Answered step by step

Verified Expert Solution

Question

1 Approved Answer

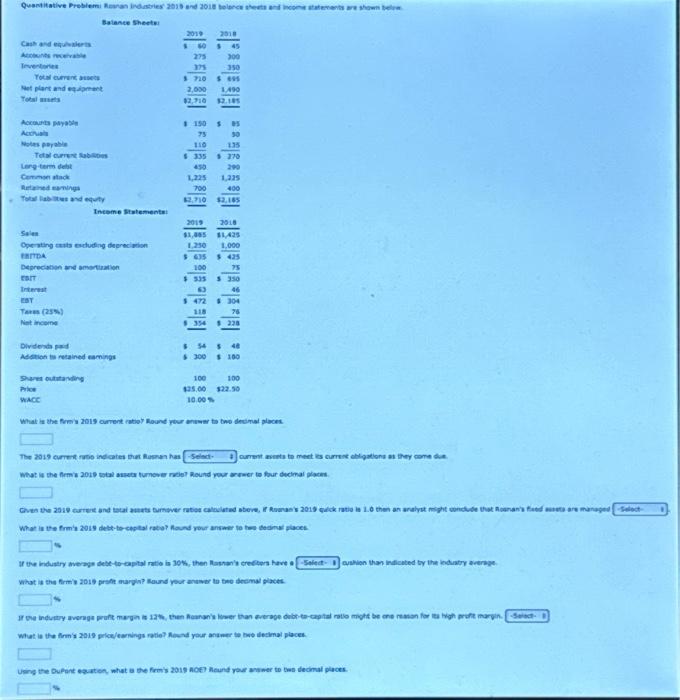

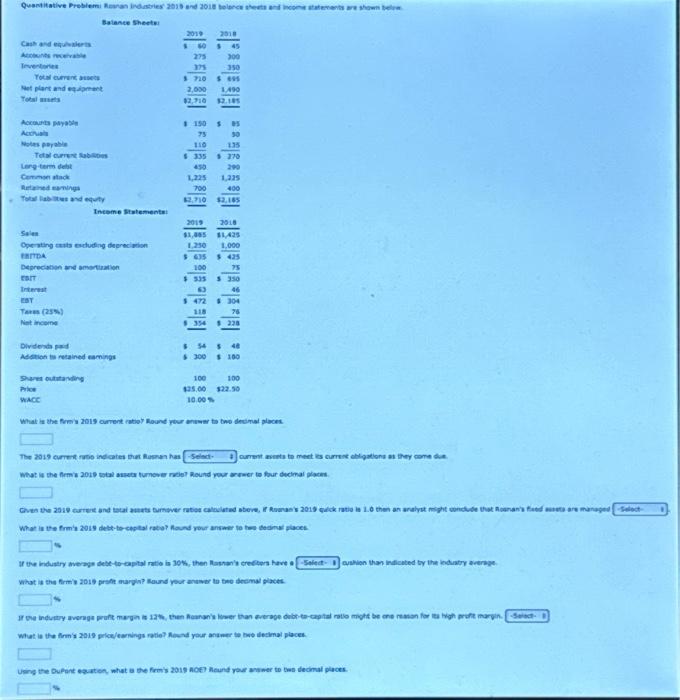

Quantitative Problem: Resnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Balance Sheets: Cash and equivalents Accounts receivable Inventories Total current

