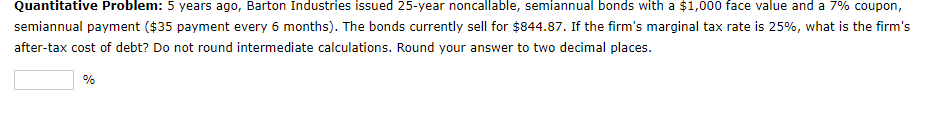

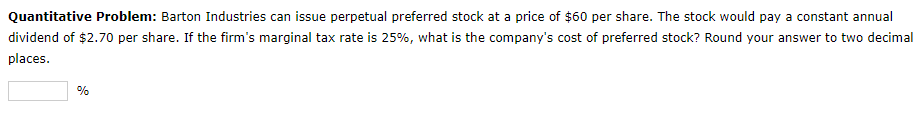

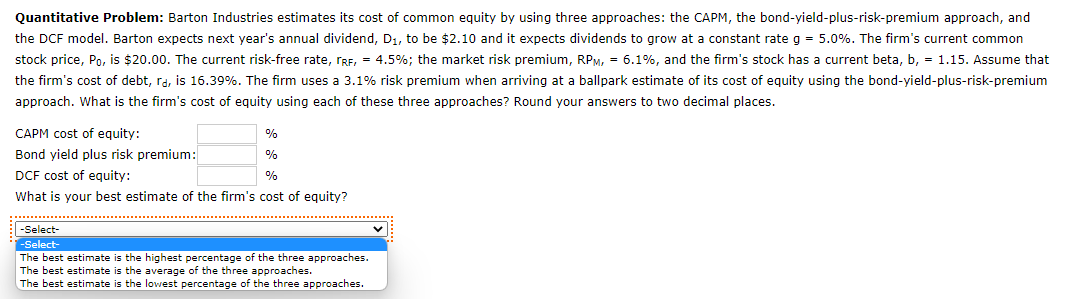

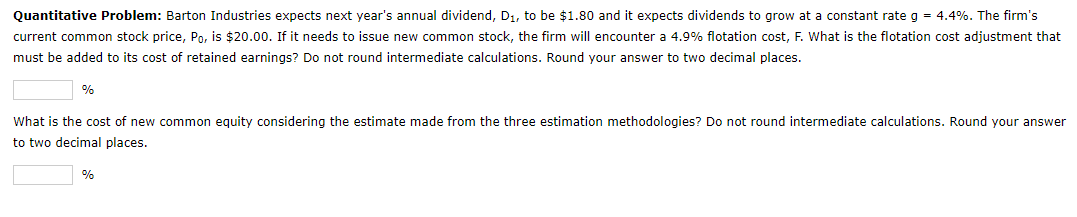

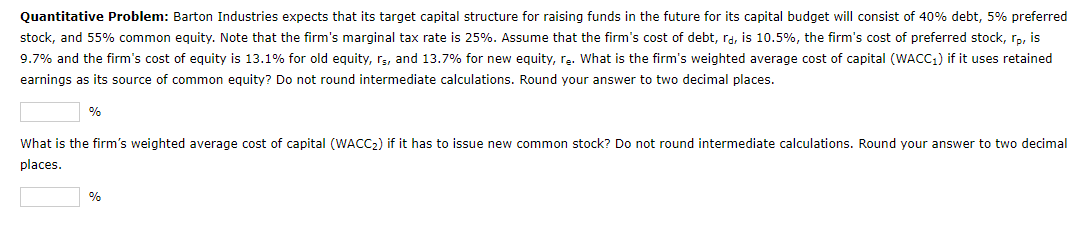

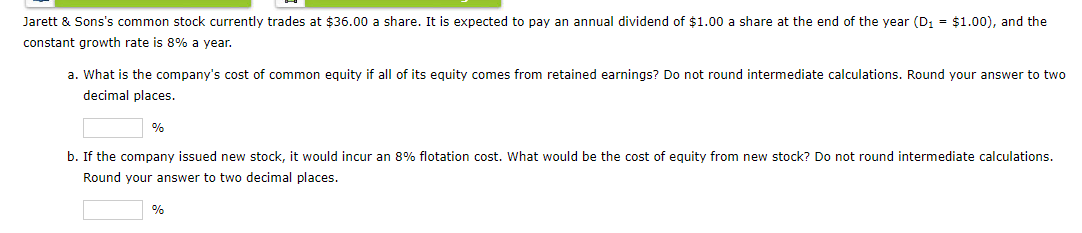

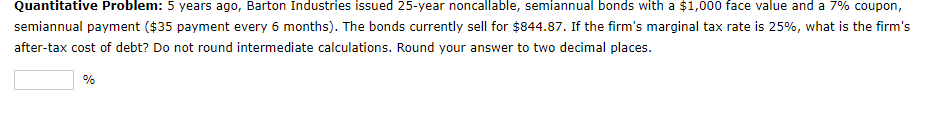

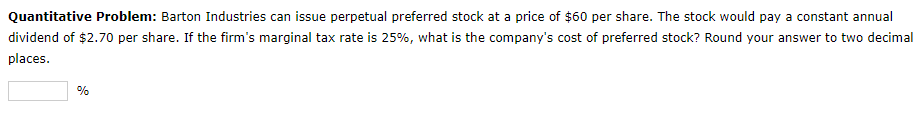

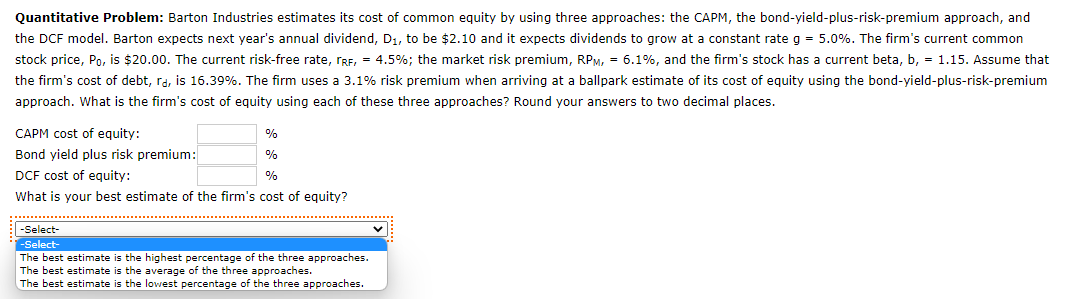

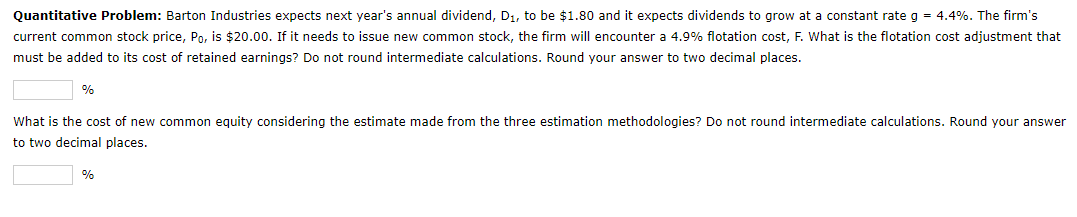

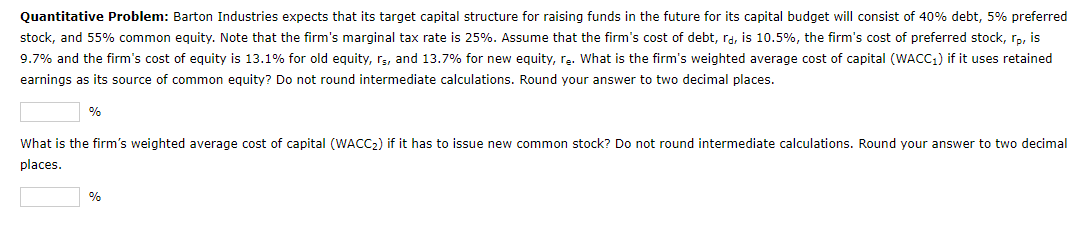

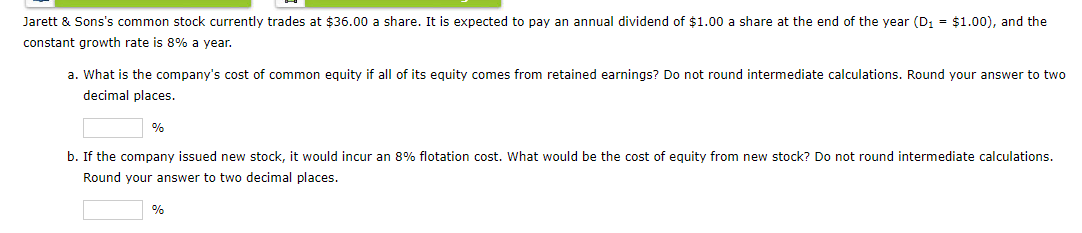

Quantitative Problem: 5 years ago, Barton Industries issued 25 -year noncallable, semiannual bonds with a $1,000 face value and a 7% coupon, semiannual payment ( $35 payment every 6 months). The bonds currently sell for $844.87. If the firm's marginal tax rate is 25%, what is the firm's after-tax cost of debt? Do not round intermediate calculations. Round your answer to two decimal places. Quantitative Problem: Barton Industries can issue perpetual preferred stock at a price of $60 per share. The stock would pay a constant annual dividend of $2.70 per share. If the firm's marginal tax rate is 25%, what is the company's cost of preferred stock? Round your answer to two decimal places. % Quantitative Problem: Barton