Answered step by step

Verified Expert Solution

Question

1 Approved Answer

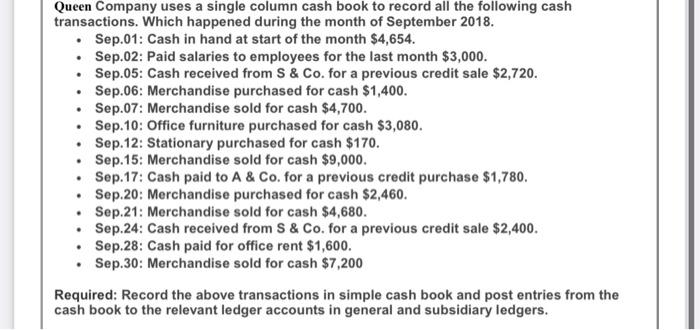

Queen Company uses a single column cash book to record all the following cash transactions. Which happened during the month of September 2018. Sep.01: Cash

Queen Company uses a single column cash book to record all the following cash

transactions. Which happened during the month of September 2018.

Sep.01: Cash in hand at start of the month $4,654.

Sep.02: Paid salaries to employees for the last month $3,000.

Sep.05: Cash received from S & Co. for a previous credit sale $2,720.

Sep.06: Merchandise purchased for cash $1,400.

Sep.07: Merchandise sold for cash $4,700.

Sep.10: Office furniture purchased for cash $3,080.

Sep.12: Stationary purchased for cash $170.

Sep.15: Merchandise sold for cash $9,000.

Sep.17: Cash paid to A & Co. for a previous credit purchase $1,780.

Sep.20: Merchandise purchased for cash $2,460.

Sep.21: Merchandise sold for cash $4,680.

Sep.24: Cash received from S & Co. for a previous credit sale $2,400.

Sep.28: Cash paid for office rent $1,600.

Sep.30: Merchandise sold for cash $7,200

Required: Record the above transactions in simple cash book and post entries from the cash book to the relevant ledger accounts in general and subsidiary ledgers.

Intermediate accounting

Its better if its computer writing but if its hand writing please clear font

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started