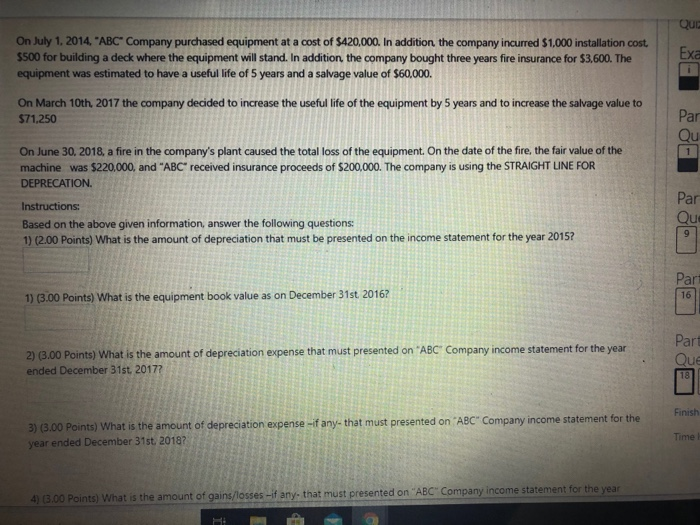

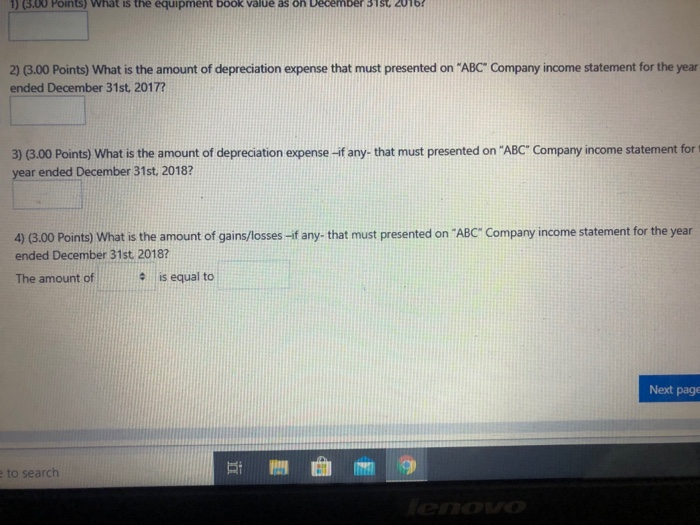

Que Exa On July 1, 2014, "ABC Company purchased equipment at a cost of $420,000. In addition, the company incurred $1,000 installation cost. $500 for building a deck where the equipment will stand. In addition, the company bought three years fire insurance for $3,600. The equipment was estimated to have a useful life of 5 years and a salvage value of $60,000. On March 10th, 2017 the company decided to increase the useful life of the equipment by 5 years and to increase the salvage value to $71,250 Par Qu 1 On June 30, 2018, a fire in the company's plant caused the total loss of the equipment. On the date of the fire the fair value of the machine was $220.000, and "ABC" received insurance proceeds of $200,000. The company is using the STRAIGHT LINE FOR DEPRECATION. Instructions: Based on the above given information, answer the following questions: 1) (2.00 Points) What is the amount of depreciation that must be presented on the income statement for the year 2015? Par Que Par 16 1) (3,00 Points) What is the equipment book value as on December 31st 2016? Part 2) (3.00 Points) What is the amount of depreciation expense that must presented on "ABC" Company income statement for the year ended December 31st 2017? Que 18 Finish 3) (3.00 Points) What is the amount of depreciation expense -ifany- that must presented on "ABC" Company income statement for the year ended December 31st 2018? Time 4) 3.00 Points) What is the amount of gains/losses -if any, that must presented on "ABC" Company income statement for the year 1) (5.00 Points) What is the equipment book value as on Decem 2) (3.00 Points) What is the amount of depreciation expense that must presented on "ABC" Company income statement for the year ended December 31st, 2017? 3) (3.00 Points) What is the amount of depreciation expense -if any- that must presented on "ABC" Company income statement for year ended December 31st, 2018? 4) (3.00 Points) What is the amount of gains/losses -if any- that must presented on "ABC" Company income statement for the year ended December 31st 2018? The amount of is equal to e Next page to search