Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quebec tax Question 2 (20%) Dayana is very happy about her financial year. For the first time, she has crossed over the 6 figures threshold.

Quebec tax

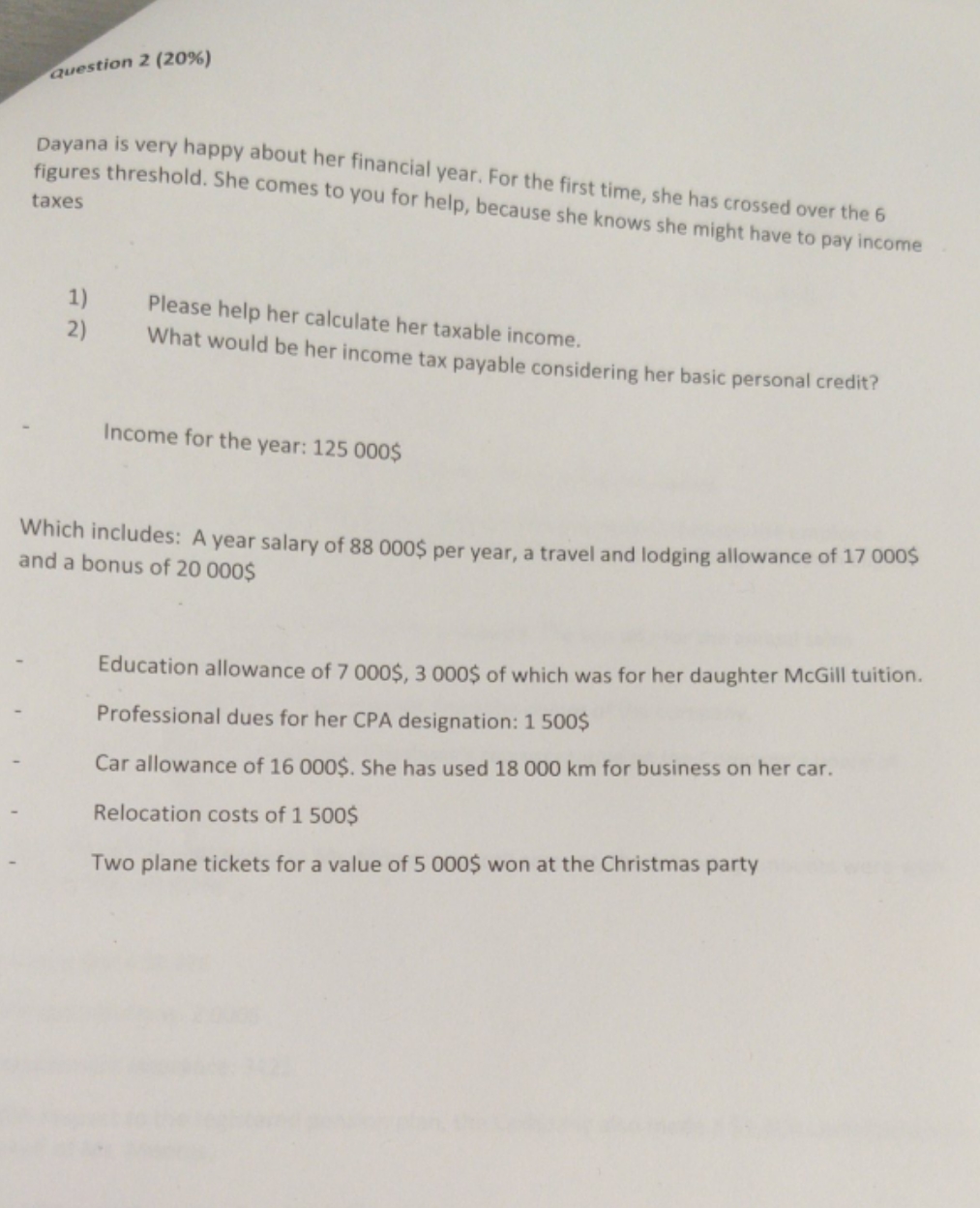

Question 2 (20%) Dayana is very happy about her financial year. For the first time, she has crossed over the 6 figures threshold. She comes to you for help, because she knows she might have to pay income taxes 1) 2) Please help her calculate her taxable income. What would be her income tax payable considering her basic personal credit? Income for the year: 125 000$ Which includes: A year salary of 88 000$ per year, a travel and lodging allowance of 17 000$ and a bonus of 20 000$ Education allowance of 7 000$, 3 000$ of which was for her daughter McGill tuition. Professional dues for her CPA designation: 1500$ Car allowance of 16 000$. She has used 18 000 km for business on her car. Relocation costs of 1 500$ Two plane tickets for a value of 5 000$ won at the Christmas party

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To help Dayana calculate her taxable income and income tax payable lets break down her income and deductible expenses 1 Income Yearly Salary 88000 Tra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started