Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quantitatively illustrate how a box spread can be constructed using any number of the options given above. Clearly indicate what options you use, draw the

Quantitatively illustrate how a box spread can be constructed using any number of the options given above. Clearly indicate what options you use, draw the profit diagram of the position you create, and numerically identify the axis intersection points and maximum/minimum payoffs.

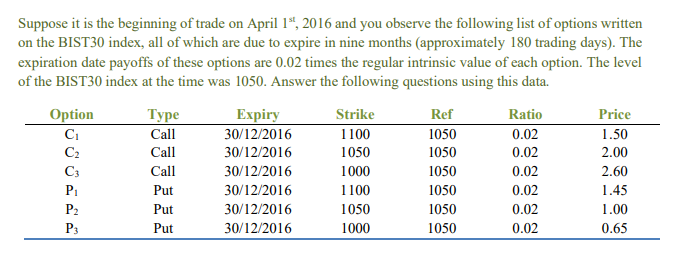

Suppose it is the beginning of trade on April 19, 2016 and you observe the following list of options written on the BIST30 index, all of which are due to expire in nine months (approximately 180 trading days). The expiration date payoffs of these options are 0.02 times the regular intrinsic value of each option. The level of the BIST30 index at the time was 1050. Answer the following questions using this data. Option C C2 C3 P P2 P3 Type Call Call Call Put Put Expiry 30/12/2016 30/12/2016 30/12/2016 30/12/2016 30/12/2016 30/12/2016 Strike 1100 1050 1000 1100 1050 1000 Ref 1050 1050 1050 1050 1050 1050 Ratio 0.02 0.02 0.02 0.02 0.02 0.02 Price 1.50 2.00 2.60 1.45 1.00 0.65 Put Suppose it is the beginning of trade on April 19, 2016 and you observe the following list of options written on the BIST30 index, all of which are due to expire in nine months (approximately 180 trading days). The expiration date payoffs of these options are 0.02 times the regular intrinsic value of each option. The level of the BIST30 index at the time was 1050. Answer the following questions using this data. Option C C2 C3 P P2 P3 Type Call Call Call Put Put Expiry 30/12/2016 30/12/2016 30/12/2016 30/12/2016 30/12/2016 30/12/2016 Strike 1100 1050 1000 1100 1050 1000 Ref 1050 1050 1050 1050 1050 1050 Ratio 0.02 0.02 0.02 0.02 0.02 0.02 Price 1.50 2.00 2.60 1.45 1.00 0.65 PutStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started