Industries estimates its cost of common equity by using three approaches: the CAPM, the bond-yield-plus-risk-premium approach, and the DCF model. Barton expects next year's annual dividend, D1, to be $2.10 and it expects dividends to grow at a constant rate g=5.0%. The firm's current common stock price, P0, is $20.00. The current risk-free rate, rRF=4.5%; the market risk premium, RPM,6.1%, and the firm's stock has a current beta, b, =1.15. Assume that approach. What is the firm's cost of equity using each of these three approaches? Round your answers to two decimal places. CAPM cost of equity: % Bond yield plus risk premium: % DCF cost of equity: % What is your best estimate of the firm's cost of equity? Quantitative Problem: Barton Industries expects next year's annual dividend, D1, to be $1.80 and it expects dividends to grow at a constant rate g=4.4%. The firm's current common stock price, P0, is $20.00. If it needs to issue new common stock, the firm will encounter a 4.9% flotation cost, F. What is the flotation cost adjustment that must be added to its cost of retained earnings? Do not round intermediate calculations. Round your answer to two decimal places. % What is the cost of new common equity considering the estimate made from the three estimation methodologies? Do not round intermediate calculations. Round your answer to two decimal places. % Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, rd, is 10.5%, the firm's cost of preferred stock, rp, is 9.7% and the firm's cost of equity is 13.1% for old equity, rs, and 13.7% for new equity, re. What is the firm's weighted average cost of capital (WACC 1 ) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % What is the firm's weighted average cost of capital (WACC ) if it has to issue new common stock? Do not round intermediate calculations. Round your answer to two decimal places. Jarett \& Sons's common stock currently trades at $36.00 a share. It is expected to pay an annual dividend of $1.00 a share at the end of the year ( D1=$1.00 ), and the constant growth rate is 8% a year. a. What is the company's cost of common equity if all of its equity comes from retained earnings? Do not round intermediate calculations. Round your answer to two decimal places. % b. If the company issued new stock, it would incur an 8% flotation cost. What would be the cost of equity from new stock? Do not round intermediate calculations. Round your answer to two decimal places. %