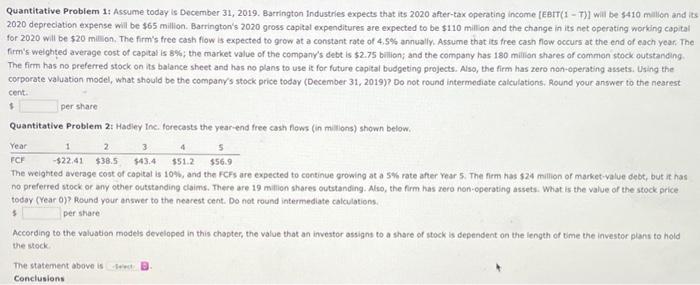

Quantive Problem December 2013. ned that in 2010 werk per 10 do www1110 thing wrong with spect MAGHI at the west of the theme $2.750 The pred She ha contempla pelice del 2019 oddie 1 Quantitative che anche WITH PU The FOR anywa with . Ardog to the located in the wet en om There Coco the credited and the camere model hogar de distruttura, hering her outro dan berstoder so. The project for at del bosc dancing and that mich n's value and for the end for Quantitative Problem 1: Assume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income (EBIT(1 - T)] will be $410 million and its 2020 depreciation expense will be $65 million Barrington's 2020 gross capital expenditures are expected to be $110 million and the change in its net operating working capital for 2020 will be $20 million. The firm's free cash flow is expected to grow at a constant rate of 4,5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is 8%; the market value of the company's debt is $2.7 billion; and the company has 180 million shares of common stock outstanding The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. Also, the firm has zero non operating assets. Using the corporate valuation model, what should be the company's stock price today (December 31, 2019) Do not round Intermediate calculations, Round your answer to the nearest cent. $ per share Quantitative Problem 2: Hadiey Inc. forecasts the year-end free cash flows (in millons) shown below. 1 3 5 FCF $22.41 $38.5 $51.2 $56.9 The weighted average cost of capital is 10%, and the FCFs are expected to continue growing at a 5% rate after years. The firm has $24 million of market value debt, but it has no preferred stock or any other outstanding claims. There are 19 million shares outstanding. Also, the firm has zero non operating assets. What is the value of the stock price today (Year )Round your answer to the nearest cent. Do not round intermediate calculations per share Year 2 $43.4 According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the stock The statement above is Conclusions