Question

Que 1. Show steps and calculations clearly! The demand curve for pizza in the Smalltown is: Qd = 120 - P, where Qd represents the

Que 1.

Show steps and calculations clearly!

The demand curve for pizza in the Smalltown is: Qd = 120 - P, where Qd represents the quantity demanded of pizza in the Smalltown, and P represents the market price of pizza.

There are TWO pizza restaurants in Smalltown now: Restaurant A and Restaurant B. Both of them have the same cost of production, that is Restaurant A's total cost of production is TCA= 600 + 24qA , and Restaurant B's total cost of production is: TCB= 600 + 24qB, where qA and qB are the output level chosen by Restaurant A and B, respectively. Restaurant A and B strategically interact with each other.

a) If Restaurant A and B enter into a collusion agreement and split the market, what will be the market (total) equilibrium quantity and market equilibrium price? (4 points)

b) If Restaurant A and B choose their output (quantity produced) to maximise profit, do you think that they will both honor their collusion agreement? What are the levels of output for each restaurant and the market equilibrium price? Please explain with equations/models and your reasoning clearly. (8 points)

c) If Restaurant A and B get into a competition by choosing their price level, what will be the equilibrium market price and equilibrium market quantity? (2 points)

d) Given the answer from part c), what will be the possible problem(s) facing by Restaurant A and B? (4 points)

e) Given the market demand and cost function stay the same as above, and if the number of restaurants increases to 5. If restaurants compete by choosing quantity produced, what will be the equilibrium market (total) quantity and price? (4 points)

Now, let the market demand curve: Qd = a - bP ("a" and "b" are the unknown parameter); the number of restaurants increases to 3 (Restaurant A, B, and C) and Restaurant A's cost function is: TCA= FA + cAqA; Restaurant B's cost function is: TCB= FB + cBqB; Restaurant B's cost function is: TCC= FC + cCqC, where FA, cA, FB, cB, FC, cC are all positive numbers.

f) Please find the best response function of Restaurant A, B, and C in general form, respectively. *Here, only the best response function of Restaurant A, B, and C would be enough, you don't need to solve the equilibrium. (10 points)

Question 2.

Homework #2 International Trade

1. Consider the numerical examples of exercise 1 and 2 on Krugman and Obstfeld.

Draw the production possibility frontier for each country.

Which country has a comparative advantage in apples, which one in bananas?

Which country has an absolute advantage?

Indicate the range of the international prices within which there will be gains from trade for both countries.

Now imagine that Home's technology is different. It turns out that one unit of Home labor can produce 0.2 apples or 1 banana. What would the pattern of production/trade be in this case? Explain the reason why the trade pattern is the way it is.

2.Take the numerical example we used in class to discuss the Ricardo model.

Draw the world production possibility frontier. (Hint: To do so, ask yourself what world output would be for all possible international prices (Pc/Pw)t). Now assume that both countries consume wine and clothing in equal proportions (i.e., their utility function is of the form U(c,w) = min {c,w}. Wine (w) and clothing (c ) are perfect complements) Now indicate on the graph the exact point on the world production possibility frontier at which the world consumes. Compare that point to the world consumption point before trade and before specialization.

As you notice, there are indeed gains from trade.

The question left is whether a world with free trade is the best of all possible worlds. Convince yourself that it is actually not always the best case. Allow for international mobility of labor. In other words, workers are free to decide where they want to work (at home or abroad). Show us how the production possibility frontier will look like in this case. Convince yourself that indeed, under this scenario, the world is better off than in the case of free trade. Now when you consider the international division of production (i.e., where goods will be produced) with internationally mobile labor, would you say that it is in line with the principle of comparative advantage? Discuss

You should realize while doing this exercise how essential the assumption of the international immobility of labor is for international trade and the theory of comparative advantage.

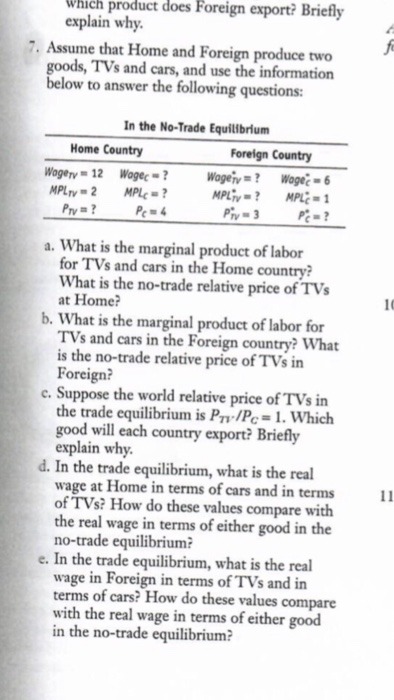

3.Discuss problems 6 and 9 in Krugman and Obstfeld, p. 52.

4.Your country imports high tech products and exports agricultural products.

Suppose you had any control over future technological developments (You have none, but anyway), would you prefer scenario (a), (b) or (c) and why? (Where necessary, illustrate with a graph using the Ricardo nalysis of comparative advantage.)

a. There is a technological revolution abroad in the high tech industry. In other words, productivity increases significantly in the technology sector.

b. There is a productivity increase abroad in the agricultural sector.

c. No technological revolution at all abroad.

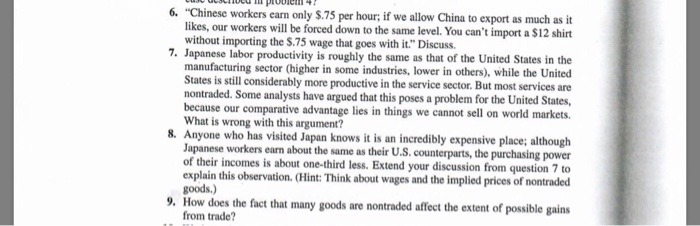

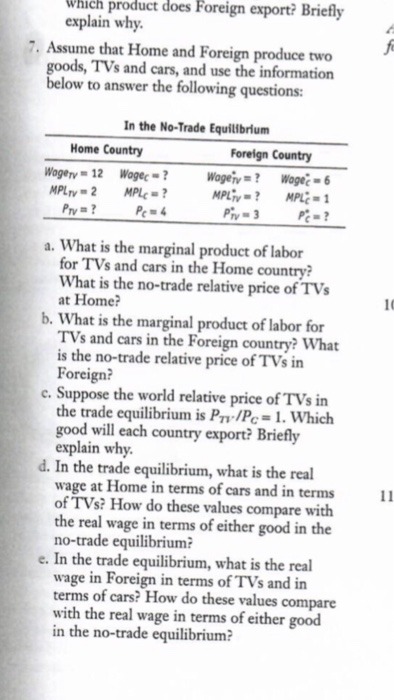

5.Answer the problem 7 in Feenstra and Taylor, p. 57.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started