Quantitative Problem: Resnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Balance Sheets: Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Accounts payable Accruals Notes payable Tetal current abilities Long-term debt Common stock Retained eamings Total liabities and equity Sales Operating costs excluding depreciation EBITDA Depreciation and amortization EBIT Interest EST Taxes (25%) Not income Income Statements: Dividends paid Addition to retained earnings Shares outstanding Price WACC 2019 $ 45 $ 60 275 300 375 350 $ 710 $ 695 2,000 $2,710 $2.710 L $ 150 $ 75 110 $335 430 1,225 700 63 $ 472 % 2018 118 $ 354 1,490 $2,185 2019 2018 $1,885 $1,425 1,250 $ 635 1,000 $425 75 100 $535 $ 350 46 $ 304 76 $ 54 $ 300 85 50 135 $ 270 299 1,225 400 $2,185 $ 228 - 100 100 $25.00 $22.50 10.00% What is the firm's 2019 current ratio? Round your answer to two decimal places. $ 48 $ 100 The 2019 current ratio indicates that Rosman has-Select- what is the firm's 2019 total assets turnover ratio? Round your answer to four decimal places current assets to meet its current obligations as they come due. Given the 2019 current and total assets turnover ratios calculated above, if Rosman's 2019 quick ratio is 1.0 than an analyst might conclude that Rosnan's fixed assets are managed-Select- What is the firm's 2019 debt-to-capital ratio? Round your answer to two decimal places. If the industry average debt-to-capital ratio is 30%, then Rasnan's creditors have a Select cushion than indicated by the industry average. What is the firm's 2019 profit margin? Round your answer to two decimal places. If the industry average profit margin is 12%, then Rosnan's lower than average debt-to-capital ratio might be one reason for its high profit margin. -Select- What is the firm's 2019 price/earnings ratio? Round your answer to two decimal places. Using the DuPont equation, what is the firm's 2019 ROE? Round your answer to two decimal places.  Batanee sheets: Cabs and equivilers Irventoine Yocal cumen ansect plant and equartant Tobal minerta Mccourta Berabin: Acroniah Woles peracie Tetal currest kablopis Larg-term debt Cominon atadk Retrined eonices - Tolal liablates and equaty Inteme stwlementa! Sala rarras Depreciabon and amoctination eart Tnement ear Tans (2ss) Net inceine Dividesh rast Mdation to retained camings Shere outitandery File Whes: \begin{tabular}{|c|c|} \hline 2010 & 2018 \\ \hline146 & 45 \\ \hlinem & 300 \\ \hlinem & 350 \\ \hlinen0 & \( 5 \longdiv { 6 4 } \) \\ \hline 2,000 & 1.490 \\ \hline12,710 & 2.105 \\ \hline \end{tabular} 1.1507530511052701354501,2251,22570012,710 11,055201911,4252516 5051,230,84251,000 355100,35075 43+30446 354118+22076 534548 s 300 \& 100 100125.0010.00%100122.90

Batanee sheets: Cabs and equivilers Irventoine Yocal cumen ansect plant and equartant Tobal minerta Mccourta Berabin: Acroniah Woles peracie Tetal currest kablopis Larg-term debt Cominon atadk Retrined eonices - Tolal liablates and equaty Inteme stwlementa! Sala rarras Depreciabon and amoctination eart Tnement ear Tans (2ss) Net inceine Dividesh rast Mdation to retained camings Shere outitandery File Whes: \begin{tabular}{|c|c|} \hline 2010 & 2018 \\ \hline146 & 45 \\ \hlinem & 300 \\ \hlinem & 350 \\ \hlinen0 & \( 5 \longdiv { 6 4 } \) \\ \hline 2,000 & 1.490 \\ \hline12,710 & 2.105 \\ \hline \end{tabular} 1.1507530511052701354501,2251,22570012,710 11,055201911,4252516 5051,230,84251,000 355100,35075 43+30446 354118+22076 534548 s 300 \& 100 100125.0010.00%100122.90

Quantitative Problem: Resnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Balance Sheets: Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Accounts payable Accruals Notes payable Tetal current abilities Long-term debt Common stock Retained eamings Total liabities and equity Sales Operating costs excluding depreciation EBITDA Depreciation and amortization EBIT Interest EST Taxes (25%) Not income Income Statements: Dividends paid Addition to retained earnings Shares outstanding Price WACC 2019 $ 45 $ 60 275 300 375 350 $ 710 $ 695 2,000 $2,710 $2.710 L $ 150 $ 75 110 $335 430 1,225 700 63 $ 472 % 2018 118 $ 354 1,490 $2,185 2019 2018 $1,885 $1,425 1,250 $ 635 1,000 $425 75 100 $535 $ 350 46 $ 304 76 $ 54 $ 300 85 50 135 $ 270 299 1,225 400 $2,185 $ 228 - 100 100 $25.00 $22.50 10.00% What is the firm's 2019 current ratio? Round your answer to two decimal places. $ 48 $ 100 The 2019 current ratio indicates that Rosman has-Select- what is the firm's 2019 total assets turnover ratio? Round your answer to four decimal places current assets to meet its current obligations as they come due. Given the 2019 current and total assets turnover ratios calculated above, if Rosman's 2019 quick ratio is 1.0 than an analyst might conclude that Rosnan's fixed assets are managed-Select- What is the firm's 2019 debt-to-capital ratio? Round your answer to two decimal places. If the industry average debt-to-capital ratio is 30%, then Rasnan's creditors have a Select cushion than indicated by the industry average. What is the firm's 2019 profit margin? Round your answer to two decimal places. If the industry average profit margin is 12%, then Rosnan's lower than average debt-to-capital ratio might be one reason for its high profit margin. -Select- What is the firm's 2019 price/earnings ratio? Round your answer to two decimal places. Using the DuPont equation, what is the firm's 2019 ROE? Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started