Question

Quark acquired 70% of the 1m issued 1 ordinary shares of Whey on 1 January 20X1 when Whey's retained earnings were 1,500,000. The group

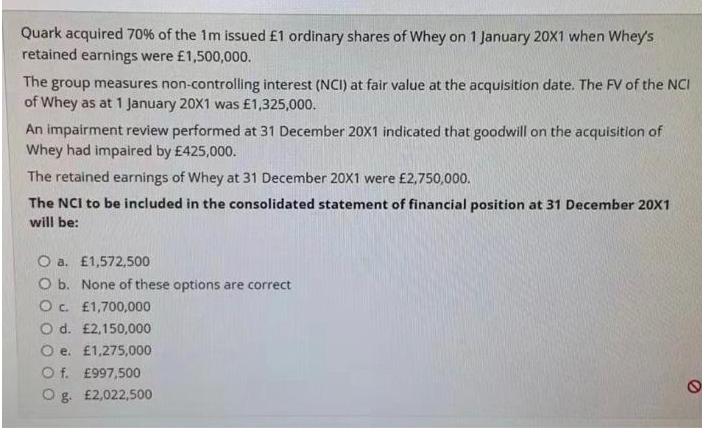

Quark acquired 70% of the 1m issued 1 ordinary shares of Whey on 1 January 20X1 when Whey's retained earnings were 1,500,000. The group measures non-controlling interest (NCI) at fair value at the acquisition date. The FV of the NCI of Whey as at 1 January 20X1 was 1,325,000. An impairment review performed at 31 December 20X1 indicated that goodwill on the acquisition of Whey had impaired by 425,000. The retained earnings of Whey at 31 December 20X1 were 2,750,000. The NCI to be included in the consolidated statement of financial position at 31 December 20X1 will be: O a. 1,572,500 O b. None of these options are correct Oc. 1,700,000 O d. 2,150,000 O e. 1,275,000 Of. 997,500 Og. 2,022,500

Step by Step Solution

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Joe Hoyle, Thomas Schaefer, Timothy Doupnik

10th edition

0-07-794127-6, 978-0-07-79412, 978-0077431808

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App