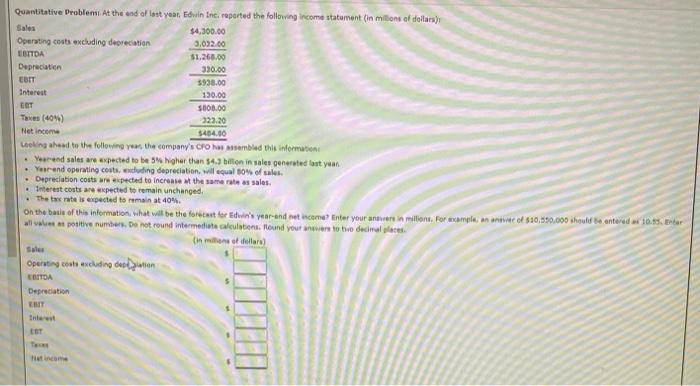

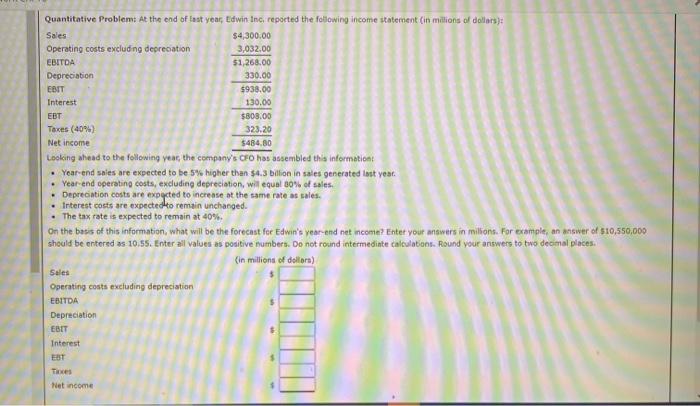

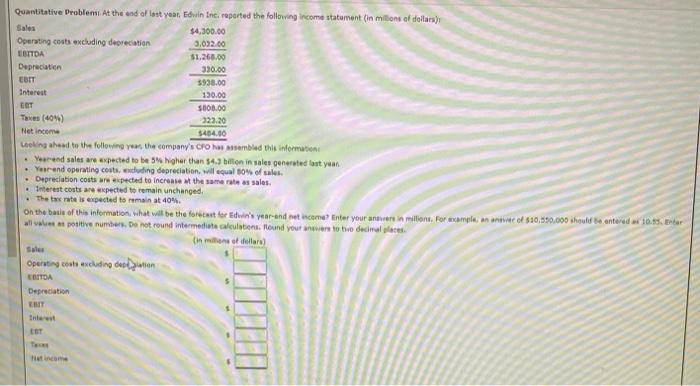

Quantitative Problems At the end of last year Edwin Inc. reported the following income statement (in millions of dollars) Sales $4,300.00 Operating costs excluding depreciation 3.032.00 EBITDA $1,260.00 Deprecation 330.00 EBIT $933.00 Interest 130.00 ERT 5000.00 Taxes (40%) 223.20 Net income $464.00 Looking shed to the following year, the company's Crossembled this information Yared sales are expected to be 5 Ngher than 34.3 billion in sales generated butyan . Yarand operating costs.eduling depreciation will equal 80% of sales Depreciation costs are expected to increase at the same rate as sales Interest costs are expected to remain unchanged the tax rate is expected to remain at 40% On the basis of this information what will be the forecast for din's year and the income? Enter your answers in milion. For example, an awe of $10,550,000 huld be entered 10.15. Enter all positive numbers. De not round intermediate action. Found your newers to be decimal in modellars) Operating cos excluding deodwin COITOA Depreciation HT LET Nincome Quantitative Problem: At the end of fast year, Edwin Inc reported the following income statement (in milions of dollars): Sales $4,300.00 Operating costs excluding deprecation 3,032.00 EBITDA 51,268.00 Depreciation 330.00 EBIT $938.00 Interest 130.00 EBT $800.00 Taxes (40%) 323.20 Net income $484,80 Looking ahead to the following year, the company's CFO has assembled this information Year-end sales are expected to be 5% higher than $4.3 billion in sales generated last year. Year-end operating costs, excluding depreciation, will equal 80% of sales. Depreciation costs are exerted to increase at the same rate as sales. Interest costs are expected to remain unchanged. The tax rate is expected to remain at 40%. On the basis of this information, what will be the forecast for Edwin's year-end net income? Enter your answers in milions. For example, an answer of 510,550,000 should be entered as 10.55. Enter all values as positive numbers. Do not round intermedinte calculations. Round your answers to two decimal places. (in millions of dollars) Sales Operating costs excluding depreciation EBITDA Depreciation EBIT Interest Thes Net income