Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Queens plc. is a UK company which is considering whether to expand its operations in Europe. The forecasted Internal Rate of Return (IRR) of

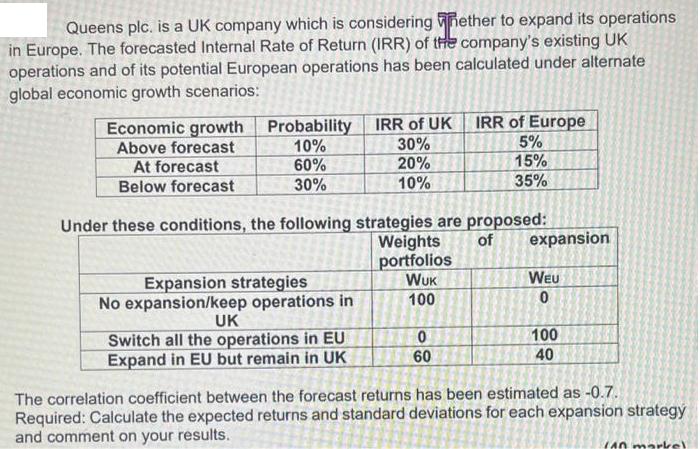

Queens plc. is a UK company which is considering whether to expand its operations in Europe. The forecasted Internal Rate of Return (IRR) of the company's existing UK operations and of its potential European operations has been calculated under alternate global economic growth scenarios: Economic growth Above forecast At forecast Below forecast Probability IRR of UK 10% 30% 60% 20% 30% 10% Under these conditions, the following strategies are proposed: Weights of portfolios WUK 100 Expansion strategies No expansion/keep operations in UK Switch all the operations in EU Expand in EU but remain in UK IRR of Europe 5% 15% 35% 0 60 expansion WEU 0 100 40 The correlation coefficient between the forecast returns has been estimated as -0.7. Required: Calculate the expected returns and standard deviations for each expansion strategy and comment on your results. (40

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started