 1.50 per cent from 1.15 per cent in April 1994, Canadian economic indicators were showing increasing strength on the domestic front as retail sales were up 1.3 per cent in both Februnty and March of 1994 over the previous month. These results were partly off- set by a weaker trade performance. Nevertheless, real gross domestic product (GDP) increased by 0.5 per cent in March and by three per ccot in the first quarter of 1994 over the same period a year previously. The inflation environnent remained very good with the annual consumer price index (CPI) increasing only by 0.2 per cent and wage settlements averaging up 0.5 per cent during the first three months of the year over the same period a year earlier DECISION The Udderlics were passionate about the franchising idea. They both loved ice cream and foundLs to be unique and exciting. They considered the consequence if Le turned out to be simply a fad. The costs that the Udderlies woald incur to start up the store were significant, and the store would need to generate income over a number of years to guarantee that the loans were covered. They were confident that his was not simply a fad since the ice cream was of very good quslity and the retail line was a social satire and was there- fore, perpetually renewable. The Udderties knew that the ice creana might be moderately cyclical and was certainly seasonal, despite the franchiser's active development of products aimed at smoothing revenue flow, and wondered how that would affect their ability to repay any loans, In order to prepare for his next mecting with MacNeil, James beeded to calculate their cash needs and sat down to develop proforma financial statements. 47 Exhibit 1 SELECTED MARKET RESEARCH 1993 Ave. Annual Growth Rale Per Capila Income Per Capita Retail Sales Population 30,200 71,200 95,000 387,300 Huron County Perth Counly Oxford County Middlesex County Includes London) Elgin County Lambton County 1.03% 0.95% 1.62% 2.21% $5,200 5,700 5,800 6,700 $ 14,600 16.100 16,400 19,000 77,300 130,400 1.36% 0.65% 15,700 18,200 5,600 8,500 Number of Individuals in the Labour Force, Ontario, 1991 Number of Individuals in the Labour Force, London, 1991 Families in Private Households, Total, London, 1993. Total Supermarkets and Grocery Retail Salcs, Canada, 1993 Tourism Expenditure on Food and Beverage, London, 1989 Estimated Number of Tourists, London, 1993... 5,511,235 169,245 ........ 102,935 $14.4 billion $59.4 million .300,000 Sources: The London Vis Hors and Convention Bureat, The Financial Post, Statistics Canada 48 Part 1 An Assessment of the Firm and its Cash Needs Exhibit 2 ESTIMATED SEASONALITY AND AWARENESS FACTORS AND FORECASTED MONTHLY SALES Awareness Seasonality 0.70 0.85 0.95 0.1 0.2 Month April 1995 May June July August September October November December January 1996 February March 1.00 0.60 0.50 0.30 0.30 0.25 0.25 0.35 04 0.5 0.6 0.7 0.8 08 0.8 0.8 0.8 Sales $ 9,286 21,146 34,808 48,470 60,350 43,718 42,630 29,462 29,462 24,710 24,710 34,214 $402 850 Total (fiscal year 1995-96) April 1996 May June 67.478 81,734 91,238 95.990 95,990 57,974 48,470 29,462 29,462 0.B 0.8 0.8 0.8 0.8 0.8 08 0.8 0.8 0.70 0.85 0.95 1.00 1.00 0.60 0.50 0.30 0.30 0.25 0.25 0.35 July August September 24.710 October November December January 1997 February 0.8 0.8 24,710 34,214 March $681,436 Total (fiscal year 1996-97)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started