Question

Queestion 1; A sibling will start his/her first year at Local University in the Fall of 2024. Annual tuition and books are $15,000 and are

Queestion 1; A sibling will start his/her first year at Local University in the Fall of 2024. Annual tuition and books are $15,000 and are to be paid in semi-annual installments at the opening of each semester. Assuming that your parents have invested this money in an account that earns 5% p.a., how much must there be in the account to fund his/her four-year education as of September 1st, 2024. The answer is below. Now using the answers to question 1, answer question 2.

Question 2: Referring to the question 1 and your answer in question 1, now assume that your parents inform your sibling that there is only $40,000 in the account as of September 1st, 2023. Apparently, they have spent more money on your education than they anticipated. How much must your parents deposit into the education account at the end of each month, over the next 12 months, to make up for the difference needed to fund your siblings education?

Answer for question 1 is below. Answer Question 2.

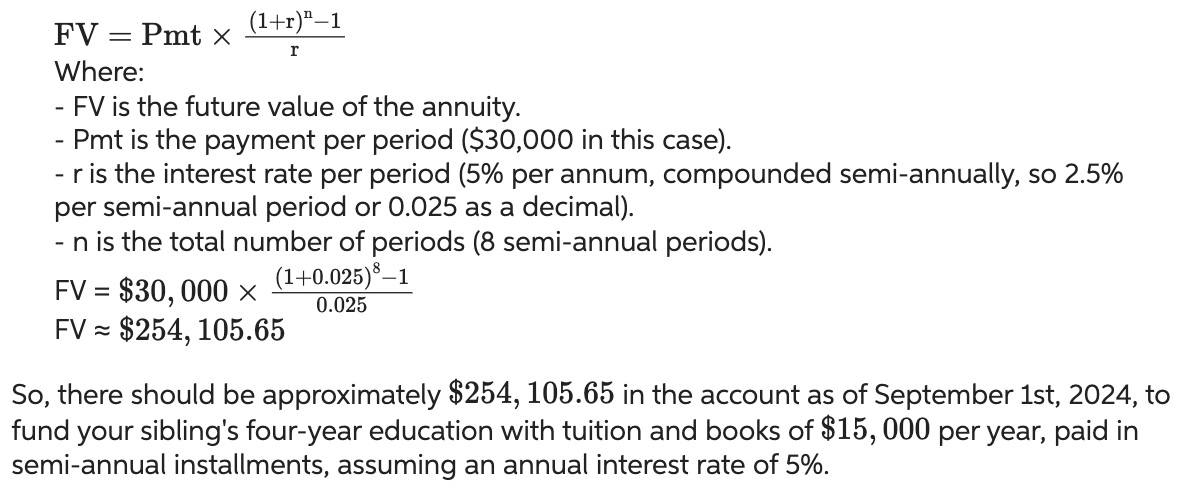

FV=Pmtr(1+r)n1 Where: - FV is the future value of the annuity. - Pmt is the payment per period ($30,000 in this case). - r is the interest rate per period ( 5% per annum, compounded semi-annually, so 2.5% per semi-annual period or 0.025 as a decimal). - n is the total number of periods (8 semi-annual periods). FV=$30,0000.025(1+0.025)81FV$254,105.65 So, there should be approximately $254,105.65 in the account as of September 1 st, 2024 , to fund your sibling's four-year education with tuition and books of $15,000 per year, paid in semi-annual installments, assuming an annual interest rate of 5%

FV=Pmtr(1+r)n1 Where: - FV is the future value of the annuity. - Pmt is the payment per period ($30,000 in this case). - r is the interest rate per period ( 5% per annum, compounded semi-annually, so 2.5% per semi-annual period or 0.025 as a decimal). - n is the total number of periods (8 semi-annual periods). FV=$30,0000.025(1+0.025)81FV$254,105.65 So, there should be approximately $254,105.65 in the account as of September 1 st, 2024 , to fund your sibling's four-year education with tuition and books of $15,000 per year, paid in semi-annual installments, assuming an annual interest rate of 5% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started