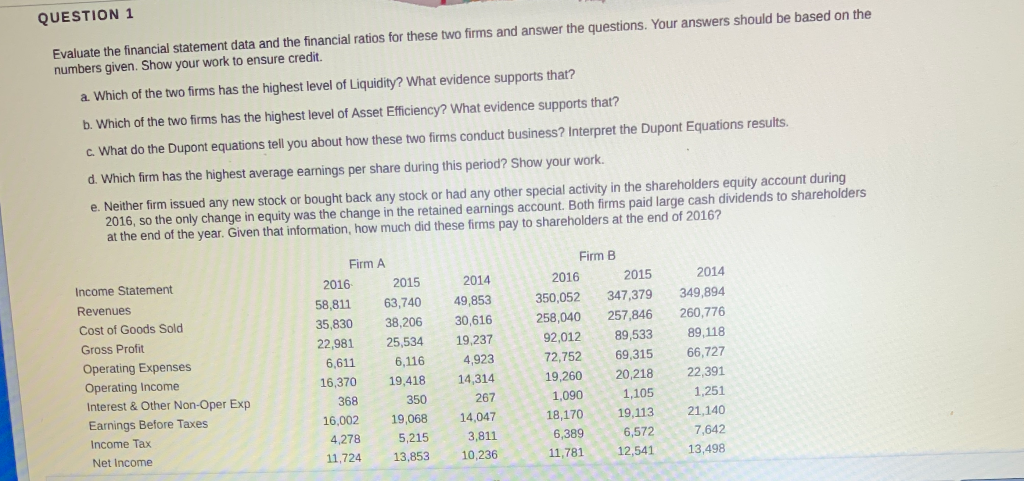

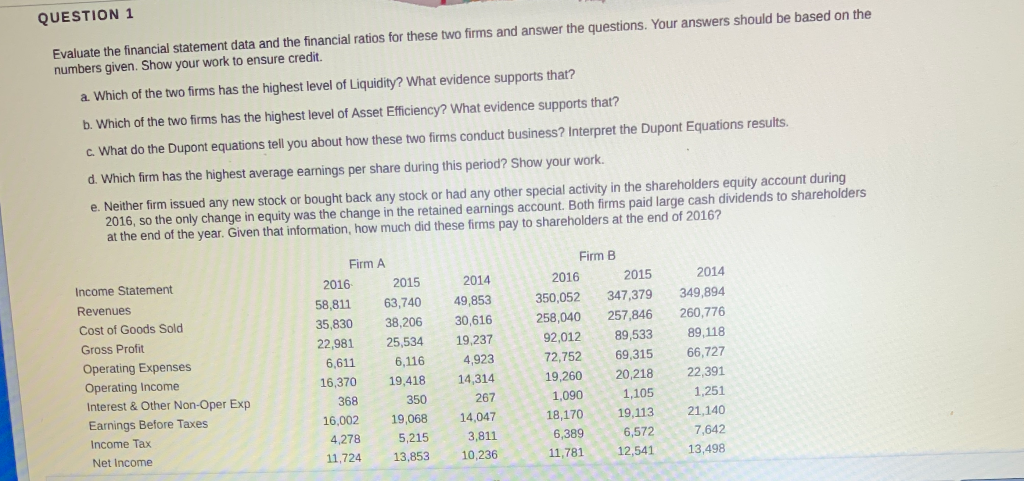

QUEJTUN 1 Evaluate the financial statement data and the financial ratios for these two firms and answer the questions. Your answers should be based on the numbers given. Show your work to ensure credit. a. Which of the two firms has the highest level of Liquidity? What evidence supports that? b. Which of the two firms has the highest level of Asset Efficiency? What evidence supports that? c. What do the Dupont equations tell you about how these two firms conduct business? Interpret the Dupont Equations results. d. Which firm has the highest average earnings per share during this period? Show your work. e. Neither firm issued any new stock or bought back any stock or had any other special activity in the shareholders equity account during 2016, so the only change in equity was the change in the retained earnings account. Both firms paid large cash dividends to shareholders at the end of the year. Given that information, how much did these firms pay to shareholders at the end of 2016? 2014 30,616 19,237 Income Statement Revenues Cost of Goods Sold Gross Profit Operating Expenses Operating Income Interest & Other Non-Oper Exp Earnings Before Taxes Income Tax Net Income Firm 2016 58,811 35,830 22,981 6,611 16,370 368 16,002 4,278 11,724 A 2015 63,740 38,206 25,534 6,116 19,418 350 19,068 5,215 13.853 4,923 Firm B 2016 2015 350,052 347,379 258,040 257,846 92,012 89,533 72,752 69,315 19,26020,218 1,090 1,105 18,170 389 6,572 781 12,541 14,314 267 14,047 3,811 10.236 2014 349,894 260,776 89, 118 66,727 22,391 1,251 21,140 7,642 1 3,498 QUEJTUN 1 Evaluate the financial statement data and the financial ratios for these two firms and answer the questions. Your answers should be based on the numbers given. Show your work to ensure credit. a. Which of the two firms has the highest level of Liquidity? What evidence supports that? b. Which of the two firms has the highest level of Asset Efficiency? What evidence supports that? c. What do the Dupont equations tell you about how these two firms conduct business? Interpret the Dupont Equations results. d. Which firm has the highest average earnings per share during this period? Show your work. e. Neither firm issued any new stock or bought back any stock or had any other special activity in the shareholders equity account during 2016, so the only change in equity was the change in the retained earnings account. Both firms paid large cash dividends to shareholders at the end of the year. Given that information, how much did these firms pay to shareholders at the end of 2016? 2014 30,616 19,237 Income Statement Revenues Cost of Goods Sold Gross Profit Operating Expenses Operating Income Interest & Other Non-Oper Exp Earnings Before Taxes Income Tax Net Income Firm 2016 58,811 35,830 22,981 6,611 16,370 368 16,002 4,278 11,724 A 2015 63,740 38,206 25,534 6,116 19,418 350 19,068 5,215 13.853 4,923 Firm B 2016 2015 350,052 347,379 258,040 257,846 92,012 89,533 72,752 69,315 19,26020,218 1,090 1,105 18,170 389 6,572 781 12,541 14,314 267 14,047 3,811 10.236 2014 349,894 260,776 89, 118 66,727 22,391 1,251 21,140 7,642 1 3,498