Answered step by step

Verified Expert Solution

Question

1 Approved Answer

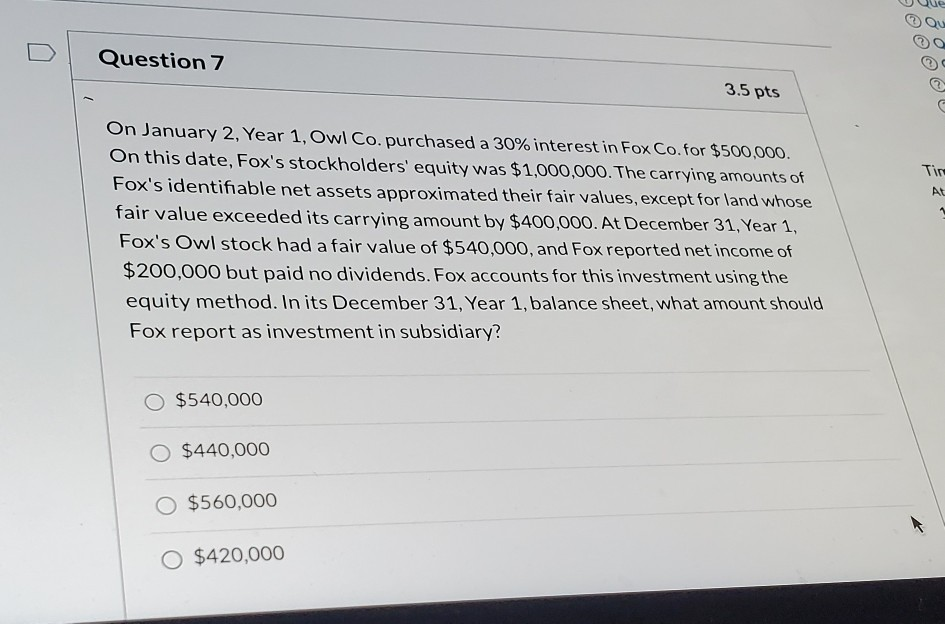

Que Question 7 3.5 pts Al On January 2, Year 1, Owl Co. purchased a 30% interest in Fox Co. for $500,000. On this date,

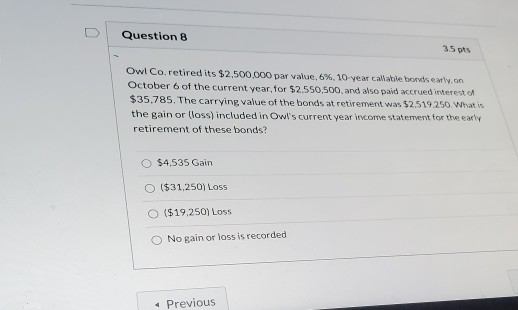

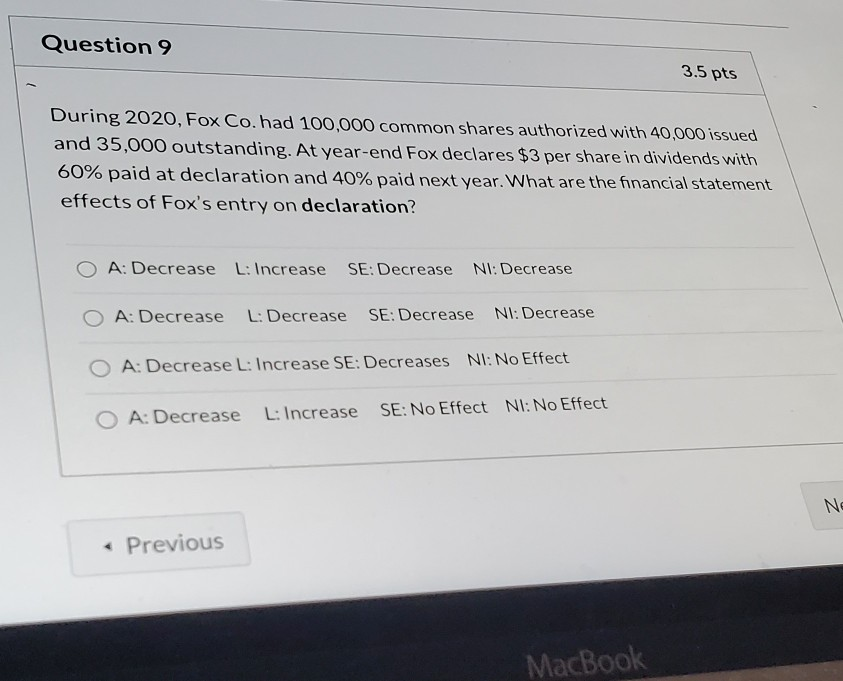

Que Question 7 3.5 pts Al On January 2, Year 1, Owl Co. purchased a 30% interest in Fox Co. for $500,000. On this date, Fox's stockholders' equity was $1,000,000. The carrying amounts of Fox's identifiable net assets approximated their fair values, except for land whose fair value exceeded its carrying amount by $400,000. At December 31, Year 1, Fox's Owl stock had a fair value of $540,000, and Fox reported net income of $200,000 but paid no dividends. Fox accounts for this investment using the equity method. In its December 31, Year 1, balance sheet, what amount should Fox report as investment in subsidiary? $540,000 $440,000 O $560,000 O $420,000 Question 8 35 pts Owl Co. retired its $2.500.000 par value, 6%, 10-year callable bonds early on October 6 of the current year, for $2.550.500, and also paid accrued interest of $35.785. The carrying value of the bonds at retirement was $2,519 250. What's the gain or loss) included in Owl's current year become statement for the early retirement of these bonds? $4.535 Gain O $31,250) Loss ($19.250) Loss O No gain or loss is recorded - Previous Question 9 3.5 pts During 2020, Fox Co. had 100,000 common shares authorized with 40,000 issued and 35,000 outstanding. At year-end Fox declares $3 per share in dividends with 60% paid at declaration and 40% paid next year. What are the financial statement effects of Fox's entry on declaration? A: Decrease L: Increase SE: Decrease NI: Decrease A: Decrease L: Decrease SE: Decrease NI: Decrease O A: Decrease L: Increase SE: Decreases NI: No Effect O A: Decrease L: Increase SE: No Effect NI: No Effect Ne

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started