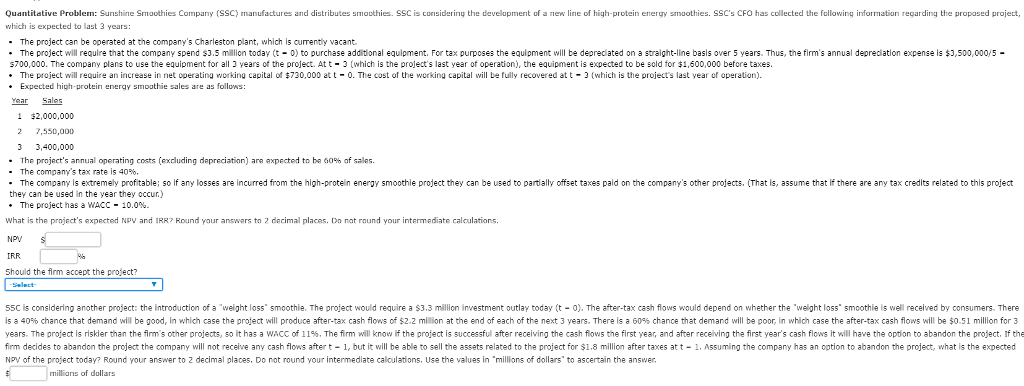

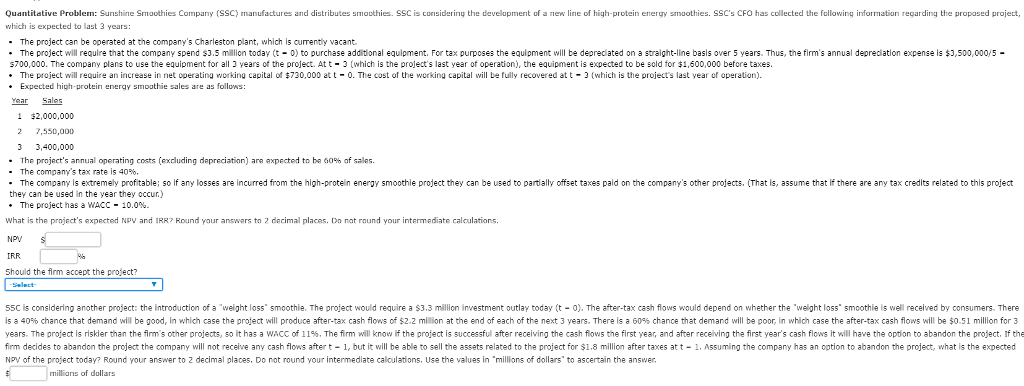

Quantitative Problem: Sunshine Smoothies Company (SSC) manufactures and distributes smoothies. SSC is considering the development of a new line of high-protein energy smoothies. SSC's CFO has collected the following information regarding the propased project which is expected to last 3 years - The project can be operated at the company's Charleston plant, which is currnty acant * The p ect will require that the company spend $3.5 million today t 0 to purchase additional equipment. For ta purposes the equipment will be depreciated on a straight-line basis over 5 years. Thus, the fir s annual depreciation expense s? 500 000 5 $700,000. The company plans to use the equipment for all years of the project. At t3 ?which is the project's last year of operation), the equipment is expected to be sold for 1,600,000 before taxes. .The project will require an increase in net operatina working capital of $730,000 at t-0. The cost of the working capital will be fully recovered att-3 (which is the project's last year of operation). s $3,500,000/5 Expected high-protein energy smoothie sales are as follows Year Sales 1 $2,000,000 7,550,000 3 3,400,000 The project's annual operating costs (excluding depreciation) are expected to be 00% af sales. The company's tax rate is 40%. - The company is extremely profitable; so If any losses are Incurred from the high-prote n energy smoothle project they can be used to parally offset taxes pald on the company's other projects, (That is, assume that if there are any tax credits related to this project they can be used in the year they occur.) The project has a WACC-10.0%. what is the project's expected NpV and IRR?Round your answers tn 2 decimal places. Do nat round your intermediate calculations. NPV IRR Should the firm accept the project? 55C is considering another project: the introduction of a "weight loss smoothie. The project would require a $3.3 million investment outlay today (t -0), The after-tax cash flows would depend on whether the "welight loss smoothie is well received by consumers. There is a 40% chance that demand will be good n which case the pr e t wil produce after tax cash flows of S2.2 milion at the end of each of the next 3 years. There s a 60% chance that demand will be r n which case the afte tax cash flows be $0.51 million for 3 years. The pro ect is skier han the firms other projects, so t has a w ACC of 11%. The firm will know the pro ect is successful after receiving the cash flows the first year, and a r ece ing the first year's cash flows t wil have the tion to abandon the project ft firm decides to abandon the project the company will not receive any cash flows aftert 1, but it will be able to sell the assets related to the project for $1.8 million after taxes at t 1. Assuming the company has an option to abandon the project, what is the expected NPV of the project today? Round your answer to 2 decimal places, Do not round your intermediate calculations, Use the values in "millions of dollars to ascertain the answer. millians of dollars