Answered step by step

Verified Expert Solution

Question

1 Approved Answer

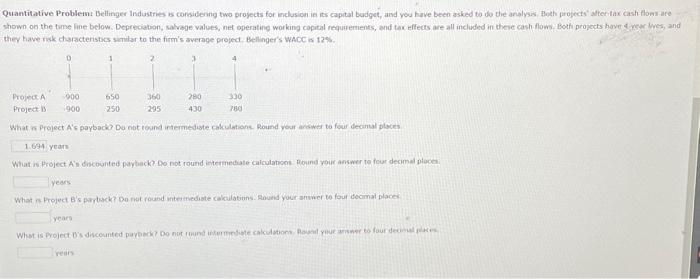

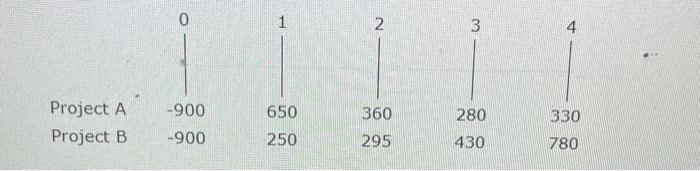

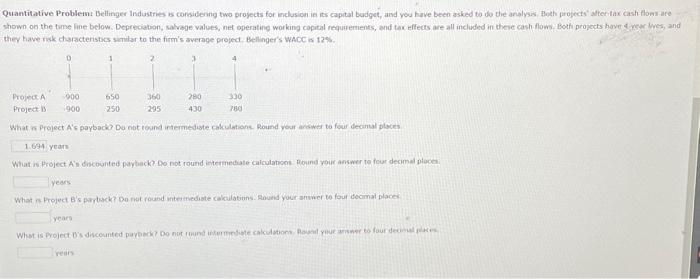

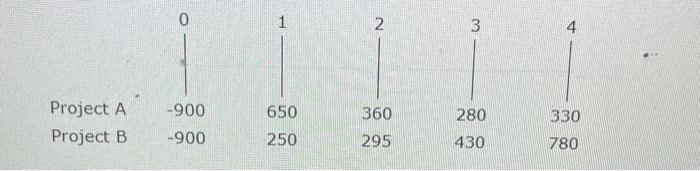

Quantitative Problems Industries is considering projects for inclusion capital budget, and you have been asked to do the analysisBoth projectsafter-tax flows are the below. Deprecation,

Quantitative Problems Industries is considering projects for inclusion capital budget, and you have been asked to do the analysisBoth projectsafter-tax flows are the below. Deprecation, salvage values, net operating working capital requirements, and tax effects are all included in these cash Both projects year fives, and they have risk characteristics simdar to the firm's average projectBellinger's WACC 12%

Quantitative Problemt Bellinger lndustres is consideng two projects for inclusion in its capital budget, and you have been asked to do the analysis, Aeeh grojects' atrectax cash flonzare they have risk characterstsos similar to the firm's swerage project Bellnger's wacC is 12%. What in Prolect A's poybado Du not iound internediste cakulations. Round your answer to four decambl ploces year What is Project A's docourted paytiack? Do not round intermediate calculabiom. Round yeir answer te four decimal plocel years What is Hroject B's parback? Do nat round nite itiediate cakulations. Found your anwer to for decimat placer resers ProjectAProjectB09009001650250236029532804304330780 1. What is Project A's payback ? Do not round intermediate calculations. Round your answer to four decimal places.

2. What is Project A's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places.

3. What is Project B's payback? Do not round intermediate calculations. Round your answer to four decimal places.

4. What is Project B's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started